Aroon Indicator – Technique and Best possible Settings

Aroon indicator is a trend-following oscillator that gauges the fad power. The Aroon indicator used to be evolved by means of Tushar Chande, an Indian dealer, in 1995. Chande’s origins performed a job within the selection of an peculiar title for the oscillator, because the Sanskrit that means of ‘Aroon’ is ‘the primary ray of the morning solar.’ This text covers the Aroon indicator intimately, describing its options, buying and selling indicators, and using the software in actual buying and selling.

The object covers the next topics:

Aroon indicator definition

The Aroon indicator is used within the the Forex market (foreign currency echange) buying and selling and buying and selling binary choices to spot fashion and the path of the associated fee motion, measure the associated fee relative power of the underlying traits, outline native highs and lows, and due to this fact, download buying and selling indicators.

The Aroon determines the adjustments happening within the uptrend or downtrend, whether or not there’s a stong or susceptible fashion inside a specific duration.

How Aroon Indicator works

To make use of the Aroon indicator successfully, one will have to know how this oscillator works.

The Arron indicator is composed of 2 strains.

Aroon indicator is on the backside of the EURUSD chart. The yellow line items the Aroon up indicator by means of default; the pink one – the Aroon Down indicator.

As with every oscillator, those strains differ inside a restricted vary. Relating to Aroon, the indicator strikes between 0 and 100. The Aroon-Up line displays the dealer on a 100-point scale the selection of sessions time relative (mins, hours, or days, relying on the time frame) that experience handed for the reason that absolute top passed off all through a specific duration. And the Aroon Down indicator, respectively, displays the selection of sessions that experience handed for the reason that formation of the bottom value within the chart.

Aroon Indicator System Defined

Calculation formulation:

Aroon-Up = [(number of periods) – (number of periods since the High)] / (selection of sessions) * 100%.

Aroon-Down = [(number of periods) – (number of periods since the Low)] / (selection of sessions) * 100%.

As an example, in the event you carry out calculations within the day by day chart and take the default duration of 14 days, and the top passed off six days in the past, the Aroon-Up line will display the next price:

((14-6)/14)*100 = 57,

Now that you know how the Aroon indicator works, you’ll be able to bet that once the latest top is shaped all through the present buying and selling day, Aroon Up indicator displays the price of 100. In a continual new uptrend, the Aroon-Up price can be 100, and within the Aroon-Down – 0, respectively.

Best possible environment for Aroon indicator

The Aroon indicator can be utilized on other buying and selling platforms. Allow us to discover the Aroon settings in the most well liked buying and selling terminals, MetaTrader 4, MetaTrader 5, and the LiteFinance on-line terminal.

Aroon MT4

MetaTrader 4 doesn’t have the Aroon in the usual indicator checklist. However you’ll be able to obtain the indicator free of charge. You’ll to find other variations of the Aroon within the MQL library.

I can show the Aroon indicator settings at the instance of the vintage model that you’ll be able to obtain by means of this hyperlink.

Paste the downloaded report into the “Signs” folder and restart the terminal. After restarting, Aroon seems within the checklist of to be had signs. You’ll learn extra concerning the process for putting in quite a lot of technical research equipment in MT in my article “Bollinger Bands Indicator in the Forex market Defined.”

So as to add the Aroon indicator to the chart, input the Insert menu and click on at the technical Signs tab. Move to the Customized phase and make a choice Aroon signs within the checklist.

When the indicator is added, you are going to see the settings. For those who click on at the OK button, the indicator with the default parameters can be added to the chart.

You’ll specify the duration of the Aroon strains within the Inputs tab. The default duration is 14. With any such duration, the indicator identifies quick trending value conduct however indicators a fashion reversal on maximum corrections.

If you wish to business longer term fashion, you will have to build up the duration to 25-30.

Within the Colours tab, you’ll be able to make a choice the colours of the indicator strains. Via default, the strains are yellow and blue. I’d change yellow with crimson.

Within the Ranges tab, you’ll be able to alter the overbought and oversold stipulations. The default values of 30% and 70% are regarded as optimum.

You’ll alter the timeframes to show the indicator within the Visualization tab.

The above determine presentations the Aroon indicator within the chart. The crimson line is Aroon Up indicator, the blue one Aroon Down indicator.

Aroon MT5

Within the MQL5 technical research buying and selling equipment database, you’ll be able to to find a number of variations of the Aroon indicator for MetaTrader 5. I used the vintage model. The Aroon charts may also be downloaded by means of this hyperlink.

The entire leisure is very similar to putting in the indicator at the MT4. You’ll practice the information from the former phase.

You probably have finished the entirety accurately, the Aroon indicator with the default parameters within the MT5 seems like the only within the above chart. The golf green line is the Aroon Up indicator, the crimson one displays the Aroon Down strikes.

Aroon within the LiteFinance on-line terminal

You’ll additionally use the Aroon indicator within the LiteFinance on-line terminal.

So as to add the Aroon indicator to the chart, click on at the tab with different Signs.

Make a selection Aroon within the checklist of alternative technical signs.

The indicator with the default values seems like the only above.

The settings have two tabs, Parameters and Taste. The Parameters tab supplies the duration environment (the default period is 14) and the selection of decimal puts analysed by means of the set of rules.

Within the Taste tab, you’ll be able to set the colors for the Aroon-Up and Aroon-Down strains.

Distinction between Aroon oscillator and Aroon-Up/ Aroon-Down strains

Along with the vintage Aroon indicator, there’s a model with one line – the so-called Aroon oscillator. You’ll obtain the Aroon indicator by means of this hyperlink.

Aroon indicator line signifies the variation between the readings of Aroon Up indicator and Aroon Down indicator. The software is helping one outline the fad phases (starting, height, and finish); it additionally indicators the beginning and the tip of the low and high costs sideways motion. The above Aroon chart presentations the vintage indicator within the backside indicator window and the oscillator above.

The oscillator sends transparent and simple indicators. Buyers wait for 0 line Aroon crossovers to sign doable fashion adjustments. When the oscillator line is going from the destructive zone into the certain one, this is a purchase sign; a promote sign seems when the road is going from the certain zone to the destructive one. If the Aroon indicator readings are within the ranging markets of 40 -100, it signifies a bullish fashion; if the readings are within the zone between -40 and -100, there’s a transparent bearish fashion.

Tips on how to learn Aroon indicator indicators?

Allow us to talk about the Aroon buying and selling indicators, that are moderately winning in Forex in addition to in buying and selling CFDs, shares, binary choices. The applying of the Aroon indicator is in line with studying a number of indicators.

Id of the fad path

The craze is outlined in step with the positioning of the strains relative to one another at a degree on the subject of 30% and 70%. In an uptrend, Aroon-Up rises above 70% and now and then can succeed in 100%. In a downtrend, Aroon-Down line, accordingly, falls under 30%, periodically achieving 0%.

Allow us to learn about the examples under to know higher how the Aroon indicators paintings.

The golf green zone marks an uptrend within the XAUUSD value chart, and the crimson zone marks the next bearish correction. Observe that the yellow line is above the golf green horizontal line at 70% all through the bullish value conduct. The pink line is under the crimson horizontal line at 30% as a rule.

Strains crossovers

The principle Aroon sign is the crossovers of its strains.

When the Aroon-Up line is going above the zone of 30% and on the identical time its line crosses the descending Aroon Down indicator from the ground up, this is a purchase sign. A brand new uptrend normally begins at this second, giving a nice access level for an extended place.

The crimson horizontal line marks stage 30% within the EURJPY chart. The blue circle marks the purpose the place the Aroon-Up crosses the Aroon-Down line from backside to most sensible. As you understand, the following Aroon crossover happens instantly after the indicator line is going above the zone of 30% nowadays of the bullish fashion’s inception.

One can use this business sign each to go into lengthy trades and to calculate the binary choices expiration duration. As an example, if there’s nonetheless numerous time left prior to the contract expiration, then this sign in moderately lengthy timeframes can be a nice affirmation that the associated fee will transfer up for a slightly very long time.

The Aroon promote sign emerges when the Aroon Down stays out of doors the 30% zone, its line crosses the descending Aroon-Up from the ground up.

The above Aroon indicator displays a nice promote sign. The golf green line marks stage 70%. The blue circle marks the instant when the crimson Aroon-Down line crosses the blue Aroon-Up line upside. This sign signifies that a brand new downtrend begins out there.

Development phases

The Aroon chart indicator readings supply moderately correct details about the low and high costs motion and the power of the continuing fashion, the degree of the fad building.

If Aroon-Up:

upper than 70% – a powerful fashion (bullish);

50-70% – rising bullish fashion;

30-50% – the fad is arduous;

not up to 30% – consumers are not keen on riding the associated fee up.

If Aroon-Down line:

upper than 70% – bearish sentiment dominates the marketplace;

50–70% – bearish fashion is strengthening;

30–50% – the bearish fashion is arduous; alternatively, consumers have no longer but taken over the initiative;

not up to 30% – the downtrend has completed.

Strains transfer in parallel

When Aroon strains are shifting in parallel, buyers don’t normally imagine it as an access sign. Maximum regularly, the parallel motion of the strains indicators value consolidation, which is continuously adopted by means of the associated fee breakout.

Common crossovers

Common crossovers point out a stability of provide and insist, which normally ends up in a sideways fashion or buying and selling flat.

Aroon indicator methods

Neatly, having studied the indicators equipped by means of the Aroon indicator, allow us to discover well-liked buying and selling methods.

Breakout Buying and selling Technique

Aroon indicator buying and selling methods are in line with coming into trades when the fad adjustments sharply.

I’ve already discussed {that a} parallel motion of the Aroon-Up and Aroon-Down strains indicators the associated fee consolidation, which is able to inevitably be adopted by means of a brand new value breakout. So, to multiply your funding, you are expecting a breakout and input a business within the path value of the brand new fashion.

The tactic is in line with the next steps:

Outline consolidation.

Be expecting the Aroon breakout sign (the strains crossover, adopted by means of the crossing of the central line).

Be expecting the sign affirmation to be sure that the Aroon strains crossover isn’t a false sign. As an example, a affirmation may well be the breakout of the channel borders.

Input a business within the breakout path.

Let me give an explanation for this Aroon indicator buying and selling technique at the instance of the BTCUSD value chart.

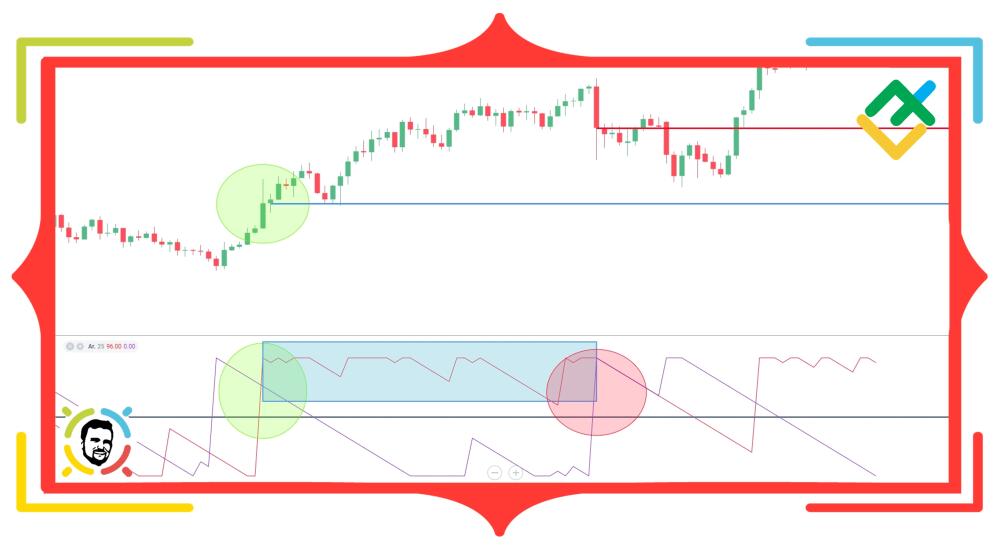

The gray zone within the Aroon chart marks the duration when the indicator strains are shifting in parallel, which indicators the marketplace is buying and selling flat. Subsequent, the Aroon-up line breaks in the course of the central line and crosses the Aroon-Down line from backside to most sensible. On the identical time, the associated fee chart breaks out the higher channel border, marked by means of the pink horizontal line. The breakout bar closes above the channel. Subsequently, we will safely input an extended business on the opening of the following bar.

Development Energy Technique

When there’s a sturdy fashion, the Aroon indicator strains stay on the subject of the very best ranges. Buyers continuously use this selection to make income.

This kinds of buying and selling methods recommend coming into a business when strains succeed in the utmost values; it’s 70% for the Aroon-Up and 30% for the Aroon-Down. The craze line is recognized in step with the path of the previous crossover of the strains. The benefit is taken when the middle line is crossed or when the reversal sign, the other crossover of the Aroon strains, emerges.

Allow us to once more learn about the BTCUSD chart. The blue zone marks the phase the place the Aroon Up stays round its top for a very long time. It approach a super doable of the uptrend. Subsequently, we practice the fad and dangle up the lengthy business till the middle line is crossed. This second is marked with the crimson circle within the chart.

Buying and selling technique for binary choices

Each buying and selling methods described above can be utilized in buying and selling binary choices. For brief-term contracts, the breakout buying and selling technique will completely swimsuit.

The craze power technique may well be used for long-term contracts. But even so, one will have to imagine the expiration duration to near the contract prior to the fad reverses in the other way.

There could also be a buying and selling technique in line with the mix of the Aroon and the EMA. The Put sign seems when the Aroon-Up crosses the Aroon Down indicator from the ground up, and the chart is underneath the EMA. An reverse sign is when the crimson line breaks in the course of the blue one drawback, and the contract value is above the EMA.

Aroon indicator vs ADX

Each Aroon Up Down and the ADX establish the fad path and its power. They appear to be producing buying and selling indicators of the similar ideas. Then again, the symptoms deal with other assets.

The Aroon indicator chart formulation essentially center of attention at the period of time between highs and coffee costs; its strains display the share of the desired duration between the associated fee extremes. The ADX formulation is extra complicated, together with the common true vary (ATR).

So, I received’t say that those two equipment are interchangeable. I guess one may use Aroon and the ADX in combination to verify the buying and selling indicators out there motion.

Tips on how to business with Aroon indicator

Let me give an explanation for an instance of using the Aroon indicator in the Forex market buying and selling as a number one software to generate access and go out indicators.

The above determine presentations the Brent oil value chart. The golf green level marks the instant when the Aroon-Up is going past the median and crosses the Aroon-Down (the pink) from the ground up. Having gained a sign, we open an extended place at the subsequent candlestick, the blue line within the chart.

Subsequent, the crimson line is going up and remains for a very long time across the very best values, which identifies sturdy fashion. So, we dangle up the business till the fad reversal sign seems. The reversal sign emerges when the descending crimson line breaks in the course of the pink one and is going under the center line, the crimson level. The location is closed with a benefit. This second is marked with the golf green horizontal line within the chart.

Benefits and Disadvantages

The Aroon indicator, like different technical research equipment, has its execs and cons.

Benefits:

It appropriately defines general traits;

It doesn’t repaint;

It’s similarly environment friendly in buying and selling other tools and for quite a lot of buying and selling platforms;

It supplies correct indicators each in long-term and non permanent timeframes;

It supplies good-quality indicators equipped the settings are right kind.

Disadvantages:

Which indicator is easiest mixed with the Aroon?

I’ve already famous that the Aroon indicators can neatly be showed by means of the ADX. Those two technical signs ship the similar more or less indicators however in step with other marketplace components.

There’s a buying and selling technique in line with the Aroon and Stochastic utilized in conjunction. Aroon defines the worldwide fashion, and the Stochastic is used to resolve a winning access level.

Aroon is continuously used together with the EMA. In line with this buying and selling indicator machine, the primary buying and selling indicators seem when the Aroon up and down strains go; the EMA serves as a supplementary software to verify indicators. You’ll learn an in depth assessment of the exponential shifting reasonable indicators right here.

Aroon oscillator buying and selling: Abstract

Aroon is a well-liked indicator of technical research used to spot fashion and not directly gauge the fad’s general power and the fad exhaustion. The Aroon indicators are moderately easy and simple, so this is a nice indicator for novices. Then again, Aroon on my own can’t supply enough data to go into and go out trades. Subsequently, it will have to be used together with different signs to ensure business indicators and build up the standard of trades. Aroon plays higher when buying and selling in trending markets because it sends moderately many false indicators in sideways traits. For a similar explanation why, the Aroon indicator will supply extra correct indicators in longer timeframes, even if it’s typically versatile in opting for the period. To sum up, I may conclude that the Aroon indicator can be appropriate for all buyers, each learners {and professional} buyers.

The content material of this text displays the creator’s opinion and does no longer essentially mirror the authentic place of LiteFinance. The fabric printed in this web page is supplied for informational functions best and will have to no longer be regarded as as the supply of funding recommendation for the needs of Directive 2004/39/EC.