Voluntary Tax Withholding on Promoting I Bonds at TreasuryDirect

Many of us purchased I Bonds remaining 12 months when charges had been top. As inflation has come down and rates of interest have long past up in different places, some are making plans to promote their I Bonds to shop for new I Bonds at a better fastened fee. I Bonds bought between Would possibly 2020 and October 2022 have a nil% fastened fee for existence. The fastened fee on new I Bonds to be introduced on November 1 might probably cross upper, most likely to one.5%. See Money Out Outdated I Bonds to Purchase New Ones for a Higher Price.

I selected to shop for TIPS for higher inflation coverage than I Bonds once I offered a few of my I Bonds on August 1. The cash went into Constancy’s TIPS fund (ticker FIPDX). The yield on 5-year TIPS is above 2% as I’m scripting this on August 30, 2023. I’m making plans to promote extra older I Bonds on October 1 to shop for extra stocks in that TIPS fund. Please learn extra in this in Higher Inflation Coverage with TIPS Than I Bonds.

Most of the people cross by means of the default tax remedy on I Bonds and defer taxes at the hobby till they promote (see I Bonds Tax Remedy Throughout Your Lifetime and After You Die). Through default, TreasuryDirect doesn’t withhold any taxes from the proceeds since the IRS doesn’t require tax withholding on hobby bills. Banks most often don’t withhold taxes once they pay hobby in financial savings accounts or CDs both. You obtain a 1099 from TreasuryDirect subsequent 12 months and document the hobby source of revenue for your tax go back.

Some other folks like to have taxes withheld even if tax withholding isn’t required. Taxes paid thru withholding are assumed to had been paid right through the 12 months. It is helping with some timing problems.

For those who’d love to have TreasuryDirect withhold taxes whilst you promote I Bonds, right here’s how one can do it.

Log in on your TreasuryDirect account and click on on “ManageDirect” at the most sensible.

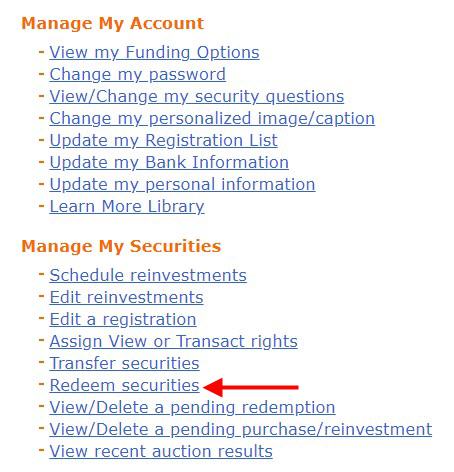

Click on on “Replace my private data” beneath the heading “Arrange My Account.”

Resolution a safety query. Scroll to the ground. Exchange the “Withholding Price” from the default 0% on your desired fee (as much as 50%). This new withholding fee might be used on all long run gross sales. If you purchase common Treasuries at TreasuryDirect, it impacts bills from the ones common Treasuries as neatly.

The withholding fee applies simplest whilst you promote I Bonds. It doesn’t cut back the hobby credited on your I Bonds when you nonetheless dangle them.

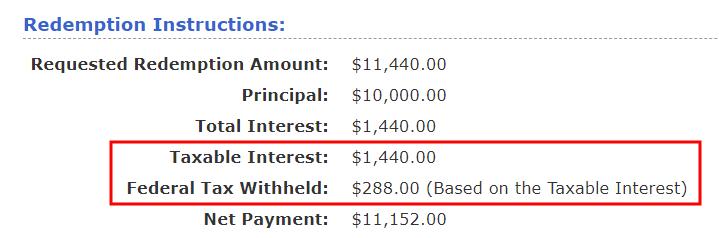

To promote (money out) your I Bonds, return to ManageDirect and click on on “Redeem securities.” You’ll see this at the assessment web page after you choose the I Bonds to money out:

I set the withholding fee to twenty% for this check. TreasuryDirect is aware of how a lot hobby is incorporated within the sale. The withholding fee simplest applies to the hobby portion, to not the gross quantity. TreasuryDirect does no longer withhold state taxes as a result of I Bonds are exempt from state taxes.

If you select to have TreasuryDirect withhold taxes, the quantity withheld for federal source of revenue tax might be in Field 4 of Shape 1099-INT in conjunction with the hobby quantity in Field 3. Tax instrument will take them under consideration whilst you input each quantities from the 1099 shape. You should definitely obtain the 1099 shape from TreasuryDirect subsequent 12 months. TreasuryDirect will ship an e mail when the shape is in a position however you must set a reminder for your calendar when you omit the e-mail.

Having TreasuryDirect withhold taxes from the sale is totally non-compulsory. I make a choice no longer to try this as a result of I like to pay quarterly estimated taxes myself, however it works completely neatly when you desire withholding.

Say No To Control Charges

If you’re paying an consultant a proportion of your belongings, you’re paying 5-10x an excessive amount of. Discover ways to to find an impartial consultant, pay for recommendation, and simplest the recommendation.