GBP/USD Weekly Forecast: Fed’s Behind schedule Reduce Weighs on Pound

- The buck rallied amid a drop in fee lower expectancies.

- Markets now expect simplest two Fed fee cuts this yr.

- Subsequent week, buyers will center of attention on retail gross sales knowledge from the United States and the United Kingdom.

The GBP/USD weekly forecast is pointing southward, with the Fed anticipated to hold tight earlier than making any strikes to slash rates of interest.

Ups and downs of GBP/USD

The GBP/USD pair had a bearish week because the buck rallied amid a drop in fee lower expectancies. The foremost match this week used to be the United States inflation record. When it got here out, buyers had been shocked by means of any other month of higher-than-expected value enlargement. Additionally, it got here after a blockbuster jobs record appearing a strong hard work marketplace.

-Are you searching for the most productive AI Buying and selling Agents? Take a look at our detailed guide-

In consequence, there used to be a pointy adjustment in Fed fee lower expectancies. Markets now expect simplest two fee cuts this yr, beginning in September. Inflation in the United States has confirmed to be extra cussed than different main economies. This put the buck in a greater place than the pound.

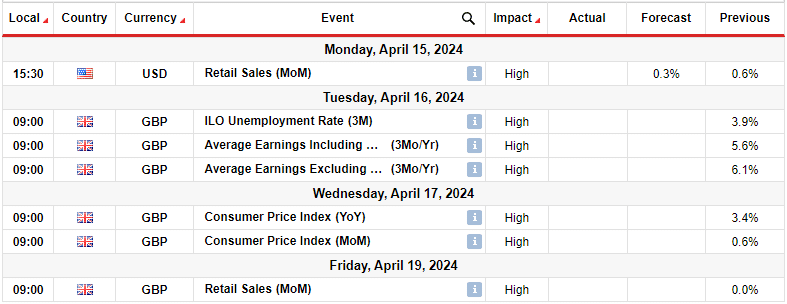

Subsequent week’s key occasions for GBP/USD

Subsequent week, buyers will center of attention on retail gross sales knowledge from the United States and the United Kingdom. Moreover, the United Kingdom will unlock knowledge on employment and inflation. All center of attention can be on the United Kingdom CPI record, which is able to display the state of value enlargement within the financial system. The hot US inflation record has put the GBP/USD pair in a vulnerable place because the timing for the primary Fed lower has moved to September.

Subsequently, buyers will wait to look whether or not the Financial institution of England can be able to chop rates of interest earlier than the Fed. A decline in UK inflation would additional weaken the GBP/USD pair.

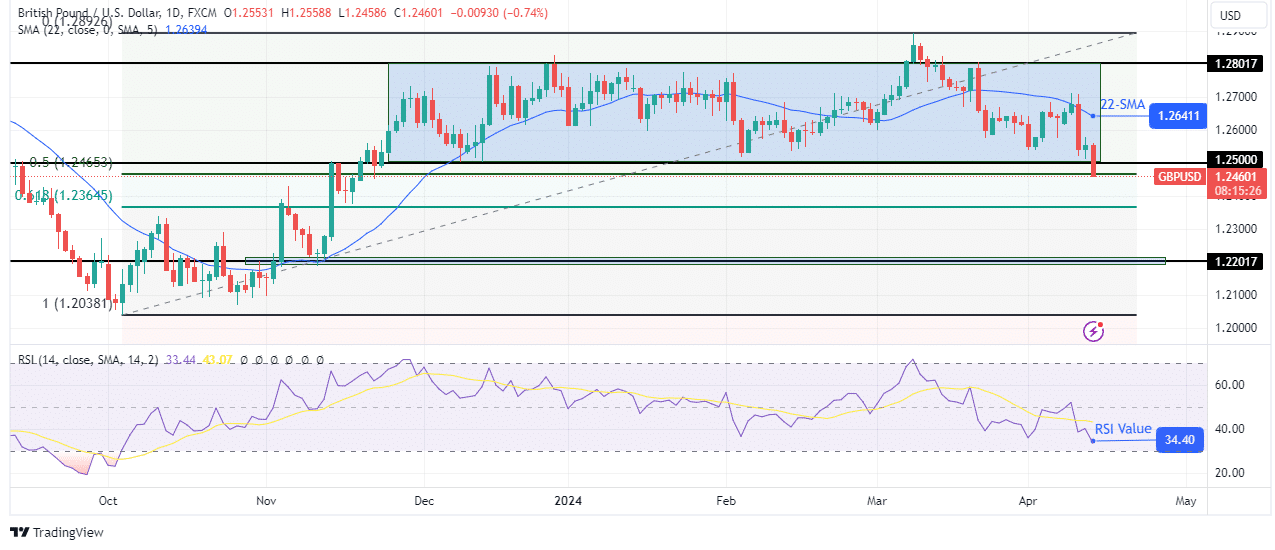

GBP/USD weekly technical forecast: Worth alerts coming near near rectangle breakout

At the technical aspect, the GBP/USD value is at the verge of breaking out of its rectangle trend. Additionally, the prejudice is bearish as the cost falls neatly beneath the 22-SMA, and the RSI is coming near the oversold area.

-Are you searching for the most productive MT5 Agents? Take a look at our detailed guide-

The former bullish pattern paused when the cost reached the 1.2801 key resistance degree. It then consolidated with the 1.2801 degree as resistance and the 1.2500 degree as enhance. There was a surge in momentum that has driven the cost to the 0.5 Fib retracement degree.

If the cost closes beneath the rectangle enhance, it is going to most probably fall to the 0.618 Fib retracement degree. Additionally, the trail can be transparent for the cost to achieve the 1.2201 enhance degree.

Having a look to business foreign exchange now? Make investments at eToro!

75% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll come up with the money for to take the top possibility of shedding your cash.