Tearing Down the 8.6% Dividend Yielding Allianz GI Source of revenue and Expansion Fund.

There’s this unit agree with that individuals were bringing up to us, or myself for the longest time: Allianz Source of revenue and Expansion Fund.

I don’t know what’s the fascination over this fund.

The ones other people making an investment in finances mentioned it. Possibilities and purchasers mentioned it.

Even lead era corporations who assist advisory corporations generate leads use it to be a part of it’s “8% P.A. Retirement Plan”!

At the first minimize, here’s the attraction:

- It will pay out per thirty days dividend revenue, which appeals to other people searching for revenue similar to retirees so much.

- The dividend revenue in accordance with the unit worth is above 8%.

- This can be a five-star Morningstar Rated fund since April 2020.

- Their pals or you-know-who says it’s excellent.

I took a handy guide a rough have a look at the fund, then I used to be confused. I observed my justifiable share of high-yield bond-based revenue unit agree with and this one appeared simply as dangerous.

Do other people in reality know what they’re getting themselves into?

So here’s how I have a look at the fund from my point of view.

What’s the Allianz Source of revenue and Expansion Fund?

The fund is a Luxembourg-domiciled unit agree with that seeks long run capital expansion and revenue via making an investment in company debt securities, equities of US/Canada and bonds.

This fund was once officially controlled via an Allianz supervisor however just lately Allianz International Buyers and asset control company Voya Funding Control entered right into a long-term strategic partnership and the funding group was once transferred to Voya Funding Control.

There are some constraints set at the fund:

- I feel on the whole, the fund can not make investments greater than 70% in both equities, convertible bonds or high-yield bonds at anyone time.

- Can not make investments greater than 30% of fund in rising markets.

- Can not make investments greater than 20% in ABS or MBS.

- Can not make investments greater than 25% in deposits in cash marketplace tools and can’t be greater than 10% in cash marketplace finances.

- Can’t be greater than 20% in non-USD Foreign money Publicity.

The Source of revenue and Expansion fund is an actively-managed fund.

The principle marketplace is in United States Securities.

For the reason that fund is domiciled in Luxembourg, it’ll observe the inheritance and withholding tax regulations of the rustic. It is very important assess the place you’re a tax-resident of, and whether or not you’re prone to those taxes.

What Will Power the Fund’s Returns?

I’ve this philosophy constructed up after taking a look at finances through the years:

There aren’t numerous excellent managers. Managers of finances even have funding constraints that may save you them from doing dramatically various things with their finances, similar to protecting 30-40% money after they really feel “the time is correct”. Even supposing the chief is excellent, don’t be expecting her or him to do miracles like getting a excellent go back when the underlying areas, sectors, and elegance issue they’re focused on isn’t doing effectively.

What does this imply?

In the event you make investments over a very long time, the returns you get are going to revolve both higher or worse than their underlying tilts against explicit asset magnificence, areas, sectors, and elegance components.

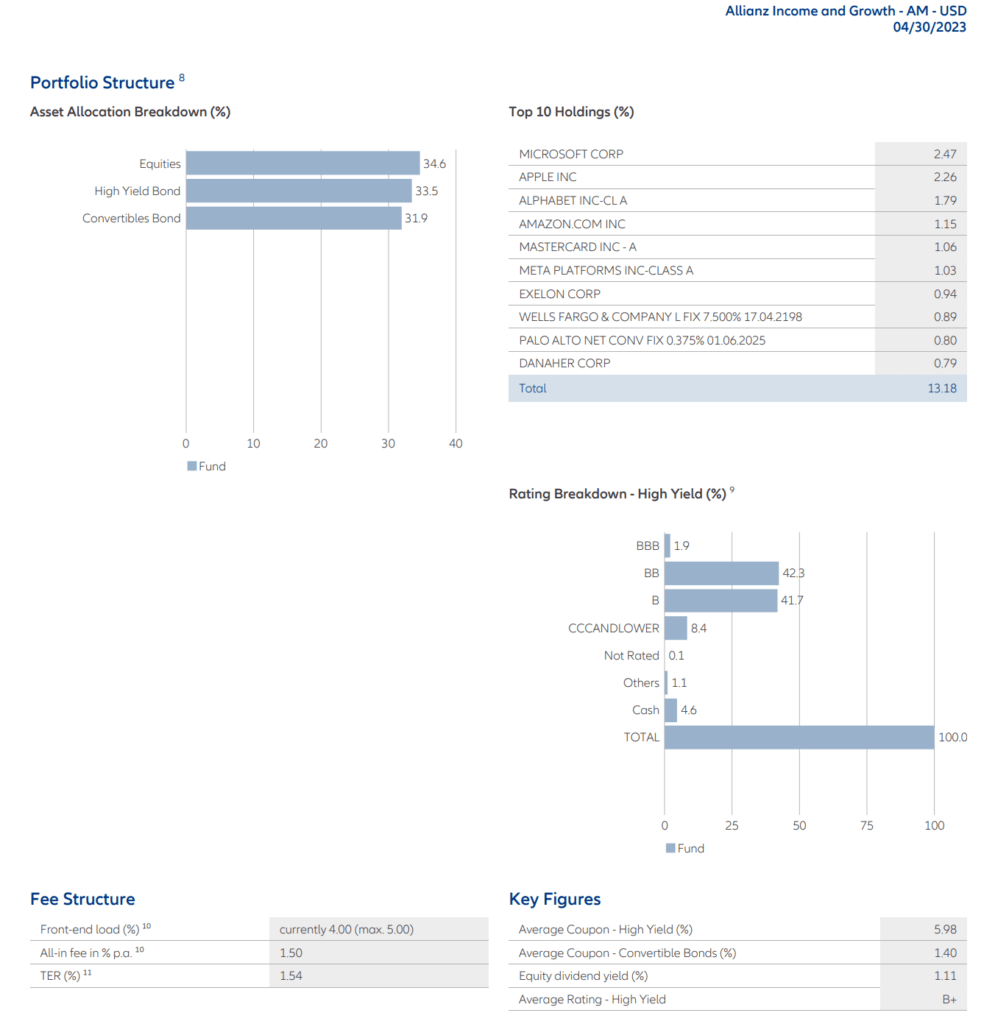

I took a have a look at Allianz Source of revenue & Expansion factsheet:

The fund has nearly equivalent weighting to :

- US Equities

- US Top Yield Bonds

- US Convertibles Bond

Holy shit.

I wonder whether the folk put money into the fund perceive what they’re making an investment in. Like all unit agree with, you’ll be able to get it at Fundsupermart, DollarDex, Poems, Endowus, thru some Funding-linked insurance policies.

Relying at the platform, you could have to pay a gross sales price however there are not any efficiency and go out charges (however do notice that during Funding-linked coverage construction, you possibly can incur give up fees in case you go out early).

The whole expense ratio of the fund is just about 1.50%.

The Entire Fund Is Levered In opposition to Equities

Buyers taking a look to retire desire to not take too many dangers for his or her retirement cash.

This implies they like mounted income-based answers then equities.

However they nonetheless want revenue.

Conventional bonds didn’t give numerous revenue now not too way back!

So they appear against revenue finances or search for promising bonds that may give them extra revenue.

Or revenue merchandise similar to Allianz Source of revenue & Expansion.

In the event you have a look at what makes up the fund, all 3 elements are levered against equities.

What does that imply?

Convertible bonds and high-yield bonds do effectively when equities do effectively and don’t achieve this effectively when equities don’t achieve this effectively.

Whilst they’ve the phrase “bonds” of their identify, each are nearer to being equities than bonds.

Convertible bonds have very low coupons. But when the issuer’s proportion worth will increase, the bondholder can convert the bonds to fairness stakes at a particular strike worth. Because of this if the fairness worth transfer against the strike worth, the worth of the convertible bond additionally rises.

Convertible bonds are issued as a substitute of rights or placement to forestall dilution. It may also be appeared as reasonable debt, which stays as reasonable debt if the trade transformation or initiative does now not figure out. The present fairness holders received’t be diluted when the convertible bonds are transformed for the reason that proportion worth would have risen a good bit at a well-priced strike worth.

Thus, convertible bonds do effectively when equities do effectively. The disadvantage of convertible bonds is greyer. I feel they aren’t factor via distressed corporations as a result of in case your corporate is distressed, bond holders would call for a better yield, which means that now not many will devour your convertible bonds.

Top-yield bonds also are from time to time referred to as junk bonds. The yield is excessive for the reason that issuer are dangerous trade. The bonds raise a better chance of default. The yield of the bonds most often get compressed when markets do effectively, which means that the bond costs move up. The other is right as effectively.

Equities most often don’t achieve this effectively all the way through recession and all the way through recession the issuer of excessive yield bonds are probably the most in danger.

Convertible and excessive yield bonds aren’t the protected bonds that traders take into account.

I do assume that newbie traders positioned numerous hope that those bonds showcase Treasury-like traits all the way through instances of misery.

They are able to be in for a surprise.

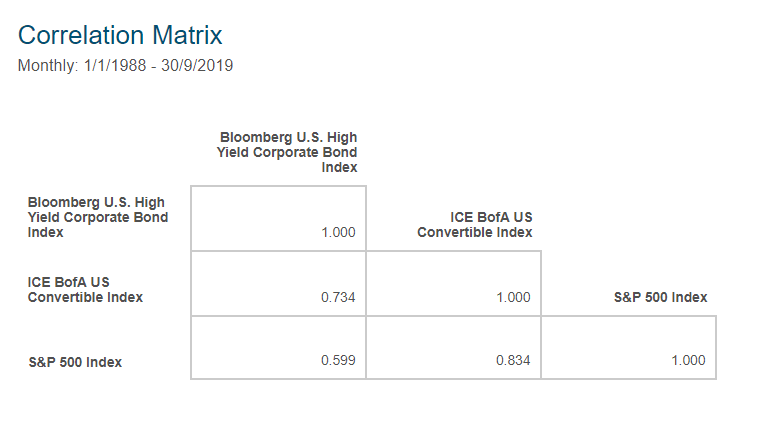

Here’s the correlation of the 3 other teams of securities:

- Bloomberg US Top Yield Company Bond Index represents US high-yield bonds

- ICE BofA US Convertible Index represents US convertible bonds

- S&P 500 index represents US equities

The correlation of Convertible bonds to Top yield bonds and equities is 0.73 and zero.83, respectively. A correlation nearer to one manner the 2 teams are considerably correlated from the index information from 1988 to 2019 (32 years).

The correlation of Top yield bonds to Convertible bonds and equities is 0.73 and zero.60, respectively.

The correlation of US Equities to Top yield bonds and convertible bonds is 0.60 and zero.83, respectively.

The correlation of the 3 is excessive with excessive yield bonds having the least correlation to equities.

I wonder whether a retiree or an investor searching for revenue is pleased with a 100% fairness portfolio producing revenue for her or him.

My revel in tells me maximum will HAVE RESERVATIONS if 100% or 80% in their revenue resources are from equities.

However their choice for the Allianz Source of revenue & Expansion fund for revenue befuddles me. If you’re comfortable with this fund, what then is your factor with a excessive fairness revenue resolution? In the event you aren’t comfortable with a excessive fairness revenue resolution, then you definately must now not feel good about Allianz Source of revenue & Expansion fund.

The Ancient Efficiency is Objectively No longer Excellent

In the event you subscribe to my philosophy that the character of the elements drives the returns of the fund, then the returns of Allianz Source of revenue & Expansion are pushed via US equities, US convertible bonds and US high-yield bonds.

I determined to create a reference index made up of:

- 34% S&P 500 Index.

- 33% Bloomberg US Top Yield Company Bond Index

- 33% ICE BofA US Convertible Index

The opposite to Allianz’s revenue and expansion can be to put money into an ETF portfolio of those 3 indexes.

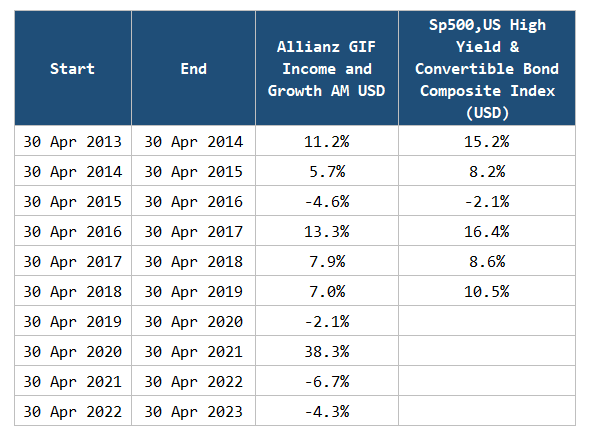

Allianz publishes some ancient fund returns of their fund factsheets.

I come to a decision to check the ancient fund go back by contrast reference index I created:

We’ve about six years of information which we will be able to examine.

You can realize that the reference index efficiency meanders like Allianz GIF Source of revenue and Expansion AM fund. When the efficiency is excellent, the reference index efficiency could also be excellent, and when the fund efficiency isn’t excellent, so is the efficiency of the reference index fund.

Nearly yearly, the reference index did higher than the Allianz GIF Source of revenue and Expansion AM fund. Indubitably, the index does now not come with charges and the expense ratio of the fund is a hefty 1.5% p.a.

I feel with out the hefty rate the efficiency of the fund might be nearer to the reference index.

However even supposing charges are decrease, what are you purchasing the Allianz fund for? To stay alongside of the index? Most likely that strips away a lot of the sophistication you’re paying to the chief.

What determines the efficiency you revel in are because of the underlying equities, high-yield bonds and convertible bonds.

32 Years of Reference Index Returns

If the character of the Allianz Source of revenue & Expansion drives the returns, what does 32 years of US equities, US excessive yield bonds and US convertible bonds let us know concerning the conceivable returns nature?

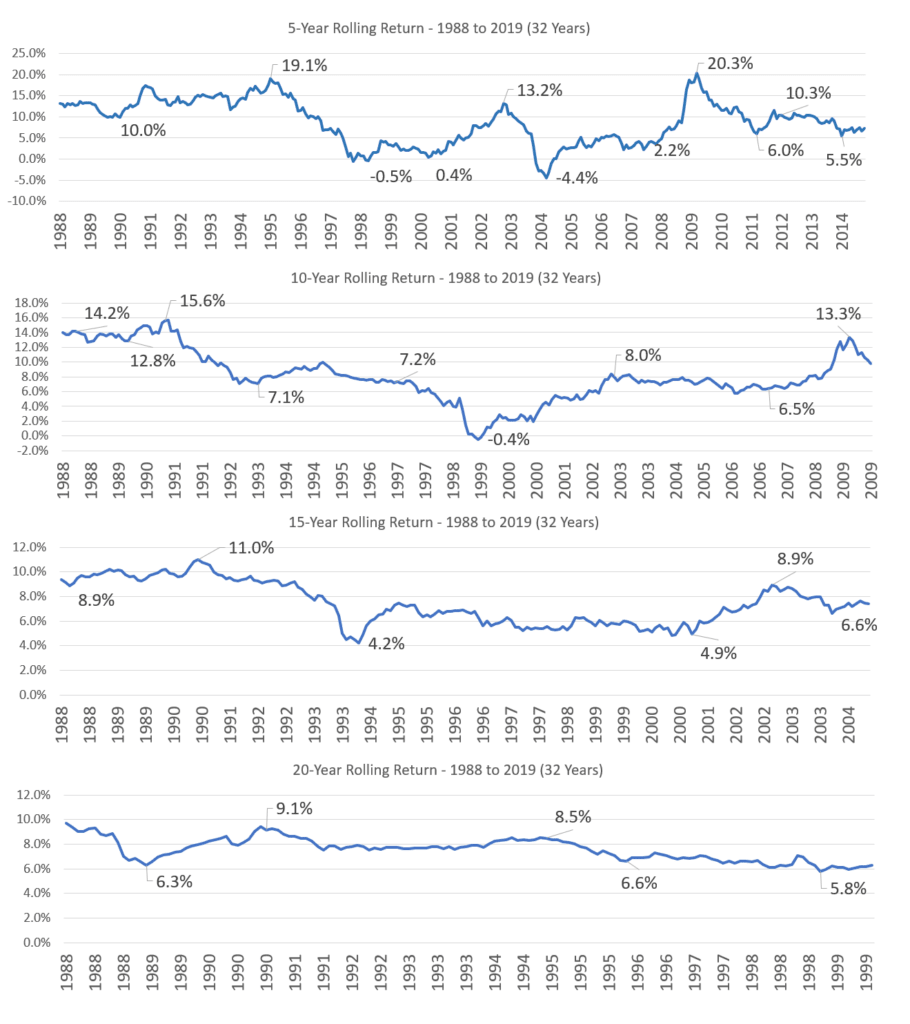

Within the charts underneath, I laid out the 5-year, 10-year, 15-year and 20-year rolling returns of the reference index from 1988 to 2019:

Each and every level at the chart represents a 5-year, or 10-year, or 15-year, or 20-year duration.

We see a quite common development readers of Funding Moats most often follow: when the making an investment duration is brief, you’ll be able to get a much wider vary of result.

The fortunate investor gets 19% a yr for 5 years whilst an unfortunate investor gets -4.4% a yr for 5 years.

However in case you make investments longer, the variety of returns narrows.

Something I realize is that, the USA fairness, convertible bond and high-yield reference index have the tightest 20-year annualized go back vary. It’s principally between 5.8% a yr and 9.1% a yr.

I feel this can be interesting for some traders who felt that this kind of go back is respectable all the way through their retirement or for capital preservation.

However is that this in reality spectacular?

A 60% S&P 500 and 40% 5-year US Treasury can have a spread between 5.4% and 10% a yr.

So no, it’s not so particular as opposed to the standard 60/40 portfolio.

General, the fund’s go back is reasonably just about a 60/40 portfolio.

We do have to recognize that whilst 32 years is lengthy, it’ll be nice to look the efficiency of this reference index over other financial regimes. The 60/40 is “struggle examined” over 200 years of ancient efficiency and we are hoping to look the similar for this kind of portfolio.

Allianz Source of revenue & Expansion’s Falling Dividend Distribution

Monetary advisory corporations tout the Source of revenue & Expansion fund as the foundation in their passive revenue resolution.

So allow us to speak about revenue.

The principle promoting level of Allianz Source of revenue & Expansion is its MONTHLY dividend distribution which recently yields just about 8.6%.

How constant is the dividend?

Buyers want to know that the portfolio supervisor of an unit agree with fund like Source of revenue & Expansion wears each the funding supervisor hat in addition to the monetary adviser hat.

The fund units a excessive dividend distribution, however that distribution can alternate over the years.

The chart underneath presentations the dividend distribution historical past of the AM magnificence of the fund:

The per thirty days dividend was once $0.075 a month, then in Jul 2014, to Jul 2018, there weren’t any dividend cost, prior to the chief resumes dividend cost. The dividend cost dropped to $0.066 which is a 12% relief. Then in Apr 2019, that dropped an extra 9% to $0.06 prior to just lately shedding to $0.055.

In case your thought for the fund is to supply inflation-adjusted revenue or revenue that is going up over the years, and NOT spend the capital since you assume that may maintain your capital, the fund’s dividend historical past must shed extra mild.

The Fund is Most likely Paying its Dividend Out of its Capital Appreciation or Capital in Normal

I’m a complete returns man so I will view returns as a mixture of dividends and capital appreciation.

However many revenue traders want to stay their capital intact as a result of they equate holding their capital intact to be able to lengthen their revenue move or to make sure their revenue move final endlessly.

I were given information for traders with this mindset:

Simply since you are spending solely the dividend revenue out of your unit agree with does now not imply you aren’t spending your capital. The fund supervisor could also be liquidating your capital from time to time, or at all times, to pay your dividend revenue.

We all know the present dividend yield of the Allianz Source of revenue & Expansion AM magnificence fund yields 8.6%.

Here’s the next:

- S&P 500 Dividend Yield: 1.66% (from YCharts)

- iShares Convertible Bond ETF Reasonable Yield to Adulthood: 4.97%

- Bloomberg Top YIeld Bond ETF Yield to Worst: 9.06%

Only one out of three hits 8.6%.

How the F*** do you are expecting the fund to stay producing an revenue that helps to keep up with an 8.6% yield?

There’s sufficient proof that the revenue has to return from some capital appreciation returns, which is one thing that can be uncomfortable for some revenue traders.

Convertible bonds, via their nature, is low yielding and far of the excessive revenue should include systematic harvesting of capital appreciation returns.

Can a Aggregate of S&P 500, US Top Yield Bonds and US Convertible Bonds Give You an Source of revenue of $80,000 on a $1 Million Portfolio?

I’m curious concerning the 8% revenue advisory corporations put of their commercials.

Are you able to get an 8% revenue for your retirement?

Seasoned Funding Moats readers will know that your preliminary revenue in your portfolio ratio dramatically determines the luck of whether or not your revenue streams final thru your retirement.

Many be expecting an revenue of $80,000, $80,000, $80,000, and $80,000 from their revenue resolution however they don’t understand that the revenue from this kind of fund similar to Allianz Source of revenue & Expansion isn’t constant (see the Falling Distribution phase above).

The revenue could also be now not adjusted for inflation.

Spending 8% of your portfolio is wildly positive. It calls for the retiree to reside thru a fortunate series. All through unfortunate series, the cash will run out in not up to 10 years.

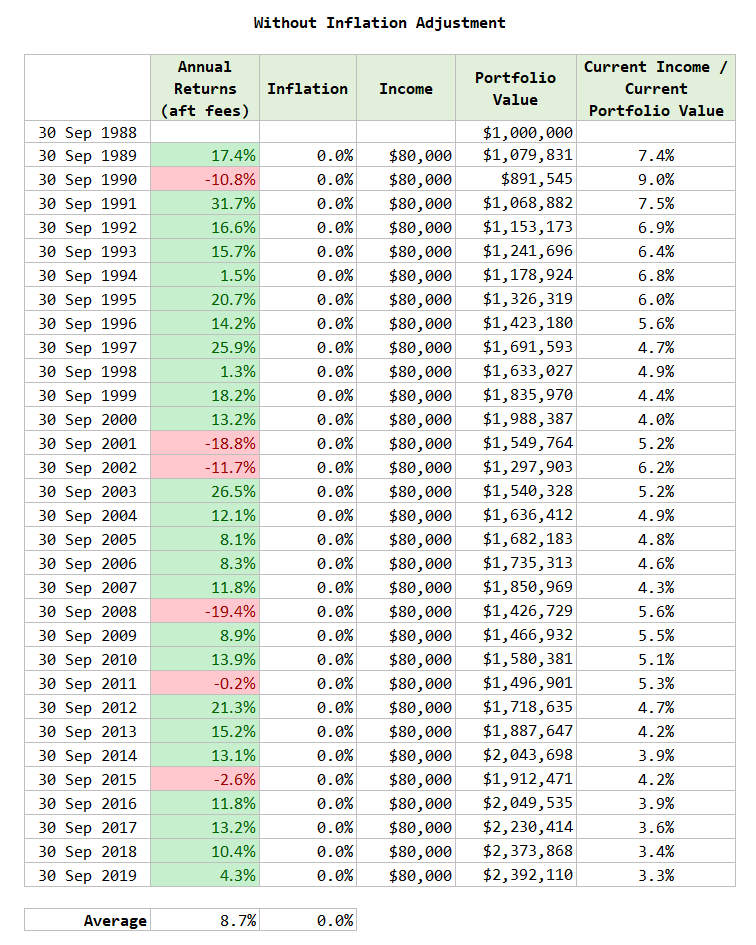

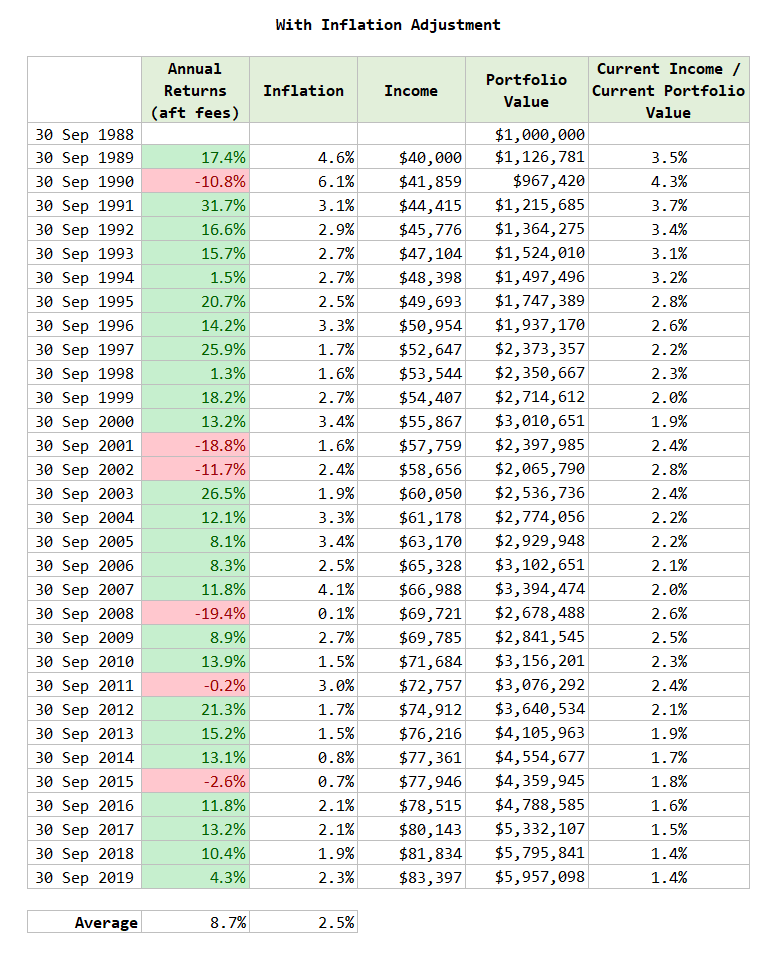

Since we now have go back information of the reference index spanning from 1988 to 2019, we will be able to see whether or not a retiree retiring in 1988 can final until 2019 or 31 years:

Apply that the revenue of $80,000 does now not move up with inflation.

The worst drawdown for this reference index is -19.4% all the way through the GFC which could be very, excellent.

As you’ll be able to see, the portfolio final but additionally grew from $1 mil to $2.3 mil.

You’ll be able to get 31 years of revenue and maintain your capital.

The compounded go back all the way through this era is 8.7% a yr.

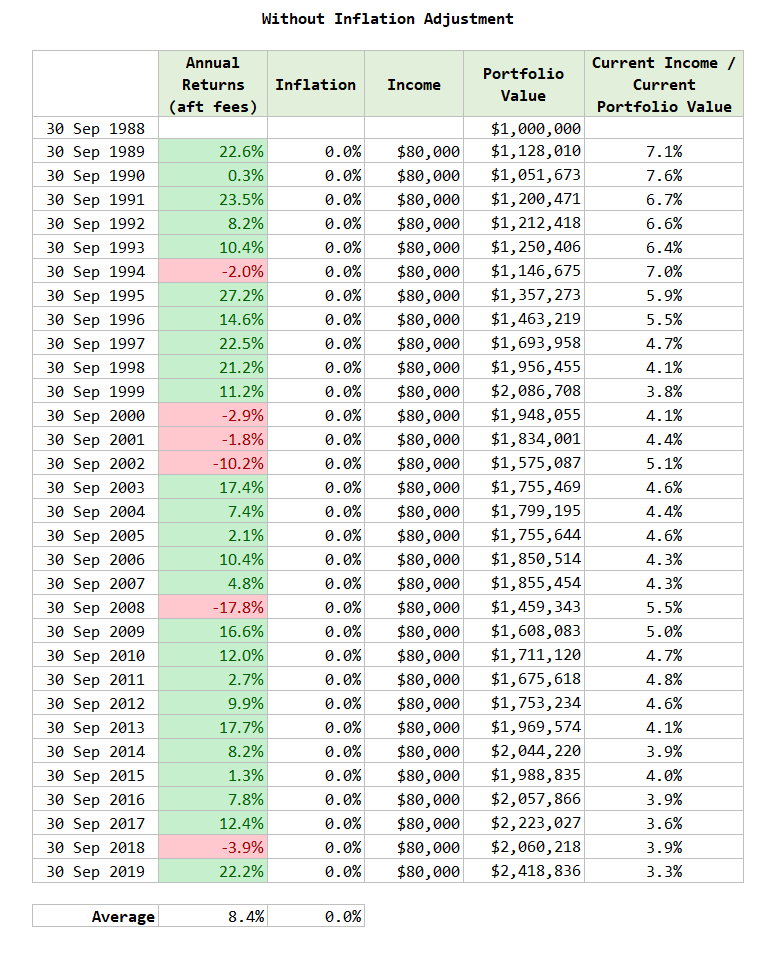

This appears to be like very, very spectacular, till we check out a 60% S&P 500 and 40% US Treasury Bond portfolio:

A 60/40 portfolio in the similar time frame will even final and the portfolio price additionally finally end up on the similar spot.

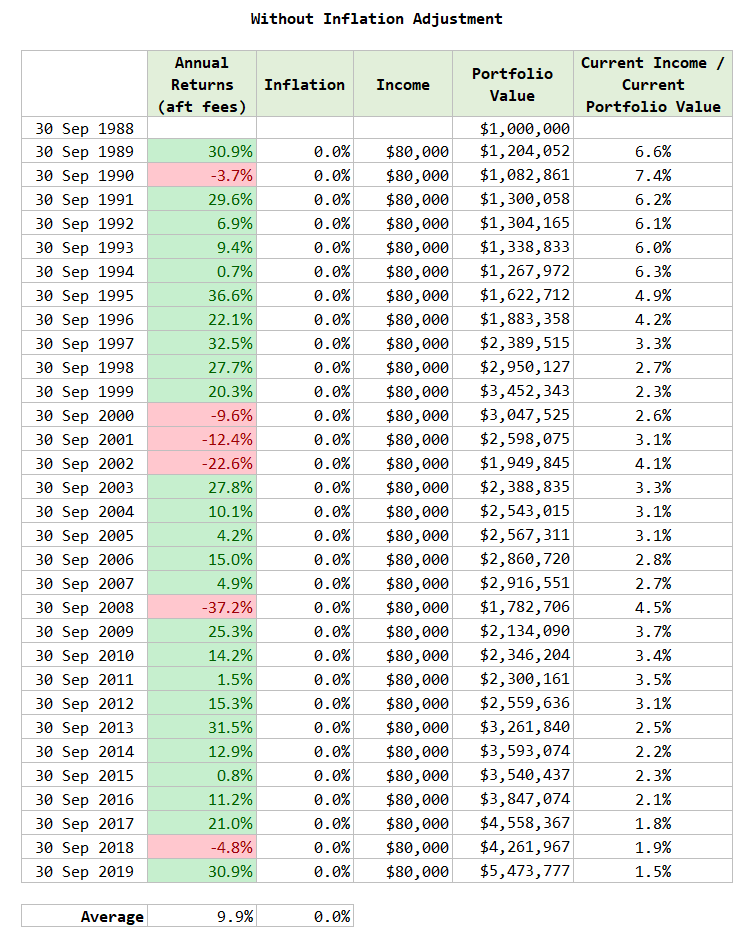

How a couple of 100% S&P 500 portfolio?

Bear in mind, that is the bottom yielding portfolio. The portfolio now not simply final however grew to $5.4 million!

So what does this evidence?

It’s not {that a} aggregate of S&P 500, US Top YIeld bonds, US Convertible bonds is a superb retirement resolution.

It is only that 1988 to 2019 isn’t such an unfortunate series to reside thru.

In truth, this is a beautiful excellent series to reside thru.

This is the reason even a 100% fairness portfolio paintings effectively, regardless of this kind of excessive preliminary revenue withdrawn.

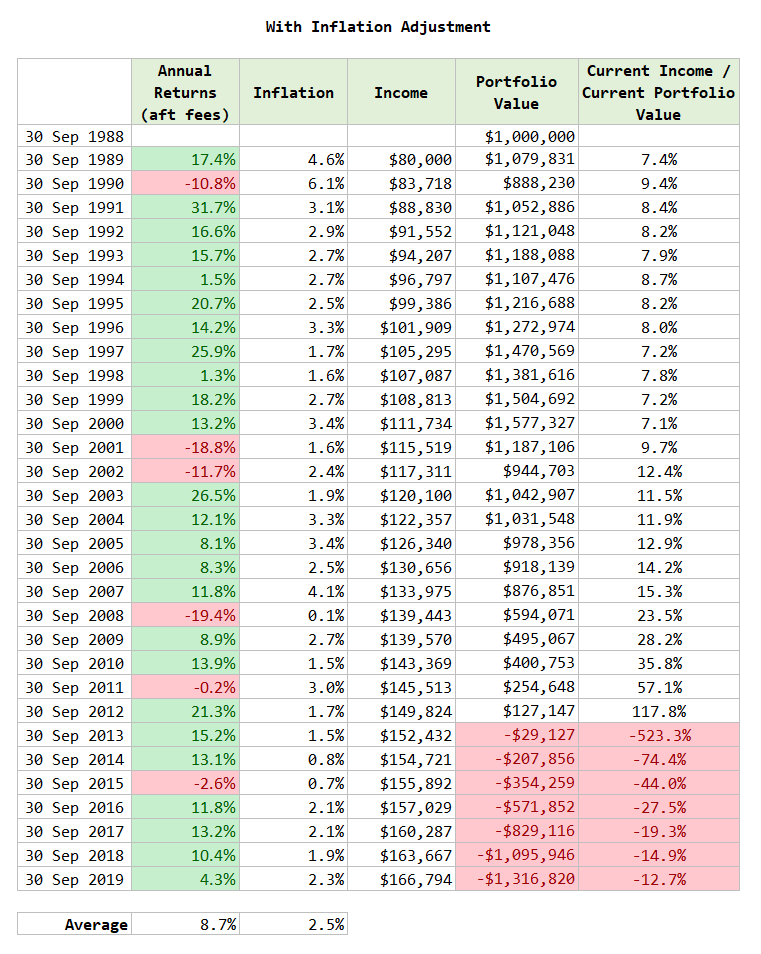

The Source of revenue Movement Dies with Inflation Adjustment

Now what if we tries to regulate the $80,000 first yr revenue via final yr’s inflation?

The inflation all the way through this era is fairly delicate at 2.5% a yr all the way through this 31 yr duration.

However the portfolio ran out of cash upfront.

Spending an preliminary 8% of the portfolio is simply too positive and a retiree runs a chance of revenue now not lasting lengthy sufficient.

Even supposing the compounded expansion is 8.7% a yr, which is greater than 8%, it does now not imply you’ll be able to spend such a lot.

However in case you scale back your first yr revenue from $80,000 to a smart $40,000 or an preliminary 4% of the portfolio the wealth portfolio will final and thrive:

This string of checks drives house the next level:

- The series you reside thru is extra vital than your asset allocation.

- Even if your go back is excessive, it does now not imply you’ll be able to spend a excessive revenue.

- A decrease income-to-portfolio ratio improves the chances that your portfolio final all over your retirement.

Conclusion

Listed below are a few of my ideas after deep diving into it:

- The longer term returns most probably might be pushed via the efficiency of US equities, convertible and high-yield bonds.

- We’ve peeled away any funding sophistication of the funding supervisor. I don’t assume there may be a lot alpha pushed prior to now to warrant such an “interesting standing”

- Bear in mind that convertible and high-yield bonds are extra equities-like than protected bond-like. Don’t be surprised about its volatility all the way through misery sessions.

- The only-year worst efficiency of the reference index is best than a 60/40 portfolio however now not via an excessive amount of.

- I don’t see the attraction of such allocation when pitted towards a 60/40 portfolio to warrant its “interesting standing”

- The low money drift yields of convertible bonds and US equities most probably imply that a part of your excessive 8% distribution will come from promoting capital appreciation proceeds or in our phrases, promoting capital.

- The dividend distribution presentations a decline over its ten-year historical past. If you are expecting the payout to carry stable, historical past does now not display that.

- In relation to revenue making plans, be it for retirement or any other explanation why, it does now not have a lot distinction examine to a 60/40 portfolio or for the topic an 100% fairness portfolio. What is important as to if you are going to run out of cash pre-maturely is the beginning revenue, relative in your portfolio price. Spending an preliminary 8% and holding consistent might glance excellent on this 30-year 1988 to 2019 retirement series, however this can be a “fortunate” 30-year duration. If the fund efficiency is so very similar to equities, this kind of excessive preliminary payout would most probably imply you run out of revenue pre-maturely in case you reside thru a extra “unfortunate” 30-year duration such because the 1937 to 1966 duration.

- If we modify the 8% preliminary payout via inflation (you’ll be able to do that via promoting some gadgets), in order that you maintain your real-spending energy, the simulation display that you’d run out of cash pre-maturely.

- I display that in case you get started with a decrease preliminary revenue payout, relative in your portfolio price ($40,000 on a $1 million portfolio, or 4%), you’ll be able to maintain your wealth. It illustrates once more that the crucial issue of sustainable revenue is much less asset allocation, momentary funding efficiency.

For my part, I feel the fund does now not deserve this kind of nice recognition for underperforming the reference index. Whether or not it really works for you is every other topic.

If you’re nonetheless within the fund, you’ll be able to make investments thru Endowus and with a bit of luck thru my Endowus Referral Code right here. You get $20 off your Endowus Rate in case you join thru it.

Endowus will rebate 0.63% of the 1.54% Allianz Source of revenue and Expansion fund-level charges, leaving you with 0.92% in charges.

I invested in a assorted portfolio of exchange-traded finances (ETF) and shares indexed in the USA, Hong Kong and London.

My most well-liked dealer to industry and custodize my investments is Interactive Agents. Interactive Agents let you industry in the USA, UK, Europe, Singapore, Hong Kong and lots of different markets. Choices as effectively. There are not any minimal per thirty days fees, very low foreign exchange charges for foreign money change, very low commissions for more than a few markets.

To determine extra discuss with Interactive Agents as of late.

Sign up for the Funding Moats Telegram channel right here. I will be able to proportion the fabrics, analysis, funding information, offers that I come throughout that allow me to run Funding Moats.

Do Like Me on Fb. I proportion some tidbits that aren’t at the weblog submit there incessantly. You’ll be able to additionally make a selection to subscribe to my content material by the use of the e-mail underneath.

I destroy down my sources consistent with those subjects:

- Construction Your Wealth Basis – If and practice those easy monetary ideas, your long run wealth must be beautiful effectively controlled. In finding out what they’re

- Lively Making an investment – For energetic inventory traders. My deeper ideas from my inventory making an investment revel in

- Studying about REITs – My Unfastened “Route” on REIT Making an investment for Newcomers and Seasoned Buyers

- Dividend Inventory Tracker – Monitor the entire not unusual 4-10% yielding dividend shares in SG

- Unfastened Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Making plans, Monetary Independence and Spending down cash – My deep dive into how a lot you want to reach those, and the alternative ways you’ll be able to be financially loose

- Providend – The place I recently paintings doing analysis. Rate-Handiest Advisory. No Commissions. Monetary Independence Advisers and Retirement Consultants. No price for the primary assembly to know the way it really works