Buck Mounts a Comeback Publish Powell

- Traders awaited a the most important US employment file later within the week.

- Information printed that Canada added extra jobs than expected remaining month.

- Canada’s production sector shriveled in November.

On Monday, there was once a bullish shift within the USD/CAD outlook. The greenback staged a comeback, even if buyers digested wary remarks from Fed Chair Jerome Powell. Additionally, they awaited a the most important employment file later within the week that would have an effect on the United States rate of interest outlook.

–Are you to be told extra about foreign exchange choices buying and selling? Take a look at our detailed guide-

In the meantime, the Canadian greenback surged to a two-month prime towards the United States greenback on Friday. This transfer got here after certain home information that exposed the financial system added extra jobs than expected remaining month.

In November, Canadian employment higher via 24,900 jobs, surpassing economists’ expectancies of a fifteen,000 acquire. On the other hand, hours labored declined, and the jobless price higher to five.8%.

This jobs information contributed to the certain sentiment surrounding the Canadian greenback. Particularly, the forex had already benefited from the new broad-based weak point in the United States greenback.

Moreover, information indicated that Canada’s production sector shriveled in November because of international business weak point affecting output and new orders.

Concurrently, the United States greenback weakened towards a basket of main currencies as Federal Reserve Chair Jerome Powell cautioned about additional rate of interest changes. Moreover, the cost of oil, an important Canadian export, settled 2.5% decrease. This decline was once because of considerations about the most recent spherical of OPEC+ manufacturing cuts out there.

USD/CAD key occasions nowadays

The pair will most probably transfer sideways as there gained’t be any key financial stories from Canada or the United States.

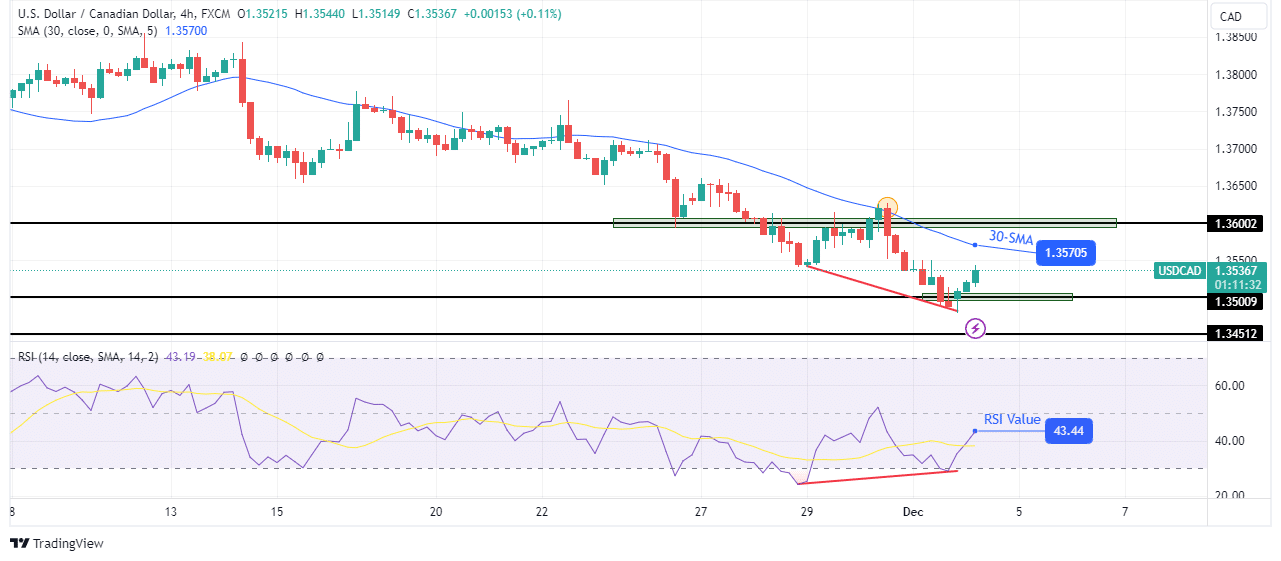

USD/CAD technical outlook: 1.3500 strengthen triggers rebound

At the charts, the prejudice is bearish. On the other hand, the fee is convalescing after respecting the 1.3500 key strengthen degree. Bears had been within the lead for lengthy, pushing the fee to new lows. On the similar time, bulls stored difficult the uptrend on the 30-SMA however did not push above.

-If you have an interest in figuring out about scalping foreign exchange agents, then learn our tips to get started-

The downtrend has paused on the 1.3500 key degree, a brand new low within the decline. On the other hand, the RSI displays weaker momentum at this degree, which has allowed bulls to emerge for a rebound. Nonetheless, for the reason that bearish bias is robust, bulls may pause on the 30-SMA resistance, the place bears will resume the decline. A spoil beneath the 1.3500 key degree would permit the fee to retest the 1.3451 degree.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must imagine whether or not you’ll be able to find the money for to take the prime chance of dropping your cash.