A Sustainable Funding Technique That Suits Your Way of life Could be a Extra Sub-Optimum Technique – Corey Hoffstein

Newfound Analysis‘s Leader Funding Officer and Co-founder Corey Hoffstein sat down with Jack and Justin from Validea to discuss his personal portfolio and the way he manages his cash.

A excellent interview is one the place we’re in a position to peel again the layers and be informed concerning the nuances of making an investment and monetary making plans. Corey is a highly intelligent man, however on this interview, you can notice that like many people, he makes his fair proportion of economic making plans errors.

We will additionally find out how a quant will construction his personal portfolio. I specifically like how he describes on a excessive stage, his function when crafting his portfolio and the result.

He additionally shared his philosophy against portfolio development with leverage, some great benefits of being open to finding out, and why sub-optimal methods might every so often be extra sustainable.

You’ll be able to watch the podcast right here:

What He’s Attempting To Succeed in For His Investments

His objective shifted through the years:

When younger: Get to the purpose the place Corey is happy with the belongings he has.

What’s sufficient:

Property More than Long term Liabilities

Corey is an excessively giant believer in liability-driven making an investment (LDI) (Principally, your whole long run wishes/targets are a legal responsibility that you’ll be able to calculate a gift price. Your belongings these days wish to fund those liabilities)

At this level, Corey felt that his source of revenue and funding belongings outmoded his long run liabilities.

Now: What’s cash for?

Corey concluded that he:

- He doesn’t wish to take into consideration cash.

- As an alternative of claiming cash can not remedy all issues, re-frame and believe that cash can de-stress a large number of issues. (e.g. liberate time)

- He’s going to have youngsters quickly, so training for children is a large objective. His guardian permit him to graduate with out debt, so he would care to do one thing an identical if imaginable.

Corey’s Retirement: Converting the Tempo of Existence

Corey is 35 this 12 months and has been operating NewFound Analysis for 15 years. Entrepreneurship has been the short tempo and worrying.

His objective is so that you can take his foot off the pedal when he reaches 50 years previous.

He believes within the philosophy:

In the event you don’t use it, you lose it.

You want bodily and psychological sharpness, so Corey deliberately builds this into his lifestyles exploration.

He hopes in fifteen years’ time, he can decelerate and be found in his child’s lifestyles.

Corey shared his dad’s early retirement enjoy (8 min 20 sec).

He hopes to gradual it down like his dad and now not be as hands-on right through the later years.

The 3-Legged Stool Portfolio

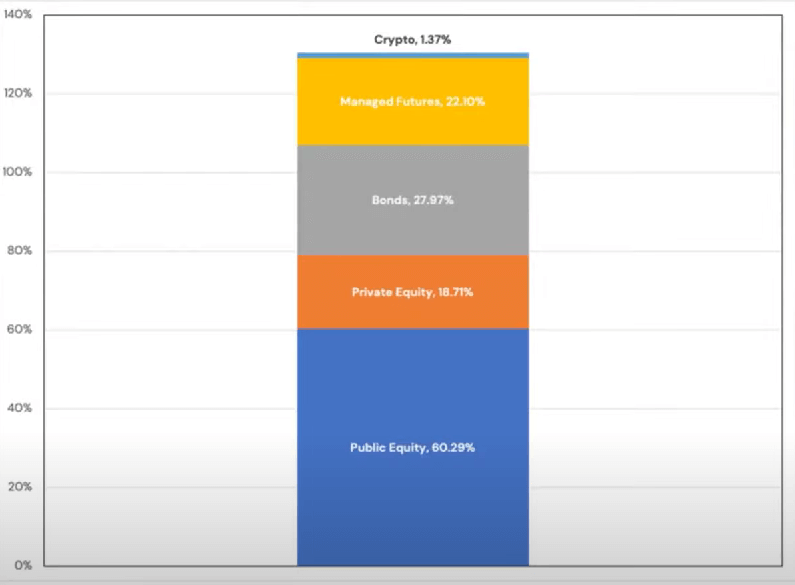

The next diagram illustrates Corey’s present asset allocation:

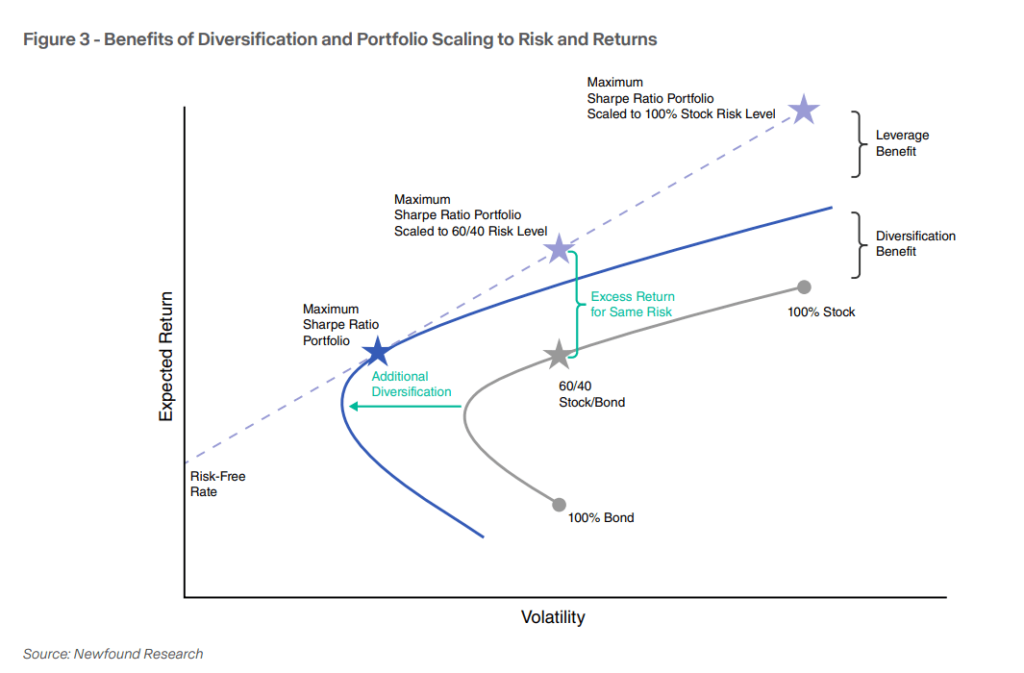

Corey explains that in response to fashionable portfolio principle, and environment friendly frontier, we will have to in finding the portfolio with the most efficient extra go back in line with unit possibility after which leverage it up.

However most of the people are afraid to do this of their investments however are very prepared to do it for actual property.

“You’ll be able to create a a lot more well-diversified, sustainable portfolio if you’re prepared to combine asset categories after which upload on leverage to a possibility stage you wish to have.”

Corey published that as a finance particular person, he’s continuously being scrutinized, and it’s difficult for him to manoeuvre buying and selling person securities with leverage. So he has spent a large number of time packaging his concepts into price range in order that he can put money into them.

“Warren Buffett was once purchasing positive, successful firms, then leveraging them 1.6 instances.”

He crafted a 3-legged Stool Portfolio Technique:

- The primary is the use of asset categories or methods to generate long-term compounded returns round possibility premia.

- Then, we believe #1 in conjunction with the commercial and inflation dangers in order that we don’t seem to be too uncovered in particular financial regimes.

- Chance can’t be destroyed can solely be transferred. Corey likens possibility to a large bowl of playdough. If our portfolio may be very concentrated, our portfolio may be very concentrated within the regime of financial enlargement. If the financial system suffers, your portfolio is in for an important drawdown. He is attempting to remove dangers in that financial enlargement regime and introduce dangers in different regimes. That is as though we’re smashing the playdough and spreading it out.

His portfolio is:

- In response to 3 asset categories (Private and non-private fairness, bond futures, controlled futures)

- In finding the important thing long-term go back drivers. To get returns, you need to take dangers.

- Shares & bonds constitute the 2 important “muscle actions.” referring to possibility premia to be had. Corey thinks it’s “extremely defensible” why you will have to earn excellent returns by way of holdings shares and bonds.

- The large possibility of conserving a shares and bonds-only portfolio is that each asset categories are extremely vulnerable to inflation shocks.

- We will have to have a 3rd leg of a stool that does nicely in an inflationary setting. Corey does now not favour commodities as a result of commodities are inferior right through deflation.

- Controlled futures, which will cross lengthy or brief world futures markets, traditionally showcase low correlations with shares and bonds and feature absolute return-like traits. Controlled futures has additionally performed nicely right through fairness disaster and inflationary classes.

“Your human capital is like you’re lengthy a bond.”

Corey liken that the wage from our bond will also be believe an inflation-protected, credit score bond.

If you wish to have, you’ll be able to style your human capital, by way of calculating the online provide price of a flow of your long run source of revenue.

For an adolescent, they have got an enormous human capital, this means that an enormous bond place.

They are able to find the money for to have extra fairness allocation.

There are white papers that argue you will have a extra leverage fairness portfolio.

Conversely, as you grow older, chances are you’ll now not wish to simply have shares for your portfolio.

Corey has such a lot bonds (for a 35-year-old) as a result of as an entrepreneur, he struggles to “style” his human capital.

“I wish to construct my funding portfolio as “all-weather” as imaginable. Proudly owning bonds lets in me to seize the chance top rate.”

What folks misunderstand about bonds is that your portfolio is much less dangerous as a result of the low correlation however that bonds are simply decrease unstable then a large number of different issues. We will succeed in the similar impact if we use money as an alternative.

“Whilst you paintings a couple of years longer, you’re including extra bonds for your portfolio, offsetting extra of your long run liabilities.”

Corey makes use of a fund which put money into bond futures to offer him publicity to treasury bonds throughout a couple of other intervals.

“I tousled my equities allocation.”

Corey defined that he has the great fortune of in a position to reap a good quantity of taxable cash early in his profession and he make a decision to put money into person firms which can be predominately tilted against positive, successful, dividend-paying.

The equities did so nicely that he misplaced his talent to tax misplaced harvest.

In the United States, asset location is significant. Whilst you promote, you wish to have to pay lengthy or non permanent capital beneficial properties tax. In case you have losses, you’ll be able to harvest the ones losses to offset your tax invoice.

The associated fee foundation on Corey’s person shares is low, this means that that the capital beneficial properties that might be tax is considerable.

“If I had been to pinpoint my major mistake, it was once now not considering ‘how would this be ten-years down the street?’”

He lamented that if he has invested in a high-quality-based ETF, what he ‘owns’ technically will also be reconstituted and rebalanced higher.

“Being knowledgable in a single house of funding does now not imply I’m an expert in all spaces of investments.”

At 23 min 15 secs, Corey explains his embarrassment of now not making the most of positive tax-advantaged accounts.

He stresses {that a} excellent adviser can upload alpha simply by their sophistication.

At this level of his lifestyles, he reveals that his time is probably not nicely spent discovering strategy to avert taxes versus rising his wealth higher.

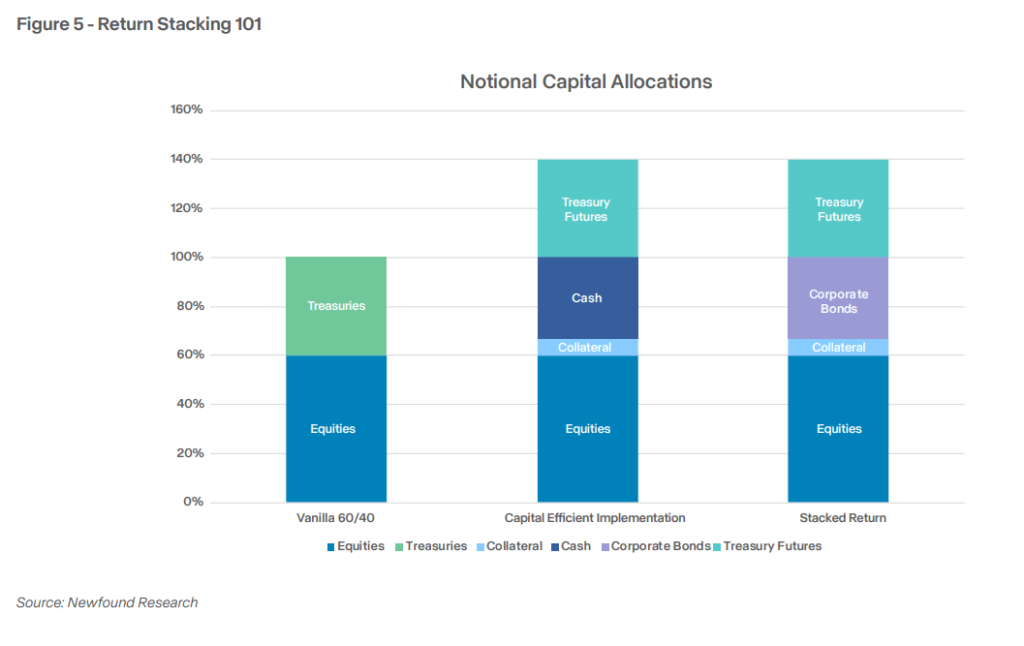

Core Thought of Go back Stacking

Corey wrote a paper about returns stacking, explaining what it manner.

[White paper] Go back Stacking: Methods for Overcoming a Low Go back Atmosphere

To shape a extra well-rounded, much less correlated portfolio, we will upload hedging methods to the portfolio.

On the other hand, the portfolio could have decrease volatility and no more possibility. This implies the go back might be not up to equities.

So the standard technique has a investment downside.

Go back stacking introduces leverage to the portfolio. With leverage, the chance stage is going up, and we are hoping so that you can seize the returns that include the chance.

Newfound Analysis not too long ago introduced a fund that, for each $100 invested, it will provide you with $100 bond publicity and $100 controlled futures publicity. For a 60% fairness and 40% bond allocation investor, it means that you can substitute 20% of the bond with this fund. This takes your allocation to 120% with extra diversification.

The Proper Quantity of Leverage to Observe to Your Funding Portfolio Might Want a Behavioural Layer

36 min.

Corey says that obtaining the correct quantity is extra artwork than science.

You’ll be able to take other portfolios and backtest other quantities of leverage carried out.

In the event you compute the other allocations, with other leverage stage, you’ll in finding that the form of the chart resembles a hump. The height of the hump represents the best quantity of leverage with the perfect go back. Earlier than that hump, you don’t seem to be taking sufficient leverage; after the hump, you’re taking an excessive amount of leverage.

The issue is if the period of time you backtested is other, and the duration of funding is other, the best leverage stage is DIFFERENT, If the length has a 2008 GFC, the leverage stage can be approach decrease.

“The artwork of what I attempt to do is I take a look at all of those subperiods, what stage of leverage do I believe is extra protected and sustainable over those shorter time horizons that, in principle, nonetheless will get me to that long-term optimum leverage stage. After I plotted those charts over the long term (30 years), I finished up beautiful a long way to the left of ‘the best quantity’. As an example, the best quantity would possibly say I will have to be thrice leverage however the higher quantity is 1.5 instances. that 1.5 instances is extra sustainable as a result of there could be a 90% drawdown this is hidden at one level in that thrice leverage.”

“I’m seeking to maximise my returns, however respecting some drawdown constrains that make it extra sustainable.”

Kyith: To earn the ones nice returns, it is very important face up to the ones high-leverage drawdowns first.

On Rebalancing

We will have to steadily rebalance our portfolio just a little at a time.

The issue with many finance folks is compliance oversight constraining us. If we’re in person shares, we wish to post industry requests ahead of we will do a majority of these stuff.

Corey needs to slowly promote and transfer into the price range he crafted in order that rebalancing can happen inside the fund.

He’ll take a look at his portfolio on an asset magnificence stage as soon as a month to peer if they’re out of whack, and make small adjustments the use of tax loss harvesting their place.

“I’ve some doubts about how my Non-public Fairness funding will determine.”

His personal fairness investments don’t come with his corporate Newfound Analysis.

- In early 2010, he invested in a fund that invests in seed-stage tech firms around the globe.

- In 2014/15, he invested in a non-public fairness fund. Corey give an explanation for that within the PE area, just a few corporations do it nicely and he was once lucky so that you can put money into considered one of them.

- He invests in protected notes, which is a normal construction to seed investment to start-ups of his pals’ firms when they want capital. Those are folks he works with, and he feels protected running with them to take a position his personal cash.

“It’s not that i am certain whether or not I earn an good enough top rate within the personal area. I believe if I taken the cash I had invested within the seed level and put it into the Nasdaq, I would possibly have the similar go back however 100% extra liquid.”

“I’m up ostensibly 5 instances within the seed fund I invested in however there’s no liquidity recently so It’s not that i am certain if I’d be capable to get my cash out. They invested on this corporate name Canva within the seed level and Canva has gotten huge. About 80% of the fund’s price is in Canva, so now I’ve a large allocation to this corporate referred to as Canva.”

Reflections on his Crypto Enjoy and Portfolio Sizing

Corey was once skilled in laptop science and skim the white papers early on however solely were given inquisitive about 2021 when lots of the crypto infrastructure was once already arrange.

He was once lucky that he was once dwelling in Cayman, which allowed him to industry on global exchanges.

As a quant, there have been many straightforward methods corresponding to money & elevate, which is lengthy underlying crypto and brief the futures. There’s a huge 20% annualized top rate.

He was once defi-yielding farming (in his phrase the platforms had been offering incentives to develop the community), flipping NFTs.

From a tax viewpoint, making an investment in crypto is a nightmare for Corey.

Corey doesn’t really feel that it’s wholesome NOT to take part in new applied sciences as a result of you’ll be able to develop dismissive about issues.

“For younger investors, buying and selling NFTs is excellent follow for buying and selling illiquid belongings, supplied they don’t get sucked in. You know about caught stock, learn how to paintings a marketplace, learn how to do issues OTC. When FTX was once round, they may be able to discover ways to write buying and selling bots as a result of there have been API to do this. Simply watch out as a result of we will simply get sucked in.”

The Price of Monetary Making plans

Corey shared one thing that was once weighing on his thoughts about his property making plans:

- As a person, if he will get hit by way of a bus, his belongings will cross to his dad, who will do no matter he needs with the cash.

- After he were given married, if he will get hit by way of a bus, and his spouse remains to be round, the belongings will cross to his spouse, and his dad, who’s versed in finance will be capable to assist determine it out because the directions are there.

- Now that he’s going to have a child, if he will get hit by way of a bus, and his spouse remains to be round, how can he construction his belongings in this type of approach that it makes his spouse’s lifestyles more straightforward?

- If either one of them will get hit by way of a bus, how does he construction his property for the child?

He indubitably wishes some property making plans assist however am now not certain if a monetary adviser will paintings for him as a result of he’s so well-versed investment-wise.

The host and Corey were given right into a dialogue that their family members might wish to restructure their portfolios:

“I had a good dialog with my spouse the opposite day. The way in which I controlled our cash is the best way I believe is perfect for us. However this won’t make a lot sense to her (she does now not know what’s controlled futures.). Even though the controlled futures are in a fund, that construction won’t assist her a lot.

If I took my belongings and put them in positive dividend-paying firms as an alternative, which is a sub-optimal technique, she simply is aware of that each month, there might be cash this is popping out and not have to the touch the portfolio.

There’s something to be stated about a sustainable funding technique that fits your way of life.

If I kick the bucket early, there may be some justification for her to restructure the portfolio quite than having to head in and promote the portfolio a bit by bit.”

If you wish to industry those shares I discussed, you’ll be able to open an account with Interactive Agents. Interactive Agents is the main low cost and environment friendly dealer I exploit and consider to take a position & industry my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They mean you can industry shares, ETFs, choices, futures, foreign exchange, bonds and price range international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with learn how to create & fund your Interactive Agents account simply.