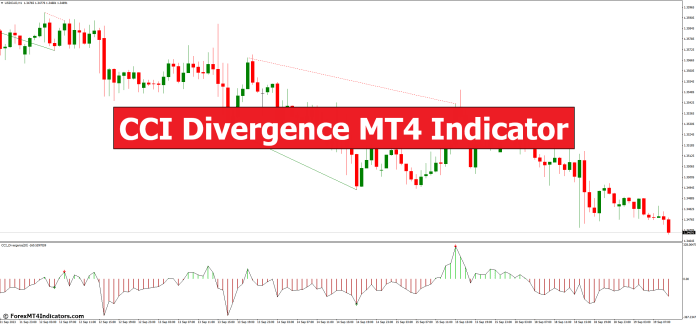

CCI Divergence MT4 Indicator – ForexMT4Indicators.com

On the earth of the Forex market buying and selling, luck is steadily made up our minds via one’s talent to make knowledgeable selections. Technical signs play a an important position in serving to buyers analyze marketplace traits and make predictions. Amongst those signs, the CCI Divergence MT4 Indicator sticks out as an impressive software that can give treasured insights into marketplace actions. On this article, we can delve into the intricacies of this indicator, exploring its options, programs, and the way it may be used successfully via buyers.

Working out the CCI Divergence MT4 Indicator

What’s CCI?

Sooner than diving into the specifics of the CCI Divergence MT4 Indicator, let’s first perceive what CCI stands for. CCI stands for Commodity Channel Index. Evolved via Donald Lambert in 1980, this indicator was once first of all designed for the commodities marketplace however has discovered its manner into the sector of the Forex market buying and selling.

The CCI is a flexible momentum oscillator that may be implemented to more than a few monetary markets, together with the Forex market. It measures the present worth stage relative to a mean worth stage over a specified length. The ensuing price oscillates round a 0 line and is used to spot overbought and oversold stipulations available in the market.

Divergence in the Forex market Buying and selling

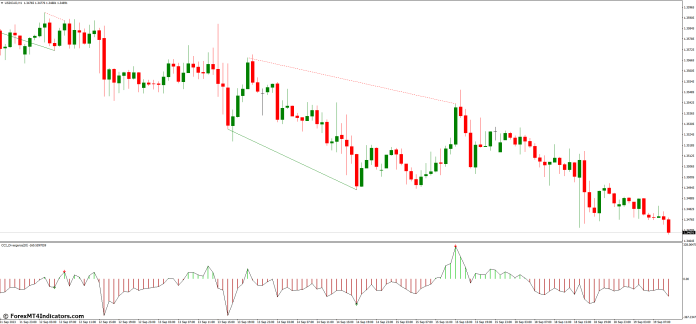

Divergence is an idea continuously utilized in the Forex market buying and selling to spot attainable reversals or pattern adjustments. It happens when the associated fee motion of a foreign money pair disagrees with the motion of a trademark, such because the CCI. There are two primary varieties of divergence: bullish and bearish.

- Bullish Divergence: This happens when the CCI makes decrease lows whilst the associated fee makes upper lows. It suggests a imaginable upward reversal in the associated fee.

- Bearish Divergence: Conversely, bearish divergence occurs when the CCI makes upper highs whilst the associated fee makes decrease highs. This indicators a possible downward reversal in the associated fee.

The Energy of CCI Divergence MT4 Indicator

Now that we have got a foundational working out of CCI and divergence let’s discover how the CCI Divergence MT4 Indicator combines those ideas to empower the Forex market buyers.

Key Options of CCI Divergence MT4 Indicator

The CCI Divergence MT4 Indicator comes with a number of options that make it a treasured asset for buyers:

Consumer-Pleasant Interface

The indicator is designed with buyers in thoughts, providing a user-friendly interface that makes it out there to each newbies and skilled buyers.

Actual-Time Research

Certainly one of its most vital benefits is its talent to offer real-time research. Buyers can obtain signals when a divergence development is detected, permitting them to do so promptly.

Customization Choices

The indicator gives customization choices, permitting buyers to regulate settings to fit their buying and selling technique and chance tolerance.

Versatility

The CCI Divergence MT4 Indicator may also be implemented to a couple of timeframes, making it flexible for buyers with other buying and selling types.

How one can Use CCI Divergence MT4 Indicator Successfully

Step 1: Configure the Settings

Customise the indicator settings in step with your personal tastes. You’ll be able to alter the lookback length and different parameters to align together with your buying and selling technique.

Step 2: Establish Divergence

Stay an in depth eye at the indicator for attainable divergence patterns. While you spot a bullish or bearish divergence, it’s time to concentrate.

Step 3: Verify with Different Signs

Whilst the CCI Divergence MT4 Indicator is robust by itself, it’s smart to verify its indicators with different technical signs or basic research.

How one can Industry with CCI Divergence MT4 Indicator

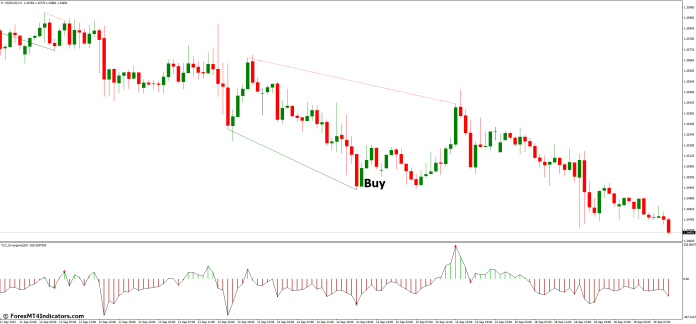

Purchase Access

- Search for bullish (sure) divergence indicators the place CCI bureaucracy upper lows and worth bureaucracy decrease lows.

- Verify with worth motion or different technical research.

- Input an extended (purchase) business with affirmation.

- Set a stop-loss beneath fresh swing lows or fortify ranges.

- Position a take-profit order at resistance or a predetermined goal.

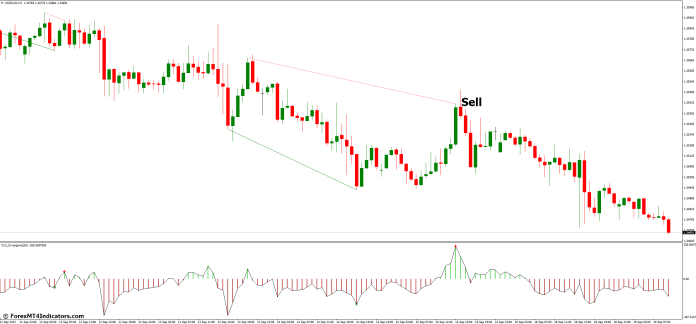

Promote Access

- Establish bearish (unfavorable) divergence indicators the place CCI bureaucracy decrease highs and worth bureaucracy upper highs.

- Verify with further technical research or worth motion.

- Input a brief (promote) business with affirmation.

- Set a stop-loss above fresh swing highs or resistance ranges.

- Position a take-profit order at fortify or a predetermined cash in goal.

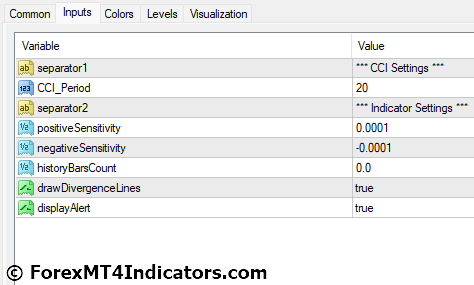

CCI Divergence MT4 Indicator Settings

Conclusion

The CCI Divergence MT4 Indicator is a treasured software within the arsenal of the Forex market buyers. It combines the energy of the Commodity Channel Index with the idea that of divergence to offer well timed insights into marketplace traits. By means of the use of this indicator successfully, buyers could make extra knowledgeable selections and improve their probabilities of luck within the dynamic international of the Forex market buying and selling.

FAQs

- Can the CCI Divergence MT4 Indicator be used for scalping?

Sure, the indicator can be utilized for scalping methods, nevertheless it’s crucial to mix it with different signs and chance control ways for efficient scalping. - Is the CCI Divergence MT4 Indicator appropriate for long-term buying and selling?

Completely. The indicator’s versatility lets in it to be implemented to more than a few buying and selling types, together with long-term buying and selling. It will probably lend a hand determine pattern reversals and access issues for long-term positions. - Can the CCI Divergence MT4 Indicator be used at the side of different technical signs?

Sure, combining the CCI Divergence MT4 Indicator with different technical signs can give a extra complete view of the marketplace. Buyers steadily use it along transferring averages, RSI, and MACD for higher accuracy.

MT4 Signs – Obtain Directions

It is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to grow to be the accrued historical past knowledge.

This MT4 Indicator supplies for a chance to come across more than a few peculiarities and patterns in worth dynamics which can be invisible to the bare eye.

In accordance with this knowledge, buyers can suppose additional worth motion and alter their technique accordingly. Click on right here for MT4 Methods

Beneficial the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling Straight away! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses During The 12 months

>> Declare Your $50 Bonus Right here <<

How one can set up MT4 Indicator?

- Obtain the mq4 report.

- Reproduction mq4 report on your Metatrader Listing / mavens / signs /

- Get started or restart your Metatrader 4 Shopper

- Make a selection Chart and Time frame the place you wish to have to check your MT4 signs

- Seek “Customized Signs” to your Navigator most commonly left to your Metatrader 4 Shopper

- Proper click on at the mq4 report

- Connect to a chart

- Alter settings or press good enough

- And Indicator shall be to be had in your Chart

How to take away MT4 Indicator out of your Metatrader Chart?

- Make a selection the Chart the place is the Indicator operating to your Metatrader 4 Shopper

- Proper click on into the Chart

- “Signs checklist”

- Make a selection the Indicator and delete

(Unfastened Obtain)

Click on right here beneath to obtain: