Nevada Gold Co. In finding A couple of Top-Grade Intercepts

November 22, 2023 (Investorideas.com Newswire) This morning, Western Exploration Inc. shared a promising replace on its drilling at its Gravel Creek assets. Learn on to peer those effects and what the corporate has deliberate for the brand new yr.

This morning, Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC) introduced up to date drill effects at its Gravel Creek assets in Nevada, U.S.

Western Exploration is a gold exploration and manufacturing corporate, with its primary hobby in Northern Nevada. The effects shared nowadays got here from its 2023 core drilling program, concerned about figuring out vein extensions within the Jarbidge rhyolite north-east of the Gravel Creek useful resource space on the corporate’s 100%-owned Air of mystery gold-silver venture.

Highlights of those effects have been shared by way of the corporate:

- Two orientated core holes totaling 1,470 meters have been finished to ensure the lifestyles of a mineralized hall trending northeast from the Gravel Creek deposit, as defined in a information liberate of the Corporate dated March 6, 2023, entitled “Western Exploration Publicizes Further Exploration Effects at Gravel Creek.”

- Each holes WG456 and WG457 intersected a couple of quartz-pyrite-marcasite bearing veins, stockwork, and hydrothermal breccias inside the centered mineralized hall.

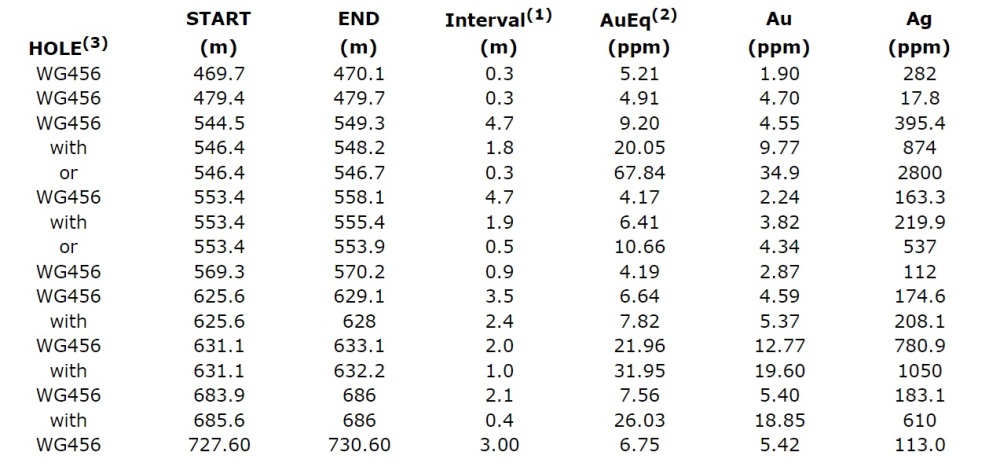

- Hollow WG456, situated 250 meters north-east of the Gravel Creek useful resource space, reported particular person assays as much as 34.9 g/t Au (grams according to tonne gold) and 2800.0 g/t Ag (silver), with key intercepts together with:

- 4.7 meters of 9.20 (g/t AuEq (gold similar)) (4.55 g/t Au and 395.4 g/t Ag)

- 2.4 meters of seven.82 g/t AuEq (5.37 g/t Au and 208.1 g/t Ag)

- 2.0 meters of 21.96 g/t AuEq (12.77 g/t Au and 780.9 g/t Ag)

- 2.1 meters of seven.56 g/t AuEq (5.40 g/t Au and 183.1 g/t Ag)

- 3.0 meters of 6.75 g/t AuEq (5.42 g/t Au and 113 g/t Ag)

- Gold-silver grades in WG456 happen on the similar elevation because the “productive horizon” within the Gravel Creek deposit and are similar in grade to these noticed in a couple of legacy intercepts.

- Those effects beef up additional exploration drilling to the northeast alongside a 2.0-kilometer development of Au-As soil and rock anomalies that parallel a N35E trending density anomaly.

- WG456 used to be deserted at a intensity of 730.6 meters because of drilling headaches, with the overall 3.0 meters returning 5.42 g/t Au and 113 g/t Ag.

- Assays for hollow WG457 are lately being finalized by way of ALS Chemex.

In step with the corporate, previous drilling discovered many high-grade Au-Ag vein intercepts of as much as 40.05 g/t Au and 1951 g.t Ag within the Miocene Jarbdidge volcanics, which might be lateral to Gravel Creek. Earlier calculations have by no means incorporated those intercepts.

To place issues into point of view, Bullion Via Publish notes that 8 to ten g/t Au is regarded as high-grade.

The corporate stocks this Desk:

In mild of those effects, CEO Darcy Marud stated, “Western Exploration has lengthy believed within the possible to a great deal amplify assets inside the Picket Gulch/Gravel Creek mineralized machine, and it’s now develop into extra glaring that Picket Gulch and Gravel Creek are a part of a big Au-Ag bearing hydrothermal machine over a space of 10km2. The combination of structural floor alteration and geochemical knowledge generated by way of the 2023 core drilling program has introduced larger figuring out of the controls at the high-grade veins within the Jarbidge rhyolite overlying and peripheral to the Gravel Creek deposit. Important further orientated core drilling is justified to higher outline the vein traits and decide the level of the mineralized machine to the north-east, with without equal function of increasing the venture useful resource base.”

Why Gold? At the Verge of a Primary Breakout

Ceaselessly noticed as a hedge towards inflation, gold is seeing promise as inflation and waning religion within the U.S. greenback will increase. In October, Marin Katusa of Katusa Analysis echoed those sentiments, announcing, “Gold is responding to uncertainty at the geopolitical chess board and may just simply as simply spike to new highs or right kind decrease.”

The day before today, Technical Analyst Clive Maund wrote he noticed promise in gold in his publication. He wrote, “Gold is at the verge of a significant breakout, and albeit, it could be sudden if it wasn’t for the reason that cash advent is within the ultimate vertical phases of a parabolic blowoff. Gold has taken see you later to construct as much as this, having been in a large buying and selling vary since mid-2020, that after it occurs, it is going to take maximum traders by way of wonder, which is after all what you are expecting when a significant breakout happens.”

Catalysts: Additional Drilling

Western Exploration shared in its corporate presentation additional drilling plans, extending all over 2024. A brand new useful resource replace for Gravel Creek is about to be launched within the first two quarters of the brand new yr.

Additional drilling is deliberate on Gravel Creek and Dolby George within the 3rd quarter of 2024, and a PFS for Dolby George shall be launched within the final quarter of 2024.

Possession and Percentage Construction

In step with Reuters, 2.81% of the corporate is held by way of control and insiders. Chairman Marceau Nicolas Jean Schlumberger owns 1.91%, with 0.66 million stocks. CEO and President Darcy E. Marud owns 0.56%, with 0.19 million stocks. Director Gerard Emmanuel Munera owns 0.24%, with 0.08 million stocks, and Director Nicolas J.R. Schlumberger owns 0.10%, with 0.04 million stocks.

74.79% is owned by way of establishments. Golkonda, LLC, owns 57.97%, with 19.97 million stocks. Agnico Eagle Mines Ltd. (a CA$32 billion marketplace cap main mining corporate) owns 15.80%, with 5.44 million stocks, and US World Buyers, Inc., owns 1.02%, with 0.35 million stocks.

The remainder is with retail traders.

Reuters experiences that there are 34.45 million stocks exceptional and eight.07 million unfastened waft traded stocks, whilst the corporate has a CA$16.23 million marketplace cap and trades within the 52-week duration between CA$0.65 and CA$2.40.

Extra Data:

This information is printed at the Investorideas.com Newswire – a world virtual information supply for traders and trade leaders

Disclaimer/Disclosure: Investorideas.com is a virtual writer of 3rd birthday party sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Authentic content material created by way of investorideas is safe by way of copyright rules rather then syndication rights. Our web site does now not make suggestions for purchases or sale of shares, product or service. Not anything on our websites will have to be construed as an be offering or solicitation to shop for or promote merchandise or securities. All making an investment comes to possibility and imaginable losses. This web site is lately compensated for information newsletter and distribution, social media and advertising and marketing, content material advent and extra. Disclosure is posted for every compensated information liberate, content material printed /created if required however in a different way the inside track used to be now not compensated for and used to be printed for the only hobby of our readers and fans. Touch control and IR of every corporate without delay relating to particular questions.

Extra disclaimer data: https://www.investorideas.com/About/Disclaimer.asp Be told extra about publishing your information liberate and our different information services and products at the Investorideas.com newswire https://www.investorideas.com/Information-Add/

World traders will have to adhere to laws of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp