New 6-Month Singapore T-Invoice Yield in Mid-September 2023 Will have to Keep at 3.75% (for the Singaporean Savers)

A Singapore Treasury Invoice factor (BS23118S) can be auctioned on Thursday, 14th September 2023.

If you want to subscribe effectively, get your order by the use of Web banking (Money, SRS, CPF-OA, CPF-SA) or in individual (CPF) by means of thirteenth September.

You’ll view the main points at MAS right here.

Prior to now, I’ve shared with you the virtues of the Singapore T-bills, their ultimate makes use of, and easy methods to subscribe to them right here: Easy methods to Purchase Singapore 6-Month Treasury Expenses (T-Expenses) or 1-Yr SGS Bonds.

Within the ultimate factor introduced two weeks in the past and not too long ago concluded, the present t-bills traded at a yield of three.73%. In any case, the cut-off yield for the t-bill ended decrease at 3.70%.

For the second one time, if you choose a non-competitive bid, you’ll be pro-rated the volume you bid and would yield 3.70%. If you need to make sure you secured all that you just bid, it is going to be higher to make a choice a aggressive bid, however you wish to have to get your bid proper.

A excellent rule of thumb is to make sure you get what you wish to have and settle for regardless of the cut-off yield bid 50% of the ultimate cut-off yield. On this case, you’ll be able to bid 1.95%. Whether or not the general cut-off yield is two% to 4.3%, your 1.95% bid will lend a hand safe the overall allocation you wish to have.

Gaining Insights Concerning the Upcoming Singapore T-bill Yield from the Day-to-day Ultimate Yield of Present Singapore T-bills.

The desk beneath presentations the present hobby yield the six-month Singapore T-bills is buying and selling at:

The day by day yield at last offers us a coarse indication of the way a lot the 6-month Singapore T-bill will business on the finish of the month. From the day by day yield at last, we will have to be expecting the impending T-bill yield to business with regards to the yield of the ultimate factor.

Recently, the 6-month Singapore T-bills are buying and selling with regards to a yield of 3.71%, relatively decrease in comparison to the three.73% yield we seen two weeks in the past.

Gaining Insights Concerning the Upcoming Singapore T-bill Yield from the Day-to-day Ultimate Yield of Present MAS Expenses.

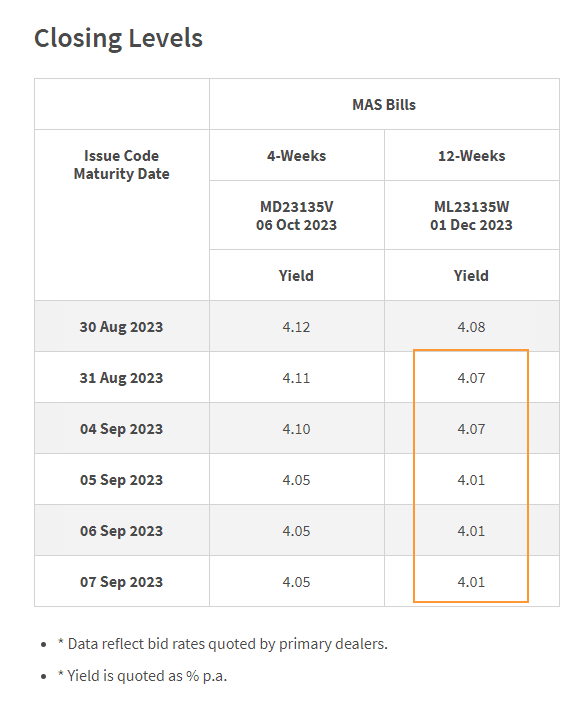

Usually, the Financial Authority of Singapore (MAS) will factor a 4-week and a 12-week MAS Invoice to institutional buyers.

The credit score high quality or the credit score chance of the MAS Invoice will have to be similar to Singapore T-bills because the Singapore executive problems each. The 12-week MAS Invoice (3 months) will have to be the nearest time period to the six-month Singapore T-bills.

Thus, we will be able to achieve insights into the yield of the impending T-bill from the day by day last yield of the 12-week MAS Invoice.

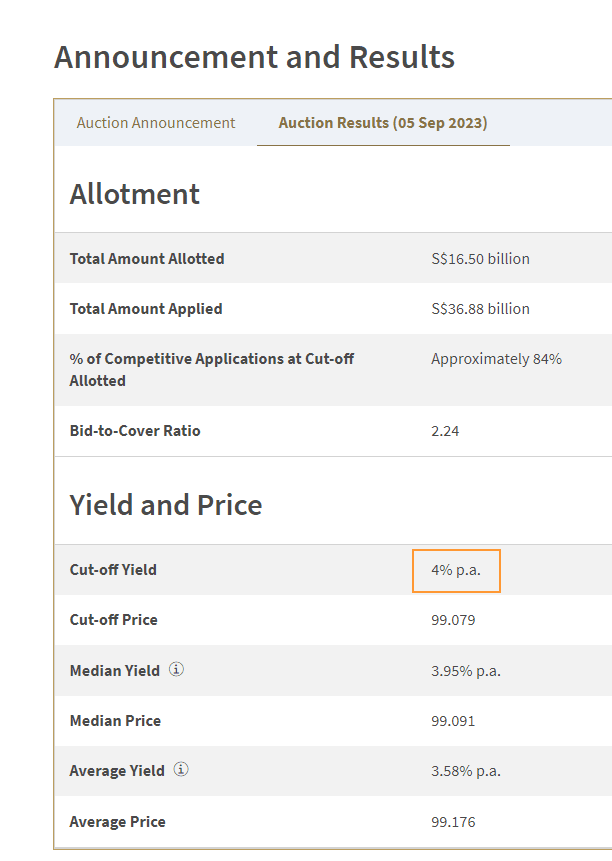

The cut-off yield for the newest MAS invoice auctioned on fifth Aug (two days in the past) is 4.0%. The MAS invoice is very similar to the ultimate factor two weeks in the past.

Recently, the MAS Invoice trades with regards to 4.0%.

For the reason that the MAS 12-week yield is at 4.0% and the ultimate traded 6-month T-bill yield is at 3.71%, what’s going to most likely be the T-bill yield this time spherical?

We proceed to watch that the 1-month and 3-month business with a distinction to the 6-month and one-year Treasury invoice yields not too long ago traded with a distinction, and this most likely signifies that the yield at the 12-week MAS Invoice is probably not indicative of the place the 6-month treasury invoice ultimately trades at.

Given this shift, the 6-month Treasury invoice will most likely business nearer to 3.75%.

Listed below are your different Upper Go back, Protected and Quick-Time period Financial savings & Funding Choices for Singaporeans in 2023

You will be questioning whether or not different financial savings & funding choices provide you with upper returns however are nonetheless somewhat secure and liquid sufficient.

Listed below are other different classes of securities to imagine:

| Safety Sort | Vary of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Charges | 4% | 12M -24M | > $20,000 | |

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | > $1,000 | Max $200k in step with individual. When in call for, it may be difficult to get an allocation. A excellent SSB Instance. |

| SGS 6-month Treasury Expenses | 2.5% – 4.19% | 6M | > $1,000 | Appropriate in case you have some huge cash to deploy. How to shop for T-bills information. |

| SGS 1-Yr Bond | 3.72% | 12M | > $1,000 | Appropriate in case you have some huge cash to deploy. How to shop for T-bills information. |

| Quick-term Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | > $10,000 | Be sure they’re capital assured. Normally, there’s a most quantity you’ll be able to purchase. A excellent instance Gro Capital Ease |

| Cash-Marketplace Finances | 4.2% | 1W | > $100 | Appropriate in case you have some huge cash to deploy. A fund that invests in fastened deposits will actively allow you to seize the best possible prevailing rates of interest. Do learn up the factsheet or prospectus to verify the fund solely invests in fastened deposits & equivalents. MoneyOwl’s WiseSaver – Fullerton Money Fund instance. |

This desk is up to date as of seventeenth November 2022.

There are different securities or merchandise that can fail to fulfill the standards to provide again your primary, prime liquidity and excellent returns. Structured deposits comprise derivatives that build up the level of chance. Many money control portfolios of Robo-advisers and banks comprise short-duration bond price range. Their values would possibly range within the quick time period and is probably not ultimate if you happen to require a 100% go back of your primary quantity.

The returns equipped don’t seem to be solid in stone and can range in response to the present momentary rates of interest. You will have to undertake extra goal-based making plans and use probably the most appropriate tools/securities that will help you gather or spend down your wealth as an alternative of getting all of your cash in momentary financial savings & funding choices.

If you wish to business those shares I discussed, you’ll be able to open an account with Interactive Agents. Interactive Agents is the main cheap and environment friendly dealer I exploit and believe to take a position & business my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They can help you business shares, ETFs, choices, futures, foreign exchange, bonds and price range international from a unmarried built-in account.

You’ll learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with easy methods to create & fund your Interactive Agents account simply.