XAU/USD bears wiped the ground with the bulls, however will they emerge once more?

- Gold bears moved in for the kill and swept up the bulls and stake stops.

- The marketplace’s focal point will now flip to Fed chairman Jerome Powell.

Gold worth dropped on Tuesdays to finish the week’s opening steadiness between $1,933 and $1,910 spherical numbers. The yellow steel fell from a prime of $1,930.73 to a low of $1,910.89. Necessarily, the marketplace went after the cash at the drawback following a slender within day on Monday forward of key occasions for the times forward.

US-manufactured capital items these days abruptly rose in Might, however the prior month’s information used to be revised down. At the Russian entrance, dangers from the short-lived mutiny within the country seem to have been digested and at the again burner. In the meantime, investors are having a look forward to Federal Reserve Chair Jerome Powell’s speech along side a trove of key financial information on Thursday that would be offering clues on long term rate of interest hikes.

On the other hand, analysts at TD Securities say that they be expecting that this Friday’s Non-public Intake Expenditure record would possibly not corroborate the charges markets pricing of 17bp of hikes in July, specifically because the core PCE products and services ex-housing measure is more likely to put up its smallest building up since remaining July. ”Nevertheless, algos are not likely to gas further upside till costs wreck above the $2,010/oz. mark, suggesting that gold bulls might want discretionary investors to lose religion within the Fed’s hawkish tone for costs to renew their upward trajectory.”

Gold technical research

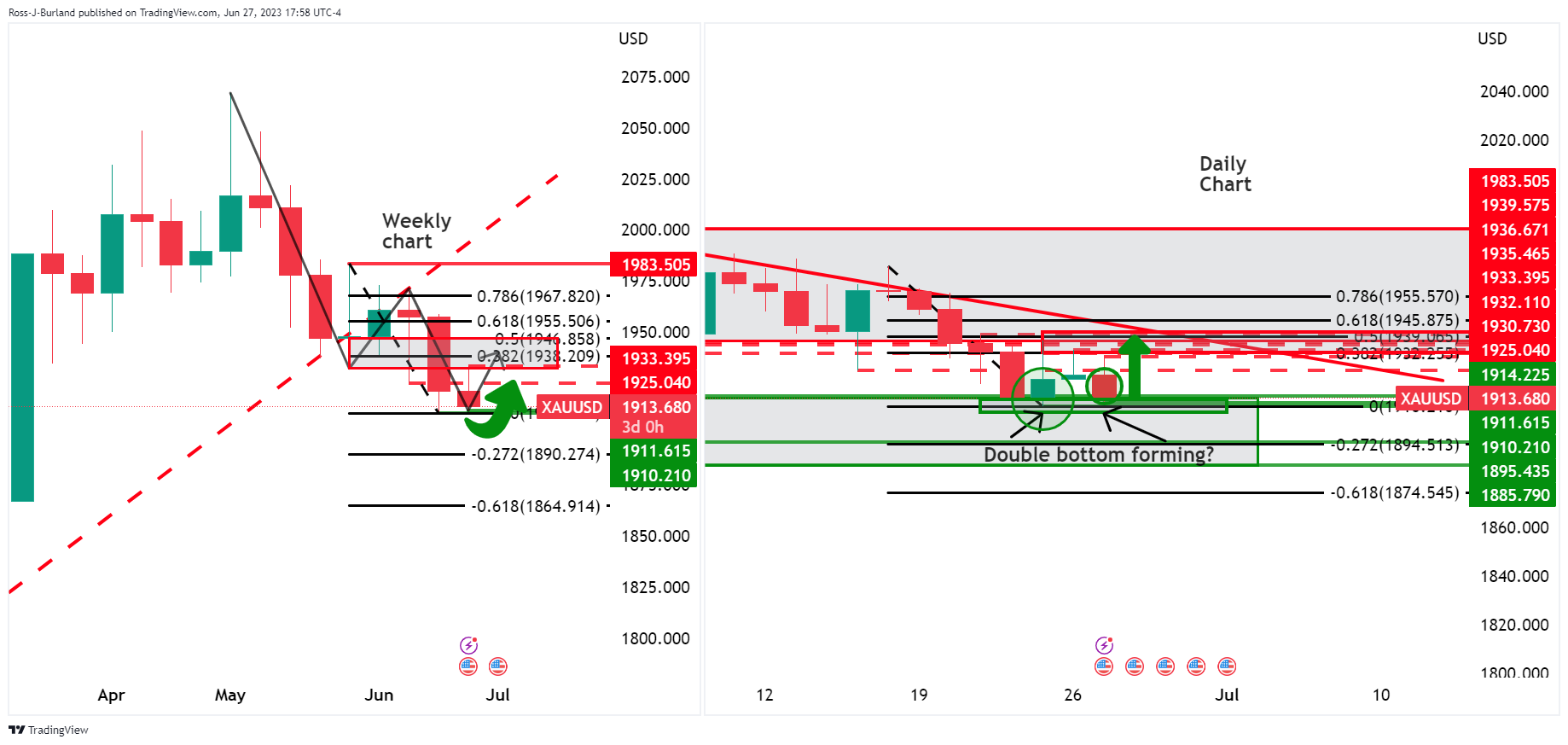

Technically, the USA Greenback is beneath drive at the weekly and day-to-day charts and this may well be the gas for the Gold insects. At the Gold weekly chart, we now have noticed a drawback extension that will have made a low and thus, the point of interest is at the upside. a 38.2% Fibonacci retracement of the newest drawback impulse’s vary at the weekly chart marries up with a 50% imply reversion house at the day-to-day chart into trendline resistance round $1,938/39. If the USD continues to become worse, this might result in a double backside on Gold’s day-to-day chart.