Streams of Source of revenue Of The Rich

This posting is for readers who need some forged information on which streams of source of revenue the rich if truth be told have. It is a non-trivial query as a result of should you’re construction wealth, you’ll need to see what’s been performed effectively previously. And, maximum articles in this matter depend much less on truth and extra on hypothesis and anecdotes.

So, what streams of source of revenue do the rich if truth be told have?

To lend a hand solution this query, I requested a professional and seemed on the educational analysis.

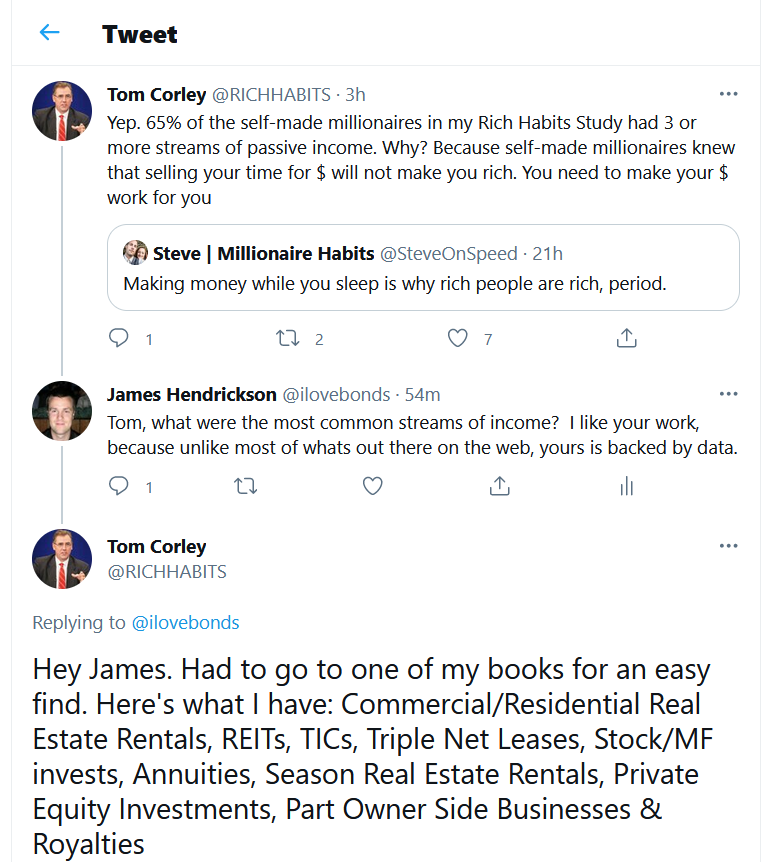

Tom Corley On The Streams of Source of revenue Of The Rich

In case you write about finance lengthy sufficient, you find yourself getting attached with others within the trade. Here’s a fast alternate with Tom Corley, creator of “Wealthy Conduct: The Day-to-day Good fortune Conduct Of The usa’s Rich“. Corley is a professional within the habits of the wealthy, so his feedback undergo weight in this matter. In it, he pulls some details about precisely which streams of source of revenue the rich have. According to Corley, they’re:

- Industrial/residential actual property leases

- REITS

- TICs (tenancy in not unusual)

- Triple Internet Rentals

- Inventory/Mutual Fund property

- Annuities

- Seasonal actual property leases

- Personal fairness

- Section possession of aspect companies

- Royalties

For extra on Corley’s ideas on what you wish to have to do to construct source of revenue, learn his CNBC article on developing more than one source of revenue streams.

His site is right here.

IRS Knowledge On The Streams of Source of revenue Of The Rich

The only excellent exception to the loss of fact-based discussions of this matter is an IRS operating paper. In 2014 Jenny Bourne and Lise Rosenmerkel analyzed historic go back information for six,053 tax filers who had died between 1996 and 2002. They when compared taxpayers who filed shape a F706 (decedent property) as opposed to those that didn’t document shape F706. What they discovered was once F706 filers had upper ranges of source of revenue than non-filers within the following spaces:

- Dividends

- Condominium actual property, royalties, partnerships, S companies, estates, trusts,

and actual property loan funding conduits - Salary source of revenue

- Taxable pensions and annuities

- Tax exempt hobby source of revenue

- Trade source of revenue from sole proprietorships

Whats fascinating concerning the IRS learn about, is not like maximum discussions on the web, the IRS additionally tells you which of them supply of source of revenue was once maximum strongly associated with wealth. The solution is:dividends.

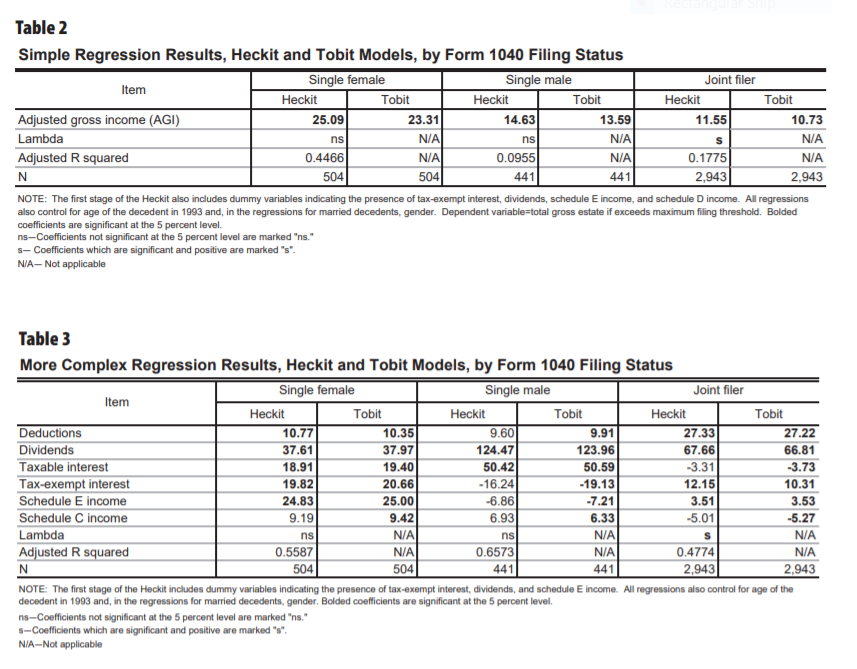

The photograph under displays some statistical fashions from the Bourne and Rosenmerkel paper. With out going into an excessive amount of element, they principally display that source of revenue is definitely related to wealth (desk 2) – and of the more than a few forms of source of revenue reported in IRS filings, dividends had the largest impact on property price at dying (desk 3).

So, in keeping with IRS information, the rich have a huge source of revenue streams, of those salary source of revenue and dividends are an important.

Here’s a hyperlink to the unique IRS paper.

Whats great is each assets display equivalent streams of source of revenue of the rich. Actual property, trade source of revenue, dividends and annuities are not unusual in each lists.

For extra nice dinks articles on construction wealth, learn those:

Construction Wealth on $600 According to Month

Higher Fashions For Construction Wealth

What Construction Seven Streams of Source of revenue In reality Seems to be Like

Save, Make investments and Reinvest to Construct Wealth

P.s. When you’ve got a couple of spare moments, you may believe studying Moneysavedmoneyearned’s article on being independently rich, right here.