WisdomTree’s Information on Prime Dividend, High quality Dividend Expansion

Knowledge Tree has a small article on their Dividend Indexes.

Knowledge Tree did the arduous paintings crunching america inventory knowledge with Shiller. The dividend used to be ready to buffer the sessions the place the capital appreciation used to be deficient.

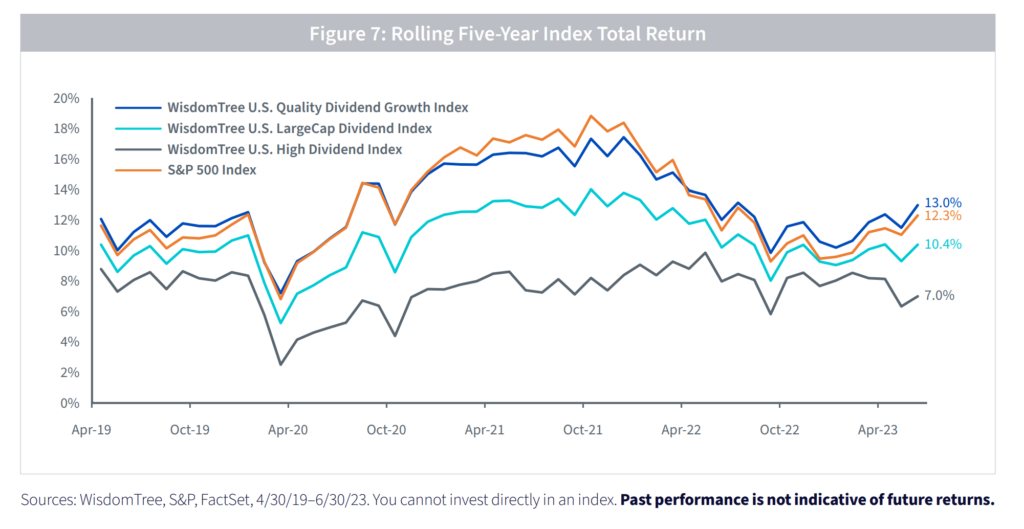

Knowledge Tree crafted a couple of other dividend indexes. The rolling 5-year efficiency over an overly brief time frame is proven under:

They most probably roll the efficiency month through month.

What you’re going to understand is that the High quality dividend expansion index kinda mirrors the efficiency of the S&P 500. The standard dividend expansion index builds in a couple of metrics comparable to weighting for medium-term estimated profits expansion, three-year reasonable ROE, three-year reasonable ROA, and in addition a momentum layer.

With those metrics, it’ll often curate a collection of businesses that do neatly when many of the money float is at some point. Now not sudden the corporations that did the more serious are the prime dividend index the place the money float is lately.

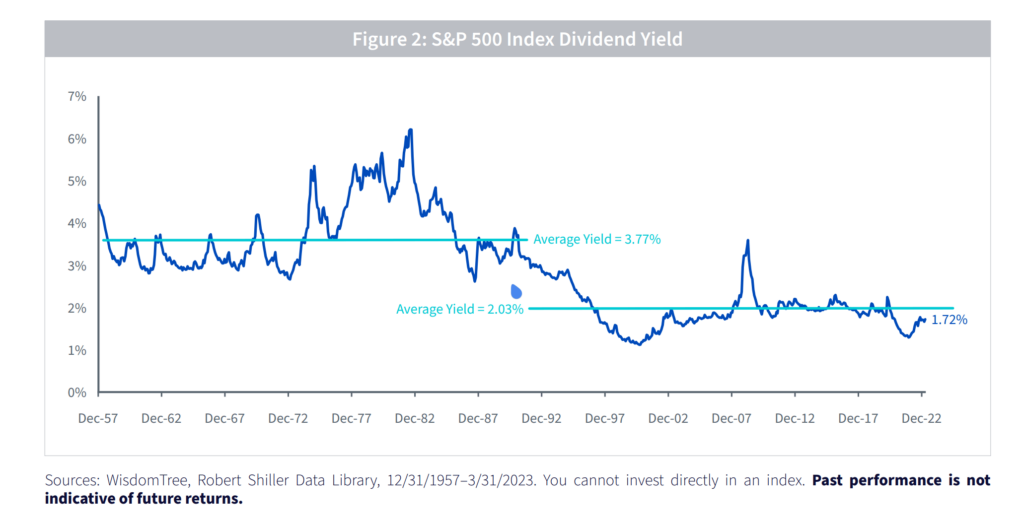

America dividend has fallen to a decrease regime because the flip of the Nineties.

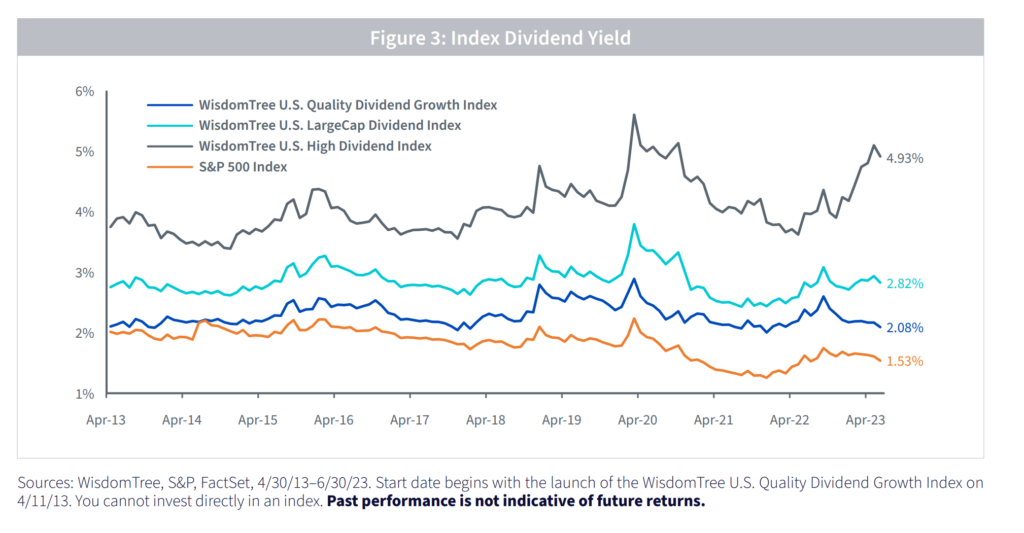

The standard dividend expansion index has a tad larger dividend yield than the S&P 500.

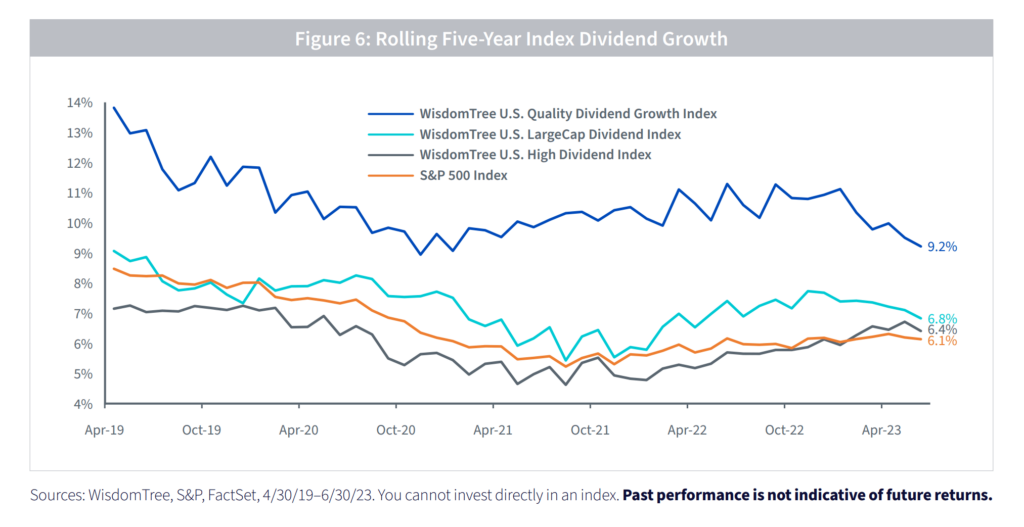

However check out the expansion of dividends.

I love this chart since you at all times marvel jointly how a lot can dividends develop for a portfolio of prime dividend shares. The dividend expansion can also be 5-6%.

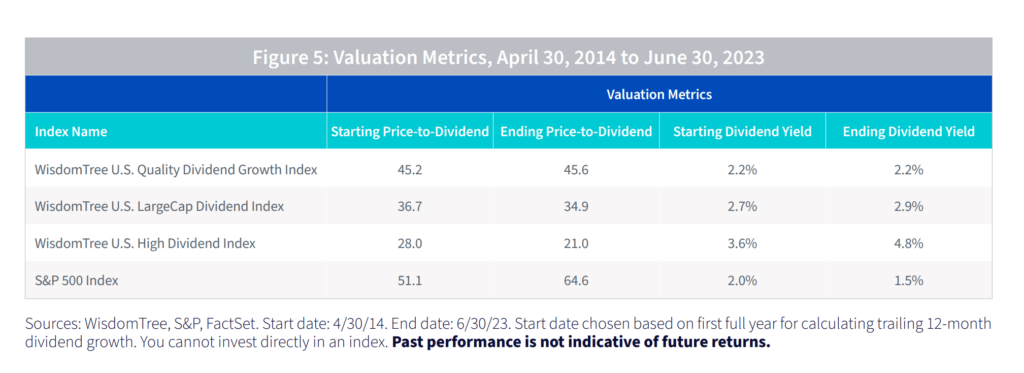

If we layer the dividend expansion of america High quality Dividend Expansion Index, we will be able to see that the finishing dividend yield is similar because the beginning dividend yield.

This kind of signifies that all of the percentage value of the shares within the index additionally develop over the years.

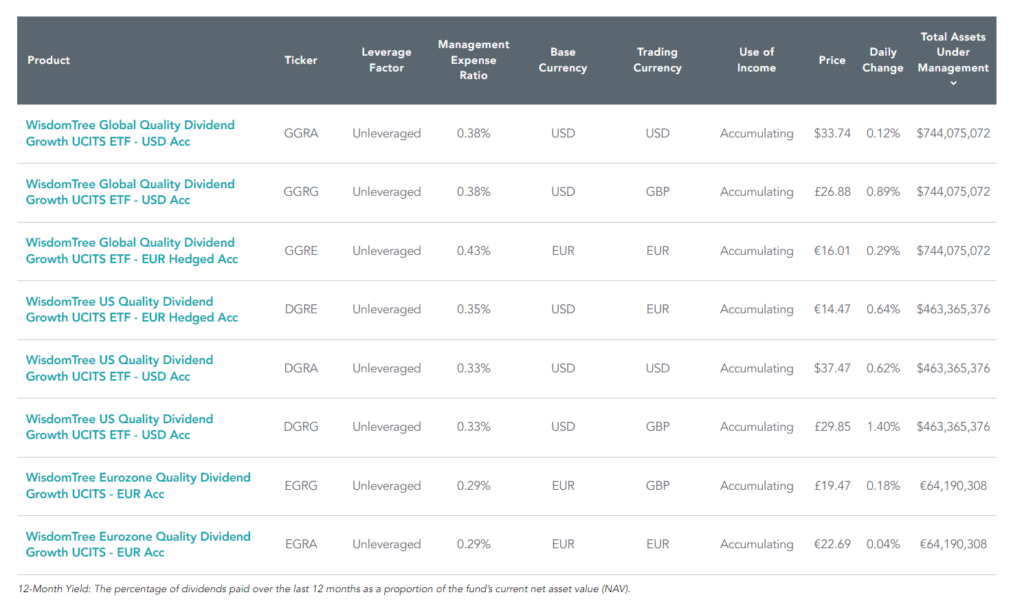

If those knowledge have perk your passion in High quality Dividend Expansion, do remember that WisdomTree have a collection of UCITS exchange-traded budget (ETFs) indexed at the London Inventory Change:

Those ETFs can be regarded as as Good Beta budget, multifactor ETFs, which let you systematically put money into fine quality firms. The dividends are extra used as a type of signalling, to spot firms that could possibly develop their dividends neatly, which is an indication of a sustainable, higher-quality corporate.

The primary knowledge chart do make me marvel how dividend expansion can be in a prime inflationary surroundings.

If you wish to industry those shares I discussed, you’ll be able to open an account with Interactive Agents. Interactive Agents is the main low cost and environment friendly dealer I exploit and agree with to speculate & industry my holdings in Singapore, the USA, London Inventory Change and Hong Kong Inventory Change. They permit you to industry shares, ETFs, choices, futures, foreign exchange, bonds and budget international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with create & fund your Interactive Agents account simply.