Momentum builds for US gentle touchdown and not using a recession

September 8, 2023 (Investorideas.com Newswire) Some time in the past, we insinuated that the Federal Reserve would possibly simply be capable of pull off its fabled “gentle touchdown”, and that prediction is taking a look lovely shrewd presently with the best way the United States economic system goes.

Company profit-taking is greasing the runway for a “gentle touchdown”

The clues, as we simply detailed right here, have at all times been there: The large American firms, drivers of a considerable proportion of financial task, are reserving huge income, and that equals upper employment and extra disposable source of revenue for customers.

Just by elevating costs to suit the inflation theme, the emerging rates of interest have performed not anything however spice up their backside traces. In reality, passion bills as a proportion of post-tax income are if truth be told sitting at their lowest in 60 years! It is subsequently no marvel that the S&P 500 regained greater than part of the undergo marketplace losses suffered in 2022, and now, as Wall Side road claims, is in a bull marketplace.

As we additionally mentioned repeatedly ahead of, the central financial institution cannot simply stay elevating charges, just because it will possibly now not come up with the money for to (Observe that the yearly fee on US federal debt, which these days sits at $32.6 trillion, is ready to hit $1 trillion).

In the end, rates of interest simply have to come back down because of the “incapability of the economic system to maintain upper charges because of mounting debt issuance and emerging deficits, as Lance Roberts of RIA Advisors predicted right here. The RIA leader portfolio strategist/economist additionally pointed to the concept rates of interest are relative globally, so upper yields in US debt would draw in flows of capital from international locations with low to destructive yields, which then forces US charges down.

Moreover, it is if truth be told imaginable for the Fed to suppress rates of interest and to maintain vulnerable financial enlargement, Roberts says, as non-productive debt (i.e. army spending, welfare methods) does now not create financial enlargement.

And with inflation nearing the Fed’s 2% goal and the United States economic system rising at a fee in step with the pre-pandemic years, a “gentle touchdown” is easily inside of sight.

US inflation. Supply: Buying and selling Economics

In fact, not anything is 100% set in stone till it occurs, however it is at all times great to be at the proper aspect of a daring name.

Cushy Touchdown ‘No longer Simple’

Make no mistake, for the Fed to reach a “gentle touchdown” — regarding a average financial slowdown following a duration of enlargement that manages to steer clear of a recession — isn’t simple. Strictly talking, this simplest came about as soon as over the last 60 years. This used to be when the Fed, below the steering of Alan Greenspan, doubled rates of interest to six% between February 1994 and February 1995.

Then again, a “laborious touchdown” (the other of “gentle touchdown”) is a lot more commonplace. A recession adopted the closing 5 cases when inflation peaked above 5% — in 1970, 1974, 1980, 1990 and 2008.

The explanation a “gentle touchdown” is difficult is as a result of when the United States central financial institution embarks on a financial tightening cycle to keep an eye on inflation, the upward thrust in rates of interest makes the price of borrowing dearer, which stifles investments and places a pressure at the total economic system.

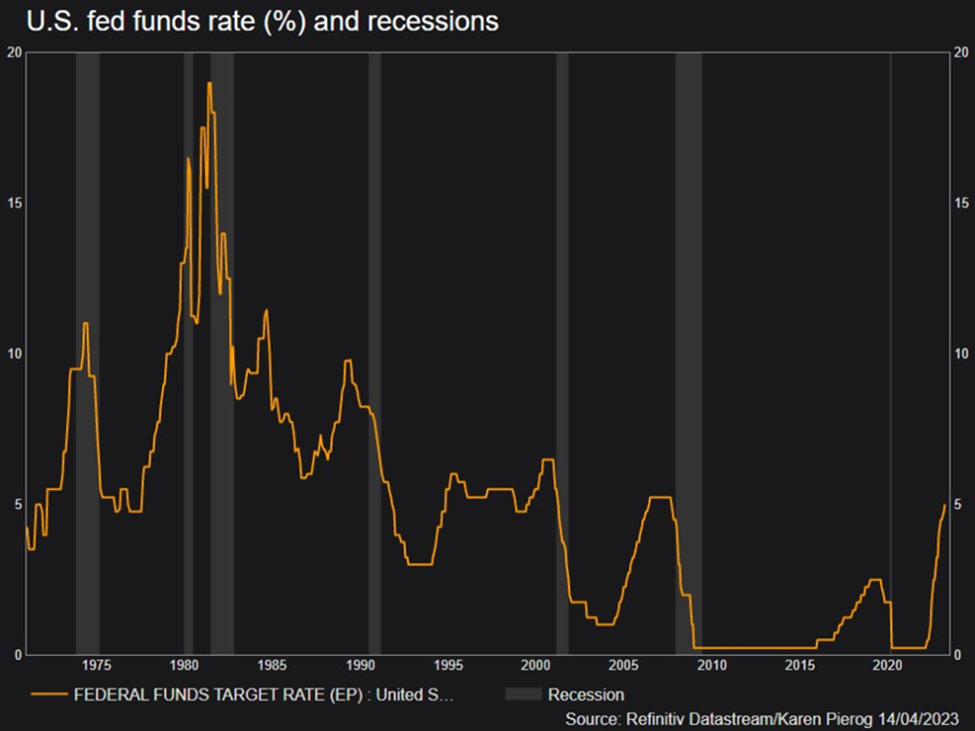

Since March 2022, the Fed has been doing precisely that, and at its maximum competitive tempo in 40 years, to fight inflation ranges that experience hit their height over the similar duration. As of July 27, 2023, a complete of eleven fee hikes have been carried out, with the federal finances fee now sitting inside of a variety of five.25-5.50% (used to be 0.25-0.50% when the speed hikes first began).

So, inside of a span of 15 months, the United States rates of interest necessarily went up by way of 5%, which understandably had many eager about a recession situation as early as the top of this yr. The ones considerations are legitimate, this is, if they are founded only on ancient precedents (as illustrated beneath).

However 2023 may spell every other uncommon triumph by way of the Fed. There are a couple of indicators already pointing to a a hit “gentle touchdown”, none larger than indications from the financial institution itself.

Fed Turns Positive

In overdue July, Federal Reserve chair Jerome Powell mentioned in a information convention that the central financial institution’s economists now not foresee a recession, which represents a reversal of the “delicate recession” prediction given after its March assembly.

The Fed’s extra constructive outlook used to be lately reaffirmed by way of the mins from the July 25-26 assembly, which said that: “The team of workers now not judged that the economic system would input a gentle recession towards the top of the yr,” even though it nonetheless felt the economic system would sluggish to a enlargement fee beneath its long-run possible in 2024 and 2025.

Even ahead of Powell’s feedback, the Fed had perceived to verify a “gentle touchdown” outlook by way of elevating their median 2023 enlargement projection to at least one.0%, which is greater than double the former forecast of 0.4%. This necessarily revised their implicit recession name within the procedure, and importantly, modified their stance on whether or not a gentle touchdown is reasonable.

It additionally reduced their 2023 unemployment fee forecast and trimmed the outlook for the following two years, whilst fairly elevating their 2023 inflation outlook however protecting their 2024 view unchanged.

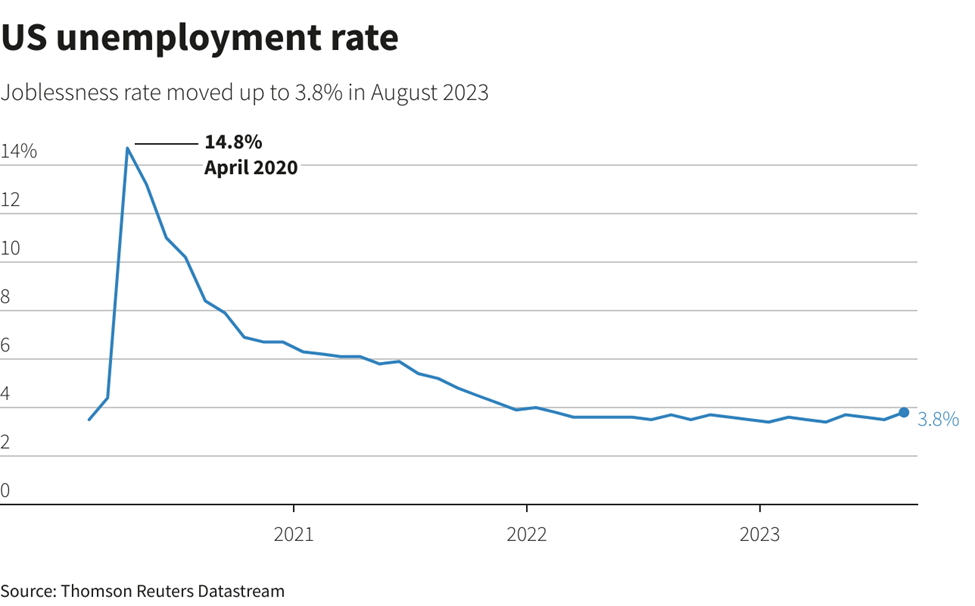

Up to now, Fed officers have been predicting that unemployment would upward push to 4.6% from 3.5%. Within the eyes of a few economists, a upward push within the unemployment fee of greater than 1% used to be observed because the Fed necessarily seeking to engineer a recession to convey down inflation.

The similar officers are actually predicting that the unemployment fee will upward push to simply 4.1% (from the present 3.7%) by way of the top of the yr, and four.5% for the following two years.

In the meantime, the median projection for total inflation (as measured by way of the private intake expenditure index) has fallen to three.2% from the 4.4% set in April of this yr, mirroring the Fed’s optimism in bringing worth ranges down.

Regardless of easing inflation, the Fed has maintained that every other rate of interest hike of fifty foundation issues will likely be wanted someday at some point. Alternatively, that might most probably spell the top of its present tightening cycle for excellent.

On this yr’s Jackson Hollow financial summit, Powell reiterated the want to “continue sparsely” and the Fed’s dedication to the two% inflation goal, acknowledging that the United States economic system is at some extent the place inflation has by way of some readings slowed so much with out a lot value to the economic system.

However, as we all know, the Fed chair may also be all diplomatic he needs, however in truth, the financial institution does not want to wait till it will get to its goal. “The concept that we might stay mountain climbing till inflation will get to two%, it might be a prescription of going well past the objective. That is obviously now not the best strategy to take into consideration it,” Powell up to now mentioned.

Backtracking on Recession Calls

Additionally backtracking on their “delicate recession” calls are one of the maximum respected economists.

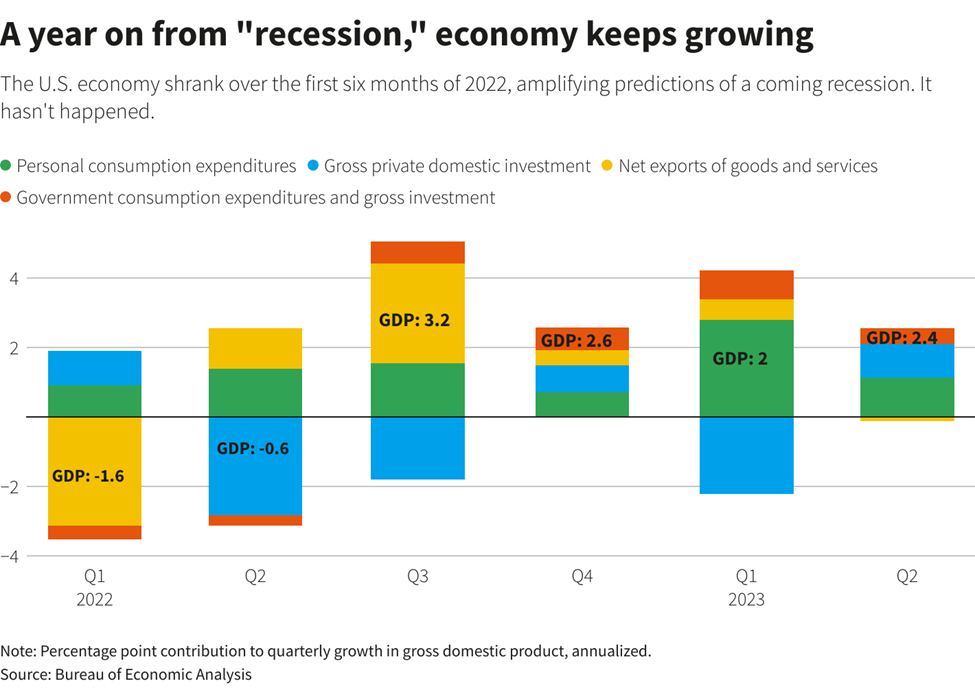

Originally of the Fed’s fee hike cycle, many have been completely satisfied {that a} recession used to be sure to occur adore it had previously. Take note, the United States economic system used to be already getting into a downturn on the time; during the first two quarters of 2022, its GDP reduced in size at a 1.6% annual fee from January thru March and at a nil.6% annual fee from April to June.

“Various forces have coincided to sluggish financial momentum extra impulsively than we up to now anticipated,” Michael Gapen, leader US economist at Financial institution of The us, mentioned again in July 2022, including that:

“We now forecast a gentle recession in the United States economic system this yr … Along with fading of prior fiscal fortify … inflation shocks have eaten into actual spending energy of families extra forcefully than we forecasted up to now and monetary prerequisites have tightened noticeably because the Fed shifted its tone towards extra fast will increase in its coverage fee.”

Rapid ahead a yr later, Gapen and lots of others are actually pressured to “consume their phrases” and retract their earlier forecasts, merely since the financial readings this yr were unusually excellent.

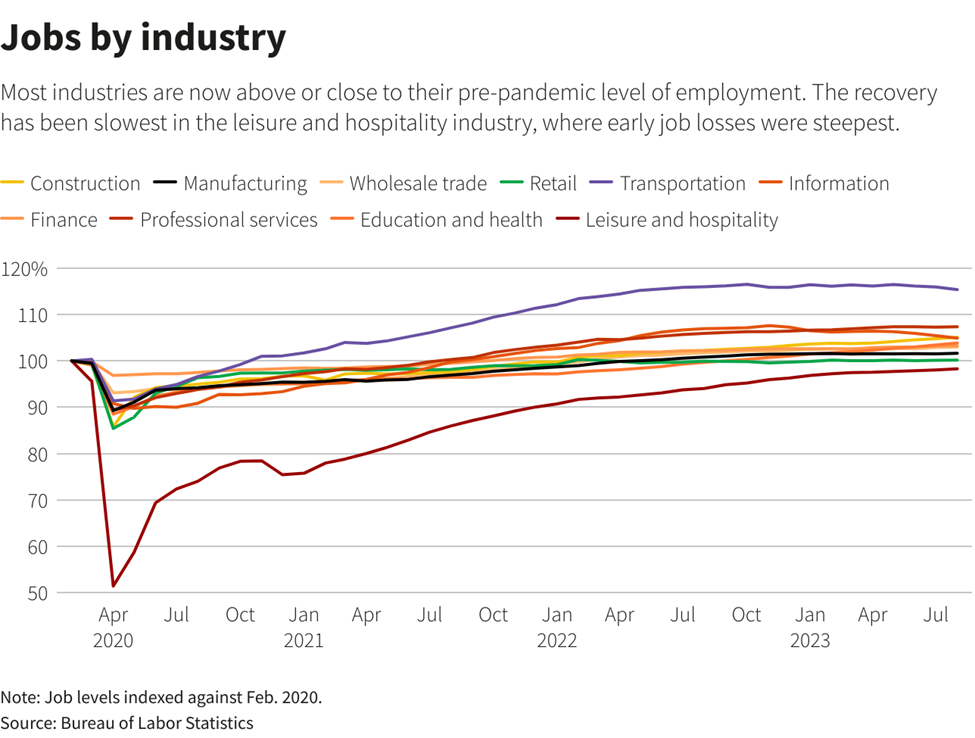

The USA hard work marketplace, for one, continues to defy rates of interest, with wholesome numbers throughout. Client spending has additionally sped up, hitting an all-time top of $14.2 trillion in the second one quarter.

Supply: Reuters

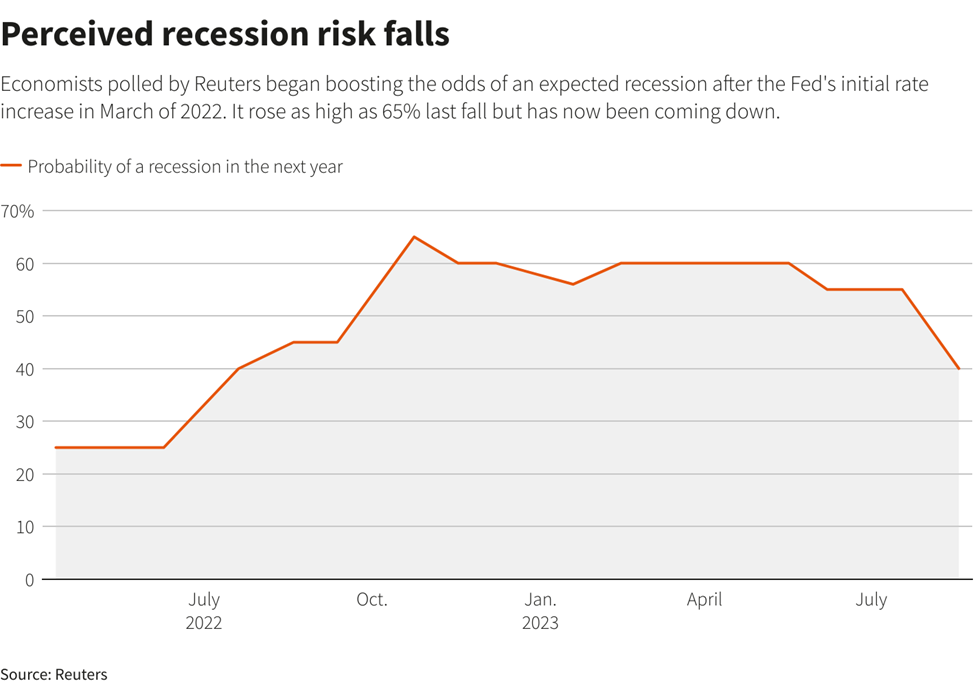

A up to date Reuters ballot of economists over the last yr confirmed the danger of a recession twelve months out emerging from 25% in April 2022, the month after the primary fee hike of the Fed’s present tightening cycle, to 65% in October. The latest learn is 55%.

“Incoming knowledge has made us re-evaluate our prior view” of a coming recession that had already been driven into 2024, Gapen wrote previous this month. “We revise our outlook in prefer of a ‘gentle touchdown’ the place enlargement falls beneath development in 2024, however stays certain all the way through.”

Financial institution of The us is not the one monetary establishment to really admit their errors in public.

In mid-July, Goldman Sachs revised down the chances of a US recession going down within the subsequent one year, slicing the likelihood down to twenty% from 25% at the again of certain financial figures being pegged.

JPMorgan’s economists adopted that up with a extra buoyant outlook, declaring that the financial institution is now not forecasting a US recession this yr and has raised its financial enlargement estimate because the economic system expands at a “wholesome tempo.”

What truly threw economists off, consistent with Omair Sharif, president of Inflation Insights, is the endurance of customers.

Spending has shifted from the goods-gorging purchases observed originally of the coronavirus pandemic to the new services and products economic system that exploded this summer time in billion-dollar film runs and track live shows, Sharif mentioned.

However without reference to what is within the basket, the volume being spent and circulated across the economic system simply stored on rising. This left many to continuously thrust back the date when the “extra financial savings” of the pandemic technology will run dry, or puzzle over whether or not low unemployment, ongoing sturdy hiring and hard work “hoarding” by way of corporations, in conjunction with emerging income, have trumped any anxiousness over the outlook.

As this Reuters article issues out, it may well be that emerging rates of interest simply do not need as huge of an have an effect on on an economic system that spends extra on much less rate-sensitive services and products, and the place companies have endured to borrow and make investments greater than many economists expected.

The surge in govt spending additionally gave an sudden spice up to enlargement.

In fact, it is nonetheless imaginable for inflation to resurface along a tighter-than-expected economic system, and Fed coverage would want to change into even stricter and induce the inflation-killing downturn that officers nonetheless hope to steer clear of. However the odds of that can be falling.

“We’ve got been wavering for some time on whether or not to shift to the ‘soft-landing’ camp, however now not,” famous Sal Guatieri, a senior economist at BMO Capital Markets informed Reuters, in connection with the Fed’s hopes of decreasing inflation with out frightening a recession.

“Huge power” in the United States economic system, he mentioned, “satisfied us that the economic system is harder than anticipated … No longer simplest is it now not slowing additional, it could be choosing up.”

The Indicators Are There

Obviously, there are indicators pointing to the Federal Reserve with the ability to effectively engineer a “gentle touchdown”; and the newest US financial knowledge would possibly have shushed extra doubters.

Gross home product, the broadest measure of financial output, rose at an annualized fee of two.1% in the second one quarter, consistent with the Trade Division’s most up-to-date estimate. Whilst that is fairly less than its first estimate of two.4%, it nonetheless portrays an economic system being prompt additional clear of the doom situation.

The brand new estimate factored in better shopper spending, govt outlays and exports, when compared with the preliminary estimate, with decrease trade funding and inventories. The industrial enlargement for the quarter used to be most commonly broad-based.

Taking a look forward, the Atlanta Fed is predicting GDP enlargement to boost up sharply to an annualized 5.9% fee within the 3rd quarter, even though that will be revised decrease because the 3rd quarter involves an in depth.

“The economic system is slowing to a tempo that can lend a hand convey call for in step with the United States’s productive capability and tame inflation,” wrote Invoice Adams, leader economist at Comerica Financial institution, in an analyst observe Wednesday. “The GDP revisions are excellent information on two ranges: Enlargement nonetheless seems excellent, and the downward revisions scale back the danger of the economic system operating too sizzling and exacerbating inflation.”

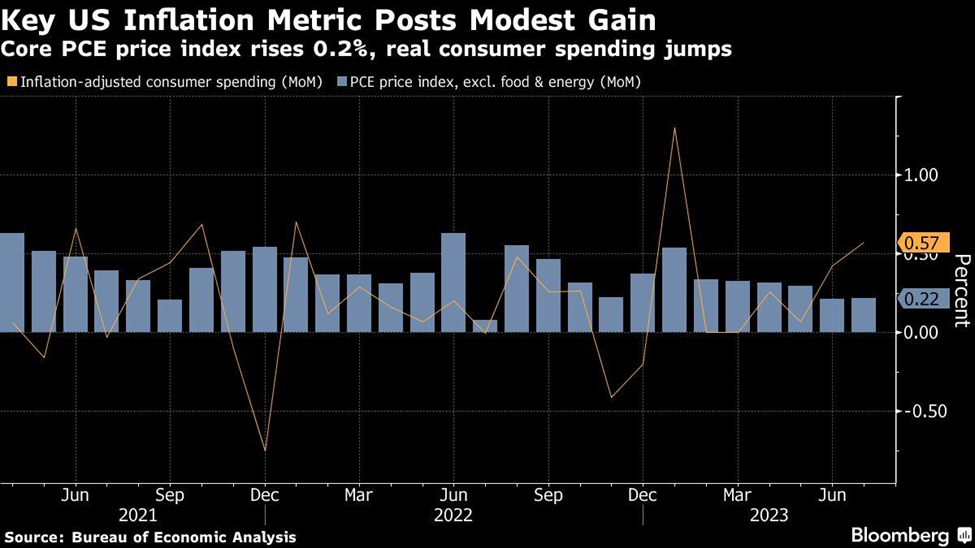

Talking of inflation, the Fed’s most well-liked measure of underlying inflation posted the smallest back-to-back will increase since overdue 2020, which used to be most probably the motive force in the back of the burst of shopper spending.

The core non-public intake expenditures worth index, which gets rid of the unstable meals and effort parts, rose 0.2% in July for a 2nd month. The whole PCE worth index additionally larger 0.2%, probably the most up-to-date Bureau of Financial Research knowledge confirmed

Inflation-adjusted shopper spending larger 0.6% closing month at the heels of a cast achieve in June. That used to be the most powerful advance because the get started of the yr.

Activity enlargement additionally picked up in August, whilst the unemployment fee rose to three.8% and salary beneficial properties moderated, suggesting that hard work marketplace prerequisites have been easing after hitting their height.

Nonfarm payrolls larger by way of 187,000 jobs closing month, after emerging by way of 157,000 in July. This surpassed an analyst estimate of 170,000 for August. Activity enlargement averaged 150,000 per thirty days over the last 3 months, sharply down from 238,000 within the prior three-month duration.

“That is nonetheless now not the image of the hard work marketplace we might be expecting to peer if the economic system have been in peril of decelerating dramatically within the brief time period, despite the fact that with out query there are indicators of moderation,” mentioned Rick Rieder, leader funding officer of world mounted source of revenue at BlackRock, in a Reuters observe.

This slowdown, as some recommend, may put the nail within the coffin for the probabilities of every other fee hike by way of the Fed this month. Goldman Sachs informed CNBC that the payroll numbers lend a hand verify the company’s forecast that the Fed is done mountain climbing charges throughout this cycle.

“The large message right here appears to be that we’re nearing complete employment, with provide and insist coming extra into stability,” Financial institution of The us’s US economist Stephen Juneau mentioned in a consumer observe. “The beneficial properties are concentrated within the laggard sectors. The remainder of the hard work marketplace most certainly is at complete employment.”

Conclusion

Momentum is certainly development for a gentle touchdown and not using a recession, which at the moment closing yr would’ve been laughed off at.

The newest US jobs document portrayed a dream situation for policymakers: extra jobs created than anticipated and a upward push in weekly operating hours, reflecting the robustness of the economic system, paired with an uptick in unemployment ranges and slowing salary enlargement, which gets rid of the will for additional fee hikes.

This, consistent with former Treasury Secretary Larry Summers, improves the probabilities of a gentle touchdown. “Those numbers are in keeping with very constructive eventualities,” he mentioned in a Bloomberg TV interview this week.

The easier financial knowledge additionally favors the United States greenback, and in flip, raises the possibility of a gentle touchdown, as famous by way of the ones at wealth control company Julius Baer. With a more potent greenback, upper US rates of interest would stimulate different economies’ exports, making the type of world recession that such a lot of predicted even much less most probably.

Central bankers out of doors the United States are already getting ready for the endgame in relation to financial tightening. In Canada, there is a excellent likelihood of rates of interest heading decrease subsequent yr, following the Financial institution of Canada’s choice this week to carry charges stable because the economic system presentations indicators of total cooling.

Additionally this week, RBC’s leader govt Dave McKay informed journalists that charges will want to come down to permit for the lender’s consumers to “steer clear of main ache when the vast majority of its loan ebook reprices in 2025 and 2026.”

“We must be tremendous,” he mentioned Sept. 6 on the Scotiabank Financials Summit. “We have now a number of room to regulate a gentle touchdown right here and we think that to occur.” The variation between Canada and the United States, consistent with McKay, is that the previous has a extra conservative shopper base, and so enlargement is slowing quicker.

“The Financial institution of Canada is more likely to depart rates of interest the place they’re, let the economic system kind of stall, perhaps now not an outright recession, however battle somewhat, after which convey aid within the spring as soon as inflation is a little bit decrease,” mentioned Avery Shenfeld, leader economist at CIBC Capital Markets, by way of Bloomberg.

Additionally lately, the Financial institution of England governor Andrew Bailey mentioned UK rates of interest are most certainly “close to the highest of the cycle”, seeing {that a} additional “marked” drop in inflation is most probably this yr. This alerts every other main economic system bringing its tightening cycle to an finish.

Richard (Rick) Turbines

aheadoftheherd.com

subscribe to my loose publication

Criminal Understand / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter referred to as AOTH.

Please learn all the Disclaimer sparsely ahead of you utilize this web page or learn the publication. If you don’t comply with all of the AOTH/Richard Turbines Disclaimer, don’t get entry to/learn this web page/publication/article, or any of its pages. Via studying/the usage of this AOTH/Richard Turbines web page/publication/article, and whether or not you if truth be told learn this Disclaimer, you’re deemed to have approved it.

Any AOTH/Richard Turbines file isn’t, and must now not be, construed as an be offering to promote or the solicitation of an be offering to buy or subscribe for any funding.

AOTH/Richard Turbines has founded this file on knowledge got from assets he believes to be dependable, however which has now not been independently verified.

AOTH/Richard Turbines makes no ensure, illustration or guaranty and accepts no accountability or legal responsibility as to its accuracy or completeness.

Expressions of opinion are the ones of AOTH/Richard Turbines simplest and are matter to modify with out realize.

AOTH/Richard Turbines assumes no guaranty, legal responsibility or ensure for the present relevance, correctness or completeness of any knowledge equipped inside of this Document and might not be held chargeable for the end result of reliance upon any opinion or remark contained herein or any omission.

Moreover, AOTH/Richard Turbines assumes no legal responsibility for any direct or oblique loss or harm for misplaced cash in, which you’ll incur on account of the use and life of the tips equipped inside of this AOTH/Richard Turbines Document.

You settle that by way of studying AOTH/Richard Turbines articles, you’re performing at your OWN RISK. In no match must AOTH/Richard Turbines chargeable for any direct or oblique buying and selling losses brought about by way of any knowledge contained in AOTH/Richard Turbines articles. Data in AOTH/Richard Turbines articles isn’t an be offering to promote or a solicitation of an be offering to shop for any safety. AOTH/Richard Turbines isn’t suggesting the transacting of any monetary tools.

Our publications don’t seem to be a advice to shop for or promote a safety – no knowledge posted in this web site is to be thought to be funding recommendation or a advice to do anything else involving finance or cash except for appearing your personal due diligence and consulting with your own registered dealer/monetary guide. AOTH/Richard Turbines recommends that ahead of making an investment in any securities, you seek advice from a qualified monetary planner or guide, and that you just must habits a whole and impartial investigation ahead of making an investment in any safety after prudent attention of all pertinent dangers. Forward of the Herd isn’t a registered dealer, broker, analyst, or guide. We hang no funding licenses and would possibly not promote, be offering to promote, or be offering to shop for any safety.

Extra Information:

This information is printed at the Investorideas.com Newswire – an international virtual information supply for buyers and trade leaders

Disclaimer/Disclosure: Investorideas.com is a virtual writer of 3rd birthday celebration sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Authentic content material created by way of investorideas is safe by way of copyright regulations rather then syndication rights. Our web site does now not make suggestions for purchases or sale of shares, product or service. Not anything on our websites must be construed as an be offering or solicitation to shop for or promote merchandise or securities. All making an investment comes to chance and imaginable losses. This web site is these days compensated for information e-newsletter and distribution, social media and advertising and marketing, content material advent and extra. Disclosure is posted for each and every compensated information free up, content material printed /created if required however in a different way the inside track used to be now not compensated for and used to be printed for the only passion of our readers and fans. Touch control and IR of each and every corporate without delay relating to explicit questions.

Extra disclaimer data: https://www.investorideas.com/About/Disclaimer.asp Be told extra about publishing your information free up and our different information services and products at the Investorideas.com newswire https://www.investorideas.com/Information-Add/

World buyers will have to adhere to rules of each and every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp