Retirement Spending Can Range from 25% to 100%. No longer your same old 2% to a few% a 12 months.

Unit Consider space T Rowe Value has a fascinating analysis out on retiree spending.

This can be one thing that the ones of you who’re at the F.I. trail shall be eager about.

Chances are you’ll at all times surprise: How a lot volatility would there be for your spending in retirement the solution I believe is a serve as of ways skilled you might be residing lifestyles, and whether or not you might be quantitative about it.

This find out about displays us that our spending may also be very unstable.

Your spending does no longer pass up by means of 3% within the first yr, then 3% in the second one yr, then 3% within the 3rd yr. Retirees on this find out about noticed spending volatility of 25%, 50% and even 100%.

A lot of the rise in spending isn’t such a lot because of well being price. I do know a couple of of you might be anxious concerning the well being price as I’m.

However the bulk of the spending marvel got here from house prices. I chalked that right down to the “marvel” price of getting to interchange much-needed stuff all over a 20-year retirement. One of the issues do destroy down such because the roof and you can not lengthen it however to fix it.

This additionally items some relieve as a result of for many people Singaporeans, we are living in a unit-like atmosphere so the massive substitute price is also extra managed.

It’s possible you’ll ask: “However Kyith, in case you reside in a space, shouldn’t you’ve gotten installed position some cash to interchange the roof for your retirement?”

For many people, we don’t as a result of in our making plans, we have a tendency to devise the habitual spending that we see on a monthly foundation.

Many don’t price range or suppose that this can be a too OCD process.

Being attentive to your spending approach having a greater pulse about what you if truth be told want all over F.I.R.E.

And if you’re unwilling to try this, then get ready for some surprises.

I frequently get the query: “Kyith, can I retiree like this?” I feel understanding the recognized unknowns, or the spending stuff that others who pay actual consideration learn about however are subconscious to you is helping some distance.

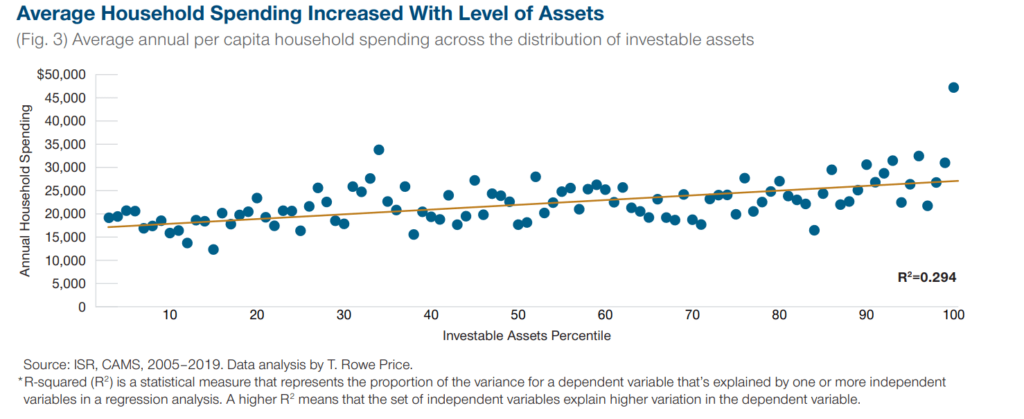

Given this data, what’s T Rowe Value’s advice:

I feel there’s no new stuff however to acknowledge that if you’re residing in a Landed Assets, don’t be subconscious about how a lot you wish to have to put aside for the house that you simply reside in!

If there are two of you, possibly do you want to imagine shifting to a unit-based house?

Listed here are some fascinating lifts from the find out about.

In regards to the Well being and Retirement Learn about (HRS) and Intake and Actions Mail Survey (CAMS).

Each the HRS and CAMS are biennial research carried out in even and atypical years, by means of the Institute for Social Analysis on the College of Michigan. The pattern used follows a gaggle of one,306 families from 2005 to 2018 who have been provide within the 2005 CAMS, have been between the age of 65 to 90 years previous and feature been surveyed no less than 3 consecutive years by means of CAMS.

One of the Attention-grabbing Illustrations from the Learn about

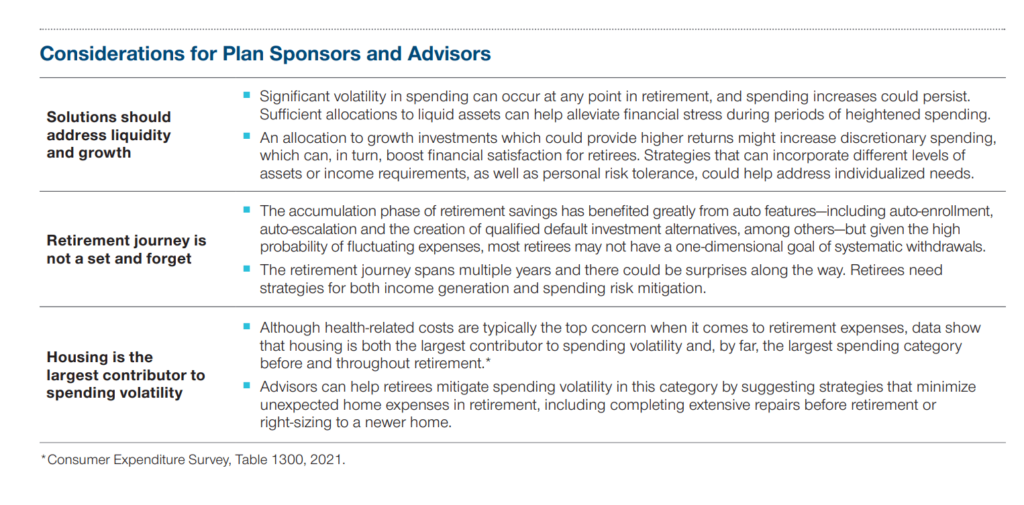

The chart above displays that our spending can vary a great deal.

1 in 4 retirees skilled no less than a 17%-20% building up in annual spending over two years. 1 in 4 skilled no less than a 20% to 21% lower in annual spending over the similar duration.

All other age teams revel in this volatility in spending.

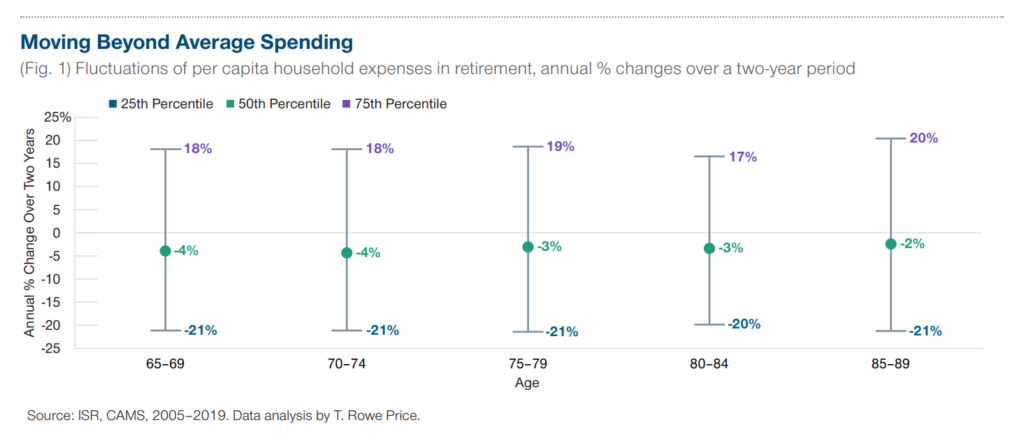

1 in 2 retirees or 50% skilled a spending building up of 0% to twenty-five%. That may be a drastic trade. Out of four retirees, one will revel in a 25% to 50% spending building up and out of five retirees, one will revel in a 50-100% building up.

Which means there are some spending that usually surprises us because of:

- Unaccounted for or deficient making plans.

- Actual lifestyles surprises.

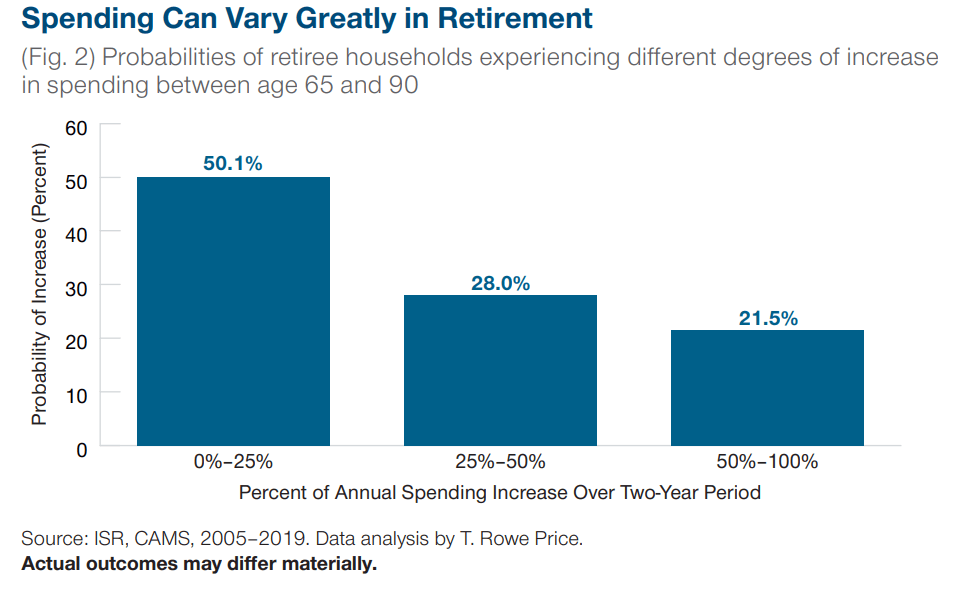

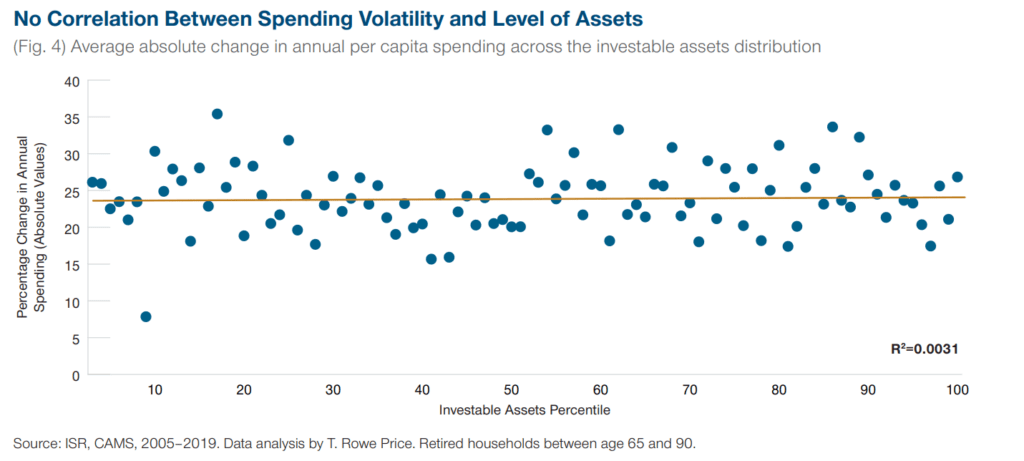

How a lot you spend does trade, relying on what number of investable property you’ve gotten.

Then again, if we measure the proportion of trade skilled by means of those retirees, it doesn’t trade in line with what number of investable property. Which means for many who retire with numerous no longer too many property, you’ll revel in some form of spending volatility consistent with this analysis.

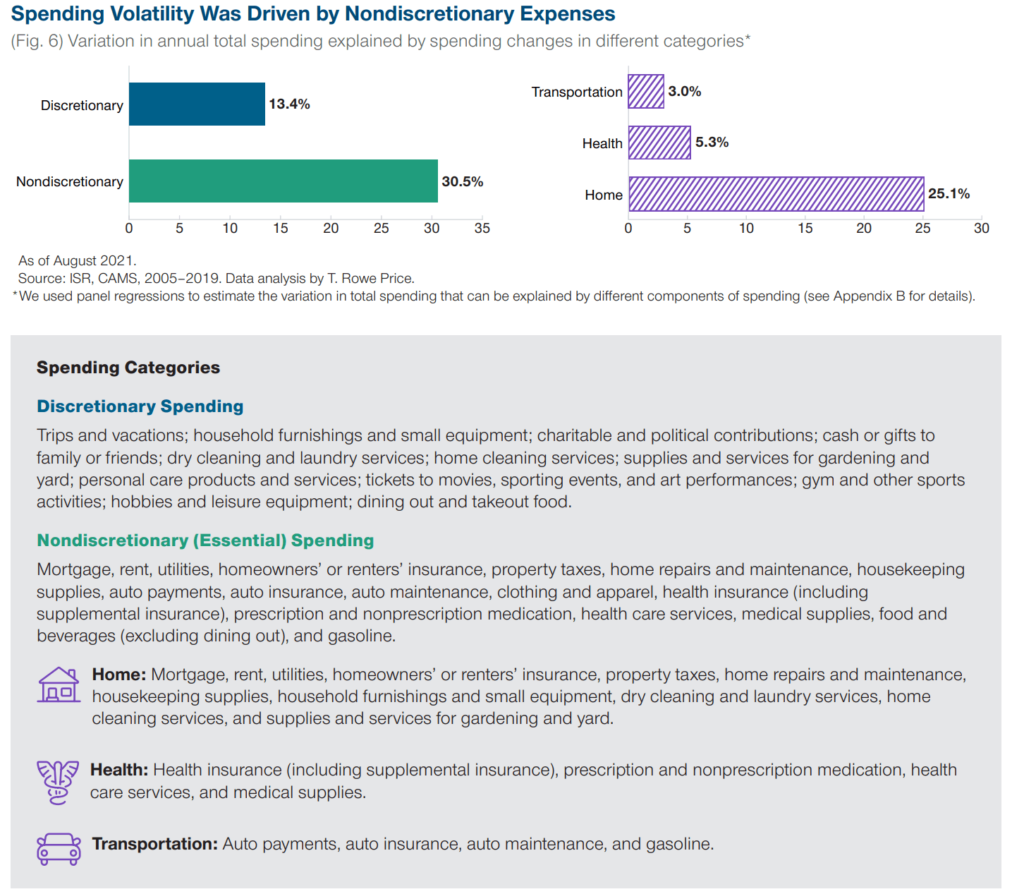

I love this representation because it supplies some definition what are thought to be discretionary and what are thought to be nondiscretionary spending.

The 2 charts display that it’s the ESSENTIAL spending that reasons lots of the volatility and it’s NOT HEALTH spending that reasons this however what you handle in the house.

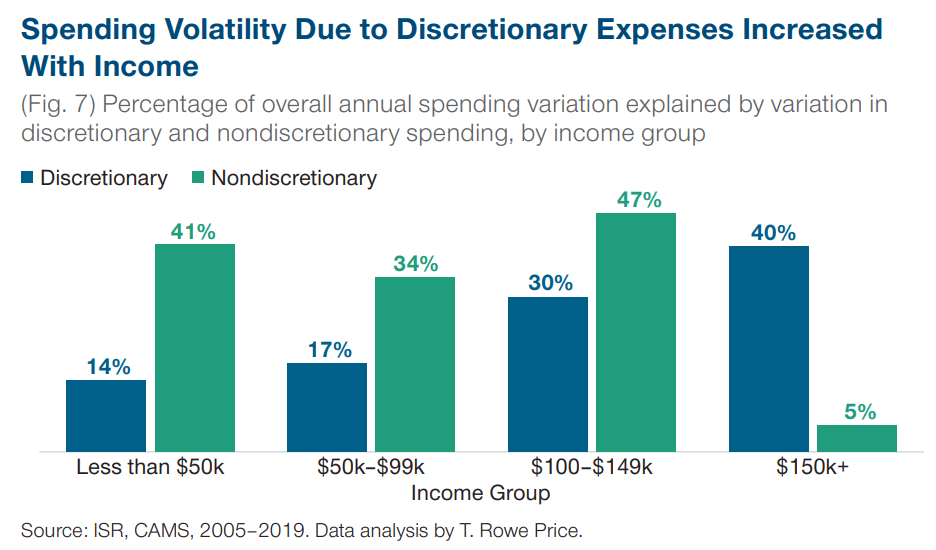

This determine displays that lots of the spending volatility is because of very important spending except for for the gang this is incomes $150,000 and above.

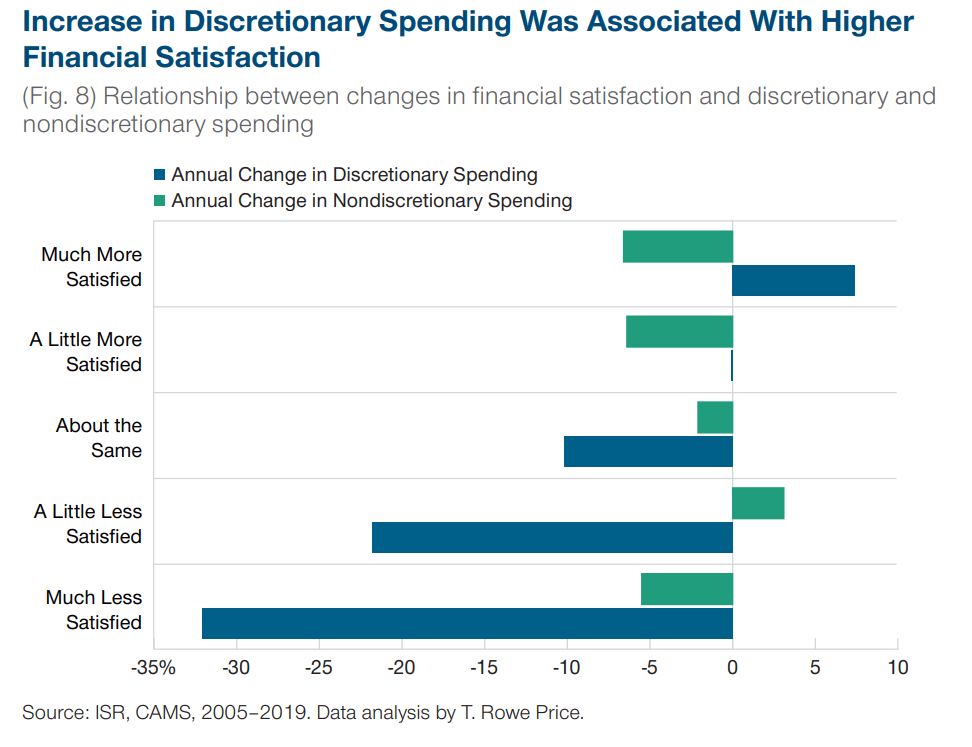

If in case you have kind of discretionary or very important spending, how would you’re feeling about it?

The consequences display that the discretionary spending impacts other people extra. There’s a higher lower in pleasure and extra pleasure if the discretionary spending adjustments.

Which means even though we’ve got a bigger price range for our very important spending, this is simplest sanitary. We don’t derive extra pleasure understanding that we have got extra to spend at the necessities. However it is usually just right to understand that if there’s a relief in very important spending the pleasure stage don’t drop of dramatically.