Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique

Divergence buying and selling is most definitely probably the most underrated technical research ways that many new buyers disregard. It’s not as fashionable as one way as maximum simplistic buying and selling setups are. Then again, with the correct oscillator indicator and the correct parameters, buyers may considerably support their buying and selling accuracy the usage of divergences.

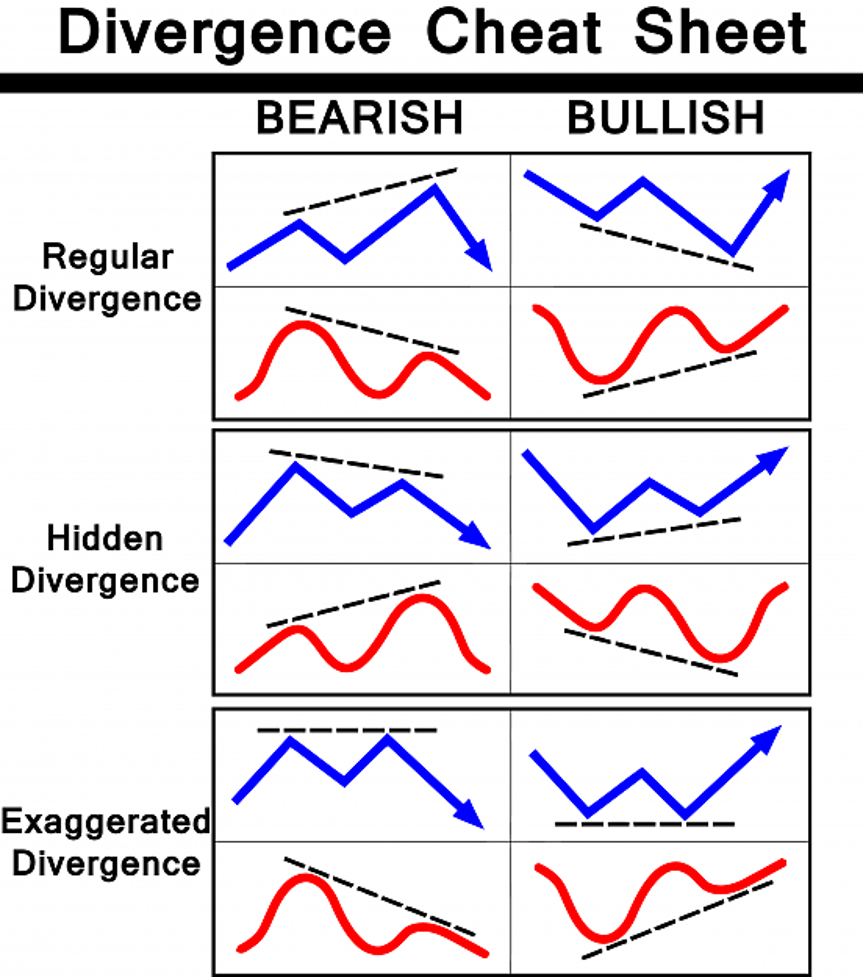

Divergences are mainly discrepancies within the magnitude of the cost swings in accordance with value motion in comparison to the swings in accordance with peaks and troughs on an oscillator.

In buying and selling, oscillators are technical signs which most often point out momentum via plotting strains or histogram bars that oscillate round a mean or inside of a variety. Those oscillators would typically apply the motion of value motion reasonably intently. It creates peaks every time swing highs are shaped and troughs every time swing lows are shaped.

The peak and intensity of an oscillators peaks and troughs would typically replicate that of the swing top and swing low of value motion. Then again, there are circumstances in which the peak and intensity of the peaks and troughs of an oscillator would fluctuate from that of value motion. Those stipulations are referred to as divergences. Underneath is a chart of what the several types of divergences appear to be.

Hidden Divergences are in particular fascinating as a result of this kind of divergence most often happens in a trending marketplace as outlined via value motion buyers. Worth motion buyers outline an uptrend as value motion developing upper swing highs and swing lows, whilst downtrends are outlined as value motion developing decrease swing highs and swing lows. In accordance with the chart above, that is precisely what hidden divergence value motion seems like. Then again, the oscillator in a hidden divergence would create an exaggerated top or trough which signifies that value is overextended. This creates a chief situation for value to opposite and create and worth swing within the route of the rage.

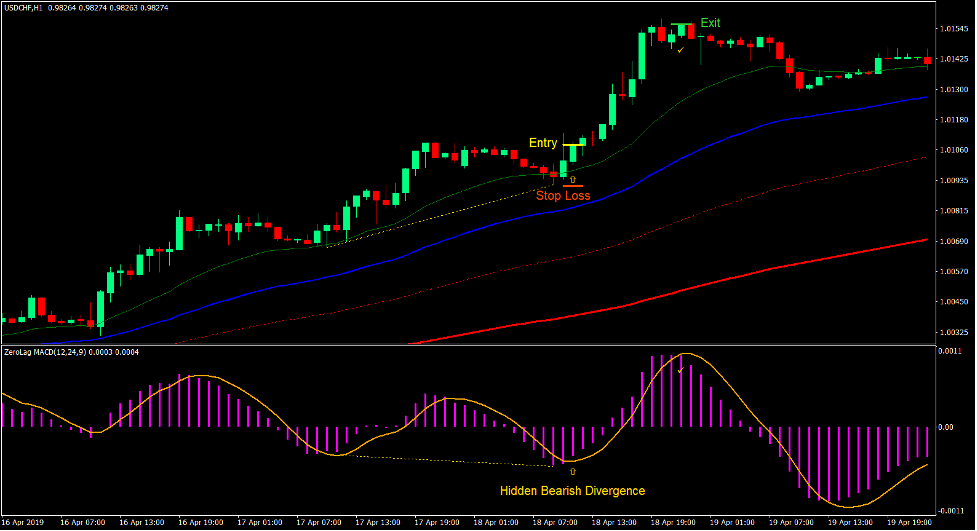

Right here we will be able to read about a hidden divergence setup the usage of a customized technical indicator, which is the 0 Lag MACD.

0 Lag MACD

The 0 Lag MACD is a customized technical indicator which is in accordance with the vintage Transferring Reasonable Convergence and Divergence (MACD).

The vintage MACD is a well-liked momentum oscillator which is in accordance with the crossover of 2 transferring reasonable strains. It plots its MACD line in accordance with the variation of 2 underlying transferring reasonable strains. This is known as the MACD line. Different variations plot a histogram bar quite than a line, such because the 0 Lag MACD. The MACD then plots a sign line which is a transferring reasonable derived from the primary MACD line or histogram.

Crossovers between the MACD line or histogram and the sign line point out a momentum reversal. Buyers can use this as an access sign in accordance with momentum reversals.

The site of the crossover additionally signifies the chance of the reversal. Crossovers going on a long way from the midline point out that value is both overbought or oversold and may well be top for a pointy reversal.

This indicator, being an oscillator, additionally works neatly when used with divergence ways.

The normal MACD might every now and then be too lagging. The 0 Lag MACD is a model of the MACD which considerably decreases the volume of lag making the indicator a super momentum reversal indicator.

Carter MA

Carter MA is a customized technical indicator which is in accordance with transferring averages. It plots a suite of changed transferring reasonable strains which can be utilized to spot development route.

Buyers use commonplace transferring reasonable line classes to spot non permanent, mid-term and long-term traits, such because the 21-period, 50-period, 100-period and 200-period transferring reasonable strains. Carter MA plots those transferring reasonable strains which is helping buyers determine the overall development route.

Pattern route will also be known the usage of the Carter MA indicator in accordance with how the transferring reasonable strains are stacked. The marketplace is in an uptrend if the non permanent transferring reasonable strains are above the long-term transferring reasonable strains, and in a downtrend if the non permanent transferring reasonable strains are underneath the long-term transferring reasonable strains. Buyers too can determine if the marketplace is reversing if the strains are crossing over or if the marketplace isn’t trending if the strains don’t seem to be obviously stacked.

The spaces between the strains may additionally act as a dynamic house of strengthen or resistance. Buyers can industry bounces from those spaces buying and selling within the route of the rage.

Buying and selling Technique

Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique is a development following divergence buying and selling technique which uses the 0 Lag MACD and the Carter MA indicator.

Pattern route is known first the usage of the Carter MA indicator. That is merely in accordance with how the transferring reasonable strains are stacked.

The Carter MA indicator could also be used as a dynamic house of strengthen or resistance. Worth motion will have to display that it’s respecting the realm between the golf green and blue strains as a space of dynamic strengthen or resistance.

The 0 Lag MACD is used to spot hidden divergences evaluating its peaks troughs with swing highs and swing lows of value motion. Legitimate industry setups are regarded as if a hidden divergence is seen.

Industry indicators are generated as quickly because the MACD bars pass the sign line.

Signs:

Most popular Time Frames: 1-hour, 4-hour and day-to-day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

Purchase Industry Setup

Access

- The Carter MA strains will have to be stacked within the following order:

- Inexperienced Line: most sensible

- Blue Line: 2nd from the highest

- Dotted Purple Line: 2nd from the ground

- Forged Purple Line: backside

- Worth motion will have to retrace in opposition to the realm between the golf green and blue strains.

- Worth motion will have to display indicators of bullish value rejection at the dynamic strengthen house.

- A bullish hidden divergence will have to be seen at the 0 Lag MACD.

- Input a purchase order as quickly because the bars at the 0 Lag MACD crosses above the sign line.

Forestall Loss

- Set the prevent loss on a strengthen underneath the access candle.

Go out

- Shut the industry as quickly because the bars at the 0 Lag MACD crosses underneath the sign line.

Promote Industry Setup

Access

- The Carter MA strains will have to be stacked within the following order:

- Inexperienced Line: backside

- Blue Line: 2nd from the ground

- Dotted Purple Line: 2nd from the highest

- Forged Purple Line: most sensible

- Worth motion will have to retrace in opposition to the realm between the golf green and blue strains.

- Worth motion will have to display indicators of bearish value rejection at the dynamic resistance house.

- A bearish hidden divergence will have to be seen at the 0 Lag MACD.

- Input a promote order as quickly because the bars at the 0 Lag MACD crosses underneath the sign line.

Forestall Loss

- Set the prevent loss on a resistance above the access candle.

Go out

- Shut the industry as quickly because the bars at the 0 Lag MACD crosses above the sign line.

Conclusion

This straightforward buying and selling technique is an efficient development following technique, which is blended with a divergence buying and selling setup. This technique may be regarded as as a top chance buying and selling technique.

There are buyers who use the similar form of buying and selling technique who declare to have an accuracy stage of round 60%.

The important thing buying and selling this technique is in being disciplined sufficient to industry best when the marketplace is obviously trending and to keep away from buying and selling if it’s not.

the Forex market Buying and selling Methods Set up Directions

Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to become the gathered historical past information and buying and selling indicators.

Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique supplies a chance to stumble on more than a few peculiarities and patterns in value dynamics which might be invisible to the bare eye.

In accordance with this data, buyers can think additional value motion and regulate this technique accordingly.

Really useful the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling Immediately! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-Via-Step XM Dealer Account Opening Information

How you can set up Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique?

- Obtain Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique.zip

- *Reproduction mq4 and ex4 information for your Metatrader Listing / mavens / signs /

- Reproduction tpl document (Template) for your Metatrader Listing / templates /

- Get started or restart your Metatrader Consumer

- Make a selection Chart and Time-frame the place you wish to have to check your foreign exchange technique

- Proper click on to your buying and selling chart and hover on “Template”

- Transfer proper to make a choice Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique

- You’ll see Carter MA 0 Lag MACD Divergence the Forex market Buying and selling Technique is to be had to your Chart

*Word: Now not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.