How A lot Will have to a Singaporean Graduate Save Per 30 days if he needs to Spend $5,000 Per 30 days in a Conventional Retirement? (in As of late’s greenbacks)

I’ve a pal who requested the next query:

If we do the mathematics for a youngster in 20s, simply got to work, how a lot does the individual wish to set aside per thirty days ranging from now to succeed in the objective of $5,000 per thirty days in a conventional retirement?

In truth, I did a video to give an explanation for this:

I believe my pal might need a solution extra particular so here’s the extra particular math.

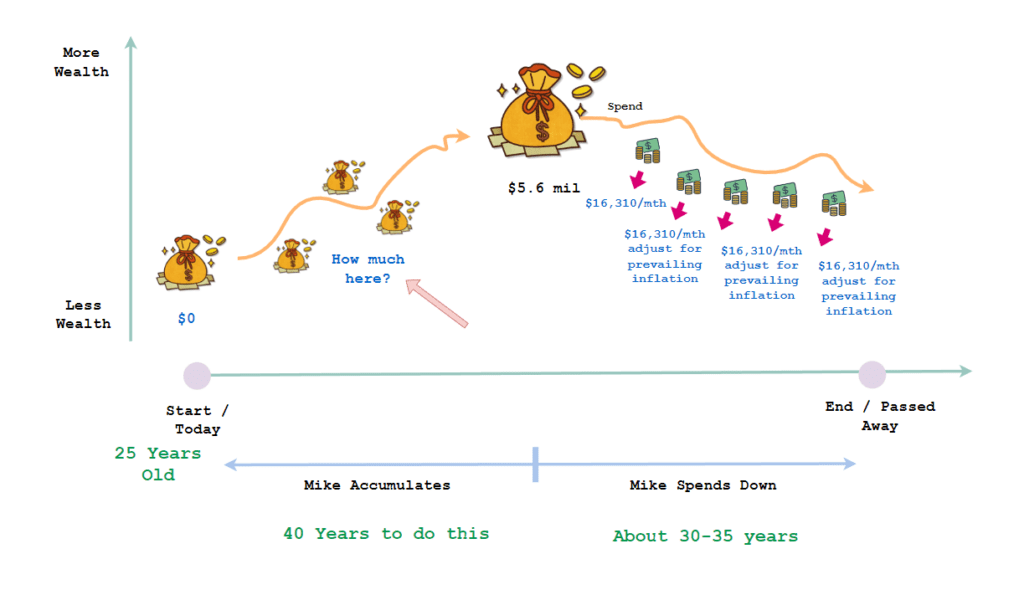

We will think some man that graduated as a 25-year-old is calling this query. Let’s name him Mike. If this can be a Jane, Jane will have to graduate when she is 23 years outdated. A conventional retirement will happen from 65-years-old onwards.

To learn how a lot we wish to gather to (the magic $$$ quantity), we wish to learn how a lot Mike must spend at 65-years-old.

My pal needs to mend the spending source of revenue wish to $5,000 per 30 days in as of late’s cash.

We use a three% p.a. inflation fee.

Mike will want: (1.03)^40 x $5,000 x 12 = $195,722 once a year or $16,310 per 30 days.

In case you don’t like 3% inflation, you’ll be able to trade the numbers accordingly.

Subsequent, how a lot capital you want is dependent very a lot on:

- How lengthy you want the source of revenue circulation? 30 years or 60 years?

- Do you want the source of revenue to be adjusted for inflation?

- Do you want the source of revenue to be constant and are slightly rigid with how a lot you want?

In case you are solution is sure to all, the protected withdrawal fee (SWR) type could also be appropriate to calculate kind of how a lot you want. (You’ll be able to learn up on the protected withdrawal fee right here)

Other other people have other stage of conservatives once they take into consideration their source of revenue traits, how versatile they are able to be. But when the objective is thus far away, and a graduate have no longer an excessive amount of lifestyles studies, we will be able to get started with a cheap SWR to estimate the capital wanted.

As we development in lifestyles, we will be able to regulate this “how a lot we wish to gather to” determine.

Beginning with a SWR of three.5% is cheap. For the ones, who need to be extra conservative, you’ll be able to use 3.0%.

With the SWR, the capital Mike wish to gather to is: $195,722 / 0.035 = $5,592,057. If we use 3%, then it’s $6,524,066. In case you put aside extra capital, your source of revenue circulation is extra resilient in opposition to difficult financial regimes.

So we’re right here now:

Mike begins off with $0. We can wish to work out how a lot Mike wishes to position apart to succeed in $5.6 million.

How a lot depends on the speed of go back Mike is in a position to harvest right through this 40 years.

Notice that I say “is in a position to harvest” and no longer what’s the fee of go back that he can get from investments.

The funding go back can do 10% p.a. but when Mike made the entire not unusual funding errors, then he received’t be capable of get that 10% p.a. go back.

We received’t know what’s Mike’s eventual fee of go back. If its top, Mike want much less capital however whether it is low, Mike wishes extra capital.

A conservative recreation plan is to check out your absolute best to put aside “sufficient” in order that the speed of go back you want is less than the median.

We will figure out a desk with a monetary calculator how a lot Mike must put aside per 30 days at 25 to succeed in $5.6 million:

| Price of Go back Mike Can Succeed in | Per 30 days Capital from Paintings Source of revenue He Must Set Apart |

| 2% | $7,726 per 30 days |

| 4% | $4,911 per 30 days |

| 6% | $3,015 per 30 days |

| 8% | $1,801 per 30 days |

| 10% | $1,054 per 30 days |

Mike would possibly wish to discover ways to make investments early, in order that he can perceive and get started getting adjusted to put money into equities which has a better chance of accomplishing a better go back. There’s success contain as smartly. We are hoping that Mike lives via a length the place what he put money into is in a excellent regime.

We best reside as soon as, and can not flip again the clock.

Additionally, this is probably not a unmarried particular person accumulation. I assume my pal is taking a look at a $5,000 per 30 days spending wishes for a pair.

Thus, the appropriate orientation is to plot with a extra conservative fee of go back. I do assume that if maximum can transfer against a 4% fee of go back, it way a better per 30 days capital injection.

You won’t have $4,911 to position away, and you’ll be able to get started with a decrease quantity, however attempt to do higher in employment to get to $4,911 per 30 days.

What if we consider CPF LIFE Usual Annuity Source of revenue at 65 years outdated?

If we’ve got CPF LIFE source of revenue at 65, then we’d like much less source of revenue, which means that much less capital.

However how can we figure out the mathematics?

In Inflation-Regulate Your CPF LIFE Fundamental or Usual Plans, I wrote that if you’ll be able to reach CPF Complete Retirement Sum (FRS) one day on your lifestyles, you could possibly have secured a three% every year inflation-adjusted source of revenue circulation until you die this is identical to $764 per 30 days as of late.

Which means as an alternative of $5,000 per 30 days, you want $5000 – ($764 x 2) = $3,472 per 30 days.

So, as an alternative of placing $5k into the entire calculations above, exchange it with $3,472 per 30 days.

Notice that that is for a pair. The numbers for a unmarried will glance other.

You are going to want $3.9 mil as an alternative of $5.6 mil at 65-years-old.

The per 30 days capital will trade to this:

| Price of Go back Mike Can Succeed in | Per 30 days Capital from Paintings Source of revenue He Must Set Apart |

| 2% | $5,380 per 30 days |

| 4% | $3,420 per 30 days |

| 6% | $2,099 per 30 days |

| 8% | $1,254 per 30 days |

| 10% | $734 per 30 days |

The volume to avoid wasting for a pair changed into a lot more manageable.

For a pair, placing away $3,420 x 12 = $41,040 once a year from their take-home pay, with none increments, appears to be like manageable if their blended take-home wage ultimately scales as much as $164,160. This can be 25% in their blended pay, leaving enough space to reside a tight lifestyles.

On the other hand, if the couple is in a position to put away 50% in their take domestic, at the side of a greater incomes profession, they could reached a definite Coast FI state previous.

I’m hoping that is useful no longer only for my pal but in addition you.

If you wish to business those shares I discussed, you’ll be able to open an account with Interactive Agents. Interactive Agents is the main low cost and environment friendly dealer I exploit and agree with to speculate & business my holdings in Singapore, the US, London Inventory Change and Hong Kong Inventory Change. They let you business shares, ETFs, choices, futures, foreign exchange, bonds and price range international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with easy methods to create & fund your Interactive Agents account simply.