This Horny Yielding Retirement Plan Would possibly No longer Fit Your Desired Source of revenue Want.

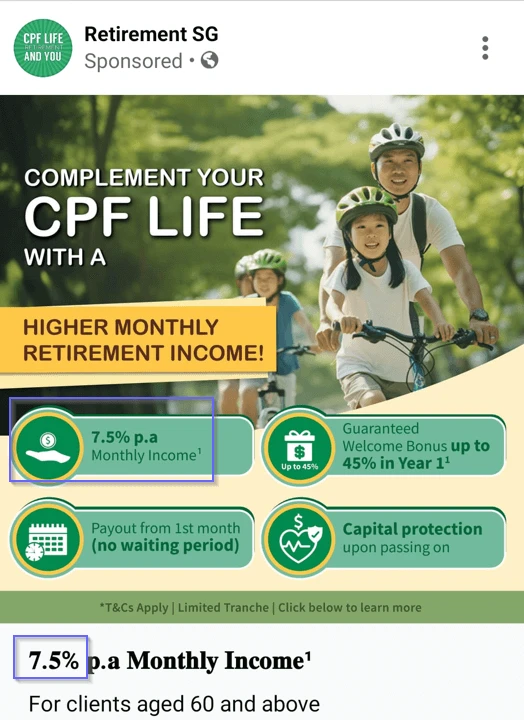

A few of you’ll have come throughout a retirement source of revenue commercial on social media platforms reminiscent of this:

No longer unusually, I’ve readers telling me such retirement plans exist and what I take into accounts such a stupendous retirement source of revenue technique.

Buyers with an source of revenue function, reminiscent of retirement source of revenue, or on the lookout for some long-term source of revenue are maximum on this.

If I requested the traders to give an explanation for extra about what they learn about “this technique”, they struggled to give an explanation for. The most typical reaction is: “I don’t consider a lot, however that 8% p.a. source of revenue turns out assured.“

Glance… this is a giant ask for any monetary establishment to vow an 8% p.a. source of revenue assured. I’m relatively certain the one that got here throughout this should have misinterpreted issues.

However why?

I believe many traders have this source of revenue requirement this is so necessary to them that they need for a option to be so true.

In order that they went in to peer the planner, gross sales representatives and was once sooner or later satisfied and were given invested.

I believe many that got here around the advert may have their belief skewed via the horny gross sales reproduction however I believe that your capital put aside to your retirement is necessary sufficient that it’s higher you know extra in regards to the plan.

On this article, I will be able to check out my highest to give an explanation for the options and sure difficult side about it that are supposed to make you believe deeper ahead of you make a decision to shop for this retirement technique.

This is the whole gross sales reproduction:

For shoppers elderly 60 and above

In lower than 5 12 months’s time, your CPF Lifestyles will get started paying out.

Then again, the $1000-$1200 is probably not sufficient for the present way of life because of present emerging inflation.

That is the most productive time to create a Retirement Portfolio to complement your CPF Lifestyles and obtain a per thirty days Source of revenue for Lifestyles!

Learn how a Retirement Portfolio can lend a hand to give you a Retirement Per month Source of revenue for Lifestyles:

- 8% p.a. Per month Source of revenue1

- Payout from 1st month (No ready length)

- Enhances your CPF Lifestyles via offering you a better per thirty days Retirement Source of revenue

- As much as 45% Assured Welcome Bonus in Yr 11

- Capital Coverage upon passing on/terminal sickness

via the use of a Retirement Portfolio to counterpoint your CPF Lifestyles, you’ll be capable to get a better payout and obtain your Per month Retirement Source of revenue previous.

Don’t wait any further. Click on beneath and to find out extra on tips on how to Supplement your CPF Lifestyles now!

*T&Cs follow

Please see our T&Cs right here: http://bit.ly/3WYnRBx

The T&Cs supply sufficient main points to let us know what about it, however I believe that the crowd that the commercial goal (relatively effectively!) have bother figuring it out.

Allow us to get started via working out what this retirement source of revenue plan is set.

What This Retirement Portfolio Is

This retirement portfolio is a unit accept as true with this is structured inside of a 101 Funding-Connected Plan (ILP) from Manulife referred to as Manulife InvestReady (III).

The unit accept as true with used is Allianz Source of revenue & Enlargement (H2-SGD) Dis.

Up to now, I wrote a complete article to give an explanation for in regards to the Allianz Source of revenue & Enlargement unit accept as true with: Tearing Down the 8.6% Dividend Yielding Allianz GI Source of revenue and Enlargement Fund.

I will be able to communicate extra in regards to the fund on the subject of source of revenue making plans later.

Whilst that is the unit accept as true with used within the commercial, the investor/shopper and adviser have the discretion to switch the unit accept as true with within the ILP.

The function of the coverage is to offer each insurance policy and funding alternatives. The insurance policy is restricted to demise and terminal sickness protection.

With that, let me attempt to make clear the options indexed within the commercial.

The 8.0% p.a. Per month Source of revenue1 which Payout from 1st Month (no ready length)

There’s a per thirty days source of revenue for the reason that underlying unit accept as true with (Allianz Source of revenue & Enlargement) distributes a per thirty days dividend.

The fund was once incepted in Feb 2017 and has been paying out dividends.

The ILP lets in the investor to obtain the payout from the underlying unit accept as true with.

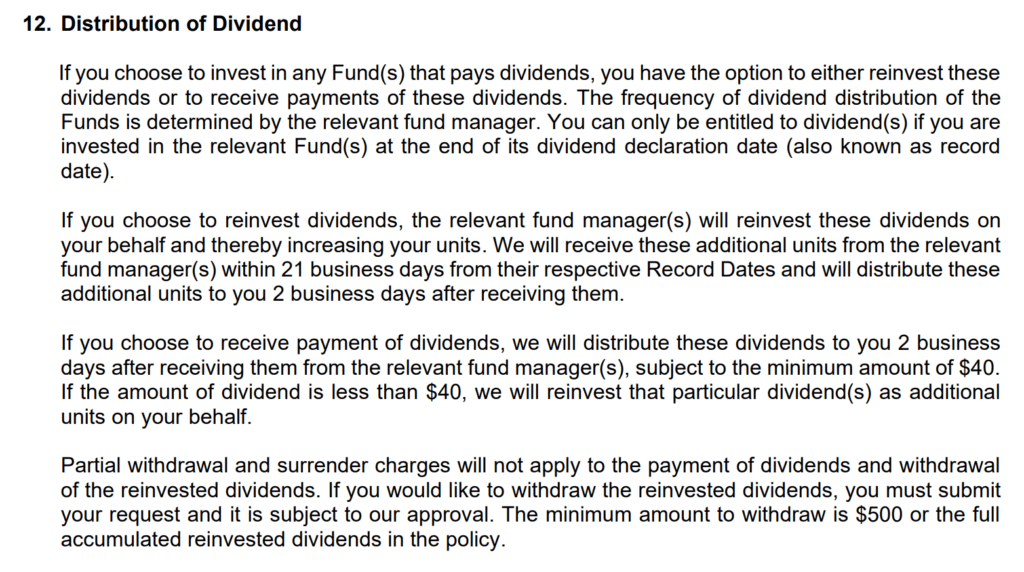

This is lifted from the product abstract:

This explains the payout from the first month. The investor additionally has the chance to reinvest the dividend will have to he/she so chooses.

May just you get 8% p.a. Per month Source of revenue?

Many traders are focused on this, however herein lies the issue. There’s a extra profound query:

What have been you anticipating while you see 8% p.a. Per month Source of revenue?

- Had been you anticipating a constant 8% of the risky portfolio price?

- OR have been you anticipating a constant source of revenue similar of 8% of the first-year portfolio price? (e.g. on a $1 million portfolio, you expect an annual $80,000, $80,000, $80,000 in source of revenue)

- OR have been you anticipating #2 however with an inflation-adjustment?

That is the issue when discussing source of revenue methods: Everybody has their very own source of revenue personal tastes however they’re undecided if the product/answer/funding is in a position to supply that.

Earlier than having a look at this product, you wish to have to be transparent in regards to the traits of your source of revenue requirement:

- How lengthy do you wish to have the source of revenue to final?

- Can your source of revenue be risky or is there a minimal quantity this is required?

- Do you wish to have the source of revenue to regulate or stay alongside of inflation?

Most of the people need an source of revenue flow that lasts perpetually, that gives a minimal quantity and for the source of revenue to regulate for inflation. No longer simply that, the source of revenue, relative to their funding capital is excessive!

I’m going to let you know… if you need the whole lot that isn’t imaginable (particularly when you come with the final one).

Many of us spend their complete existence looking for a product, that they didn’t understand monetary establishments is not going to dare to vow them.

The underlying source of revenue isn’t assured.

Buyers attempted to learn all 4 options of the commercial in combination and had the affect the source of revenue is assured.

The character of source of revenue for most monetary merchandise comes from whether or not the underlying monetary securities are in a position to offer that. On this case, the 1st query is whether or not Allianz Source of revenue & Enlargement fund may give it.

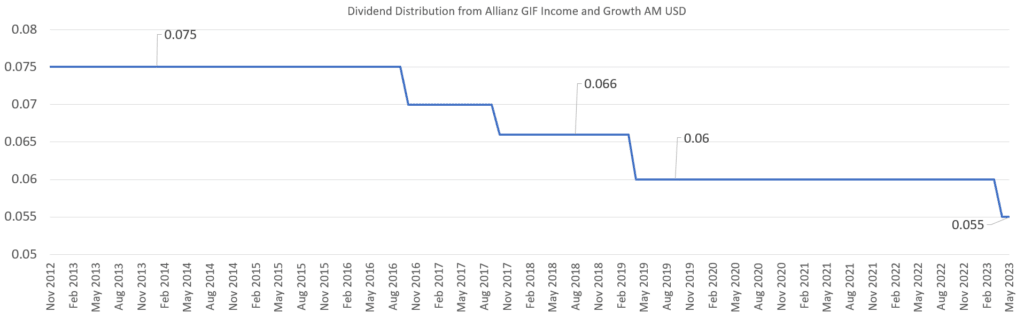

Whilst the H2-SGD magnificence has a brief historical past (incepted in 2017), we will check out the dividend historical past of the AM USD distribution magnificence of the fund which is incepted since 2012.

I shared this in my Allianz Source of revenue & Enlargement article:

This chart presentations the dividend distribution for the AM USD proportion magnificence.

What you’ll understand is that if you’re a retiree that invested on this fund, beneath most likely a equivalent ILP construction in 2012, you’ll experience strong dividends, ahead of the dividends cross down through the years (from 7.5 cents to 7 cents to six.6 cents to six cents to five.5 cents just lately)

This may increasingly come up with an concept that the source of revenue payout might get started at 8%, however in accordance with historical past your source of revenue isn’t going to be strong, with its historical past appearing the source of revenue getting lesser and lesser.

In accordance with the distribution historical past, we all know the source of revenue traits:

- There’s no disclosure of whether or not there are any empirical research as as to if one of these portfolio (33% US equities, 33% US convertible bonds, 33% US excessive yield bonds) can final for a way lengthy, and with what form of payout.

- Ancient proof presentations that the dividend payout goes to be risky. Buyers might want to promote devices and do partial withdrawals to stay the source of revenue constant. This may increasingly/won’t affect how lengthy the source of revenue will final.

- Ancient proof presentations the dividend payout is going down throughout sessions when inflation is going upper.

The proof don’t bode neatly if an investor have been to enforce this product as a retirement source of revenue plan.

If we’d like additional end up of the way variable is the source of revenue, here’s how the commercial seem like just lately:

Realize that it’s not 8% p.a. however 7.5% p.a.

Allianz Source of revenue & Enlargement introduced just lately a aid of the Dividend Distribution of the H2-SGD Distribution proportion magnificence from $0.052 to $0.045.

With such variability, how would you formulate your source of revenue technique?

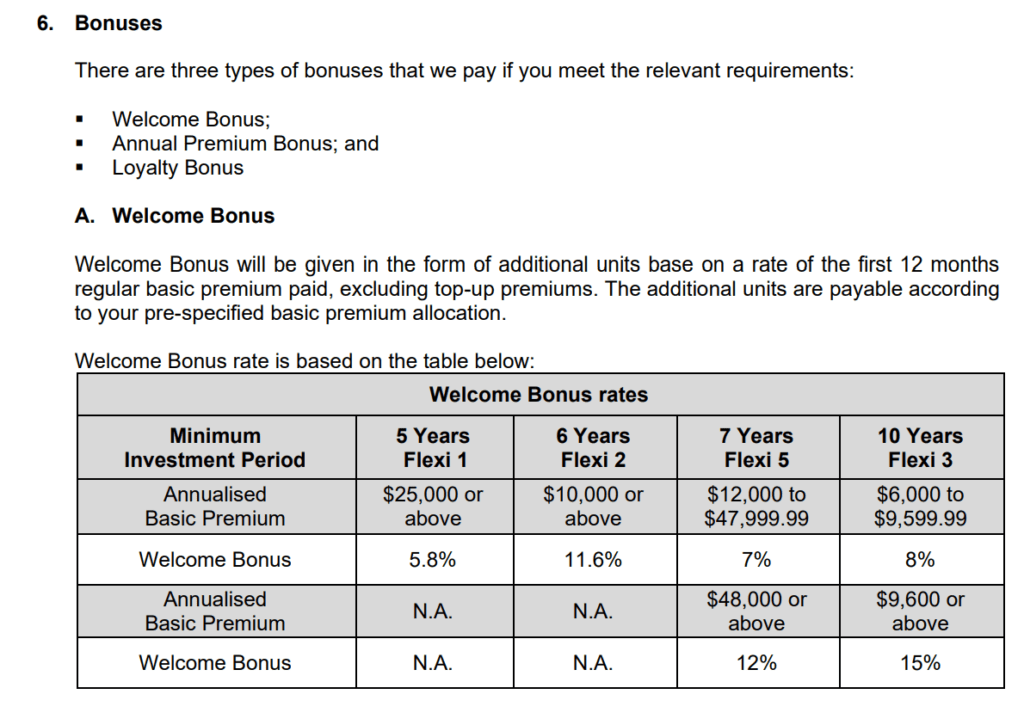

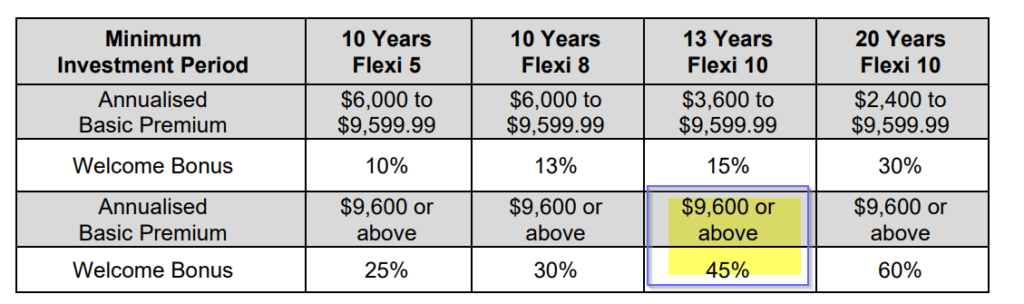

Assured Welcome Bonus as much as 45% in Yr 11

Many 101 ILPs out there praise the traders with bonus devices, which can be further unit accept as true with devices throughout the 1st 12 months or first length of funding, and at next issues.

The one ensure within the commercial refers back to the welcome bonus.

Giving 45% bonus devices of 12 months 1 sounds giant till you know you’ll solely get 45% when you:

- Put money into a 13 Years Flexi 10 fee construction and

- Make investments $9,600 and above.

This is taken from the Product Abstract:

For those who make investments much less once a year or can solely do it beneath a unique construction, you won’t get that prime assured welcome bonus.

This is the Attainable Misdirection

Those 101 ILPs are supposed for other people with much less capital.

You might understand that those plans are structured via default for an investor to give a contribution their capital over a time period as a substitute of a giant lump sum at the beginning.

I took a take a look at the product abstract and can not to find a lot mentioned in regards to the construction if I have been to give a contribution a single-premium as maximum are just like the desk you apply above, contribution over other sessions.

Which is relatively bizarre that if I’ve an source of revenue function, and I wish to get source of revenue fee from my funding in an instant to fulfil my source of revenue wishes, I’ve to give a contribution over a time period as a substitute of striking all of it in as one lump sum.

As an example, as a substitute of putting in place $1 million to get $80,000 p.a. in source of revenue, I needed to divide it over 5 years. 5 years is the quickest I will get invested, to get the source of revenue which I want.

I benefit from the lowest welcome bonus.

As an source of revenue planner looking to allocate my current monetary assets to achieve source of revenue, this construction via default is bizarre and most probably, it isn’t supposed for the excessive internet price with capital and a urgent want.

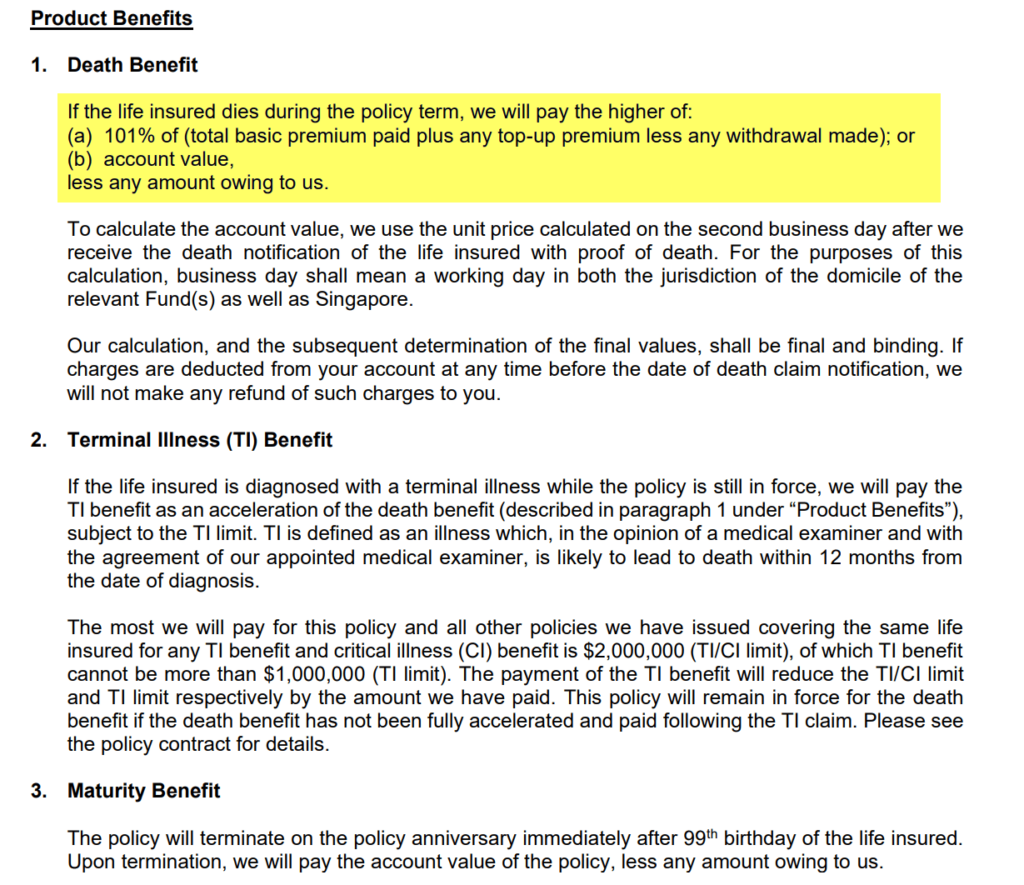

Capital Coverage Upon Passing On

The final function pertains to capital coverage and traders must be transparent on what this implies.

The capital coverage is an insurance coverage get advantages upon demise.

Here’s what is mentioned within the product abstract:

If the existence insured dies, the demise get advantages will probably be 101% of the overall elementary premiums paid plus any top-up top class much less withdrawal made or the account price whether it is upper.

So this saves your capital within the match of demise. That is really helpful if the fund does now not carry out neatly, and after payout the worth of the coverage is low. Within the demise match, your beneficiary will no less than get the overall elementary premiums paid.

Buyers will have to be aware that now not all 101 ILP demise advantages are very similar to this.

Some simply offer protection to the elemental top class, now not the top-up, whilst some are in accordance with prevailing portfolio price.

The demise good thing about Make investments Able is best, however you might be paying for the price of insurance coverage if the funding don’t carry out neatly. It is because the price of insurance coverage is on the internet quantity in danger (NAAR).

So assume if the coverage price is $200,000 and the overall cumulative premiums paid was once $300,000, there’s a price of insurance coverage charged at the coverage (via cancelling devices out of your fund) for the $100,000 distinction in insurance policy.

When the retiree is younger, the price of insurance coverage is low.

However how younger would a retiree be?

The Retirement Portfolio Construction Has Sufficient Demanding situations for You to Assume About

I’d inform a large number of other people:

An source of revenue funding product, particularly an off-the-shelf one, isn’t equivalent to an source of revenue technique.

It is because:

- The product should ensure that it will probably fulfil positive funding or product guarantees.

- The monetary markets are simply so unsure that the returns of the underlying investments are unsure in fact.

- Mix #1 and #2 manner any contractual guarantees will have a tendency to be very, very conservative to the purpose it is going to now not hobby you. Therefore, there aren’t many contractual guarantees.

- This implies maximum options are full of caveats.

Maximum merchandise via themselves can’t be an source of revenue technique as a result of they have got flaws. However that doesn’t imply the failings can’t be alleviated.

You want to be savvy sufficient or you wish to have any person to offer a technique to incorporate the product.

If we evaluate the marketed options:

- The 8% p.a. source of revenue is extra risky than you understand and there’s a query of the way lengthy the source of revenue can final.

- If you want to enforce in an instant, with important capital, you received’t experience one of these excessive welcome bonus. The implementation is inefficient.

- The security via demise get advantages is fluid in accordance with the efficiency of the unit accept as true with, however do be aware that if you’re a retiree, the price of insurance coverage at your age is probably not reasonable (because of your age). You won’t want that coverage anymore (until you have got an excessively robust legacy want)

There also are different spaces to take into accounts that aren’t mentioned:

- There’s a partial withdrawal fee that coincides with the top class fee length. Which means if the dividend source of revenue is risky and also you want to spend extra, you might be limited.

- There also are give up fees when you give up throughout the top class fee length.

- Some can have reservations about having all their cash in 100% equities throughout their retirement. You might want to bear in mind that in accordance with how the Allianz Source of revenue & Enlargement fund is ready up, equities, convertible bonds and high-yield bonds are suffering from the similar marketplace prerequisites.

Even supposing you have got an affinity against the Allianz Source of revenue & Enlargement fund, most likely you’ll believe making an investment out of doors of this ILP construction. The fund is to be had in unit accept as true with platforms reminiscent of Fundsupermarket or POEMS.

- You forgo the insurance coverage element, which a few of you may now not want, particularly while you don’t have many dependents.

- You save at the coverage and ongoing ILP fees.

- You might have a lot more flexibility to promote devices to stabilise the source of revenue.

- If wanted, you’ll simply reallocate your capital to different monetary objectives.

Having a headline yield of seven.5% or 8% source of revenue yield would clutch consideration, but when it sounds too horny, at all times keep in mind that the satan is in the main points.

Too repeatedly, merchandise disappoint other people as a result of we:

- Yearn for an source of revenue perfect this is unattainable for merchandise to ship.

- Relied on the incorrect monetary consultant, who’s much less skilled, strategically omits information about the plan that will in a different way have stopped you from signing it.

- We rationalize our selections an excessive amount of when pressed via a consultant to a nook.

If you wish to industry those shares I discussed, you’ll open an account with Interactive Agents. Interactive Agents is the main cheap and environment friendly dealer I exploit and accept as true with to take a position & industry my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They will let you industry shares, ETFs, choices, futures, foreign exchange, bonds and budget international from a unmarried built-in account.

You’ll learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with tips on how to create & fund your Interactive Agents account simply.