Asia shares swing decrease, gold climbs as oil slips By way of Reuters

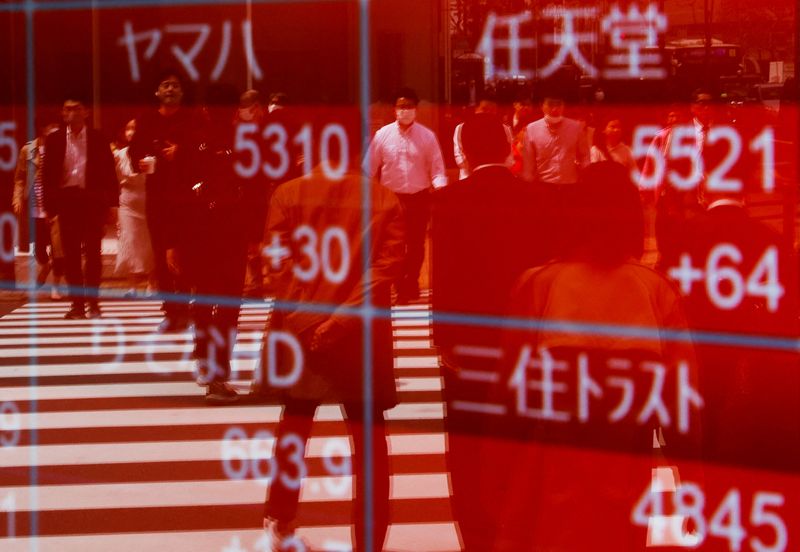

© Reuters. FILE PHOTO: Passersby are mirrored on an electrical inventory citation board outdoor a brokerage in Tokyo, Japan April 18, 2023. REUTERS/Issei Kato/Report Picture

By way of Wayne Cole

SYDNEY (Reuters) -Asian stocks slipped on Monday forward of probably market-moving inflation knowledge from the US and Europe later within the week, and a gathering of oil manufacturers that might forestall, or prolong, the new slide in costs.

One mover was once gold, which climbed to $2,009.87 an oz and in short hit a six-month best of $2,017.82. [GOL/]

The method of the month-end may additionally purpose some warning given the hefty features buyers are sitting on. eased 0.5%, however was once nonetheless up 8.4% up to now in November.

MSCI’s broadest index of Asia-Pacific stocks outdoor Japan misplaced 0.4%, giving it a per 30 days acquire of 6.3%.

Chinese language blue chips fell every other 0.8%, and feature ignored out on the entire world cheer with the marketplace down 1.8% in November up to now.

China’s central financial institution introduced it might inspire monetary establishments to toughen non-public corporations, together with tolerance for non-performing loans.

EUROSTOXX 50 futures eased 0.3%, whilst in a similar way fell 0.3%.

eased 0.2% and Nasdaq futures misplaced 0.4%. The money index has rallied for 4 weeks immediately and is up 8.7% at the month up to now, which might be its perfect efficiency since mid-2022.

The Federal Reserve’s favoured measure of core inflation is due on Thursday and is predicted to gradual to its lowest since mid-2021, reinforcing marketplace wagers that the next step in charges might be down.

Fed Chair Jerome Powell can have an opportunity to thrust back towards the doves at a Hearth Chat on Friday, and there are a minimum of seven different Fed audio system at the docket this week.

“A view we cling strongly is that central banks are not likely to ship easing within the first part of 2024 absent a danger to the growth or monetary steadiness,” argues Bruce Kasman, head of worldwide economics at JPMorgan.

“Certainly, this message of endurance could be notable in upcoming DM coverage communications in accordance with fresh monetary marketplace traits.”

OIL HANGS ON OPEC+

Eu Central Financial institution President Christine Lagarde has additionally sounded in no hurry to ease and can have every other alternative to ram house the message on the EU parliament afterward Monday.

Knowledge on EU shopper costs for November is due Thursday and anticipated to turn a cooling in each the headline and core charges, which might toughen marketplace pricing for cuts.

Markets priced in 80 foundation issues of U.S. easing subsequent 12 months, and round 82 foundation issues for the ECB.

The risk of an easing in borrowing prices has generated a large rally in bonds, with yields on 10-year Treasuries down 36 foundation issues up to now this month at 4.50%.

That during flip has been a drag at the buck which has misplaced 3% on a basket of main opposite numbers this month.

The euro was once up at $1.0952 on Monday, now not a long way from its fresh four-month prime of $1.0965, whilst the buck softened towards a extensively more impregnable yen to 148.97.

The oil marketplace faces a anxious few days forward of a gathering of OPEC+ on Nov. 30, a gathering that had in the beginning been slated for Sunday however was once postponed as manufacturers struggled to discover a unanimous place. [O/R]

Stories recommend African oil manufacturers are searching for upper caps for 2024, whilst Saudi Arabia might prolong its further 1 million bpd voluntary manufacturing reduce, which is because of expire on the finish of December.

“Saudi Arabia and OPEC+ faces a problem in convincing markets that it may possibly assist stay oil markets tight in 2024,” wrote commodity analysts at CBA in a observe.

“OPEC+ must display vital provide self-discipline, or a minimum of jawbone such skill, to relieve marketplace worries of a deep surplus in oil markets subsequent 12 months.”

The uncertainty erased early features and dropped 55 cents to $80.03 a barrel, whilst misplaced 60 cents to $74.94 in keeping with barrel.