Notes from A Quant Iciness through Robin Wigglesworth

Robin Wigglesworth, the creator of the e book Trillions, wrote a long however nice publish concerning the 2018 to 2020 wintry weather in quantitative fund making an investment.

A quant wintry weather’s story.

This newsletter is non-paywall.

I might be aware of who can provide an explanation for this funding stuff in a greater manner than I may just in this day and age. This is the reason I really like this text. Lots of the stuff isn’t new to me.

Robin additionally were given at the Rational Reminder podcast to give an explanation for the considering in the back of this text:

However I assumed I can simply word down the essential portions from this text, in order that I shouldn’t have to re-read once more and for simple long run reference.

Historical past of Go back Drivers

- 300 years in the past – Sephardi service provider Joseph de los angeles Vega wrote a couple of “new” phenomenon of navigating the monetary markets in Seventeenth-century Amsterdam:

- Have endurance.

- Settle for each income and losses with equanimity.

- Benjamin Graham’s Price Making an investment

- Charles Dow’s Dow Idea -> Spawn fashionable technical research of chart patterns.

- 1952 – Harry Markowitz – Observe quant ways to portfolio control.

- The marketplace itself introduced the optimum steadiness between menace and go back when considered in combination.

- Nineteen Sixties – Computer systems permit extra subtle and critical mathematical and knowledge analysis into what in truth would paintings. Some conclusions:

- Markets are beautiful onerous to overcome.

- It may be so dear to check out to overcome the marketplace and it might not be value it.

- Eugene Fama – Environment friendly Marketplace Speculation:

- 1000’s upon 1000’s of buyers continuously seeking to outsmart every different intended that the inventory marketplace was once “effective”.

- We must subsequently simply sit down on our arms and purchase all of the marketplace.

- A part of the explanation that spawn off the index price range within the early Nineteen Seventies.

- 1977 – Sanjoy Basu – Firms with Low inventory costs relative to their profits persistently did higher than Fama’s efficient-market speculation will recommend.

- Stephen Ross and Barr Rosenberg – Arbitrage Pricing Idea and Bionic Betas

- Returns of any monetary safety are pushed through a mess of things on best of the market-risk aspect.

- 1981 – Rolf Banz

- Outperformance for smaller indexed firms

- 1992 – Eugene Fama & Kenneth French – 3-factor Type

- Price and Dimension had been distinct elements from the market-risk aspect.

- 1993 – Narasimhan Jegadeesh and Sheridan Titman – Marketplace Momentum

- Purchasing shares that had been already bouncing and promoting those who had been sliding – may just produce marketplace beating returns.

- 1996 – Richard Sloan

- High quality profits outperformed.

- 2006 – Ang, Robert Hodrick, Yuhang Xing and Xiaoyan Zhang

- Much less unstable shares as a gaggle in truth outperform choppier ones.

How Neatly the Elements Have Completed – When Information Mined

This chart representation displays what we have now all the time identified:

The effects don’t seem to be to unexpected if we begin within the 2000.

In 2000 to 2010 many of the aspect indexes (marketplace menace + the person elements) have carried out higher than capitalization-weighted.

The Basic Foundation Why Elements Will have to Exist

Those that align with the concept that markets are effective assume that elements are repayment for some kind of menace we’re taking.

We won’t know what are the dangers, however they exists.

Price shares, for instance, are continuously present in beaten-up, unpopular and refrained from sectors, equivalent to boring commercial firms in the midst of tech bubbles. Whilst they may be able to underperform for lengthy stretches, sooner or later their underlying value shines thru, they usually praise buyers that stored the religion.

Small shares do neatly in large part as a result of small firms are much more likely to fail than larger firms.

Then there are those that argue that elements exist as a result of as human beings, we have now our irrational human biases.

As an example, identical to how we purchase expensive lottery tickets for the infinitesimal likelihood of huge wins, buyers have a tendency to overpay for fast-growing, glamorous shares and unfairly shun duller, steadier ones. Smaller shares supposedly do neatly as a result of we’re illogically attracted to names we all know.

The momentum aspect, alternatively, works in concept as a result of buyers to start with underreact to information however overreact in the end, or continuously promote winners too temporarily and cling directly to dangerous bets for a ways longer than is recommended.

AQR’s Asness studied below Professor Eugene Fama, who’s synonymous with the Environment friendly Markets Speculation, leans nearer to the behavioural camp.

He mentioned that the marketplace has grow to be LESS effective somewhat than extra effective:

I most likely assume markets are extra effective than the common particular person does — long-term effective — however I believe they’re most likely much less effective than I assumed 25 years in the past. They usually’ve most likely gotten much less effective over my profession.

The sector assumes that as a result of such things as the web that the ubiquity and immediacy of all knowledge has to make issues extra effective. However that’s by no means been the onerous section.

The similar individuals who assume the ubiquity and immediacy of data should imply that costs are extra correct are the similar individuals who twenty years in the past concept that social media would make us like every different extra.

Cliff Asness

What Principally Differentiates the Quant Price range – Implementation

“These kind of are simply semantic labels. They’re in truth no longer that other,” says Asness. “I believe maximum quants are selecting amongst a collection of things that we widely agree on, after which we’ll struggle like cats about one of the simplest ways to enforce it.”

Cliff Asness

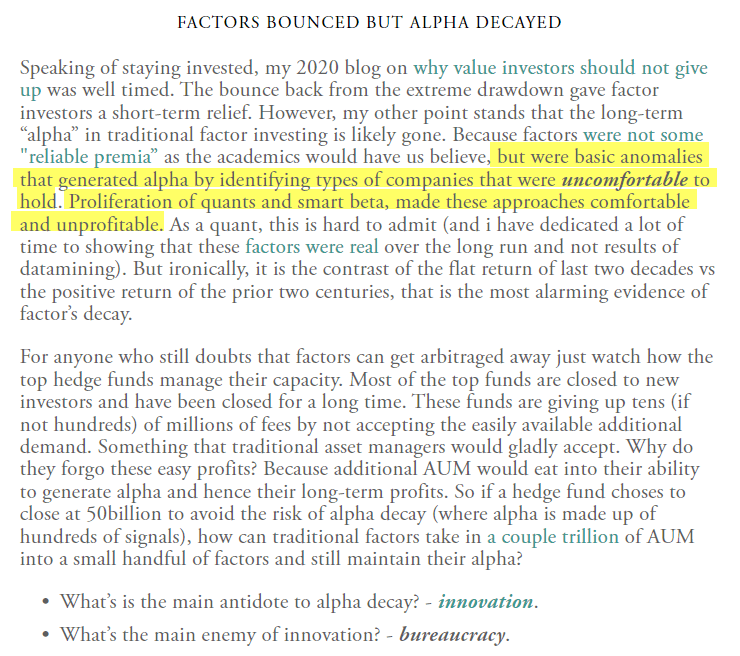

Asness additionally say that premiums come about as a result of preserving on to those investments are simply uncomfortable…

To return to the primary level, the premiums exist as a result of you’re taking on some dangers, which you can not provide an explanation for.

He cites what Newfound Analysis’s Corey Hoffstein say in No Ache, No Top rate:

If it weren’t now and again excruciating, it could most likely get arbitraged away. Any technique that’s rational, finished in a different manner and that has traditionally finished neatly and not reasons you any ache most likely has a large number of other people rush in and make it move away.

Cliff Asness

The Case Towards Issue Making an investment

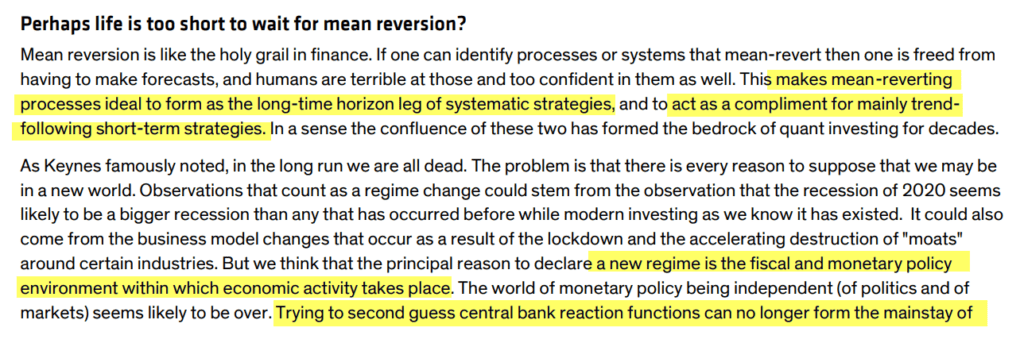

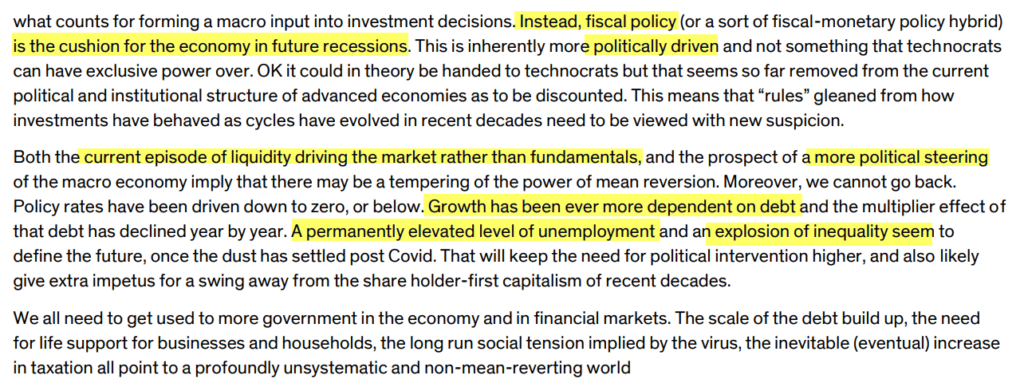

Some cited that funding methods can’t paintings perpetually into perpetuity. Marketplace regimes come and move.

When anomalies grow to be well known, they might continuously disappear.

Inigo Fraser-Jenkins, head of quant methods at Bernstein, wrote a file right here about the problem:

Quant price range were present process one thing of an existential disaster . . . At their core, quant price range attempt to practice backtests to long run funding choices. However what does it imply to do quant analysis and run backtests if the foundations have modified? There’s a problem to quant past a contemporary patch of deficient returns.

If Covid doesn’t rely as a regime exchange I don’t know what does. The character of the coverage reaction is a transparent wreck from the previous and directionally issues to the potential of upper inflation however with no commensurate building up in actual charges. That is not like fresh many years, with profound implications for elements and asset allocation.

Inigo’s article has a couple of just right nuggets.

He assume’s executive or political insurance policies that save you herbal recessions have impeded reversion to the imply, and that could be a large downside:

Others have identified that aspect making an investment is also teachers and their overzealous knowledge mining. The asset control business is all the time at the glance out to peer what will also be packaged up and promote for giant control charges.

Clif Asness has written a paper that gives a counterpoint to the concept that the preferred funding elements can’t be replicated.

There isn’t a transparent explanation why for what led to Quant Iciness, however…

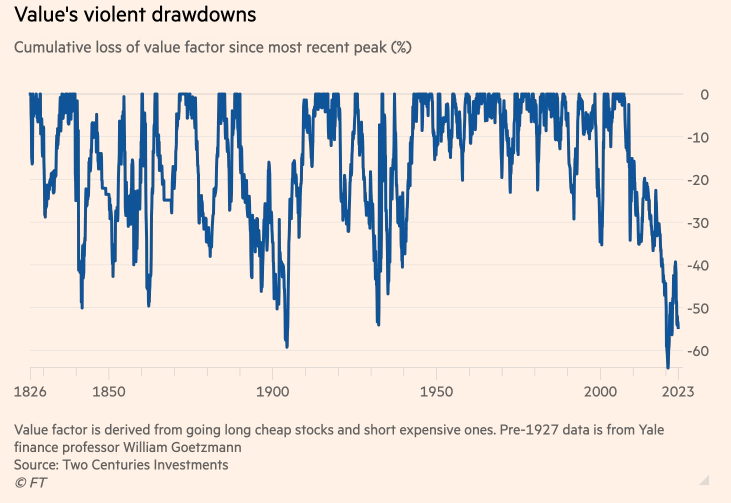

Asness’ conclusion is that worth did very badly.

Price had some of the worse drawdowns in 200 years:

This chart above may also be discovered on Two Centuries investments, they usually even have a momentum drawdown one. It displays that such loss in efficiency to expansion isn’t out of the bizarre. Price top rate doesn’t all the time display up.

Two Centuries, of their most up-to-date publish do have an reasons why elements decay: