Antler Gold Declares Choice Settlement with Prospect Sources Restricted to Promote 51% Hobby of Its Extremely Potential Kesya Uncommon Earth Undertaking in Zambia

Antler Gold Inc. (TSXV: ANTL) (“Antler” or the “Corporate“) is happy to announce that Antler and its subsidiary Antler Exploration Zambia Restricted (“Antler Exploration”) have entered into an choice settlement (the “Choice Settlement”) with Prospect Sources Restricted (ASX: PSC) (FSE: 5E8) (“Prospect” or the “Spouse”) pursuant to which Prospect has an way to gain 51% hobby in Antler Exploration, which holds the Kesya Uncommon Earth Undertaking (“Undertaking”) positioned in southern Zambia.

Deal Highlights:

- Prospect has as much as two years to procure a 51% hobby in Antler Exploration which holds the Kesya Uncommon Earth Undertaking by way of a complete blended counterparty attention and venture expenditure bills amounting to US$3.05 million.

- Segment 1 dedication by way of Prospect is 2 money bills of an mixture of US$150,000 and US$350,000 in exploration expenditures in addition to an issuance of US$500,000 price of Prospect commonplace stocks inside 30 days of the of entirety of Segment 1.

- Segment 2 choice dedication by way of Prospect is a money cost of US$150,000 and US$750,000 in exploration expenditures in addition to an issuance of US$500,000 price of Prospect commonplace stocks inside 30 days of electing to continue to Segment 2.

- The general segment dedication by way of Prospect is a money cost of US$150,000 in addition to an issuance of US$500,000 price of Prospect commonplace stocks on the finish of the two 12 months choice duration which is able to then earn Prospect 51% of Antler Exploration.

Undertaking Highlights:

- The Undertaking covers a Huge-Scale Exploration License Software the place geological mapping and floor sampling performed by way of Antler Exploration has known a big, uncommon earth-element enriched carbonatite.

- Rock chip samples assayed by way of Antler Exploration define very encouraging general uncommon earth detail oxide (TREO) mineralisation contained inside monazite and bastnaesite with low ranges of uranium and thorium.

- The Kesya rock chip effects supply extremely anomalous floor values in uncommon earth components with the perfect grasp pattern so far assaying 6559 ppm (0.66%) TREO.

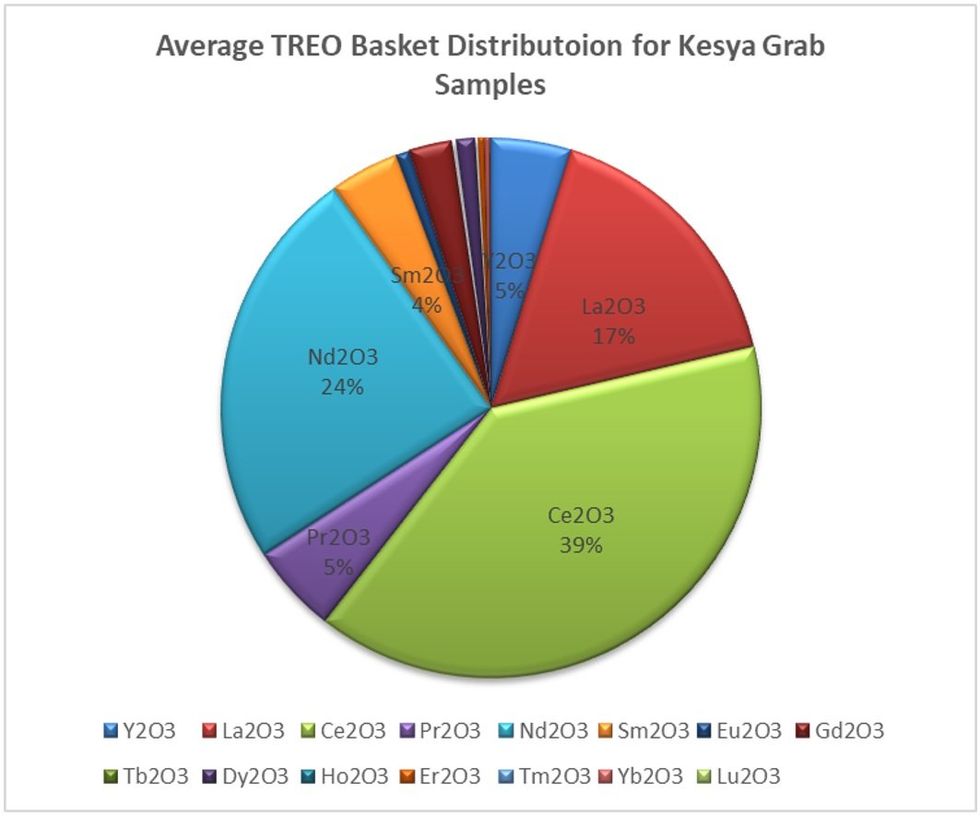

- The grasp samples are enriched in neodymium (Nd) and praseodymium (Pr) oxides which moderate 29% of the TREO content material and makes this an excessively encouraging basket distribution.

- Keysa’s great amount of carbonatite outcrop lets in for simple drill focused on providing prospectivity to unexpectedly delineate a mineral useful resource and make a vital new uncommon earth detail discovery in Zambia.

- Antler Exploration at the side of its spouse Prospect are getting ready for an preliminary 1,500m diamond drilling program to check the subsurface expression and intensity extent of the mapped and sampled uncommon earth detail enriched carbonatite.

Christopher Drysdale, CEO of Antler commented:

“We’re extraordinarily excited to announce this settlement with Prospect. It is a testomony to our dedication to strategic partnerships with extremely credible organizations that percentage our imaginative and prescient for price advent. Prospect has an impressive observe report, which is demonstrated by way of their a hit development of the Arcadia lithium venture in Zimbabwe. This settlement represents a vital milestone for Antler Gold because it underscores our skill to spot promising mineral potentialities throughout Africa and align ourselves with top-tier firms. Now not best does this partnership permit us to leverage Prospect’s industry-leading experience, nevertheless it additionally establishes a cast basis for doable long run collaborations, whilst keeping up vital publicity to the extremely promising Kesya REE venture.”

Prospect’s Managing Director and CEO, Sam Hosack, commented:

“The Choice Settlement we’ve got struck when it comes to the extremely potential Kesya REE Undertaking in Zambia is some other vital milestone, which extends our achieve additional into the battery and electrification mineral sector in Africa, consistent with our strategic targets. Kesya has all of the elements of a world-class, uncommon earth enriched, carbonatite-hosted gadget, having additionally returned vital values of the high-value REEs, neodymium and praseodymium, over a wide floor house of the Undertaking. Zambia is a number one jurisdiction to discover and expand mining operations in subSaharan Africa, having a long-standing historical past within the assets sector, specifically for copper. This contains very good infrastructure and robust strengthen from each the federal government and neighborhood, with main firms like Barrick Gold and First Quantum Minerals already calling it house. We’re overjoyed to have reached this settlement with Antler, which is a longtime and revered Canadian exploration and construction corporate focussed on its flagship Erongo and Onkoshi Gold Tasks, positioned in central Namibia. The Kesya REE Undertaking provides very good doable to ship a vital new, highvalue uncommon earths discovery, with outlined present drilling goals and a well-established running surroundings. Topic to the pride of all related stipulations precedent, this is a fine quality greenfield exploration play for Prospect.”

Creation and deal phrases:

The Kesya carbonatite used to be first known in 1961 by way of Bailey within the Kafue district in southern Zambia. An preliminary mapping marketing campaign by way of Antler demonstrated that it’s enriched with uncommon earth components and warrants additional exploration and drilling.

The Choice Settlement is amongst Prospect, Antler and a subsidiary of Antler, Antler Exploration. Topic to pride of sure stipulations precedent, Prospect could have the correct to earn a 51% hobby in Antler Exploration over a two-phased earn-in association over two years for general attention of US$3.05 million, which incorporates attention bills to Antler and in-ground venture expenditure.

Prospect pays an preliminary non-refundable money cost to Antler of US$50,000 on signing. Following pride of the stipulations precedent below Segment 1, Prospect pays Antler an extra US$100,000 in money, and decide to spend US$350,000 at the Undertaking inside 12 months (topic to sure extensions authorised below the Choice Settlement). Prospect may even factor to Antler US$500,000 price of Prospect commonplace stocks on the of entirety of Segment 1 (the price of the average stocks might be set at the cost of Prospect stocks on the time of signing, in response to earlier 10-day VWAP).

After of entirety of Segment 1, Prospect can elect to continue to Segment 2 or terminate the Choice Settlement (and on this case Prospect will dangle little interest in Antler Exploration).

If Prospect proceeds to Segment 2, it’s required to pay Antler an extra US$150,000 in money and factor US$500,000 price of Prospect commonplace stocks (the price of the average stocks might be set at the cost of Prospect stocks as on the time of election to continue to Segment 2, in response to earlier 10-day VWAP), and it is going to have the correct, however now not the duty, to spend an extra US$750,000 at the Undertaking inside 12 months from of entirety of Segment 1 (topic to sure extensions authorised below the Choice Settlement).

If Segment 2 is done, Prospect might be entitled to workout a decision way to gain 51% of the issued and exceptional stocks of Antler Exploration. To workout the choice, Prospect should make a last cost to Antler of US$150,000 money and factor US$500,000 price of Prospect commonplace stocks (the price of the average stocks might be set at the cost of Prospect stocks as on the time of the workout of the decision choice, in response to earlier 10-day VWAP).

Prospect will talk over with Antler when it comes to the paintings program and funds however will in the end resolve and set up all exploration actions when it comes to the Undertaking.

Upon of entirety of the purchase, Antler Exploration might be ruled by way of a shareholders settlement (“Shareholders Settlement”) amongst its shareholders. Prospect and Antler Exploration have agreed at the key phrases of the Shareholder Settlement, with a complete shape Shareholder Settlement to be entered into sooner or later. Construction budget for the Undertaking are to be contributed by way of shareholders of Antler Exploration on a pro-rata foundation. If a birthday celebration does now not give a contribution its professional rata percentage, its shareholding might be diluted by way of a prescribed formulation. Neither birthday celebration can also be diluted under a fifteen% hobby, from which level such hobby will likely be free-carried via to the of entirety of a JORC-Code reportable or NI 43-101 compliant Feasibility Learn about. The shareholder can then elect to transform its loose carried hobby to a 2% NSR or similar (“Royalty”) and the opposite shareholder has a proper however now not the duty to buy one part of the Royalty for US$5,000,000.

Proposed Exploration Programme

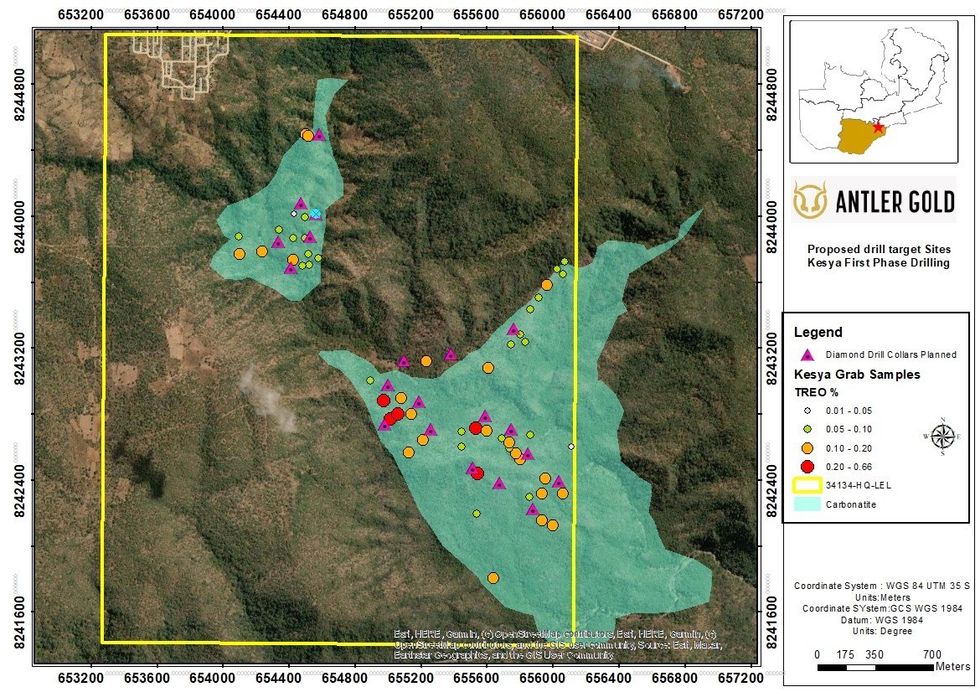

There was no historical drilling finished at the Kesya carbonatite and the subsurface underneath the level of the mapped carbonatite complicated and the intensity extension is but to be examined. Antler at the side of Prospect is designing a initial 1,500 metre diamond drilling programme on the venture. (Determine.1) The purpose is to guage the continuity of the known floor REE mineralisation to intensity. The preliminary exploration plan might be to drill twenty (20) 75m deep holes alongside the carbonatite in addition to its contacts with the rustic rock by way of the usage of a heli-man transportable drill rig and pending all environmental and statutory approvals.

Undertaking Location and Background

Determine 1.) Proposed Diamond Drill hollow location plan for preliminary 1500m drilling.

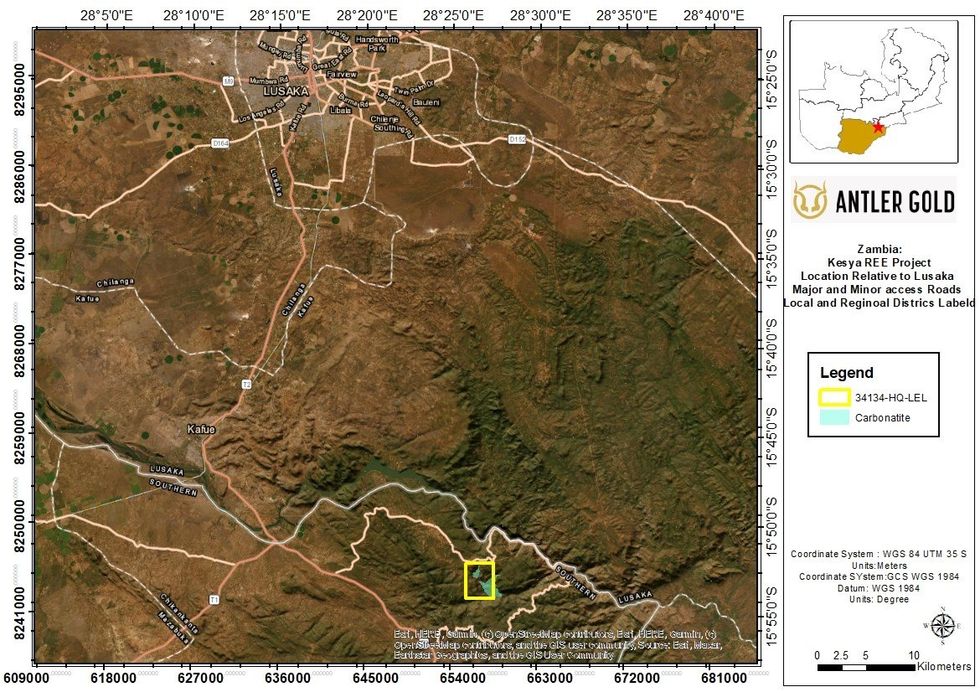

The Kesya REE Undertaking, contains a unmarried, large-scale exploration license (LEL) utility masking 1053.13 hectares and is positioned close to town of Kafue in southern Zambia within the Kafue Gorge. This license is positioned roughly 90 km by way of a tarred street touring south of the capital town of Lusaka and has water and gear infrastructure close by. As soon as the LEL is granted, Antler’s wholly owned Zambian subsidiary, Antler Exploration Zambia Restricted will personal 95% of the Kesya REE Undertaking. The remainder 5% of the Undertaking has native possession.

Determine 2.) Map of the site of the Kesya carbonatite positioned south of the capital town Lusaka.

Undertaking Geology

The Kesya Carbonatite intruded into gneisses of the Paleoproterozoic Basement Advanced rock sequences close to the intersection of the mid-Zambezi-Luangwa Rift Valley and the Kesya Rift.

The Kesya Carbonatite is split into two main rock varieties: In the beginning, a coarse-grained carbonatite with scattered nation rock xenoliths: This carbonatite is most commonly composed of coarse sövite with small quantities of chlorite. The second one rock kind is a carbonatite breccia, which surrounds the primary intrusion.

The most important minerals known are magnetite, quartz, apatite, Fe-rich phlogopite, monazite, thorite, Ti-oxides, Fe-sulphides, calcite, ilmenite, and the REE-bearing mineral bastnaesite. Relationship of apatite in samples from the carbonatite point out that it’s of Neoproterozoic age (Kesya is ca. 535±16 Ma).

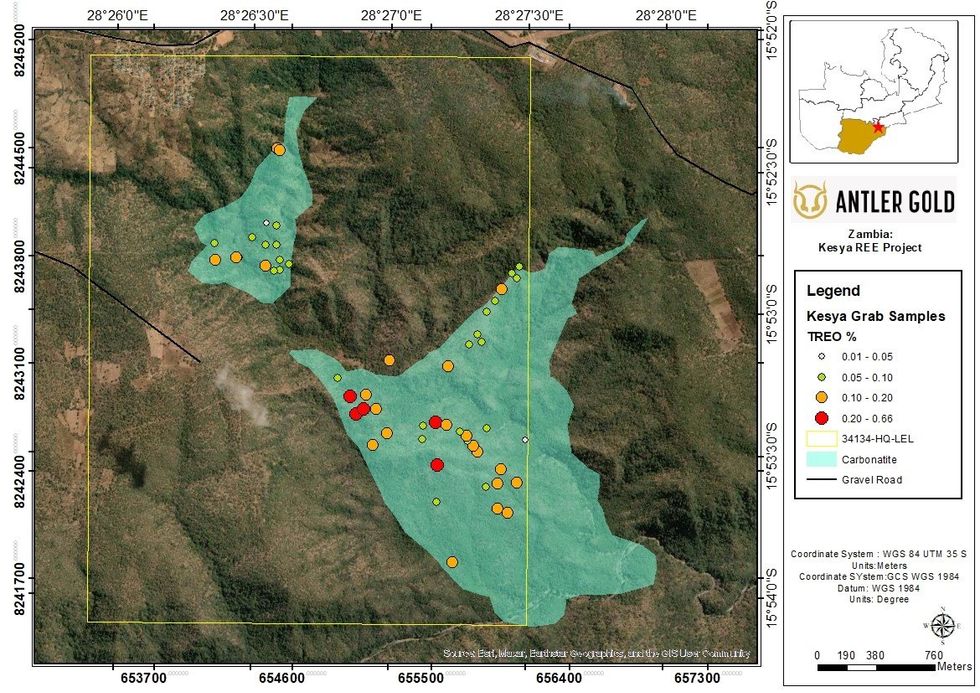

Determine 3.) Map of the grasp pattern places with related TREO assay values.

The carbonatite paperwork a central topographic excessive surrounded by way of deeply incised valleys alongside its margins the place weathering processes are extra intense.

Box investigations by way of Antler, and petrological (Scanning Electron Microscope (SEM)) research finished all the way through 2021 demonstrated that the uncommon earth mineralisation at Kesya is hosted basically in monazite (a REE phosphate mineral) and bastnaesite (a REE fluoro-carbonate mineral).

Determine 4.) View of the Kesya carbonatite (Having a look against the East from the Western fringe of the Kafue Gorge)

Uncommon Earth Component Mineralisation

Antler Gold has finished mapping and sampling campaigns at Kesya in 2021, which concerned reconnaissance paintings around the carbonatite complicated and the number of 51 rock chip grasp samples taken at the license.

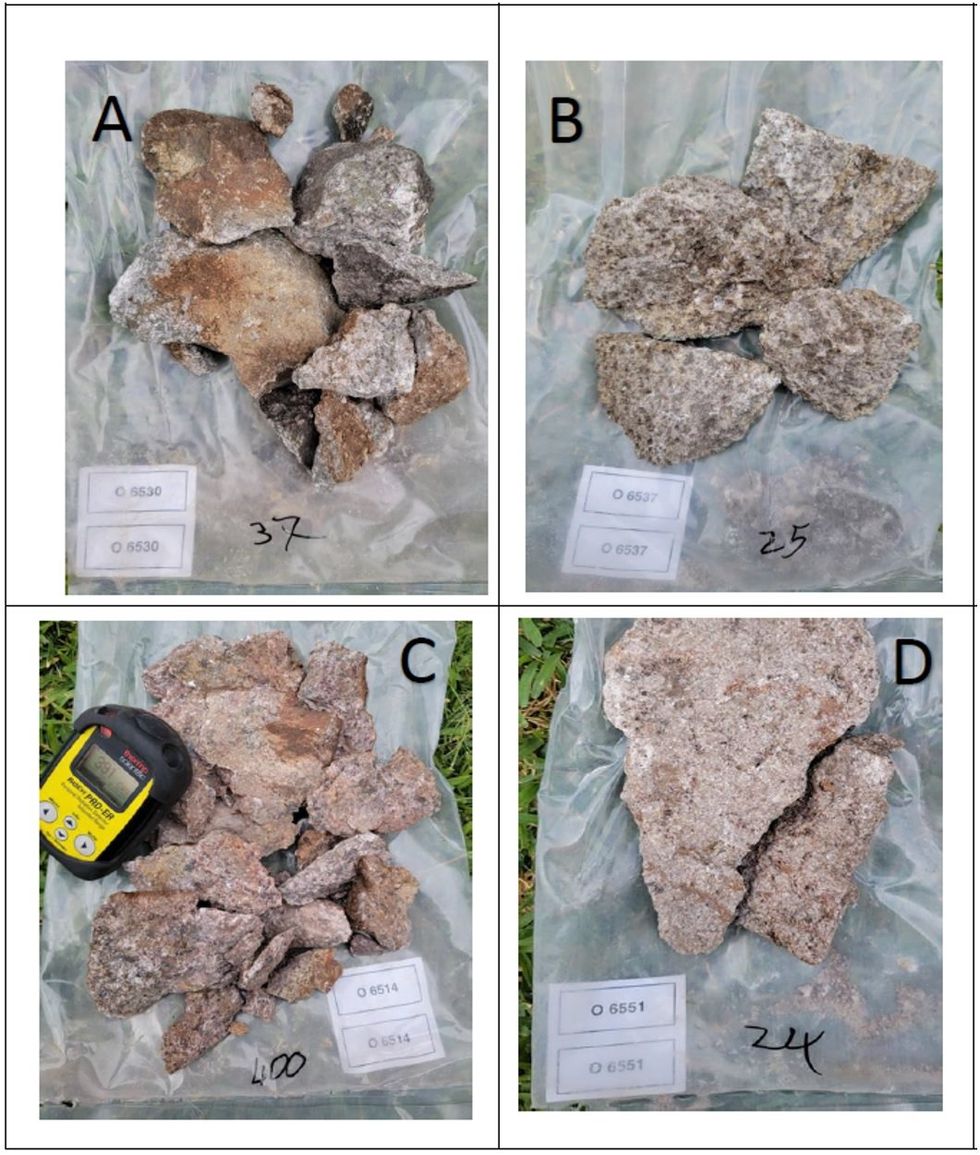

Determine 6; under presentations a small choice of those rock chip grasp samples at the side of their pattern ID’s O6530 (A), O6537 (B), O6514 (C) and O6551 (D).

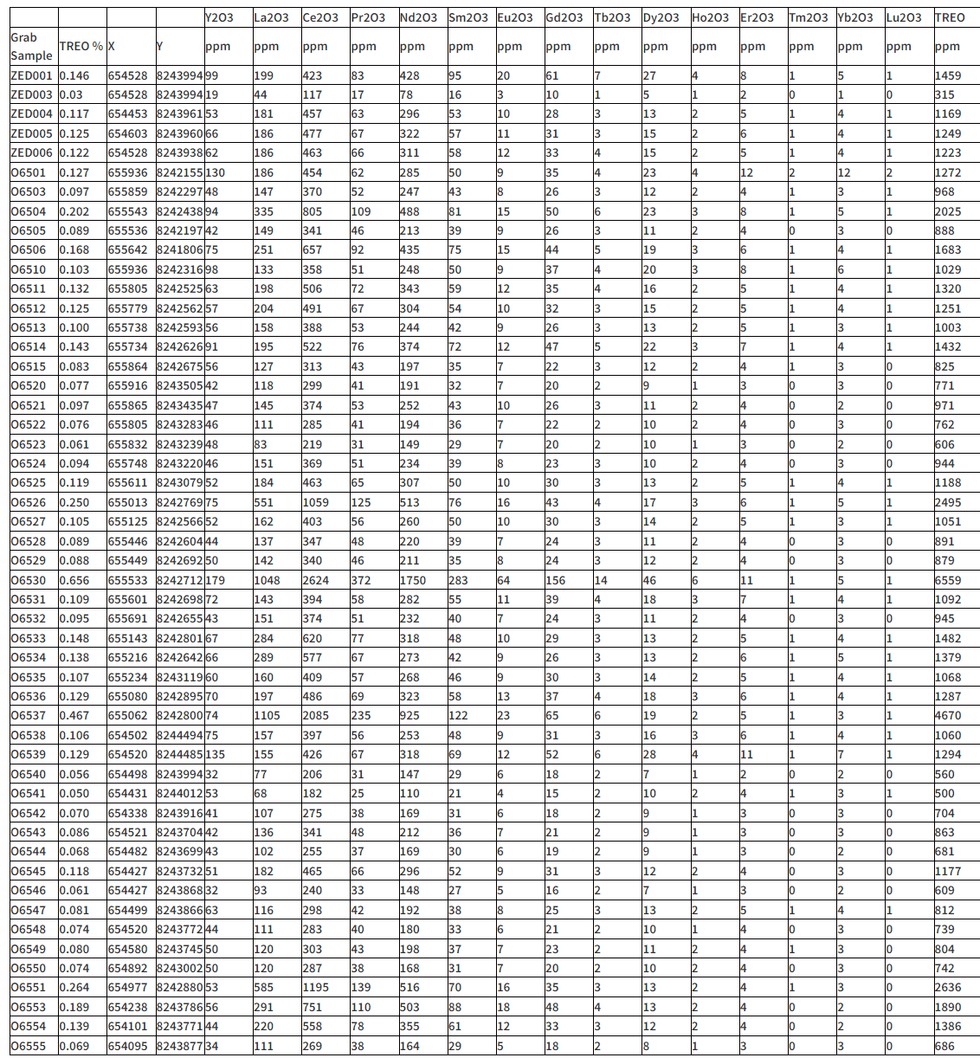

The rock chip samples accrued by way of Antler at Kesya proved to be strongly and constantly mineralised with REE, with a median of 1280 ppm (0.13%) General Uncommon Earth Oxide (TREO) content material, peaking at 6559 ppm (0.66%) TREO.

Encouragingly, those samples additionally display constantly excessive contents of neodymium- and praseodymium oxide – key number one fabrics within the manufacture of robust everlasting magnets for tough motors, utilized in such units as huge, wind generators, more and more utilised within the international renewable power sector.

Neodymium and praseodymium oxides moderate 29% of the General Uncommon Earth Oxide (TREO) content material of the rock chip samples accrued from Kesya (Determine 5).

Determine 5.) Pie Chart appearing moderate grades of Particular person REO’s from the Kesya sampling marketing campaign.

Determine 6.) Photographs of rock chip grasp samples from box mapping at Kesya.

Abstract of most up-to-date grasp assay effects

Right through the mapping marketing campaign undertaken by way of Antler Gold, 51 rock chip grasp samples have been taken from in-situ outcrop on the Kesya REE Undertaking. Pattern sizes have been 1-3 kg and brought to relatively constitute the lithology recorded at every pattern website.

Along with the rock chip samples, an additional 15% of QAQC fabrics (2 x blanks, 2 x every of CRM AMIS0185, AMIS0304, AMIS0356 and a couple of x replica box samples) have been added to the batch of samples dispatched for assaying to agree to QAQC rules.

All samples have been shipped to Namibia and ready by way of crushing and milling at Activation Laboratories Ltd (ACTLABS) in Windhoek.

Pulped samples have been then exported to ACTLABS in Ancaster, ON, Canada, for Code 8 – REE research, which is a lithium metaborate/tetraborate fusion with next research by way of ICP-OES and ICP-MS.

Certified Individual

The technical and medical knowledge on this presentation has been reviewed and licensed by way of Oliver Tors, B.Sc (Hons)., Exploration Supervisor of the Corporate, who’s registered Skilled Herbal Scientist with the (SACNASP) South African Council for Herbal Clinical Professions (Pr. Sci. Nat. No. 120660) who’s a Certified Individual as outlined by way of NI 43-101. Mr. Tors is an worker of Antler Gold Inc. and isn’t impartial of the Corporate below NI 43-101.

About Antler Gold Inc.

Antler Gold Inc. (TSXV: ANTL) is a Canadian indexed mineral exploration corporate centered at the acquisition and exploration of mineral tasks in Africa’s Best-Ranked Jurisdictions, with publicity to each gold and REE. Antler’s general license place now contains 6 tasks for a complete landholding of roughly 584,347 ha. The Corporate continues to evaluate new regional alternatives with the purpose of establishing a possibility diverse industry fashion, which permits the corporate to generate quick and long- time period source of revenue while offering stakeholders with publicity to doable a couple of returns which can be generated from the invention procedure.

About Prospect Sources Restricted (ASX: PSC) (FSE: 5E8)

Prospect Sources Restricted (ASX: PSC) (FSE:5E8) is an ASX indexed corporate centered at the exploration and construction of mining tasks, particularly battery and electrification metals, in Zimbabwe and the wider sub-Saharan African area.

Cautionary Statements

This press unlock would possibly comprise forward-looking knowledge, similar to statements in regards to the of entirety of the transactions topic to the Choice Settlement and long run plans and targets of Antler and its subsidiary, Antler Exploration when it comes to the Undertaking. This data is in response to present expectancies and assumptions (together with assumptions in reference to the continuance of the acceptable corporate as a going worry and basic financial and marketplace stipulations) which can be topic to vital dangers and uncertainties which can be tricky to are expecting, together with dangers in relation to the facility to fulfill the stipulations to of entirety of the transactions pondered by way of the Choice Settlement. Precise effects would possibly fluctuate materially from effects recommended in any forward-looking knowledge. Antler assumes no legal responsibility to replace forward-looking knowledge on this unlock, or to replace the explanation why precise effects may just fluctuate from the ones mirrored within the forward-looking knowledge until and till required by way of acceptable securities regulations. More information figuring out dangers and uncertainties is contained in filings made by way of Antler with Canadian securities regulators, copies of which can be to be had at www.sedar.com.

Neither TSX Project Trade nor its Law Services and products Supplier (as that time period is outlined in insurance policies of the TSX Project Trade) accepts accountability for the adequacy or accuracy of this unlock.

For additional knowledge, please touch Chris Drysdale, CEO of Antler Gold Inc at +264 81 220 2439 or Daniel Whittaker, Govt Chairman of Antler Gold Inc., at (902) 488-4700.