Polynomial Regression Channel MT4 Indicator

Have you ever ever felt just like the monetary markets are a chaotic dance, with costs fluctuating reputedly at random? Wouldn’t it’s superb to have a device that would allow you to unveil underlying developments and make extra knowledgeable buying and selling selections? Input the Polynomial Regression Channel (PRC) MT4 Indicator, a formidable statistical way that may make clear value actions inside the extensively used MetaTrader 4 platform.

This information delves deep into the sector of PRCs, equipping you with the data and abilities to navigate this treasured technical research instrument. We’ll embark on a adventure that begins with the core ideas of PRCs, after which dives into the practicalities of atmosphere them up and deciphering their alerts inside MT4. After all, we’ll discover complex methods and backtesting ways to refine your PRC-based buying and selling way.

So, buckle up, fellow buyers, and get able to demystify the ability of polynomial regression within the realm of technical research!

Statistical Means To Worth Prediction

Conventional channels, like transferring averages or Bollinger Bands, be offering a simplistic view of value actions through growing bands round a central line. Whilst useful, they continuously fail to seize the non-linear nature of markets. That is the place PRCs are available in, wielding the ability of statistics to color a extra nuanced image.

What are PRCs?

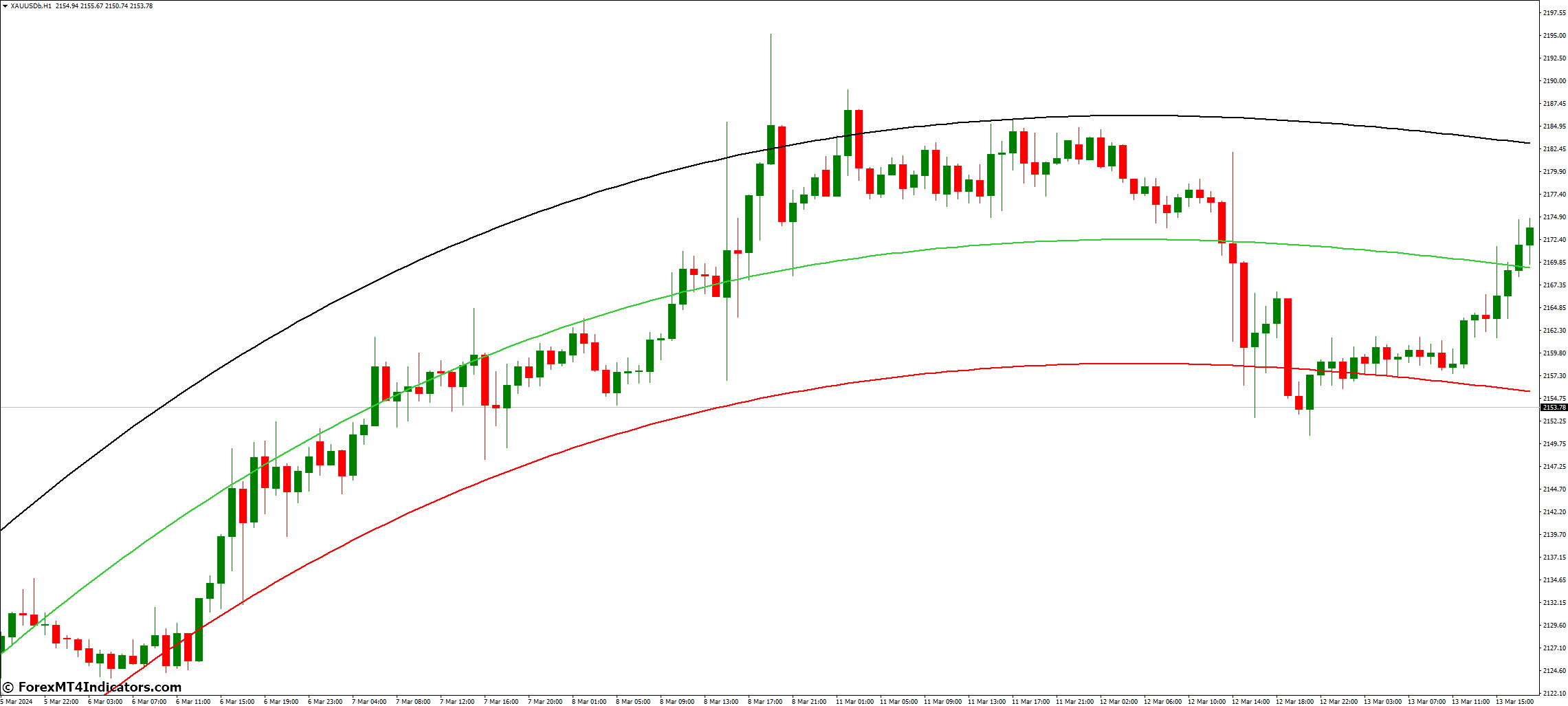

PRCs make the most of polynomial regression, a statistical methodology that matches a curved line (polynomial) thru historic value information. This line acts as a central channel, with deviations calculated above and underneath it to create a dynamic value band. In contrast to static channels, PRCs can adapt to curvature in the fee motion, probably providing a extra correct illustration of the underlying pattern.

The Energy of Statistics in Buying and selling

Consider the fee chart as a fancy puzzle. PRCs, thru statistical research, try to establish the underlying mathematical dating between previous and provide costs. This dating is then used to create a “best-fit” line, providing a glimpse into the possible long run course of costs.

A Best possible Marriage MT4 Platform and PRCs

The MT4 platform, a well-liked selection for lots of buyers, gives a limiteless library of technical signs. Thankfully, PRCs aren’t not noted! By means of putting in a customized PRC indicator, you’ll leverage this statistical research instrument without delay inside your MT4 atmosphere, seamlessly integrating it into your present buying and selling workflow.

Demystifying The Math At the back of Prcs

Whilst a deep dive into the mathematical intricacies of polynomial regression could be daunting for some, greedy the fundamental ideas can give a boost to your figuring out and alertness of PRCs.

Working out Polynomial Regression

Polynomial regression necessarily suits a curved line (polynomial) to a suite of information issues. The stage of the polynomial determines its complexity. A linear regression (stage 1) creates a instantly line, whilst upper levels (e.g., quadratic – stage 2, cubic – stage 3) permit for extra intricate curves.

Proper Stage and Knowledge Issues In MT4

The MT4 PRC indicator lets you customise the stage of the polynomial and the selection of information issues (historic value bars) used for the calculation. Choosing the right stability is the most important. A low stage may fail to seize the underlying pattern, whilst a prime stage may just result in overfitting, the place the road suits the historic information too carefully however loses its predictive energy for long run costs. Experimentation and backtesting (mentioned later) are key to discovering the optimum settings to your buying and selling technique.

Obstacles and Issues

It’s necessary to take into account that PRCs, like every technical research instrument, aren’t a crystal ball. They provide insights according to historic information, however markets are inherently dynamic and may also be influenced through unexpected occasions. Moreover, PRCs can combat all the way through sessions of prime volatility or uneven value motion. Right here’s a professional tip: Don’t depend only on PRCs. Mix them with different technical signs, basic research, and sound threat control practices to shape a well-rounded buying and selling technique.

Making Knowledgeable Buying and selling Choices

Now that you’ve your PRC arrange and working, it’s time to learn to interpret the alerts it generates. Listed below are some key issues to imagine:

- Figuring out Traits: The central regression line of the PRC acts as a dynamic pattern indicator. An upward-sloping line suggests a bullish pattern, whilst a downward slope signifies a bearish bias. Flat strains continuously sign consolidation levels.

- Worth Breakouts and Retracements: When costs ruin above the higher channel band, it could symbolize a possible bullish breakout. Conversely, a ruin underneath the decrease band may just trace at a bearish breakdown. On the other hand, take into account that breakouts may also be false alerts. Search for affirmation from different technical signs or value motion patterns ahead of making any buying and selling selections.

- Volatility and Deviations: The width of the channel bands displays the marketplace’s volatility. Wider bands point out upper volatility, making value predictions much less exact. Conversely, slender bands counsel decrease volatility, probably providing clearer pattern alerts.

Combining PRCs with Different Technical Signs

PRCs are a formidable instrument, however they shouldn’t be utilized in isolation. Believe integrating them with different well-established technical signs just like the Relative Energy Index (RSI) or Shifting Reasonable Convergence Divergence (MACD) to fortify your buying and selling alerts. By means of combining other technical research equipment, you’ll achieve a extra complete view of the marketplace and make extra knowledgeable buying and selling selections.

This concludes Phase 1 of our complete information to the Polynomial Regression Channel MT4 Indicator. Keep tuned for Phase 2, the place we’ll delve into complex PRC methods, and backtesting ways, and discover the longer term attainable of this thrilling technical research instrument!

How To Business With Polynomial Regression Channel MT4 Indicator

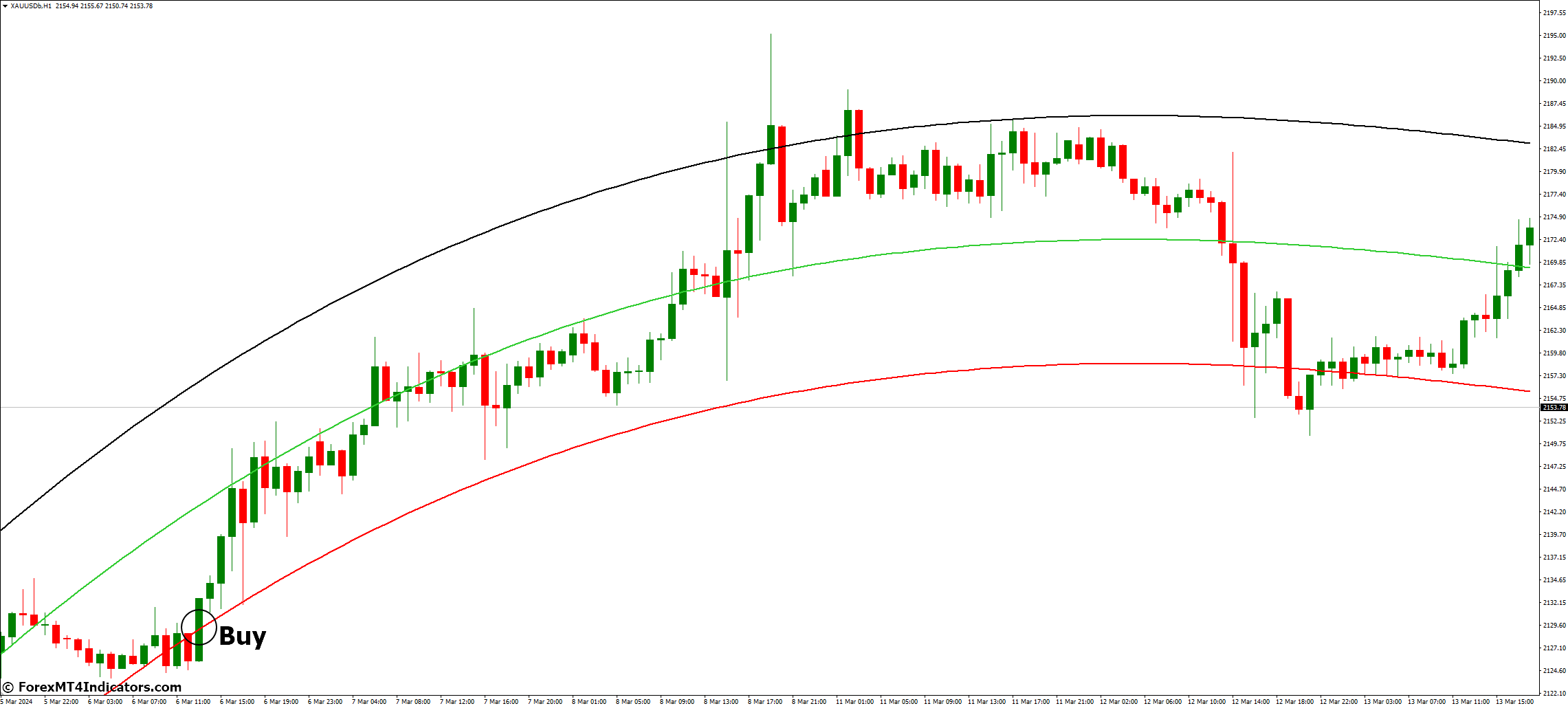

Purchase Access

- Breakout Above Higher Channel: Search for a value ruin above the higher channel band, preferably with a ultimate value affirmation above the band. This implies a possible bullish breakout.

- Worth Retracement to Central Line: After a bullish breakout, follow if the fee retraces again in opposition to the central regression line of the PRC. If the fee unearths enhance at or close to the central line and bounces again upwards, it could be a purchase alternative.

- Mixed Sign: Mix the above with a bullish sign from some other technical indicator like RSI transferring above 50 or MACD producing a purchase crossover. This provides affirmation to the possible purchase sign.

Prevent-Loss

- Position your stop-loss order underneath the hot swing low (a low level in value motion) ahead of the breakout or retracement. Purpose for a risk-reward ratio of no less than 1:2 (attainable benefit two times the quantity risked).

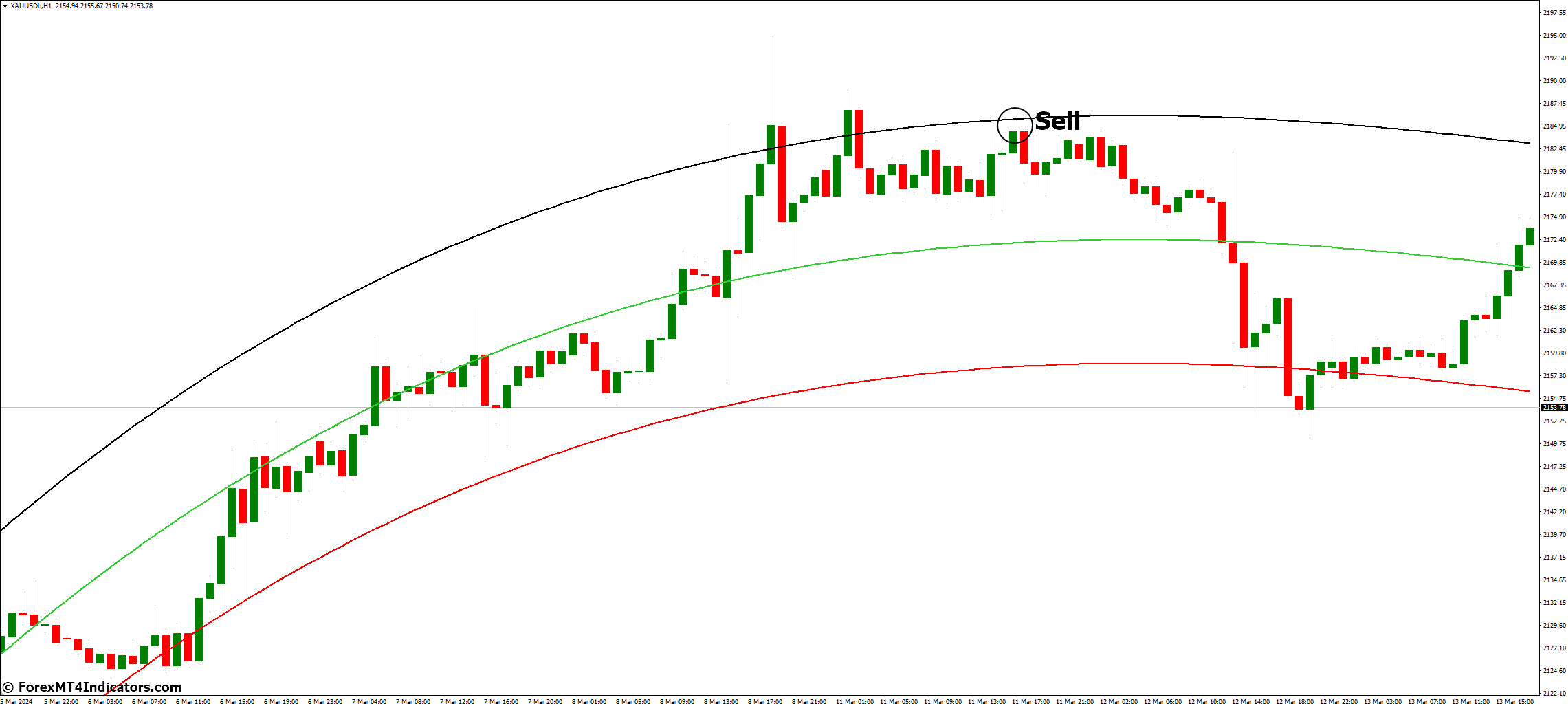

Promote Access

- Breakout Beneath Decrease Channel: Search for a value ruin underneath the decrease channel band, preferably with a ultimate value affirmation underneath the band. This implies a possible bearish breakdown.

- Worth Retracement to Central Line: After a bearish breakdown, follow if the fee retraces again in opposition to the central regression line of the PRC. If the fee unearths resistance at or close to the central line and rejects additional downward motion, it could be a promote alternative.

- Mixed Sign: Mix the above with a bearish sign from some other technical indicator like RSI transferring underneath 50 or MACD producing a promote crossover. This provides affirmation to the possible promote sign.

Prevent-Loss

- Position your stop-loss order above the hot swing prime (a prime level in value motion) ahead of the breakdown or retracement. Purpose for a risk-reward ratio of no less than 1:2.

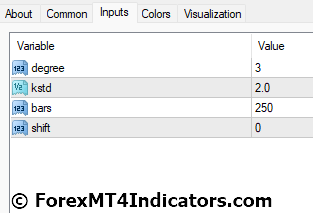

Polynomial Regression Channel Indicator Settings

Conclusion

The Polynomial Regression Channel (PRC) MT4 Indicator gives a formidable statistical lens for examining value actions. By means of incorporating its dynamic channel and figuring out its alerts, you’ll achieve treasured insights into attainable developments, breakouts, and retracements. On the other hand, take into account that the PRC is a device, no longer a magic components.

All the time prioritize sound threat control, backtest your methods, and use the PRC at the side of different technical signs and basic research to navigate the ever-changing marketplace panorama. With determination and steady studying, the PRC can transform a treasured asset for your buying and selling toolbox, serving to you’re making extra knowledgeable buying and selling selections and probably chart your route towards buying and selling good fortune.

Really useful MT4/MT5 Agents

XM Dealer

- Loose $50 To Get started Buying and selling In an instant! (Withdraw-able Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful the Forex market Dealer

- Further Unique Bonuses All over The Yr

>> Signal Up for XM Dealer Account right here <<

FBS Dealer

- Business 100 Bonus: Loose $100 to kickstart your buying and selling adventure!

- 100% Deposit Bonus: Double your deposit as much as $10,000 and industry with enhanced capital.

- Leverage as much as 1:3000: Maximizing attainable earnings with some of the best leverage choices to be had.

- ‘Very best Buyer Provider Dealer Asia’ Award: Identified excellence in buyer enhance and repair.

- Seasonal Promotions: Experience quite a few unique bonuses and promotional gives all 12 months spherical.

>> Signal Up for FBS Dealer Account right here <<

(Loose MT4 Signs Obtain)

Click on right here underneath to obtain: