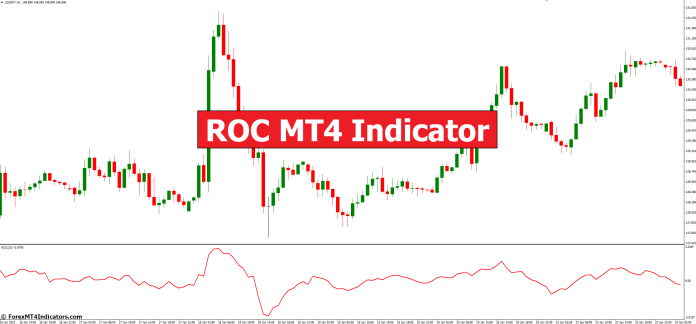

ROC MT4 Indicator – ForexMT4Indicators.com

On the planet of foreign currency trading, having the appropriate gear at your disposal could make all of the distinction between luck and failure. One such instrument that has received recognition amongst buyers is the ROC MT4 Indicator. On this article, we can delve into the main points of this indicator, explaining what it’s, the way it works, and why it’s a treasured addition on your buying and selling arsenal.

Working out ROC

What’s ROC?

ROC stands for Price of Exchange, and within the context of foreign currency trading, it’s an very important technical indicator. ROC measures the proportion alternate in worth between the present last worth and the last worth “n” sessions in the past. It is helping buyers establish the momentum of a forex pair, giving insights into whether or not it’s overbought or oversold.

How Does ROC Paintings?

The ROC MT4 Indicator calculates the speed of alternate via evaluating the present last worth to the last worth of a particular collection of sessions in the past. It’s expressed as a share. A good ROC signifies that the present worth is upper than it used to be “n” sessions in the past, suggesting bullish momentum. Conversely, a destructive ROC suggests bearish momentum.

The use of ROC in Your Buying and selling

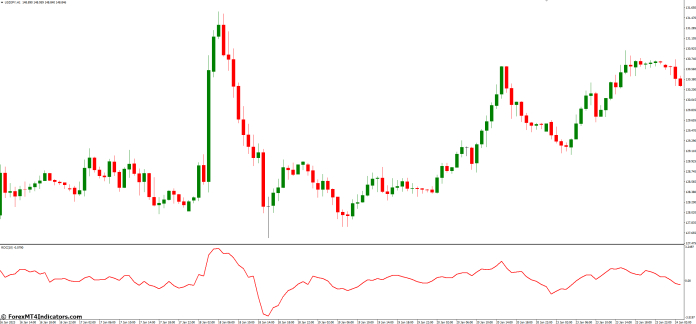

Figuring out Tendencies

Some of the number one makes use of of the ROC MT4 Indicator is to spot tendencies. When the ROC is certain and emerging, it signifies a powerful bullish development, signaling that it may well be a great time to shop for. Conversely, a destructive ROC that’s lowering suggests a bearish development, indicating a possible promoting alternative.

Divergence

ROC can be used to identify divergence between the indicator and the associated fee chart. Divergence happens when the associated fee is transferring in a single route, however the ROC is transferring in the wrong way. It is a sign {that a} development is shedding steam and may opposite quickly.

Overbought and Oversold Prerequisites

ROC can assist establish overbought and oversold stipulations. When the ROC reaches extraordinarily top ranges, it means that the asset is also overbought, and a value correction may well be drawing close. However, when the ROC reaches extraordinarily low ranges, it signifies that the asset is also oversold, and a value rebound may well be at the horizon.

Easy methods to Business with ROC MT4 Indicator

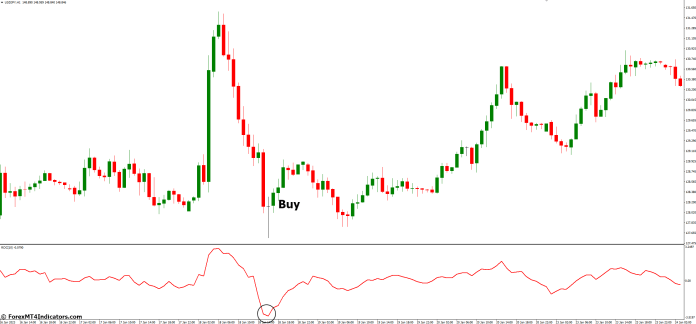

Purchase Access

- Search for a powerful certain ROC worth.

- ROC measures the proportion alternate in worth over a specified length. A emerging ROC signifies bullish momentum.

- Believe a purchase access when ROC crosses above 0 or a vital resistance stage.

- Mix ROC with different signs or worth research to verify the purchase sign.

- Use a trailing forestall or different possibility control ways to give protection to your place.

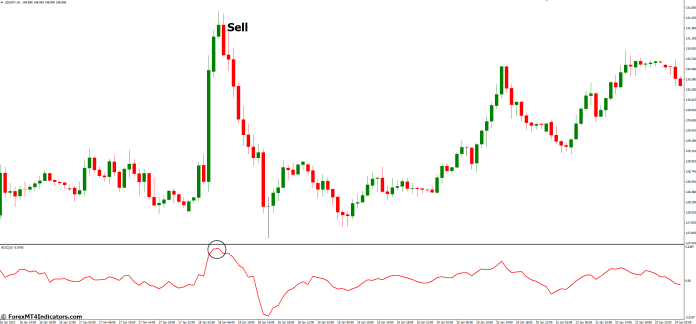

Promote Access

- Focal point on a vital destructive ROC worth.

- A falling ROC signifies bearish momentum out there.

- Believe a promote access when ROC crosses beneath 0 or a vital beef up stage.

- All the time ascertain the promote sign with further technical research or signs.

- Put into effect possibility control methods to restrict attainable losses.

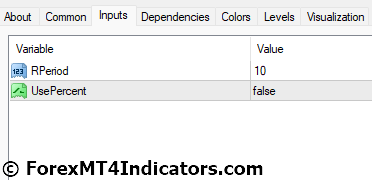

ROC MT4 Indicator Settings

Conclusion

Within the fast paced international of foreign currency trading, having the appropriate gear can considerably have an effect on your luck. The ROC MT4 Indicator is a treasured instrument that is helping buyers establish tendencies, divergence, and overbought/oversold stipulations. Through working out find out how to use this indicator, you’ll be able to make extra knowledgeable buying and selling choices and building up your probabilities of luck.

Ceaselessly Requested Questions

- Is the ROC MT4 Indicator appropriate for each novices and skilled buyers?

Sure, the ROC MT4 Indicator can be utilized via buyers of all ranges. It supplies treasured insights into marketplace momentum and development route. - What’s the ultimate collection of sessions to make use of with the ROC indicator?

The perfect collection of sessions to make use of with the ROC indicator would possibly range relying in your buying and selling technique and the time-frame you’re buying and selling. Experiment with other settings to search out what works right for you. - Can the ROC indicator be used along with different technical signs?

Completely. Many buyers use the ROC indicator together with different signs like transferring averages and RSI to verify buying and selling indicators. - How incessantly must I test the ROC indicator when buying and selling?

The frequency of checking the ROC indicator is dependent upon your buying and selling technique and the time-frame you’re the usage of. Some buyers track it every day, whilst others would possibly test it more than one occasions an afternoon for shorter-term trades.

MT4 Signs – Obtain Directions

It is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to change into the amassed historical past knowledge.

This MT4 Indicator supplies for a chance to locate quite a lot of peculiarities and patterns in worth dynamics which might be invisible to the bare eye.

In line with this knowledge, buyers can think additional worth motion and modify their technique accordingly. Click on right here for MT4 Methods

Beneficial the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling Immediately! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses Right through The Yr

>> Declare Your $50 Bonus Right here <<

Easy methods to set up MT4 Indicator?

- Obtain the mq4 document.

- Reproduction mq4 document on your Metatrader Listing / professionals / signs /

- Get started or restart your Metatrader 4 Shopper

- Make a choice Chart and Time-frame the place you wish to have to check your MT4 signs

- Seek “Customized Signs” to your Navigator most commonly left to your Metatrader 4 Shopper

- Proper click on at the mq4 document

- Connect to a chart

- Alter settings or press good enough

- And Indicator will likely be to be had in your Chart

How to take away MT4 Indicator out of your Metatrader Chart?

- Make a choice the Chart the place is the Indicator operating to your Metatrader 4 Shopper

- Proper click on into the Chart

- “Signs listing”

- Make a choice the Indicator and delete

(Unfastened Obtain)

Click on right here beneath to obtain: