Why Zillow Is Most likely Mistaken Once more About Its Housing Worth Forecast

As a house owner and actual property investor, I would like house costs and rents to upward push. Actual property is an integral a part of my Fats FIRE technique of without end producing six figures in passive source of revenue. So once I noticed Zillow’s newest bullish housing value forecasts, I used to be delighted!

Zillow believes nationwide house costs will building up by way of 6.5% thru July 2024, which turns out overly competitive on this prime rate of interest atmosphere. When you have a 20% downpayment or 20% fairness, a 6.5% value building up is like creating a 32.5% gross go back to your money or house fairness. That is a beautiful hefty go back.

After feeling just right for a second about my actual property portfolio expanding in worth subsequent yr, fact set in. Previously, Zillow has been mistaken persistently in the case of forecasting housing costs. I do not this time is any other.

Zillow Housing Worth Forecasts Through Area And State

See the map under appearing Zillow’s house value forecasts by way of area. Realize how Zillow believes house costs will upward push by way of 2% to ten% in each and every state apart from for 3 areas in Louisiana.

As it’s possible you’ll recall in a Would possibly 2, 2023 put up, A Window Of Alternative To Purchase Actual Property Emerges, I additionally believed there used to be upside attainable to actual property costs.

So perhaps 3 months later, Zillow and different establishments are coming round to my viewpoint? I simply assume 6.5% is just too competitive by way of no less than two share issues.

Why Zillow’s Housing Worth Forecasts Are Most likely Mistaken

Listed here are 5 the reason why I believe a 6.5% annual house value appreciation is not likely.

1) Affordability is at or close to an rock bottom

With housing affordability at close to an rock bottom because of prime loan charges and prime house costs, an competitive house value appreciation forecast of 6.5% is not sensible.

Under is a chart that highlights the United States median housing fee as a share of median source of revenue. At ~43.2% as of late, the proportion is upper than it used to be proper sooner than house costs began declining in 2H2006.

This is any other chart highlighting the Bloomberg Housing Affordability Index for first-time patrons. According to the under chart, the index is at an rock bottom.

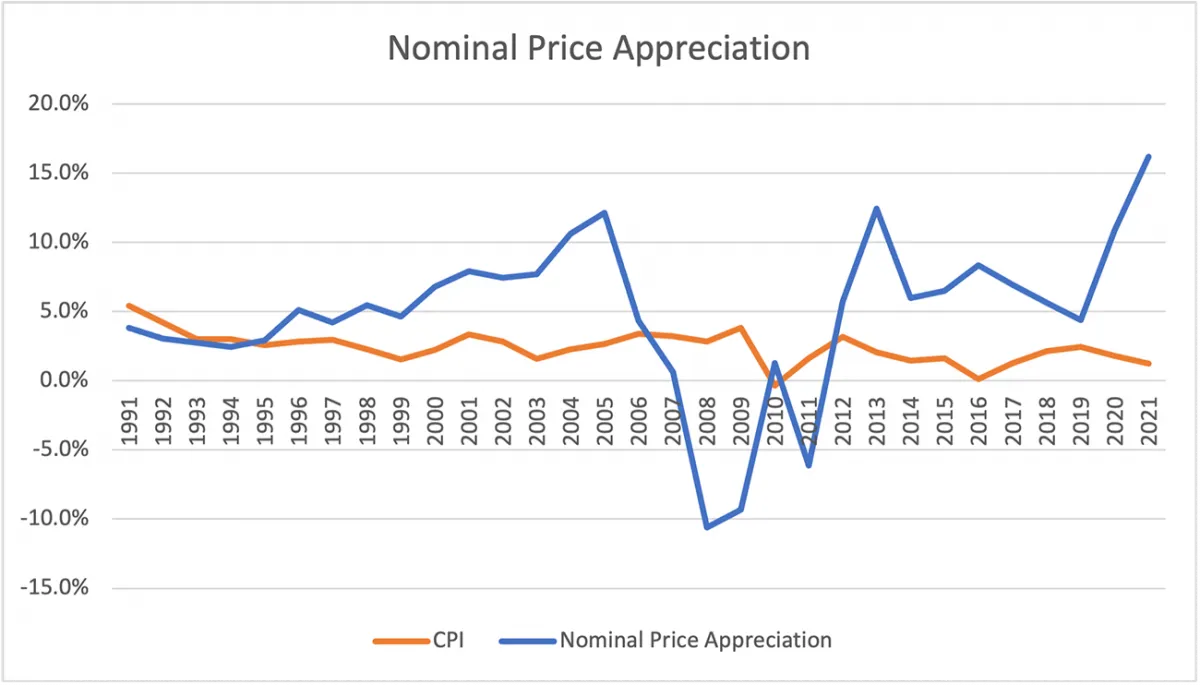

2) Historic house value appreciation is nearer to 4.6% in step with yr

Since 1992, the ancient annual house value appreciation has been nearer to 4.6%, about 2.6% above the Fed’s goal inflation fee of two%.

If inflation rebounds to round 4%, then Zillow’s 6.5% house value appreciation forecast may come true. However over the following twelve months, CPI will most probably keep under 4%.

The lag impact from the Fed fee hikes must proceed to sluggish the economic system. Due to this fact, it does not make sense for Zillow to forecast 6.5% house value appreciation, a fee 43% upper than the ancient moderate.

Having a look at this ancient nominal house value appreciation chart, a 6.5% house value appreciation thru 2024 is definitely conceivable. Then again, it is much more likely that nominal value appreciation undershoots after overshooting a ways past the ancient 4.6% nominal value appreciation fee.

3) Zillow is just too biased to have correct forecasts

Zillow makes more cash when housing costs pass up and when there are extra actual property transactions. The more potent the housing marketplace, the extra actual property brokers wish to market it their products and services on Zillow.

When the housing marketplace is susceptible, house gross sales quantity dries up, resulting in a decline in promoting earnings from actual property brokers and assets control corporations.

Due to this fact, Zillow is incentivized to have a extra bullish bias on housing than moderate. Their complete industry fashion will depend on a robust and emerging housing marketplace. In reality, Zillow lately introduced a 1% down program for certified patrons.

Given Zillow’s bias against a powerful housing marketplace, we should bargain Zillow’s bullish perspectives. We all know bias exists all over in society – from first-generation faculty admissions officials accepting extra first-generation candidates to 95% of Black citizens balloting for Obama in 2008.

We will be able to’t assist however display choice for issues and other people which are maximum very similar to ourselves or assist us probably the most.

4) Revisionist historical past

Years in the past, I wrote you cannot agree with Zillow’s estimates as a result of I had spotted massive inconsistencies. Zillow would have one estimate on a house, then totally exchange its ancient estimates after the house used to be bought. Through doing so, Zillow got rid of proof of ways mistaken its estimates firstly had been.

Consequently, I principally use Zillow (and Redfin) to decide tendencies in my native actual property marketplace. Each platforms are just right sources to trace bought houses, which you’ll be able to then use to formulate your individual value estimates.

In reality, I’ve an entire information on tips on how to use dangerous pricing estimates by way of Zillow and Redfin to recuperate offers. Consumers and dealers can cherry-pick favorable information given the plethora of inconsistent information to get a inexpensive acquire value or higher promoting value.

5) Zillow does not even agree with itself

In any case, when Zillow introduced its iBuying industry in December 2019, I used to be keen to look how it might do. If Zillow’s housing estimates had been correct, then Zillow would be capable to purchase houses at a gorgeous costs and later promote those houses for wholesome earnings.

Then again, Zillow’s iBuying industry used to be a whole dud. In 2022, Zillow took a $540 million write-off (loss) and laid off over 2,000 body of workers as it close down its iBuying industry.

In different phrases, even Zillow could not agree with its personal estimates! Maximum patrons who purchase on the mistaken value do not simply surrender the keys and record for chapter. As an alternative, these kinds of householders intestine it out by way of refinancing, renting out rooms, or understanding techniques to earn more money.

However now not Zillow. As a public corporate, Zillow’s primary function is to develop earnings to expectantly spice up its proportion value for its shareholders. Consequently, Zillow is extra taken with momentary quarterly effects.

The Route Of House Costs In The us

Going thru this workout in fact makes me much less bullish on house value appreciation over the following yr. As an alternative of a extra cheap 2% house value appreciation, why could not nationwide median house costs in fact decline by way of 5%, particularly if there is any other recession?

The S&P CoreLogic Case-Shiller Nationwide House Worth Index presentations nationwide costs are flat in 2023 vs. closing yr. Even if house value appreciation is ticking up in 2023, it might simply as simply tick backtrack once more in 2024 too.

The velocity-lock impact is discouraging householders from promoting their houses, which helps to keep provide low and helps costs. The principle query is whether or not provide or call for will building up at a better fee if loan charges decline over the following twelve months.

The concern for attainable homebuyers sitting at the sidelines is that pent-up call for is development each and every month that house sale quantity hovers at document lows. If loan charges decline, then bidding wars will most probably resume, briefly pushing costs again up.

The concern for attainable house dealers is that after loan charges decline, too many house owners will get started list their houses and motive an oversupply scenario. Developers may ramp up building as neatly, growing much more incremental provide and declining costs.

My Unhealthy Good fortune Will Throttle House Costs

In all probability the overall explanation why I believe Zillow’s house value forecast is just too prime is as a result of I am recently seeking to purchase a house with contingencies. Even if I might love to assume I perceive actual property neatly given I have invested in a couple of houses since 2003, I have additionally gotten burned sooner than.

In 2007, I determined to shop for a holiday assets in Lake Tahoe for approximately 12% off its authentic gross sales value in 2006. I assumed I used to be getting an ideal deal. After all, the world monetary disaster hit, inflicting the apartment I purchased to depreciate by way of any other 50% at its low level!

I do not believe the house I wish to purchase will depreciate by way of a equivalent magnitude since this is a single-family house in a major location versus a condotel. However this single-family house may simply depreciate by way of any other 5% – 10% if the economic system tanks once more.

Given my historical past of dangerous good fortune, I extremely doubt I’m going to bottom-tick this gorgeous house after which see it admire by way of 6.5% a yr later. Actual property down cycles frequently take years to play out. As an alternative, I am mentally and financially ready for my goal house’s worth to proceed depreciating by way of any other two years.

So Why Purchase A House Now?

I am making an attempt to shop for now as a result of I have recognized the nicest house I will be able to come up with the money for. I have were given 12-15 years sooner than my children go away house, so I determine why now not opt for the improve when costs are down.

There’s a lull in call for because of prime rates of interest. In the meantime, the upper the cost level you pass, the easier offers you’ll be able to normally get. I might do not wish to get into a possible bidding battle if loan charges decline one day.

I might love for Zillow to be proper about its housing value forecast. However in line with its monitor document, I believe Zillow will likely be mistaken like Donkey Kong once more.

Reader Query and Tips

What do you recall to mind Zillow’s housing value forecasts of 6.5%? The place do you assume the nationwide median house value will pass over the following twelve months?

If you wish to leg into actual property extra slowly, as adversarial to shopping for a assets with a loan, take a look at Fundrise. You’ll be able to put money into a Fundrise fund with as low as $10. Fundrise essentially invests in residential and business houses within the Sunbelt, the place valuations are decrease and yields are upper.

Concentrate and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview mavens of their respective fields and talk about one of the crucial maximum attention-grabbing subjects in this website. Please proportion, fee, and evaluation!

For extra nuanced non-public finance content material, sign up for 60,000+ others and join the loose Monetary Samurai e-newsletter and posts by means of email. Monetary Samurai is among the biggest independently-owned non-public finance websites that began in 2009.