Markets Await Lengthen in Fed Fee Cuts

- There are indicators that the Fed may delay any plans for rate of interest cuts.

- Japan’s exports grew for a 2nd consecutive month in October.

- Buyers have lowered the likelihood of an preliminary Fed price reduce by way of March.

Thursday’s USD/JPY outlook leans in opposition to the bullish aspect because the buck companies on indicators that the Federal Reserve may delay any plans for rate of interest cuts. In the meantime, the yen was once weaker after information published a slowdown in Japan’s financial system.

–Are you to be informed extra about MT5 agents? Take a look at our detailed guide-

Japan’s exports grew for a 2nd consecutive month in October. On the other hand, the expansion was once significantly slower, principally because of lowered shipments of chips and metal to China. Ministry of Finance information published a 1.6% build up in exports from a 12 months previous. Despite the fact that it surpassed the 1.2% forecasted by way of economists, it lagged at the back of the 4.3% upward push in September.

Significantly, the trade-dependent financial system faces demanding situations from vulnerable exports and slow home call for. In consequence, it complicates efforts to stimulate expansion within the post-pandemic restoration.

Additionally, some economists warning that Japan, missing expansion momentum, may input a technical recession, outlined as two consecutive quarters of contraction.

In the meantime, the buck discovered make stronger after retail gross sales exceeded expectancies and manufacturer costs fell. The information contributed to the narrative of an financial ‘comfortable touchdown.’ Moreover, this state of affairs would give you the Fed overtime earlier than enforcing price cuts.

Buyers proceed to be assured that rates of interest is not going to build up. On the other hand, they have got lowered the likelihood of an preliminary price reduce by way of March to lower than 1 in 4.

USD/JPY key occasions these days

Buyers are getting ready to obtain stories from america that may display the state of the financial system, together with

- The preliminary jobless claims file

- The Philadelphia Fed Production Index

USD/JPY technical outlook: Bulls eye upside possible past the 30-SMA

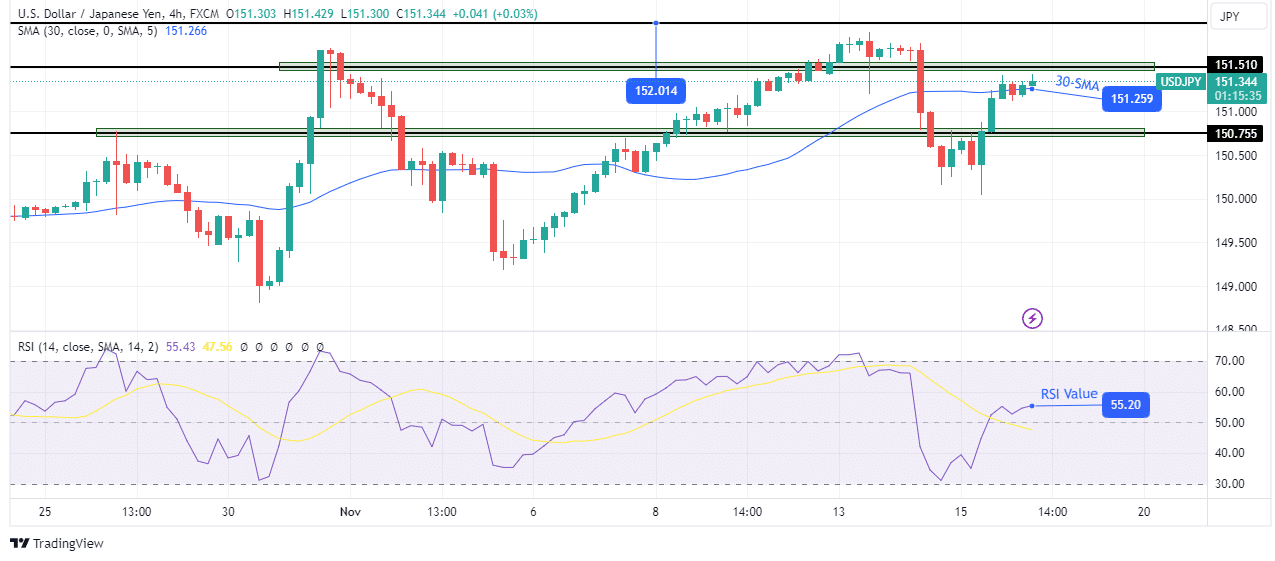

At the charts, the USD/JPY value is making an attempt to push above the 30-SMA as bulls battle for keep an eye on. On the other hand, they face an uphill process with resistance on the SMA and quite above on the 151.51 key degree. Nonetheless, the RSI has crossed above 50, appearing bulls are gaining momentum.

–Are you to be informed extra about Thailand foreign exchange agents? Take a look at our detailed guide-

Your next step for bulls will likely be to detach from the SMA and spoil above the 151.51 resistance. This could then permit the associated fee to hunt new highs. On the other hand, if bulls fail to breach the 151.51 degree, the associated fee will most likely cave in to retest the 150.75 make stronger and decrease.

Having a look to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll be able to find the money for to take the prime possibility of shedding your cash.