Destiny of the Magazine 7 depends upon their skill to ship speedy income expansion in 2024, says Goldman Sachs

Early futures buying and selling suggests Wall Side road will get started the week on a wary be aware with the S&P 500 consolidating after ultimate the former consultation at but every other document, powered through giant tech.

Can this dynamic proceed? For David Kostin, leader U.S. fairness strategist at Goldman Sachs, the solution is dependent basically at the skill of the Magnificent 7 — Alphabet

GOOG,

Amazon.com

AMZN,

Apple

AAPL,

Meta Platforms

META,

Microsoft

MSFT,

Nvidia

NVDA

and Tesla

TSLA

— to ship speedy income expansion in 2024.

“Whilst increased hedge fund positioning, a large number of antitrust complaints from the DoJ and the FTC, and shifts within the macro regime will affect returns for the shares, we consider that gross sales expansion for the seven shares will likely be crucial driving force of the gang,” says Kostin and workforce in a be aware printed overdue Friday.

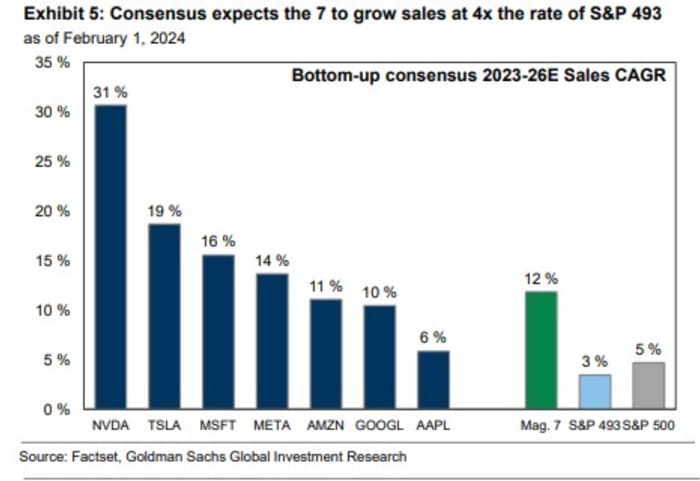

Crucially, analysts’ consensus estimates are that the Magazine 7 will “jointly develop gross sales at a 12% CAGR thru 2026 in comparison with an 3% CAGR for the rest 493 corporations within the S&P 500 index,” says Kostin. CAGR stands for compound annual expansion fee.

An anticipated growth of margins through 256 foundation issues all over the following 3 years –in comparison with 44 foundation issues for the remainder of the marketplace — will assist flip the ones upper gross sales into even better income.

The most important caveat; the Magazine 7 isn’t homogenous. As an example, Nvidia is predicted to develop gross sales all over the following 3 years at a 31%

annual tempo in comparison with simply 6% for Apple. Fresh consensus gross sales forecasts for Tesla had been lower.

Supply: Goldman Sachs

However what concerning the it sounds as if wealthy valuations that massive tech recently instructions? Kostin argues that despite the fact that the Magazine 7 shares in combination recently business at a ahead value/profits a couple of of 30 in comparison with 18 for the rest 493 S&P 500 corporations, some context is needed.

“Whilst increased vs. the remaining 10 years, this 63% P/E top class ranks neatly under the height 103% top class reached in 2021,” Kostin says. “The Magnificent 7 additionally elevate considerably decrease valuations than their friends on the peak of the Tech Bubble in March 2000,” when the 5 biggest shares traded at a 73% top class to the S&P 500’s a couple of of 25 occasions.

And importantly, Goldman says that opposite to a few fears giant tech’s surge is all about valuation multiples, advanced profits are actually the driving force for Magazine 7 shares.

For the reason that finish of 2019, the Magazine 7 jointly delivered a 28% annualized go back, consistent with Kostin. About 27 proportion issues of this is due to profits expansion, consisting of 21 pp gross sales expansion and six pp margin growth, with just one pp because of a couple of growth. By contrast, he says, profits drove best 13 pp of the S&P 500’s 17% annualized go back since 2019.

“Speedy near-term and long-term expansion, prime web margins, and powerful steadiness sheets improve the gang’s top class a couple of,” says Goldman.

Supply: Goldman Sachs

One more reason giant tech is sexy is its new-found insensitivity to rates of interest. “Traditionally, the gang has benefited from falling yields because of the lengthy period in their money flows,” says Kostin. “Then again, the gang outperformed within the prime bond yield atmosphere of the remaining 24 months largely as a result of their sturdy steadiness sheets and increased margins.”

However, for the entire positivity, the Goldman workforce finishes with a caution. Earlier sessions of tech exuberance have proven buyers consider consensus estimates at their very own possibility.

“In March 2000, Microsoft, Cisco

CSCO,

Common Electrical

GE,

Intel

INTC,

and Exxon Mobil

XOM

had been the most important S&P 500 corporations, comprising 18% of the index,” Kostin notes. Consensus forecasts confirmed the gang rising gross sales at a 16% CAGR over the following two years. They if truth be told delivered simply 8%.

“The gang went directly to underperform the S&P 500 through 21 proportion issues over the following 24 months.”

Markets

U.S. stock-index futures

ES00

NQ00

are a bit of decrease as benchmark Treasury yields

upward thrust. The greenback

is upper, whilst oil costs

CL

slip and gold

GC00

trades round $2,020 an oz.

| Key asset efficiency | Ultimate | 5d | 1m | YTD | 1y |

| S&P 500 | 4,958.61 | 0.62% | 4.10% | 3.96% | 20.62% |

| Nasdaq Composite | 15,628.95 | 1.12% | 7.61% | 4.11% | 30.17% |

| 10 yr Treasury | 4.086 | 0.70 | 5.43 | 20.48 | 44.11 |

| Gold | 2,041.00 | 0.41% | 0.34% | -1.49% | 8.55% |

| Oil | 71.9 | -6.60% | 1.38% | 0.80% | -3.43% |

| Information: MarketWatch. Treasury yields exchange expressed in foundation issues | |||||

For extra marketplace updates plus actionable business concepts for shares, choices and crypto, subscribe to MarketDiem through Investor’s Industry Day by day.

The thrill

U.S. financial information launched on Monday contains the January S&P ultimate services and products PMI, due at 9:45 a.m. Jap, and the January ISM services and products record at 10 a.m.

Corporations reporting effects on Monday come with Caterpillar

CAT,

McDonald’s

MCD

and IDEXX Laboratories

IDXX

ahead of the outlet bell rings on Wall Side road, adopted after the shut through Palantir Applied sciences

PLTR,

Vertex Prescribed drugs

VRTX

and NXP Semiconductors

NXPI.

Federal Reserve Chair Jerome Powell mentioned over the weekend that the central financial institution expects to make 3 25 foundation level fee cuts in 2024, kind of part what the marketplace expects.

Donald Trump mentioned that if he turns into U.S. President he would imagine enforcing price lists on China’s items that can exceed 60%.

Perfect of the internet

The cash and medication that tie Elon Musk to a few Tesla administrators.

The nice U.S. — Europe antitrust divide.

Why NYC condominium constructions are on sale now for fifty% off.

The chart

It is a moderately worrying chart for the ones wedded to fiscal prudence. It’s from Torsten Slok, leader economist at Apollo World, and he notes that: “In 2021, U.S. govt hobby bills had been round $350 billion, see chart under. As a result of the rise in rates of interest and debt ranges, annualized debt servicing prices are actually above $700 billion.”

Supply: Apollo World

Most sensible tickers

Right here had been probably the most energetic stock-market tickers on MarketWatch as of 6 a.m. Jap.

Random reads

Guy buys space on Amazon for £20,500.

Finance employee can pay out $25 million after video name with ‘deepfake CFO’.

International’s sexiest accessory printed.

Quelle marvel! Parisians vote for upward thrust in SUV parking charges.

Want to Know begins early and is up to date till the outlet bell, however join right here to get it delivered as soon as in your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Jap.

Take a look at On Watch through MarketWatch, a weekly podcast concerning the monetary information we’re all observing – and the way that’s affecting the economic system and your pockets. MarketWatch’s Jeremy Owens trains his eye on what’s riding markets and gives insights that can assist you make extra knowledgeable cash choices. Subscribe on Spotify and Apple.