Can Your SRS Account Decrease Your Taxes? Is it All the time Higher to Give a contribution to SRS Account?

It’s the closing day of the 12 months.

Many are considering whether or not there are different ways to decrease your taxable revenue that you want to effectively whole through lately.

You’ll be able to do a voluntary top-up for your CPF SA/RA and Medisave or your partner’s CPF SA/RA and Medisave if the accounts are nonetheless beneath their respective limits. (Check out level 3 on this article). You’ll be able to doubtlessly cut back your taxable revenue through $16,000 ($8k each and every for your self and your partner).

The opposite motion you’ll take is to give a contribution as much as $15,300 for your SRS account. The taxes within the account can be tax-deferred, because of this lately, you’ll decrease your taxable revenue through $15,300.

I by no means had an SRS Account till 4 years in the past. I determined to open the SRS account through investment it with simply $1 in order that to fasten within the present statutory retirement age. The method to create an SRS account is so easy lately.

Why can we want to lock within the statutory retirement age? Is it all the time higher to give a contribution to the SRS or there are downsides to it?

On this article, we will be able to attempt to undergo this in short.

I will be able to additionally proportion a FREE Google Spreadsheet that you’ll use to peer if this is a excellent concept to imagine contributing for your SRS account.

What’s the SRS Account, and How is it Helpful for You?

The SRS Account stands for Supplementary Retirement Scheme, a voluntary scheme encouraging folks to avoid wasting for retirement. The SRS Account is principally our non-public retirement plan that dietary supplements the government-defined contribution plan, the CPF.

By way of channelling a few of your cash yearly for your SRS account, you’ll defer your revenue tax in order that your annual revenue tax payable will also be decreased.

Let me give an explanation for.

While you give a contribution for your SRS account, you defer paying taxes until the designated withdrawal time.

This contribution quantity shall be a deduction out of your overall revenue to derive a decrease taxable revenue.

Right through withdrawal time, after your statutory retirement age, solely 50% of your withdrawal is topic to revenue tax. How a lot tax you’ll pay at withdrawal will rely on your tax bracket. The speculation is that whilst you retire, you must now not earn any strange revenue, so the revenue tax that you just pay on 50% of your withdrawal must be not up to the tax you pay for your present tax bracket.

The designated withdrawal time is tied to the present statutory retirement age. The statutory retirement age lately is 63 years previous.

SRS account is not just to be had to Singaporeans and everlasting citizens however additionally to foreigners. For foreigners, after ten years, they are able to withdraw in a single lump sum, and 50% of the price is subjected to tax with out penalty.

Thus for each Singaporeans & PR and foreigners, that is the second one number one approach that they are able to use to cut back their taxable revenue. The principle one, advocated through monetary bloggers, is to switch $8,000/year for your CPF Particular Account / Retirement account & Medisave account and every other $7,000 for your circle of relatives member’s CPF Particular account / Retirement account & Medisave account.

Lately, the utmost you’ll give a contribution for your SRS is S$15,300/year for Singaporeans and $35,700/year for foreigners.

In relation to what you’ll acquire along with your SRS account, you’ll acquire all forms of monetary belongings from shares, unit trusts, even Robo advisors, insurance coverage financial savings plans, and annuities.

Are you able to withdraw your cash out of your SRS ahead of the statutory retirement age?

Sure, you’ll however…

Should you withdraw ahead of 62 years previous, it’s important to pay a 5% penalty for your withdrawal, and the withdrawal is completely subjected to strange revenue tax. Should you withdraw after the designated withdrawal length, there shall be no penalty.

You’ll have to withdraw end your wealth inside of ten years. If you buy an annuity along with your SRS, this 10-year restriction isn’t imposed.

Taking Motion These days through Growing Our SRS Account to Hedge Our Withdrawal Age Chance

I by no means felt the want to open an SRS account as a result of because of my revenue stage and the tax reduction that I had prior to now, the tax that I ultimately pay is a tiny share of my overall revenue.

On the other hand, just lately, I began to get very uneasy with the collection of articles in mainstream publications, and on TV relating to operating longer, dialogue on retirement and the retirement age.

I were given a freaking feeling that they are going to prolong the statutory retirement age.

When that occurs, so will the penalty-free SRS withdrawal age.

So why now not spend $1 to mend that penalty withdrawal age?

I did a little analysis and turns out that I can’t to find any noticeable distinction within the providing of UOB, OCBC and DBS.

So I’m going with probably the most obtainable choice which is to open an SRS account with DBS.

It’s very best as a result of opening many accounts with DBS is only a few clicking processes.

Should you navigate accordingly and observe the directions, all it takes is to switch $1 to open it.

I didn’t even hassle that opening an account and shifting cash will internet you a money praise. On the other hand, if you have an interest on this stuff, right here it’s.

Opening an account does now not require a lot effort, why now not open one to come up with some administrative flexibility subsequent time?

A few of My Deeper Ideas about SRS and Paying Taxes

4 years in the past, I simply wish to make sure that I will lock in that penalty-free withdrawal age, simply in case I would like it.

On the other hand, I considered it and determined to perform a little fast calculations on my projected revenue tax for subsequent 12 months.

After which I notice possibly I must give a contribution to my SRS account.

When my mother passed on to the great beyond a 12 months ahead of, I misplaced some huge tax deductions. After I ROD in 2017, I additionally misplaced some small tax deductions. My tax deduction is somewhat naked.

That, at the side of upper overall revenue, would imply that my taxable revenue will considerably build up my revenue tax expense.

So SRS turned into a viable attention.

I actually, actually, actually, actually don’t love to have my cash locked up. In order that method no CPF SA top-ups and prior to now no SRS contribution.

The SRS contribution is in all probability the lesser evil between the 2 of them.

It is because you’ll withdraw SRS early and pay the 5% penalty, however you can not do this along with your CPF.

I compute that there’s a chance that I might be unemployed at some point and take an early withdrawal, and I gained’t be taxed at an strange revenue stage. The adaptation between the 5% penalty and my marginal revenue tax bracket continues to be value it.

However in any case, within the grand scheme of items, in all probability I must pay the tax build up and be performed with it.

I forecast this would be the best possible overall revenue I will be able to have for a while, so in all probability this would be the closing time I will be able to pay in such an revenue bracket.

I’m really not going to make a large deal out of it as I’m lucky I will pay a better tax as a result of it might imply I earned extra whilst others struggled to get hired.

Contributing to an SRS Account Would possibly No longer be That Helpful Mathematically if You Make investments Your Cash Decently

One of the crucial older other folks who did the maths inform me the SRS machine is damaged (which I will be able to give an explanation for later)

However if truth be told, the financial savings on taxes lately, deferring the tax fee so that you are going to solely be taxed 50% of what you’ve at some point, would possibly not lead to an important distinction.

Some extra numbers focal point folks have labored this out.

In my Monetary Independence Telegram Workforce, I’ve noticed two discussions in this.

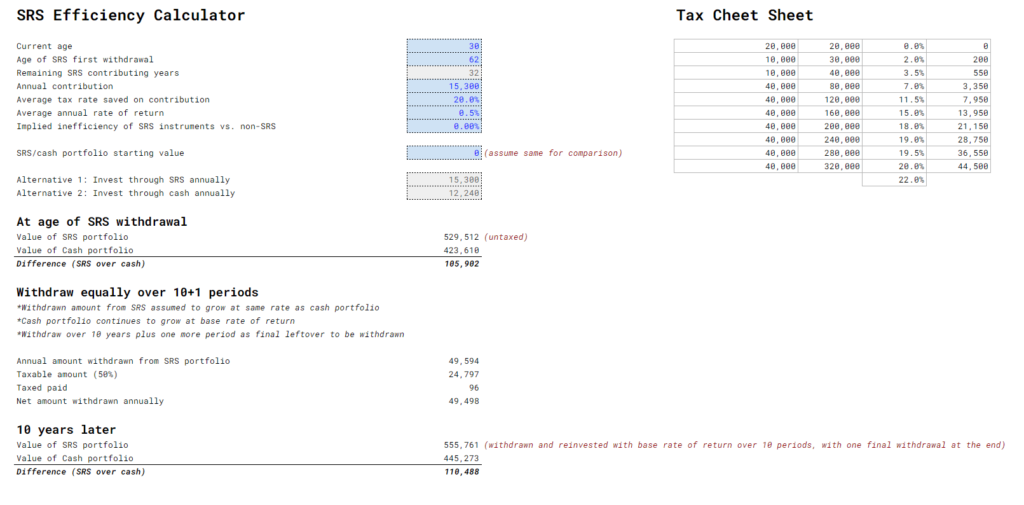

One among our contributors, Lincoln, created a Google Spreadsheet to match the trade-off between placing your cash in SRS as opposed to in case you are paying the taxes and making an investment the remaining.

You can view Lincoln’s SRS Potency Calculator spreadsheet right here. You’ll be able to keep a copy of the spreadsheet right here.

The right fashion is to match the general price of what you’ll have in the event you put your cash in SRS and, if you don’t, at other milestones.

On this case, it measures:

- On the age of SRS Withdrawal

- Ten years after SRS Withdrawal

You’ll be able to see there’s a distinction, and if the adaptation is certain, there’s some usefulness of the usage of SRS as opposed to now not the usage of SRS.

Within the case learn about above, this 30-year-old is 32 years clear of 62-years-old the place he can take out his cash. He’s within the 20% revenue tax bracket and does now not make investments in any respect, so his fee of go back is solely 0.5%.

There’s an development of $105,902 and $110,448 if he makes use of the SRS account as opposed to if he does now not.

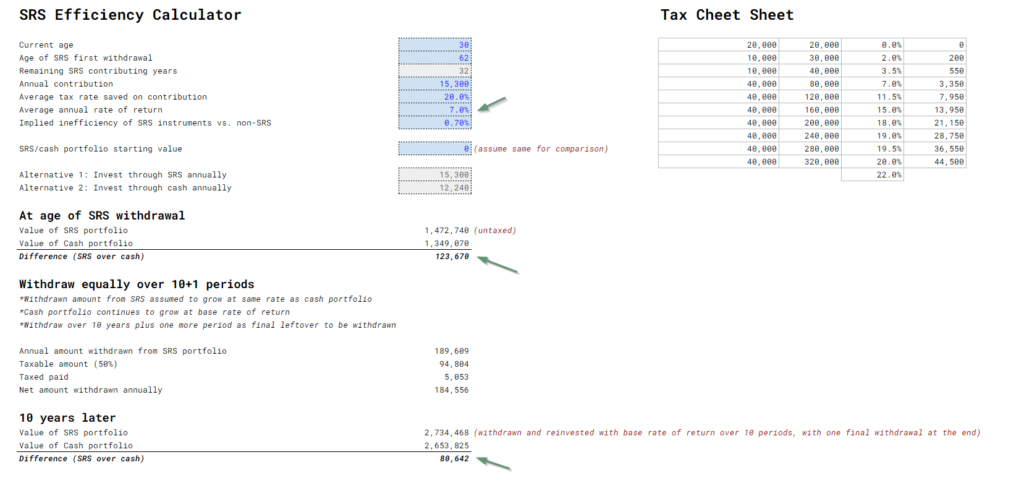

What if he invests with an anticipated fee of go back at 7% and with some funding prices of about 0.7% a 12 months?

His price from the usage of SRS continues to be upper than money ($123,670, and $80,620, respectively).

However, respective to his portfolio price, the volume is extra insignificant.

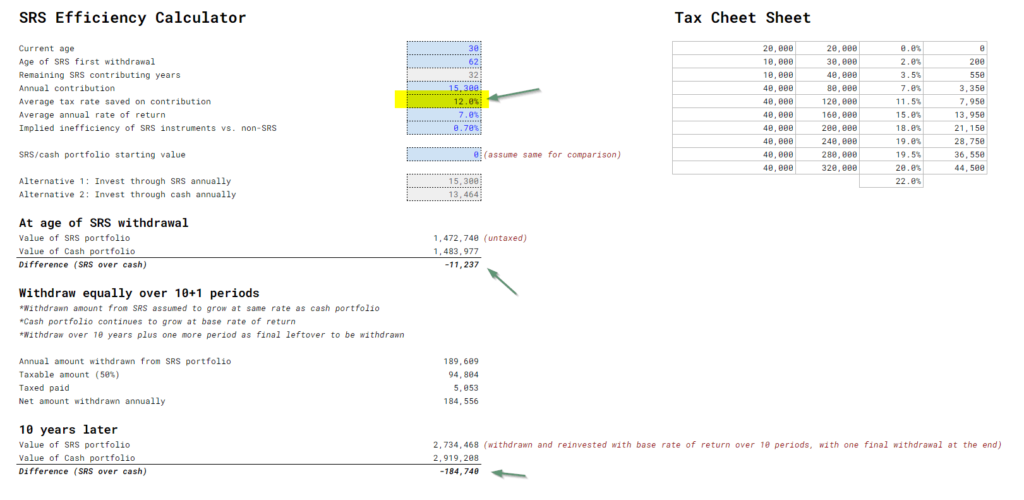

However in case you are in a decrease tax bracket lately, the financial savings, in case you are an investor that may make investments at a better fee of go back, is lesser.

If an individual invests, however his revenue tax is not up to 13%, you’ll see that the adaptation is insignificant.

I examined that although your fee of go back is 2-3% a 12 months, there isn’t a large number of financial benefit to the usage of SRS.

So this isn’t since the fee of go back is a prime 7%, but when your returns are first rate, and also you belong to a moderately decrease tax bracket, the adaptation is minimum.

It could be recommended to not defer the taxes.

The longer term has a large number of uncertainty, however confidently, the calculator assist you to fashion the financial savings or loss of financial savings.

I must inform you that your long term is unsure. The eventual fee of go back is unsure, whether or not you still give a contribution annually is unsure, the longer term revenue tax fee could also be unsure.

Why the SRS is a bit of Damaged

The maths within the earlier phase will display that typically, we will say the tax deference and tax deduction works in our favour, however you lose a large number of the optionality of your wealth through semi-locking your cash in SRS.

One of the crucial major causes it’s damaged is as a result of moderately talking, our strange taxes paid in Singapore is moderately low, as opposed to different international locations.

In different international locations, the efficient taxes paid might be 20% upwards of your overall revenue.

Not like different international locations, on a private foundation, we do not need

- longer term fairness capital positive factors taxes

- brief time period fairness capital positive factors taxes

- taxes on dividends (except from a partnership)

- taxes on passion revenue (except from a partnership)

What this implies is if we construct wealth thru our customary money, brokerage and funding accounts, there’s no tax penalty to it.

We thus don’t want to make use of personal deferred contribution accounts such because the SRS to optimize our taxes. For instance, in america, there are taxes on capital positive factors and dividends, thus optimization with conventional IRA, Roth IRA, 529, 401k, HSA and Roth 401k accounts is a should. A few of these accounts will lock your cash until 59.5 years previous. There’s a entire self-discipline of Roth conversion ladders and contribution optimization {that a} wealth builder has to take care of.

Total, we’re already paying very low taxes relative to the online value.

That is wonderful to people and households which can be financially unfettered and conscientious.

If we take a look at the affect of the tax financial savings on 3 other teams of folks, the lower-income, heart revenue and better revenue:

- if the lower-income contributes to SRS, it’s going to take in a big percentage in their annual revenue. This can be a difficult approach to economize and most likely they gained’t have that prime of a tax burden as smartly

- the prime revenue can give a contribution to SRS, and benefit from the tax financial savings. On the other hand, within the grand scheme of items, the tax financial savings throughout withdrawal as opposed to after-tax withdrawal shall be fairly minute as opposed to their internet value

- the center revenue would experience this probably the most, however so much depends upon the speed of go back of the SRS portfolio, and your present tax bracket. I haven’t performed the maths, however within the grand scheme of items, it will topic a lot not up to we expect

When you have contributed or make a choice to not give a contribution to the SRS, do let me know your idea procedure and whether or not you’ve a special tackle my private scenario.

I invested in a different portfolio of exchange-traded budget (ETF) and shares indexed in the United States, Hong Kong and London.

My most well-liked dealer to commerce and custodize my investments is Interactive Agents. Interactive Agents assist you to commerce in the United States, UK, Europe, Singapore, Hong Kong and plenty of different markets. Choices as smartly. There are not any minimal per 30 days fees, very low foreign exchange charges for forex change, very low commissions for quite a lot of markets.

To determine extra consult with Interactive Agents lately.

Sign up for the Funding Moats Telegram channel right here. I will be able to proportion the fabrics, analysis, funding information, offers that I come throughout that allow me to run Funding Moats.

Do Like Me on Fb. I proportion some tidbits that don’t seem to be at the weblog publish there steadily. You’ll be able to additionally make a choice to subscribe to my content material by means of the e-mail beneath.

I ruin down my assets in line with those subjects:

- Development Your Wealth Basis – If and follow those easy monetary ideas, your longer term wealth must be beautiful smartly controlled. In finding out what they’re

- Lively Making an investment – For energetic inventory buyers. My deeper ideas from my inventory making an investment enjoy

- Studying about REITs – My Unfastened “Path” on REIT Making an investment for Freshmen and Seasoned Buyers

- Dividend Inventory Tracker – Observe all of the commonplace 4-10% yielding dividend shares in SG

- Unfastened Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Making plans, Monetary Independence and Spending down cash – My deep dive into how a lot you want to succeed in those, and the other ways you’ll be financially loose

- Providend – The place I lately paintings doing analysis. Charge-Simplest Advisory. No Commissions. Monetary Independence Advisers and Retirement Experts. No price for the primary assembly to know how it really works