Who Will Be (Actually) Open to Pay attention to Monetary Recommendation?

I had a dialog with my colleague the day prior to this about when somebody is REALLY open to being attentive to your monetary recommendation.

Once they notice they don’t know sufficient and wish assist, and you’re subtle sufficient to assist them.

Some Other folks Made Sufficient Errors In Their Lifestyles or have Observed Other folks Essential in Their Lives Make Severe Errors to Know They Want Lend a hand.

A few of my readers percentage with me the silly investments they made or the silly issues their monetary selections made.

They notice that they’re in the long run at fault, and so they take duty for that L.

By way of default, they’re orientated to hear what it’s a must to say.

Some Understand it Is No longer So Simple to Be a Just right Investor or Cash Supervisor

The truly excellent traders, or the delicate ones know that managing cash or make investments neatly isn’t so simple as some assume.

Whilst others glance upon their effects as a success and via all measures they’re, they themselves be afflicted by the occasional deficient making an investment selections, or just about did, to be susceptible sufficient about it.

Additionally they put within the laborious paintings to get to the place they’re.

So they’ve an open-minded orientation.

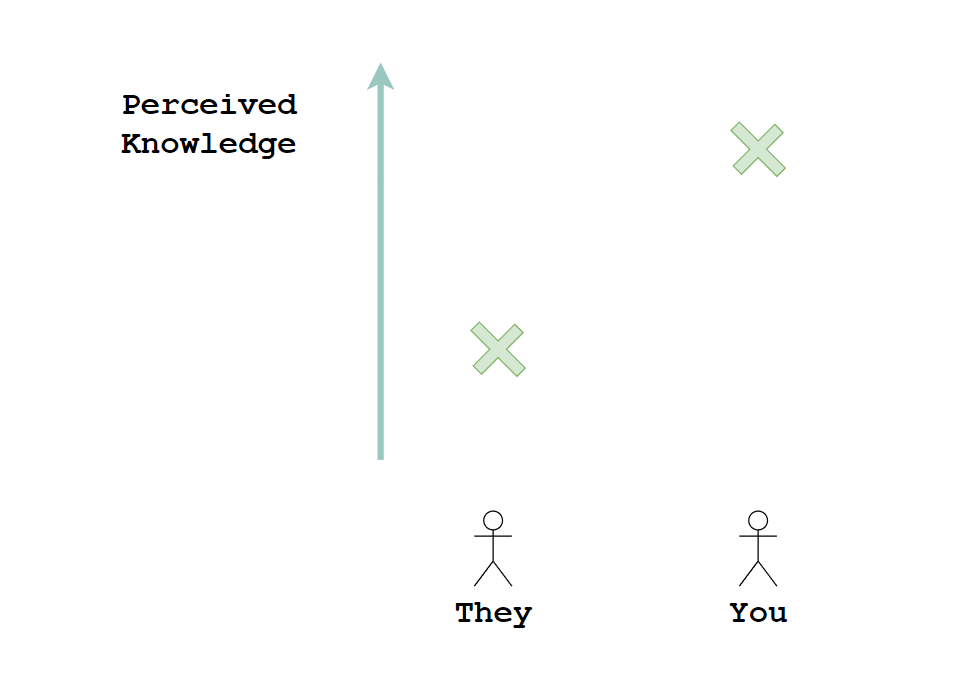

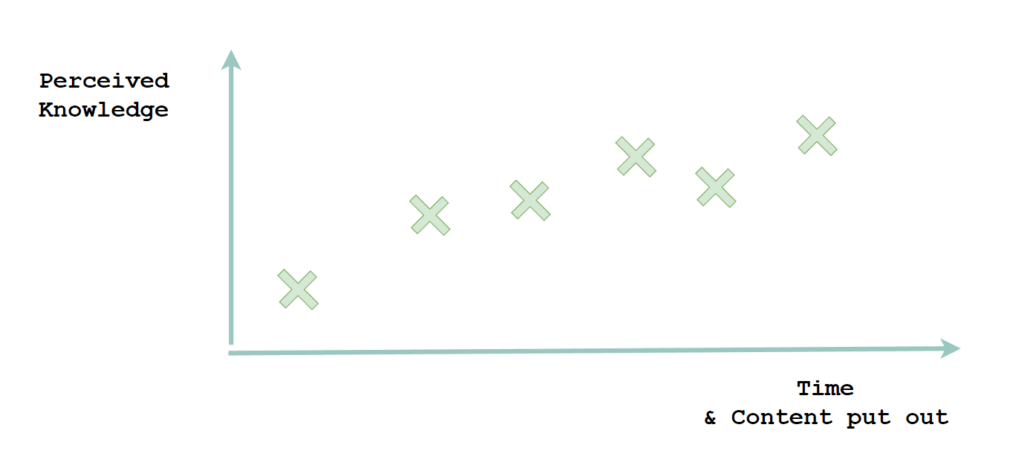

This will also be highest illustrated within the diagram above. Those excellent and complicated ones almost certainly have evolved numerous wisdom within the box to have a quiet self belief however know its sophisticated.

A few of our potentialities or shoppers are within the monetary box. They know there may be almost certainly some funding alpha to be made however whether or not that may be simply captured, or if the alpha remains lengthy sufficient is a distinct topic altogether.

The place I disagree with some is that those extra subtle folks will in truth make beautiful excellent shoppers.

For those who give an explanation for one thing this is sound to them, they get it.

You simply reminded them of one thing that they had forgotten.

Not like others, you don’t have to break your mind to dumb it down or give an explanation for the concept that in several tactics. You’ll have a dialog with them to discover whether or not this occur of their lives, or whether or not they come upon this of their skilled lives.

You need to Measure Up.

You need to be gave the impression to be excellent sufficient, or some distance higher, in comparison to themselves for them to be open to being attentive to you.

I exploit the phrase perceived as a result of some may now not have labored with you so intently to look your monetary have an effect on on their lives. Some simply spend the time being attentive to your previous dialog passively.

They’re open to being attentive to issues they’re much less an expert about. If this can be a informal dialog, they’re sizing up whether or not you understand your shit or are sprouting nonsense.

If they’re paying cash for recommendation, they’re sizing you as much as see whether or not you’re price it truly.

So how do they measurement you up?

The content material that you just put out.

Let me give an explanation for extra.

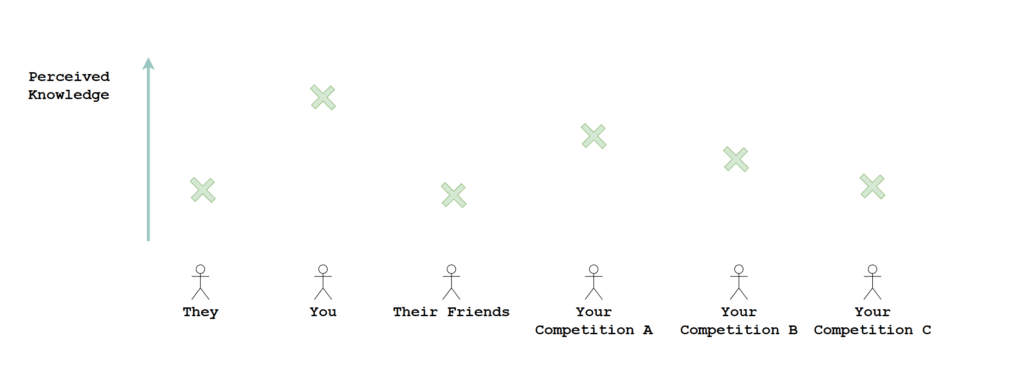

You’ll solely have that small window to allow them to see the way you measure up.

If this was once their first assembly with you, they’ve no smart way of judging you rather then THAT dialog with them.

So they’re sizing you up in that dialog with the folk they come upon, be it their buddies or your festival/friends.

For individuals who made sufficient errors, the bar will not be so low for you as a result of they paintings with sufficient “idiots” of their lives, which were given them to the place they’re at now.

They robotically suppose via default you’re like a kind of “idiots”.

Till you turn out them differently.

How do you do this?

I believe this can be a mixture of:

- Appearing how orientated to truth.

- Much less about gross sales and extra about serving to them. Being non-public sufficient.

- The intensity of information or you’re a scholar of the topic.

- The intensity of sure and detrimental studies

- Admitting you don’t know the entirety.

- There are some tricky issues you can not do, and others can’t do it as neatly.

You were given to drop sufficient fact bombs.

I attached with a few of my friends within the house as a result of now not simply did they do neatly, however they had been moderately truthseekers. They’re open about errors or demanding situations they fight to get round, but in addition drip sufficient issues that display their making an investment sophistication.

To place it merely, within the extra subtle house… Sport Acknowledges Sport.

The ones extra subtle ones, who’re prospecting for an adviser, may even know that it’s unrealistic to be expecting one individual to understand the entirety and are open to figuring out how your staff helps them.

However they don’t need to paintings with somebody who’s “only a consumer provider coordinator”.

Every now and then, I glance during the lens of a shopper and concluded that this can be a humongous problem to be subtle sufficient simply to measure up.

It’s both that, or I’m being too challenging.

The way to Identify Perceived Wisdom Past a Quick Assembly

It’s difficult when the dialog is brief.

There’s a reason why we inspire our advisers or group of workers to position their paintings available in the market.

It’s an open marketplace to let folks perceive us higher. To understand if we’re actual idiots or if we all know our group of workers. This may be some way for deeper conversations between potentialities and our consumer adviser.

The Other folks Who Are No longer Open to Listening (However Fake to be Open)

There are conversations that I’ve had through the years that I am going again to questioning how I set up to sit down thru that entire dinner.

They might say they’re partial to your paintings and would love some recommendation.

Within the dialog, I will be able to discover that they appear to assume they know the “monetary truth” however you recognize they make beautiful fallacious conclusions.

The largest problem they face is affirmation bias. Too cussed in short of one thing (a technique, funding product) they held a super affinity in opposition to to achieve success.

That dialog with me is to validate that technique or product.

I shared this with some folks.

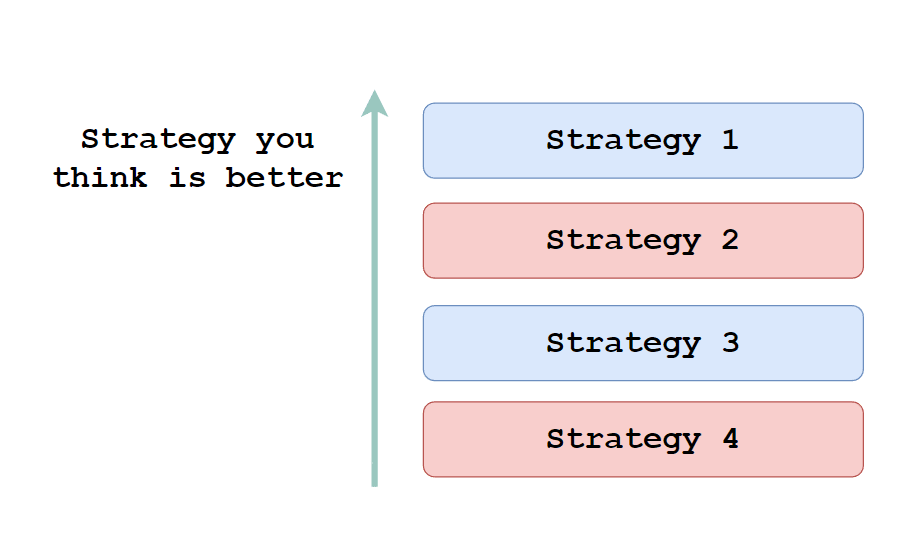

All of us have this psychological order in our heads about what’s the higher or highest technique to construct wealth.

It will be rattling tricky to overwrite the psychological order.

There may be sufficient affirmation bias, searching for out to validate that Technique 1 is truly the most productive technique.

The subtle ones will needless to say technique 1 to 4 has their excellent and dangerous issues and are much less fixated on them. With the intention to succeed in this airplane of figuring out, they could want to replicate in this extra neutrally.

In our realm, it’s that assets source of revenue or dividend source of revenue technique.

The ones are large monsters to get spherical.

Unusually, we see that evolution within the assets source of revenue house.

We enjoy a duration the place those that held assets unexpectedly realise their assets source of revenue is stagnating, now not as constant, much more paintings than they suspect and the chance is probably not excellent.

Principally, they start having doubts about their “Technique 1”

And so…. they started to be extra open mentally to listen to about different source of revenue methods.

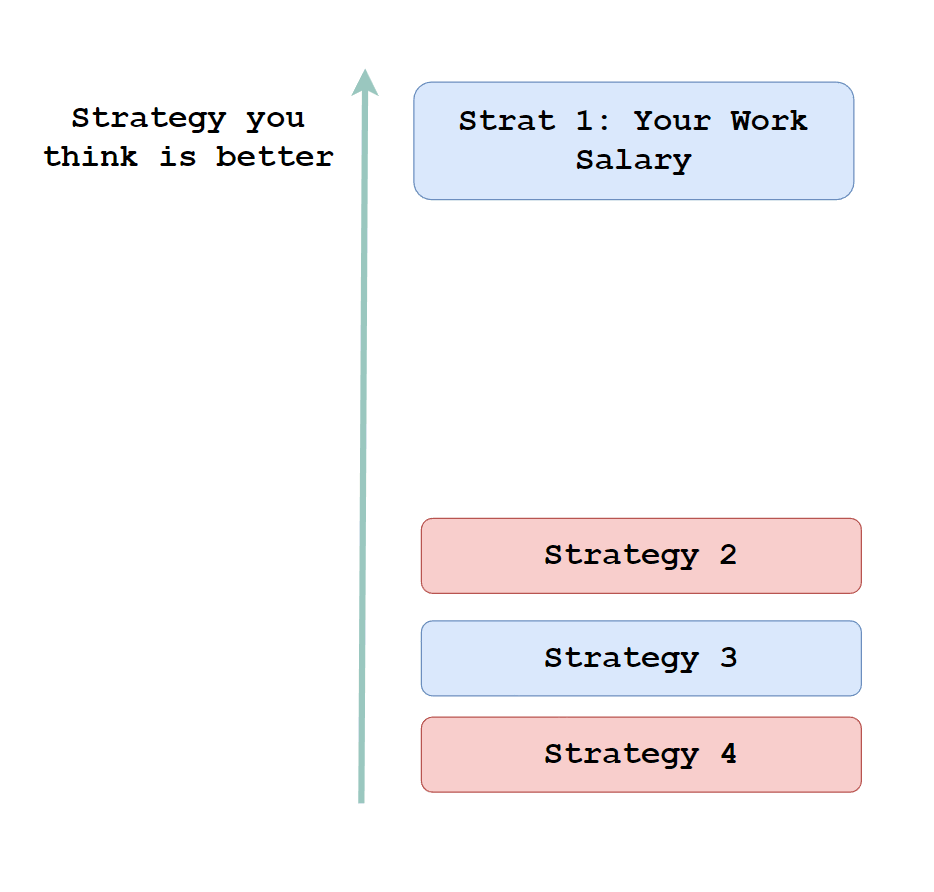

What Occurs When Technique 1 is Your Wage from Paintings?

I believe for many people, we depended such a lot on our paintings wage.

We’re conditioned to be confident that our Technique 1 will all the time be some distance higher than the remaining.

I reasoned that while you notice your technique 1 seems susceptible, or crumbling, you then change into fearful since you don’t know of alternative methods or are so out of intensity about them that you just don’t consider them.

That is the case for many of us.

Because of this there may be an fearful rush to determine what’s the highest 2nd technique and a seek to validate it really works.

Conclusion

Whether or not you’ll pay for it’s some other topic.

You could or won’t disagree of the price you get for what you pay.

However ahead of that, it’s excellent to acknowledge why folks search for monetary recommendation and philosophically how they suspect. It’s not simple to persuade that you’ve got price so as to add and so they won’t all be open to hear what it’s a must to say.

I invested in a different portfolio of exchange-traded budget (ETF) and shares indexed in the United States, Hong Kong and London.

My most well-liked dealer to business and custodize my investments is Interactive Agents. Interactive Agents mean you can business in the United States, UK, Europe, Singapore, Hong Kong and lots of different markets. Choices as neatly. There aren’t any minimal per month fees, very low foreign exchange charges for foreign money replace, very low commissions for quite a lot of markets.

To determine extra consult with Interactive Agents lately.

Sign up for the Funding Moats Telegram channel right here. I will be able to percentage the fabrics, analysis, funding knowledge, offers that I come throughout that permit me to run Funding Moats.

Do Like Me on Fb. I percentage some tidbits that don’t seem to be at the weblog put up there incessantly. You’ll additionally make a choice to subscribe to my content material by the use of the e-mail under.

I damage down my assets in step with those subjects:

- Construction Your Wealth Basis – If you understand and follow those easy monetary ideas, your long run wealth must be beautiful neatly controlled. In finding out what they’re

- Energetic Making an investment – For energetic inventory traders. My deeper ideas from my inventory making an investment enjoy

- Studying about REITs – My Unfastened “Path” on REIT Making an investment for Novices and Seasoned Traders

- Dividend Inventory Tracker – Observe the entire not unusual 4-10% yielding dividend shares in SG

- Unfastened Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Making plans, Monetary Independence and Spending down cash – My deep dive into how a lot you want to reach those, and the alternative ways you’ll be financially loose

- Providend – The place I recently paintings doing analysis. Rate-Handiest Advisory. No Commissions. Monetary Independence Advisers and Retirement Experts. No fee for the primary assembly to know how it really works