Yen Good points on Japan’s Inflation Uptick

- There was once an uptick in Japan’s core client worth enlargement.

- The buck has declined via 2.8% for the month, heading for its weakest per month efficiency.

- Japan’s manufacturing unit task reduced in size for the 6th consecutive month in November.

The USD/JPY worth research on Friday steered a refined bearish sentiment, with the yen gaining energy in keeping with an build up in Japan’s core client worth enlargement. This upward pattern additional reinforced the anticipation that the Financial institution of Japan may probably withdraw its financial stimulus within the close to long run.

–Are you to be informed extra about foreign exchange bonuses? Test our detailed guide-

Significantly, Japan’s core client worth enlargement reasonably greater in October, countering the former month’s drop. In consequence, buyers be expecting chronic inflation to push the Financial institution of Japan to cut back its financial stimulus quickly. On the identical time, ING economists look ahead to the BOJ to shift clear of its dovish stance subsequent 12 months.

The Eastern yen reinforced via 0.21% to 149.23 in keeping with buck, progressively recuperating from the close to 33-year low of 151.92. Moreover, it has observed a 1.5% build up for the month.

Moreover, a industry survey on Friday published that Japan’s manufacturing unit task reduced in size for the 6th consecutive month in November. Japan’s economic system stays fragile amid susceptible call for and inflation.

In the meantime, the buck fell 0.058% to 103.71, ultimate just about the two-and-a-half-month low of 103.17 previous within the week. Additionally, the buck has declined via 2.8% for the month, heading for its weakest per month efficiency in a 12 months. This decline was once because of rising expectancies that the Fed would conclude its rate of interest hikes and get started charge cuts subsequent 12 months.

Alternatively, marketplace expectancies for Fed charge cuts in 2024 have reduced. Nowadays, futures point out a 26% probability of a charge lower on the March 2024 coverage assembly. It’s down from a 33% probability the former week.

USD/JPY key occasions these days

- The United States S&P International Products and services PMI (Nov)

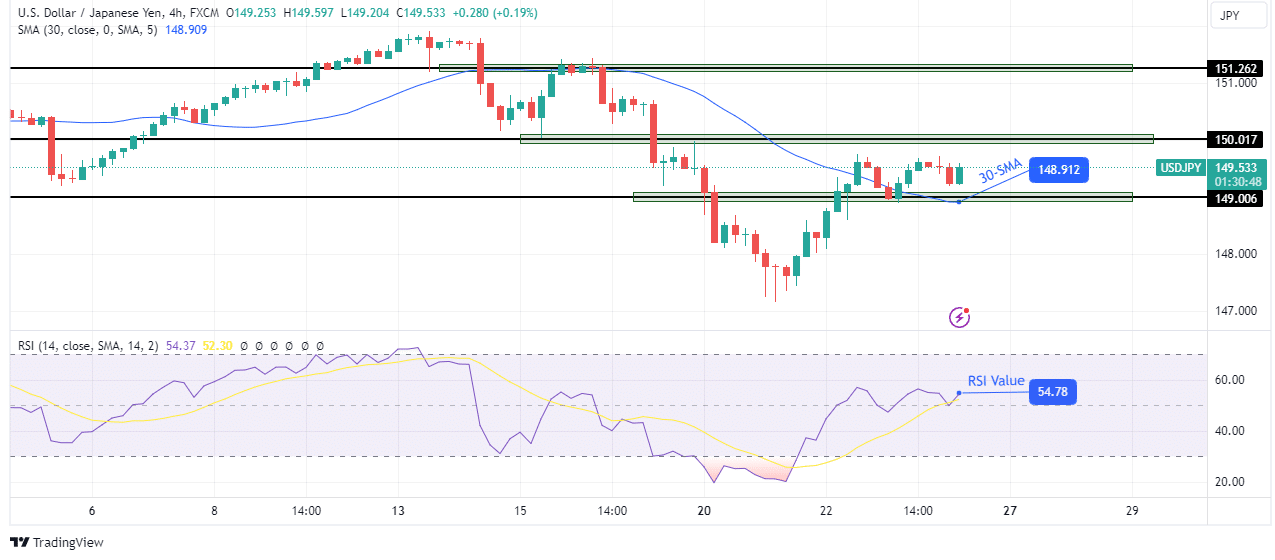

USD/JPY technical worth research: Bulls fight to sever ties with the 30-SMA

At the technical facet, the USD/JPY worth trades between the 149.00 improve and the 150.01 resistance stage. This transfer comes after bulls took over via pushing the cost above the 149.00 stage and the 30-SMA. Additionally, the RSI has risen above 50 to improve cast bullish momentum.

–Are you to be informed extra about crypto indicators? Test our detailed guide-

Alternatively, the cost continues to be pulling again to retest the SMA and is but to make a large bullish swing. Due to this fact, to substantiate the brand new bullish pattern, bulls will have to detach from the 30-SMA and take out the 150.01 resistance stage.

Having a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll be able to come up with the money for to take the prime chance of shedding your cash.