9 Robust Issues to Why I Say, the Dividend Source of revenue Retirement Mindset is No longer a Excellent Retirement Possibility Control Fashion.

I lean additional and additional clear of this dividend revenue retirement mindset as a result of I feel it isn’t any such just right retirement possibility control fashion.

Out of the entire conceivable queries that may pop out from my REIT ETF article, I wasn’t anticipating my remark at the dividend revenue retirement mindset to be the most well liked query.

I were given like 3 to 4 feedback/queries about what I imply by means of leaning additional and additional away, so I assumed I might take a small little bit of time to elaborate on why.

I’ve been a “char-pa-lang” investor for 5 years, then discovered dividend worth making an investment as I were given nearer to 29 years outdated, and it’s true dividend making an investment in person corporations the place I grew my wealth. At the moment, I lean nearer to a extra broad-based, varied, controlled portfolio.

I wish to assume I do know somewhat concerning the distinction between the 2 approaches.

What do I imply by means of the Dividend Source of revenue Retirement Mindset?

We’re discussing much less about how efficient settling on high-paying dividend shares for your portfolio, or rising dividend-paying shares for your portfolio and the way smartly those portfolio does as opposed to different roughly inventory variety technique.

Discussing the above method learning if we constant choose & make investments & rebalance that portfolio will give higher effects as opposed to the index or different methods.

That isn’t what the folks with dividend revenue retirement mindset is considering, however I feel they will have to additionally spend a bit of of time having a look at whether or not there’s a dividend making an investment top class. (I’ve more than likely helped them do a bit of of labor by means of having a look on the dividend growers.)

The dividend revenue retirement mindset is extra about adopting a spend-income-only fashion when they’re making plans for the retirement segment of existence.

Once I forestall paintings, and don’t have revenue coming in, I’ve a couple of issues I need to succeed in:

- Have revenue that may pay for my spending wishes.

- The revenue will have to be capable to retain my buying energy or stay alongside of inflation.

- The revenue will have to be constant sufficient.

- The revenue will have to ultimate so long as I are living.

- The revenue may be supposed for legacy, in order that I will go the portfolio to my heirs.

- The portfolio will have to have compatibility my possibility tolerance and my possibility tolerance is low-to-moderate.

I feel that’s what many people need, and the problem is enjoyable all six of the above in a single technique.

The most productive technique in lots of minds (in addition to mine someday in existence) is the dividend revenue fashion.

- Create a portfolio made up of shares that distributes dividends. The way you create is some other subject one by one.

- Ensure the revenue allotted from the portfolio can quilt the expense that you want.

- Spend solely the dividend distribution from the portfolio.

- Don’t spend the capital. For those who spend the capital, you are going to fritter away the portfolio and your passive revenue turns into lesser and lesser.

- Whilst you go away, the capital is unbroken so that you can go on for your inheritor.

The dividend revenue fashion turns out to fulfil lots of the necessities, however I felt that many of us overplay the way it fulfils the ones necessities.

Let me undergo them one after the other.

1. They Based totally Their Retirement on a Fashion That Has Little Empirical Proof

Retirement is a difficult monetary making plans purpose as a result of there are sufficient concerns whilst you get started spending and don’t need to fritter away speedy.

I talked concerning the protected withdrawal price machine so much on Funding Moats and the protected withdrawal price machine is the root of ways I like to get both perpetual revenue or revenue over a shorter time span. You’ll be able to learn Why the Secure Withdrawal Charge (SWR) is Very important for Your Monetary Independence (For Singaporean Traders) to comprehend it higher.

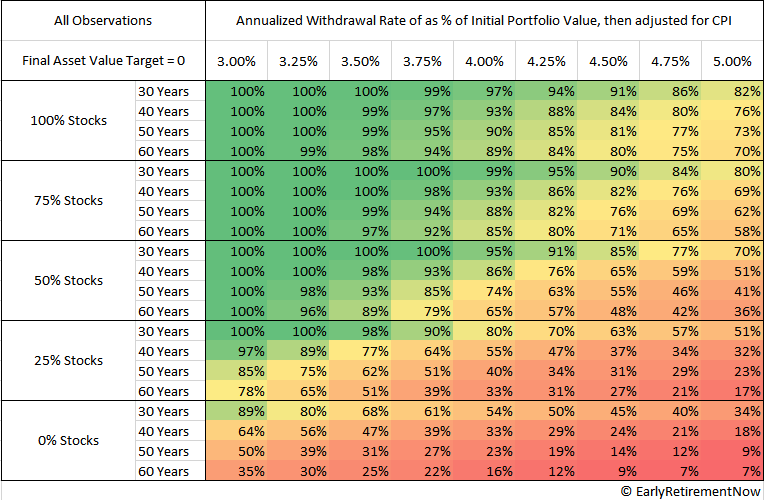

The protected withdrawal price machine isn’t best, however the foundation of the protected withdrawal price is empirical analysis of whether or not your portfolio survives over:

- Many various financial regimes (deflation, melancholy, warfare, inflation, bull marketplace)

- Other international locations

Since William Bengen create this system within the early Nineteen Nineties, many have construct upon his paintings so that we have got extra empirical analysis.

Those analysis lets in us to know higher “in case you get started spending $X and if you need it to ultimate 20, 30, 40, 50, 60 years, and I need the cash to be adjusted for inflation regardless of whether or not its the excessive inflation 1960/70s or the melancholy within the 1920/30, would the cash ultimate, for various fairness and bond portfolios, in several nation.”

With the analysis we will work out if we’ve got this capital and spend this beginning quantity, does this plan lean nearer to more secure or riskier?

With information, we’re ready to comprehend how smartly issues do.

There’s much less empirical analysis on this house for the dividend-mindset.

With the protected withdrawal price machine, a minimum of there are a little analysis just like the desk above to lend a hand us work out the sides of possibility we will have to take into consideration.

In case you have a portfolio made up of a small subset of shares, and the present reasonable dividend yield is say 5%:

- How is the volatility of the dividend over the years?

- How is the dividend revenue as opposed to inflation?

- How does this portfolio did over the other financial regimes?

There are analysis in the market on a portfolio of low-dividend paying shares, which develop their dividend over the years such because the dividend aristocrats, and whether or not the dividend assists in keeping up with inflation.

However… that isn’t your dividend portfolio.

Your dividend portfolio may be very other:

- Your taste isn’t the same as the kinds utilized in analysis. (It could be very char-pa-lang as smartly)

- You spend money on Singapore shares which is a special area and the corporations have other traits.

Those two will affect the adaptation between your eventual retirement revel in and the analysis.

There’s extra uncertainty about whether or not it’s going to paintings in comparison to different strategies. There are previous nation index general go back information, and there also are worth, expansion and profitability taste information in Fama/French’s database.

2. How do they take care of Source of revenue Volatility?

This one deal with:

- Have revenue that may pay for my spending wishes.

- The revenue will have to be capable to retain my buying energy or stay alongside of inflation.

- The revenue will have to be constant sufficient.

For those who solely need to spend the revenue and not the capital, how do you be sure you fulfill the 3 necessities above?

Covid has more than likely given us a glimpse that your revenue may also be very unstable.

I’ve even listen of a few loopy people who would founded their retirement revenue on DBS, OCBC and UOB shares as a result of they’ve observed how constant the dividends are.

However you do notice that you’re basing your retirement revenue on only one nation and concentrated in a single sector. For those who rely the majority of your spending in your portfolio, this is a large number of focus possibility there.

Retaining the revenue strong calls for extra considering as a substitute of simply spending the dividends.

Here’s a deeper UK analysis article on retirement revenue volatility the use of dividends.

3. Trusting that 5-15 Years of Dividend Document Too A lot With out Taking into account the Base Charge – Maximum Firms Don’t do Neatly Within the Lengthy Run if You Purchase and Cling

To sieve out higher corporations that may pay maintain dividends, we evaluation the corporations with profits, unfastened money drift which can be tough or rising over the years.

In my outdated conservative lens, I might glance way back to conceivable.

Ten years of money drift information is also sufficient to permit us to know the dividend robustness higher.

However in fact… maximum dividend traders don’t do that paintings, they usually agree with that in the event that they pick out just right dividend shares they keep just right dividend shares for the 30 years they want.

There’s an overconfidence over the survival and robustness of person corporations.

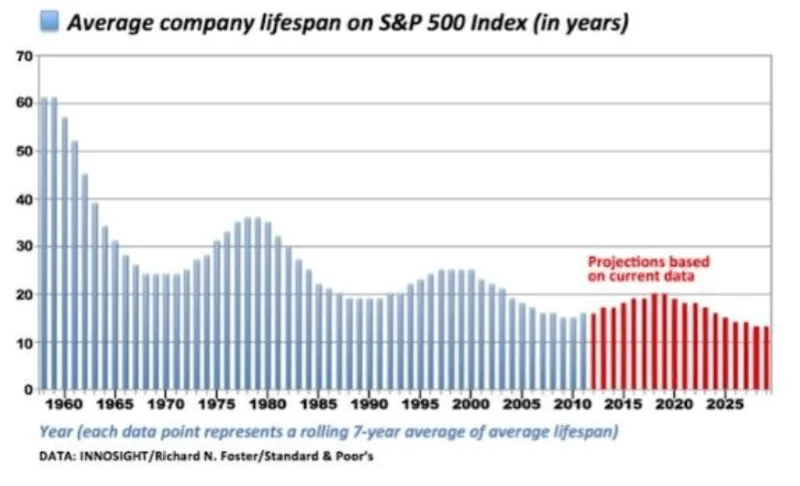

The chart above displays the common corporate lifespan of businesses indexed at the S&P 500. Some would assume the existence of businesses in the United States are longer, however this desk displays that the common lifespan is getting shorter and at maximum 18 years.

Which is shorter than your 25-30 years of retirement.

It method you’ll have to reconstitute or rebalance your portfolio. The dividend portfolio isn’t buy-and-hold.

The above is the bottom price that they is also underplaying. Extra corporations die over the years.

And the vast majority of the corporations don’t do smartly in buy-and-hold.

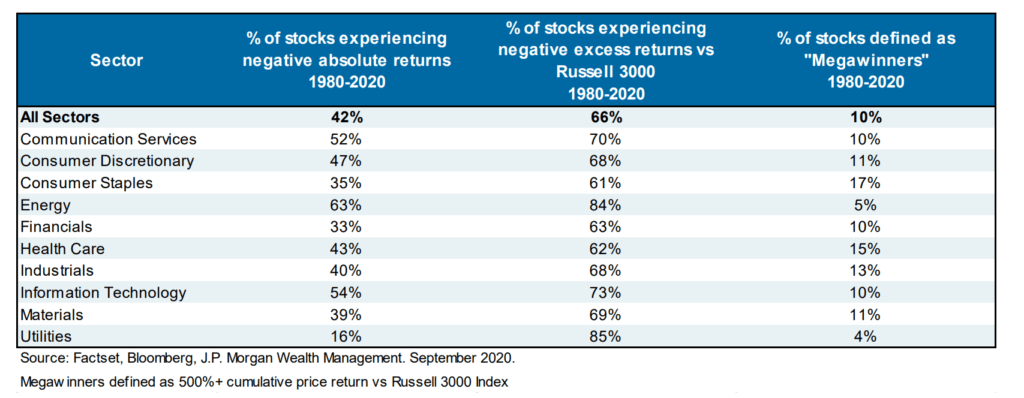

The information under is tabulated by means of JPMorgan:

They measure the efficiency of shares as opposed to the Russell 3000, which is an US index that incorporates the massive and small-caps.

There’s a huge share of businesses experiencing unfavourable returns. If we evaluate to the index, 70% of the corporations revel in unfavourable extra returns as opposed to the Russell 3000 index. Just a small selection of the shares are megawinners.

However you won’t want the mega winners.

The information would let you know that

- You will have overestimate the lifespan of companies

- Chances are you’ll overestimate the robustness of commercial and their efficiency

For those who pick out a small selection of shares, there may be extra uncertainty.

With extra uncertainty, there will have to be a top class for taking up that uncertainty, so it isn’t all unfavourable.

However in retirement revenue making plans, you need so that you can organize the uncertainty, and now not marvel in case you get a just right consequence or now not.

4. It Makes You Focal point on Selecting Firms with Dividend Payouts

A dividend retirement revenue technique would most likely pigeon you in finding corporations with a minimum of some dividend payouts since you don’t need to spend down capital.

And this may occasionally make you think about positive sectors or areas that pay higher dividends.

Normally, those corporations are the stalwarts in Peter Lynch’s One up on Wall Boulevard, however can be REITs, utilities, healthcare corporations, and shopper staples.

Because of this your portfolio would possibly observe the ebbs and flows of those sectors.

Those sectors have a tendency to be extra defensive and do smartly throughout recessions (excluding REITs which is suffering from liquidity crunch).

Stalwarts are just right as a result of their industry fashion throws off extra money drift that they don’t want.

5. Too A lot Yield Focused on Resulting in Extra Dangerous Shares

Think you want $60,000 a yr in revenue, however your capital is solely $1 million.

So you are going to finally end up looking to create a portfolio whose shares pay at least 6% dividend yield.

Within the grand scheme of items… 6% is a excessive dividend and the basket of shares that have compatibility that standards are both dangerous, or they’re returning your capital to your self as a substitute of returns in your capital.

Many attempt to “curve have compatibility”.

They begin their making plans in line with their wishes. This isn’t unsuitable. We do that for our shoppers as smartly.

However they aren’t respecting first rules and the primary idea this is that you’re selecting shares from a basket that can have extra issues.

If that’s what you hope for (selecting and conserving a basket of them my even have upper possibility premiums and returns), then its smartly and just right.

However many are simply hoping that issues figure out.

The average part of a loss of empirical proof and agree with method it results in a hoping mindset.

6. Underestimating the Effort Had to Set up the Portfolio

There are changes to be made to relieve the issues that I’ve listing out:

- Create a extra varied portfolio this is much less concentrated in positive sectors.

- Do sufficient empirical analysis on dividend-based kinds and spot how smartly they do if solely dividend revenue is spent. Do they ultimate? Do they stay alongside of inflation?

- Remember that corporations degenerate and feature a machine to reconstitute or rebalance the portfolio

- When growing the portfolio, don’t drive the composition of the portfolio in line with monetary making plans wishes first. Create the portfolio aiming for sustainability and robustness. How to succeed in this is some other subject.

I will be able to deal with revenue volatility later.

Now… you’ll do the above however you must needless to say you take on an effort.

Some dividend traders additionally get to this degree as a result of they notice they can’t agree with their bankers and the budget they suggest.

In order that they do it themselves.

They usually get started finding out easy methods to create a sustainable dividend portfolio. Some conscientious traders in the end did.

However in the course of the procedure they won’t notice how a lot paintings they do be aware of their portfolio, desiring to have a possibility set of dividend shares all the time to be had for them to reconstitute and rebalance.

For those who inquire from me, I make a choice to insulate myself from having to try this portfolio control paintings. It’s a long way more uncomplicated to study whether or not the budget/ETFs more or less seize the way issue efficiency than to take into consideration whether or not to promote, or preserve a inventory when it is going down, keeping up a possibility set and selecting from them to rotate a fallen dividend inventory into.

Uncle CreateWealth888 isn’t basing his retirement on dividend inventory however he holds a concentrated portfolio.

In his days sooner than passing away, his members of the family shared that he’s nonetheless updating his spreadsheets, the members of the family have been looking for how he may just do this on his smartphone as a substitute of the PC.

This is some self-discipline and its a self-discipline build-up over a few years.

If you want to you’ll do this.

I desire to present myself extra leeway and err at the protected aspect I don’t need to be that lively.

7. Attaining Source of revenue Balance and Inflation Adjustment Calls for Both Sufficient Conservativeness or Decreasing the Volatility of the Portfolio

Now, how do I feel we will make the dividend revenue from a dividend portfolio extra constant?

On a elementary degree, dividends payout from corporations isn’t constant. Firms minimize dividends when companies don’t do smartly.

The dividend aristocrats and a few bizarre title dividend technique center of attention on shares who has grown their dividend over the years or stayed the similar.

The method is to chop the inventory from the portfolio if the corporate cuts the dividend.

So you are going to purchase one thing else to exchange that (once more lively control).

The dividend raised has a tendency to be greater than CPI however now not the entire shares carry their dividend. We hope at the reasonable the dividend raised is upper than inflation.

And so they don’t generally tend to head down in deflation, so this section is a bonus over the protected withdrawal fashion.

However you may notice that businesses that have a tendency to lift their dividends over the years, will pay out a smaller percentage in their annual money drift as dividend, so the dividend yield has a tendency to be decrease.

And so what this implies is if you want $60,000 a yr and the common dividend yield on those dividend growers is 3% or much less, your capital wishes is $2 million.

Your plan is extra conservative.

What’s the selection?

You want to have a portfolio with a median dividend yield of 5-6% however you need to present your self sufficient buffer so whilst you plan how a lot capital you want, you employ a decrease dividend yield.

Say 3-4%.

So your capital wishes is between $1.5 – $2 million.

Is that extra conservative? I don’t know!

Surely extra conservative than when you have a capital of solely $1.2 million.

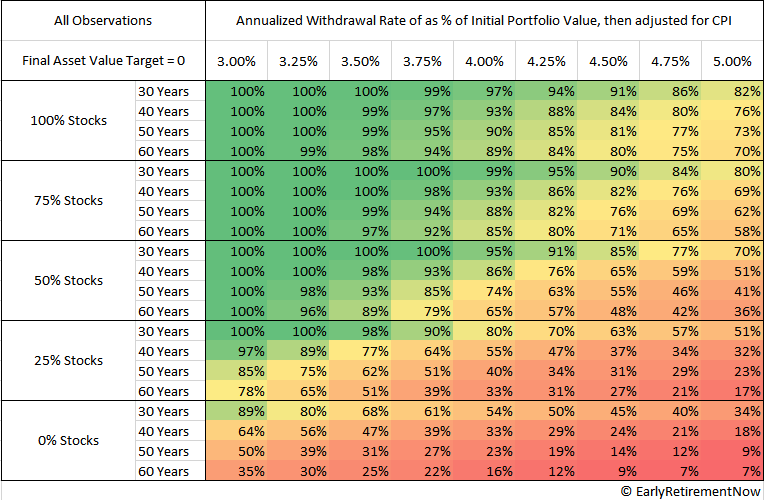

Now check out those numbers (3%) and the vibrant desk I posted at first. To make it more uncomplicated, let me submit right here:

The desk displays the good fortune price of various portfolio allocations, over other timeframes, with other preliminary withdrawal charges. Good fortune method the inflation-adjusted revenue don’t run out in that time frame.

If you want to your wealth to ultimate lengthy sufficient, the whole thing turns out to triangulate to a 3-3.25% preliminary withdrawal price.

Because of this the capital wanted in case you use a protected withdrawal price manner is $2 million as smartly.

Now… many can’t take it once I use some bizarre low protected withdrawal price corresponding to 2-3%. In order that they make a choice the dividend fashion as a result of… they want much less capital with a dividend revenue fashion to start out.

I’m positive with that.

However don’t come to me in case you categorical doubts about spaces of the dividend technique corresponding to revenue steadiness.

For those who drive your plan by means of concentrated on a median dividend yield, in all probability you’ve questions for your head about easy methods to stay revenue constant, and all that.

The solution you are going to in the end result in is… have extra buffers. I don’t even know if a three% or 4% protected withdrawal price is protected or now not however the thought is… in case you are taking into consideration a spectrum of various regimes, you want some buffers and a protected withdrawal price machine builds in that conservatism.

How a lot more buffers will have to you’ve within the dividend technique? I don’t know. This is the reason I might slightly opt for one thing that a minimum of we could me see the boundary higher.

However having extra buffers method you want extra capital.

If you need peace of thoughts, the use of one thing positive won’t in point of fact lend a hand. The answer ceaselessly is to make your plan extra conservative.

8. No longer Operating Out of Cash is No longer Simply About No longer Spending Your Capital

For those who preserve a host of dividend shares, and 50% of them impair their worth by means of 50-70%, although you watch for 15-Two decades, their values would now not come again.

The parents who held one of the crucial REITs, and SPH are nonetheless ready till the shares are delisted.

However you’ve already lose a piece of the worth.

However but this “If I don’t spend the capital and so I will buffer the unfavourable series of go back possibility, and make allowance my inheritor to experience intergenerational wealth” considering nonetheless persist.

The make up of your dividend portfolio is essential.

You wish to have a strategy to rejuvenate your portfolio.

Best dividend traders perceive this… so that they in the end listen their portfolios in Singapore banks, the Vicoms, the Mapletree and Capitaland REITs…. as a result of they can’t see those stuff worth will get impaired.

However do take into account… throughout this outdated guy’s time, other people communicate of SPH, M1, Singtel the similar approach.

9. I Hope Your Heirs Need to Set up Your Dividend Portfolio

The saving grace for a dividend portfolio is that your executors can promote it away into money whilst you go away.

However believe this… you painstakingly building up the portfolio and hope it supplies them with intergenerational revenue.

However they don’t know the way to regulate it.

So what do they do?

They promote it away.

What do they do with the cash?

They take the cash and deploy it in the most productive conceivable approach. Both fund the shortfalls of their lives corresponding to repay the loan, pay the downpayment.

Or they put it in controlled budget as a result of they don’t need to organize a basket of “char-pa-lang” shares.

One of the vital enlightening portions about going to uncle CreateWealth8888 is talking to their children and learning how a lot they know and the plans uncle CreateWealth8888 has for the portfolio.

The youngsters are in point of fact to be informed about how he manages the portfolio from us they usually combat to realize his writings.

I inform them that by means of studying his articles a large number of occasions, and clarifying thru books or others who know extra, you’ll determine that out. Repetition is an underrated however time eating ability.

This facet is one thing so that you can take into consideration.

It’s possible you’ll need to get started instructing them as of late easy methods to organize a dividend portfolio. If they aren’t then it method you were given to take into consideration guiding what they will have to do with the cash will have to they in the end promote the portfolio.

With this regard, its now not that different technique is best.

It simply method you want to be in contact your technique and needs higher.

Why I Choose the Secure Withdrawal Machine

The machine isn’t with out flaws however that is how I take a look at it:

- The machine is constructed on having a constant actual revenue (this means that inflation-adjusted revenue) flow.

- The inflation adjustment is in line with fluctuating inflation as a substitute of simply an arbitrary 2-3% a yr assumption. This isn’t best however its extra conservative.

- The above method the machine keeps buying energy higher.

- The revenue will have to be extra constant. Throughout the machine, you’ll make the revenue much less constant however buffer for uncertainty.

- There’s sufficient analysis on how lengthy the cash will ultimate, in line with the beginning spending price. This permits me to have an concept of whether or not my plan leans nearer to being very conservative, conservative, impartial, dangerous, or very dangerous. Examine this not to having any empirical foundation in any respect.

- Because of #5, I will cut up my portfolio into the portion the place I’m okay to to not go away such a lot bequest for my inheritor and the portion that they are going to have intergenerational wealth that ultimate for a very long time.

- Whether or not my possibility tolerance is low, medium or excessive, I will know the way lengthy my portfolio allocation may just ultimate and what sort of capital I would like.

- The portfolio may be extra passive. I take away the inventory and bond variety, managing a possibility set, purchase, promote and preserve choices, portfolio rebalancing and reconstitution jobs from the portfolio.

- It lets in me to know the way the portfolio will do thru difficult regimes in order that I’m underneath much less illusions

- There’s a entire frame of labor referring to easy methods to be versatile within the machine in order that you received’t run out of cash. More straightforward laws may also be created to regulate than the dividend revenue mindset.

- The machine will in the end result in a extra conservative plan with buffers as a substitute of being positive about your retirement.

The drawback is… now not many of us can perceive those.

Peace of thoughts, protection and conviction can’t be simply transplanted.

I’m moderately positive of that.

I feel it really works higher for me, and I’m really not looking to persuade you to just accept it.

However I’m hoping you additionally be capable to see that there are flaw to the dividend revenue mindset and create your individual adjustment to relieve that.

I invested in a varied portfolio of exchange-traded budget (ETF) and shares indexed in the United States, Hong Kong and London.

My most popular dealer to business and custodize my investments is Interactive Agents. Interactive Agents can help you business in the United States, UK, Europe, Singapore, Hong Kong and plenty of different markets. Choices as smartly. There aren’t any minimal per 30 days fees, very low foreign exchange charges for forex change, very low commissions for more than a few markets.

To determine extra discuss with Interactive Agents as of late.

Sign up for the Funding Moats Telegram channel right here. I will be able to proportion the fabrics, analysis, funding information, offers that I come throughout that permit me to run Funding Moats.

Do Like Me on Fb. I proportion some tidbits that aren’t at the weblog submit there ceaselessly. You’ll be able to additionally make a choice to subscribe to my content material by way of the e-mail under.

I wreck down my assets in step with those subjects:

- Construction Your Wealth Basis – If you understand and observe those easy monetary ideas, your longer term wealth will have to be lovely smartly controlled. In finding out what they’re

- Lively Making an investment – For lively inventory traders. My deeper ideas from my inventory making an investment revel in

- Studying about REITs – My Unfastened “Direction” on REIT Making an investment for Inexperienced persons and Seasoned Traders

- Dividend Inventory Tracker – Observe the entire not unusual 4-10% yielding dividend shares in SG

- Unfastened Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Making plans, Monetary Independence and Spending down cash – My deep dive into how a lot you want to succeed in those, and the alternative ways you’ll be financially unfastened

- Providend – The place I recently paintings doing analysis. Rate-Best Advisory. No Commissions. Monetary Independence Advisers and Retirement Experts. No rate for the primary assembly to know the way it really works