Will Fed’s Cushy Touchdown Have an effect on Euro?

- The Federal Reserve would possibly facilitate a clean financial touchdown.

- America financial system grew impulsively within the fourth quarter.

- Traders predict the Fed to ship a 25bps charge hike.

The EUR/USD weekly forecast is moderately bearish as easing US inflation and a resilient financial system may imply a cushy touchdown by way of the Fed.

Ups and downs of EUR/USD

On Friday, slowing inflation information fueled hopes that the Federal Reserve would possibly facilitate a clean financial touchdown and scale down its competitive financial tightening subsequent week. Because of this, the greenback crept up from eight-month lows.

–Are you to be told extra about day buying and selling agents? Test our detailed guide-

In keeping with a document from the Trade Division, US client spending declined for the second one consecutive month in December. The information additionally published the weakest building up in private source of revenue in 8 months, in large part because of average salary expansion – each just right indicators for inflation.

On Thursday, the greenback went up moderately in opposition to the euro after information published that america financial system grew briefly within the fourth quarter, bolstering the case for america Fed to deal with its hawkish stance.

The remaining quarter noticed an annualized expansion in america gross home product of two.9%.

Subsequent week’s key occasions for EUR/USD

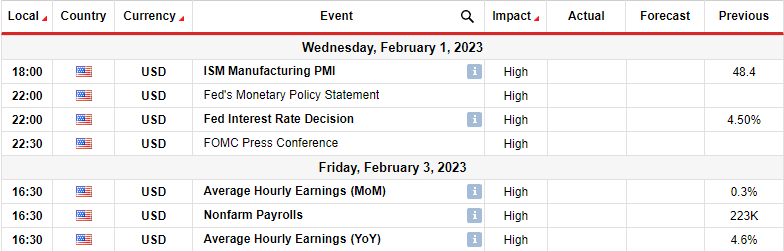

Traders be expecting essential information from america within the coming week, together with the FOMC rate of interest resolution and the nonfarm payrolls document.

Jerome Powell, the chair of the Fed, has made it abundantly glaring that the central financial institution’s struggle in opposition to decades-high inflation is some distance from carried out. Monetary markets wait for the central financial institution will lift the Fed finances goal charge by way of 25 foundation issues following its coverage assembly subsequent week.

EUR/USD weekly technical forecast: Coming near near pullback to the 22-SMA

The day by day chart presentations EUR/USD in a bullish pattern, with the cost buying and selling above the 22-SMA and the RSI above 50. Then again, the cost may be with regards to the 22-SMA, which means that bulls don’t seem to be absolutely dedicated to expanding the cost.

–Are you to be told extra about foreign exchange alerts? Test our detailed guide-

The associated fee has paused on the 1.0901 resistance, and bears have returned. This would imply a pullback within the coming week to retest the 22-SMA. The SMA improve coincides with the bullish trendline, making it a robust improve zone.

If bears damage beneath this zone, the cost will most probably fall to the following improve at 1.0503. Then again, if bulls cling directly to regulate, the cost will jump upper, retest, and almost definitely damage above the 1.0901 resistance.

Taking a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll come up with the money for to take the excessive chance of dropping your cash.