Gratitude, My Portfolio, and My Qualification to Recommendation on F.I.

A few days in the past, 5th Particular person dropped my interview about F.I or F.I.R.E on YouTube:

It’s mad that there have been most effective ten operating days between the interview and the video drop. And that is coming from any person operating in an organization looking to drop movies as neatly.

Truthfully, I didn’t get excellent vibes about this interview as a result of how I reviewed my efficiency on my method house. That caption the group designed made me marvel what sort of unfavourable feedback we’d get.

Essentially the most becoming phrase to explain the comments used to be gratitude.

I didn’t dare to look at the video till the day gone by night time. I truly spoke too speedy regardless of at all times telling myself to decelerate. It’s difficult to be succinct. My colleague Chin Yu and I have been discussing structuring probably the most more difficult responses. It boils all the way down to the usage of the fitting phrases which are easy sufficient but squeeze sufficient that means into them.

However I additionally imagine we want to give an explanation for probably the most nuances from time to time as a result of what would truly lend a hand other folks with extra figuring out is from time to time no longer the straightforward issues however that you simply enjoy the similar difficulties, and feature your personal interpretation and imaginable answers for it.

Regardless of the fumble virtually all aside from one remark used to be encouraging. Every so often I have no idea what I do to deserve this display of beef up.

Most likely this is because I take a look at my perfect to inform it as it’s.

Listed below are some doable embellishments on probably the most issues mentioned.

Defining F.I. and Whether or not I Qualify to Dish Out Recommendation at the Topic

I shared my definition of F.I. and F.I.R.E., which is able to most likely fluctuate from how other folks would outline it conventionally. Have cash and purchase the way of life you need.

To many, FI approach paintings is not obligatory. I don’t have an issue with that definition however I do assume many truly want they’d $10 million in order that they don’t need to paintings and retire. That’s not improper however I think that the frame of labor will have to be about defining the way of life you want to purchase for.

Many get the cash and finally end up having a hollow inside of as a result of they do not know what they wish to do in existence after that.

The blokes concept it used to be a good suggestion to speak about what Providend is and what I do there because it makes what I’m about to percentage about F.I. or F.I.R.E. relatable.

But it surely were given me desirous about a query which I in the end requested my Telegram staff:

Do you wish to have to be financially impartial or with regards to it to qualify as a monetary planner and lend a hand other folks plan for his or her monetary independence?

Some are of the opinion that they will have to, or be extra fervent about it

If no longer, wouldn’t or not it’s blind main the blind?

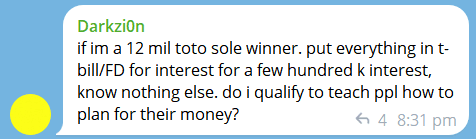

Darkzi0n introduced up a excellent level:

You’ll have so a lot more cash than you truly want in order that your plan works, however that doesn’t imply you understand sufficient to show.

However in recent times, I agree extra that you wish to have to be fervent about F.I. or F.I.R.E. extra to lend a hand other folks plan.

The principle explanation why: Those that really feel the urgency extra can “locate” extra issues/concerns, issues/concerns that those that don’t seem to be at the trail may not be about to “really feel”.

In the event that they can not locate or really feel, they could brush issues off simply.

However it is very important acknowledge that you simply don’t should be fervent at the trail of F.I. if technically, you’ve got an overly sound F.I. making plans framework.

At this second, I believe no one cares about your plan greater than your self.

Do I qualify for recommendation about it?

I believe I’m certified to advise about it, no longer as a result of I paintings in an respectable capability, however as a result of I spend sufficient of my waking (and from time to time sound asleep) hours desirous about other sides of F.I. If we’re eager about a topic, you are going to understand extra weak point, strengths, and concerns.

You don’t want an respectable certification to play DOTA neatly, you simply want to be immersed in it greater than the common particular person.

How I Body My Portfolio Mentally Going Ahead and Why I Shared My Portfolio

They mentioned my portfolio being a zoo and why it’s that method. And why does my portfolio have “such a lot of bonds”.

I believe my buddies at 5th Particular person are extra acquainted with a money/fairness portfolio combine. It’s not that i am stunned other folks take a look at my portfolio as a zoo as a result of the ones have been not unusual feedback even years in the past. I publish my portfolio about ten years in the past in 2013, as a result of I got here up with this Google Spreadsheet that information your portfolio in response to purchase, promote, and dividend transactions. You can’t to find the sort of spreadsheet again then. These days, possibly you can not to find the sort of spreadsheet rather then mine if I’m proper.

So over the last ten years the ones positions I bought, they continue to be at the spreadsheet as a result of we want to stay the transactional information. We can not simply concealed transactions with none devices/stocks like customized instrument.

I defined that, in my thoughts, it’s not as sophisticated as remaining time.

On a prime stage:

- Equities (77%)

- Bonds/Money

A lot of the returns can be pushed by way of the fairness menace top rate or the confirmed returns of fairness over a risk-free fee over the longer term.

The bonds are distinctive in that the longest length of the bond fund is 6-7 years, so if I stored it longer than that, the returns can be sure. Additionally, as a result of they’re varied, the bonds hose down the volatility.

The optimum allocation for spending down (or withdrawal) is between 40%-80% equities. Having a portfolio of 100% equities could have a excellent result in a deficient marketplace and inflation sequences however not so good as an 80% fairness allocation in response to empirical analysis.

The equities are cut up into:

- World Equities (57%)

- US Small Cap Worth (40%)

- A couple of small Rising Markets, Sectoral positions (5.5%)

If I had the selection, I’d be in World Small Cap Worth, however we can see the way it is going. World diversification has no longer performed neatly lately, however I want a portfolio no longer at all times about empirical proof however with extra humility that tries to be a “I-don’t-know-what-will-happen” portfolio.

To be truthful, that risky small-cap price place is a tad giant however we can see if my center can take it.

A couple of issue price range made up the worldwide equities portion, however in most cases, the marketplace menace top rate will nonetheless power many of the go back. If equities die, until in distinctive marketplace sequences, the standards won’t save the portfolio a lot.

The portfolio could also be the majority of my web wealth.

In my thoughts, I’m performed including extra capital to the portfolio aside from for SRS monies as a result of I added to the portfolio prior to now and it’ll be bizarre to divert the cash away. This portfolio… at this level, will reside and die by way of the marketplace and can be risky.

It’s again and again the wage, such that if it falls 50%, most effective the marketplace will save the portfolio. This can be a take a look at of my funding psychology.

In some way, my portfolio is a real-life peek into whether or not what I’ve shared will paintings or will crash and burn.

Deep down, I truly imagine this strategic, low cost, globally varied, 80-60% fairness technique can provide perpetual inflation-adjusted source of revenue if we admire the preliminary source of revenue spent relative to the portfolio price (stay it 2.5% or decrease).

There are sufficient sceptics questioning:

- Are you able to get source of revenue from one thing that doesn’t pay a dividend?

- Can making an investment be that methodical and passive?

- Are you able to take away marketplace go back uncertainty and get inflation-adjusting source of revenue by way of respecting the secure withdrawal fee?

- Can I categorical my extra tilted funding philosophy however be extra passive about it?

There are sufficient advisers, planners, and funding pros who suggest one thing and don’t consume their very own cooking. You’ll say you make investments to your advice, however hanging 2% of your web wealth into it additionally qualifies as you “imagine” in what you suggest.

No guarantees, however I’m going to take a look at and consume my very own cooking.

And everybody can watch whether or not I do k or I burn down.

Find out how to Acquire Self belief to Transfer from One Wealth Gadget to Any other

We additionally mentioned about my time doing dividend making an investment.

What made me transition from one wealth option to every other?

As a way to do this, you wish to have to dig deep sufficient to seek out some funding technique this is higher and extra appropriate for you. I understand the power to dig deep to determine how an funding technique paintings, its professionals and cons, how a lot effort realistically we want to spend to be able to make it into our wealth gadget, is the sort of uncommon talent. To start with, I believed it will have to no longer be so exhausting for other folks to try this after which I understand… just a handful of other folks may just.

The secret is no longer many sacrifice and devote sufficient time and psychological area to only consider something.

The Maximum Unheeded F.I. Tip I Will Give an explanation for Once more

I additionally shared my pointers for other folks thinking about attaining F.I or F.I.R.E:

- Make sure you Earn Extra, Optimise your Bills, and Make investments Correctly with the Surplus you’ve got. Learn this text at the Rich Formulation.

- Determine your Desired Way of life.

The second one tip is so, so underrated and no longer the very first thing other folks mentioned.

However it’ll both disappoint you or spice up your morale.

I come up with an instance.

In some portions above, I discussed that in case you stay your preliminary source of revenue to the portfolio price or preliminary secure withdrawal fee less than 2.5%, the inflation-adjusted source of revenue stands an overly, very prime risk to be intergenerational (until your subsequent technology fxxks it up).

If you understand what you wish to have and you wish to have $5,000 a month, then you wish to have ($5,000 x 12)/2.5% = $2.4 million.

When you REALLY don’t know your way of life, and don’t know what you wish to have, then you definitely wager you wish to have $8,000 whilst you F.I.R.E, then you are going to want ($8,000 x 12)/2.5% = $3.8 mil. This is $1.4 million or 50% extra.

What could also be the variation? In reality, possibly that one that thinks she or he wishes $8k in fact wishes $5k. If she or he is prime source of revenue, then nonetheless k can earn $1.4 mil in a brief span. However fxxk, this is $1.4 mil extra.

You’ll query the robustness of this 2.5% secure withdrawal fee, however I will change it with every other ratio, like 1% or 6%, and the mathematics will stay the similar.

Construction directly to that instance, if you recognize that you’ll be versatile with part of that $5,000 per month, otherwise you don’t seem to be immortal and don’t care about your subsequent technology, you must paintings with 3% or 3.5% and you are going to want ($5,000 x 12)/0.035 = $1.7 mil or $700k much less.

This cash distinction equates to years of labor, years of labor pressure that you could no longer need to undergo.

So what traits of the specified way of life do you wish to have to consider?

- Which spending do you care extra about than the others and which you care much less about?

- Which spending do you spend lately will cross away to your desired way of life?

- Which spending do you don’t or pay for lately that you are going to in the end pay for?

- How versatile or rigid is each and every of your spending?

You may have 10-15-Two decades to be aware of what you prefer or dislike to determine this out and this affect your FI adventure.

However what number of would do that?

I believe no longer a lot as a result of we’re extra eager about cash accumulation and different more uncomplicated issues to factor about.

Remaining Phrases

Once more, I want to thank the ones of you who watched the video. I will have to almost definitely get again to doing probably the most movies myself however my desktop setup is recently in transition and video manufacturing is a bit of tricky.

However when you’ve got watched the video and feature some subjects round F.I., Monetary Making plans, or Source of revenue making plans that you wish to have 5th Particular person to talk about, do let me know within the feedback right here or in my Telegram.

I invested in a varied portfolio of exchange-traded price range (ETF) and shares indexed in the United States, Hong Kong and London.

My most well-liked dealer to industry and custodize my investments is Interactive Agents. Interactive Agents permit you to industry in the United States, UK, Europe, Singapore, Hong Kong and lots of different markets. Choices as neatly. There aren’t any minimal per month fees, very low foreign exchange charges for forex substitute, very low commissions for more than a few markets.

To determine extra seek advice from Interactive Agents lately.

Sign up for the Funding Moats Telegram channel right here. I can percentage the fabrics, analysis, funding information, offers that I come throughout that allow me to run Funding Moats.

Do Like Me on Fb. I percentage some tidbits that don’t seem to be at the weblog submit there steadily. You’ll additionally make a choice to subscribe to my content material by way of the e-mail under.

I wreck down my assets consistent with those subjects:

- Construction Your Wealth Basis – If you understand and practice those easy monetary ideas, your longer term wealth will have to be beautiful neatly controlled. In finding out what they’re

- Lively Making an investment – For lively inventory buyers. My deeper ideas from my inventory making an investment enjoy

- Studying about REITs – My Unfastened “Direction” on REIT Making an investment for Novices and Seasoned Traders

- Dividend Inventory Tracker – Observe the entire not unusual 4-10% yielding dividend shares in SG

- Unfastened Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Making plans, Monetary Independence and Spending down cash – My deep dive into how a lot you wish to have to reach those, and the alternative ways you’ll be financially unfastened

- Providend – The place I used to paintings doing analysis. Charge-Best Advisory. No Commissions. Monetary Independence Advisers and Retirement Experts. No fee for the primary assembly to know the way it really works

- Havend – The place I recently paintings. We want to ship commission-based insurance coverage recommendation in a greater method.