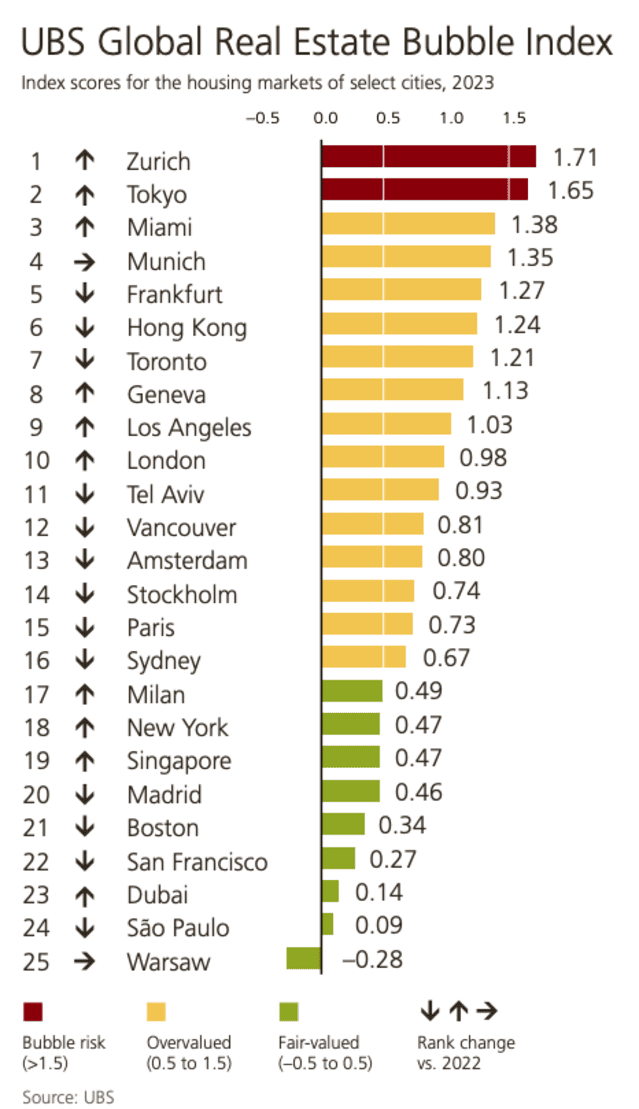

Those are probably the most overestimated housing markets on this planet, in keeping with UBS

House costs have taken a tumble in different primary towns around the globe, however many are overestimated and threat getting into “bubble” territory, in keeping with a brand new UBS record.

As rates of interest and inflation surged during the last two years, many of us have discovered it dearer to shop for a house. That has helped to decrease house costs in some towns internationally, whilst different metropolitan spaces proceed to enjoy increased costs.

“Low financing prices had been the lifeblood of worldwide housing markets over the last decade, using house costs to dizzying heights. Then again, the abrupt finish of the low interest-rate setting has shaken the home of playing cards,” in keeping with the 8th annual UBS International Actual Property Bubble record.

“On reasonable of all towns, inside the previous 12 months, inflation-adjusted house costs have observed the sharpest drop for the reason that world monetary disaster in 2008,” the record famous.

Many towns that had been integrated as being in bubble territory final 12 months — corresponding to Toronto and Frankfurt — are now not on that listing, UBS mentioned.

This 12 months, Zurich and Tokyo best the listing of overestimated housing markets, and are vulnerable to being a bubble.

UBS defines a “bubble” as a “considerable and sustained mispricing of an asset, the life of which can’t be proved until it bursts.”

The united statesranking is according to 5 elements: worth to source of revenue, worth to hire, the alternate in mortgage-to-GDP ratio, the alternate in construction-to-GDP ratio and the relative worth of town to the rustic.

In Zurich, residential homes price 40% greater than a decade in the past, in actual phrases. Against this, rents have risen via 12% during the last 10 years. “The connection between acquire costs and rents stays out of stability — particularly making an allowance for the upper interest-rate setting. The marketplace, due to this fact, remains within the bubble-risk zone,” the record mentioned.

Tokyo used to be the No. 2 maximum overestimated housing marketplace, UBS mentioned. Imbalances within the Tokyo marketplace have “larger from undervalue twenty years in the past to bubble threat now,” the financial institution mentioned.

UBS researchers additionally checked out 5 U.S. markets of their world record: Miami, Los Angeles, San Francisco, Boston and New York.

Even supposing not one of the U.S. markets had been at “bubble threat,” Miami’s housing marketplace seems to be overestimated, as town continues to draw consumers from internationally, UBS mentioned.

House costs in Miami rose sooner than the remainder of the country, doubling during the last 10 years, UBS famous. “Call for is reinforced via endured inhabitants inflow, and the nonetheless moderately low absolute worth stage in comparison to earning.”

Los Angeles is the one different U.S. town at the overestimated listing. The West Coast town is “struggling: from a wide lack of financial competitiveness “because of its important publicity to the generation and leisure sectors, high quality of lifestyles demanding situations, opposed tax law, and prime prices of dwelling,” UBS mentioned.

The housing marketplace is at a crossroads in lots of towns around the globe. Even supposing many world towns have observed a drop in house costs during the last 12 months, there’s “extra problem in actual area costs,” UBS warned. “Then again, a housing scarcity has set the degree for a renewed increase in lots of towns — if rates of interest fall.”