Why Buffett Helps to keep Purchasing Oil and Fuel Shares – R Weblog

Berkshire Hathaway (NYSE: BRK.B) purchased stocks of Occidental Petroleum Company (NYSE: OXY) once more within the first quarter of 2023. Recall that Warren Buffett’s fund has been making an investment on this corporate for the 5th consecutive quarter. Following the deal, Occidental Petroleum Company is the 6th biggest corporate by means of funding quantity within the fund’s portfolio. As well as, Berkshire Hathaway got stocks of Chevron Company (NYSE: CVX), which may be concerned within the oil and fuel sector.

Lately, we can provide an explanation for why the Oracle of Omaha is making an investment in those corporations at a time when inexperienced power is becoming more popular and attracting increasingly investments, whilst the oil and fuel sector is receiving a lot much less. We can have a look at the power sector and analyse how call for for standard power assets has declined, for the reason that extra environmentally pleasant and environment friendly choices exist.

The preferred power assets

Consistent with BP Statistical Overview of Global Power and Our Global in Information, international power intake higher by means of 15.3% from 2010 to 2021 inclusive, up from 152.96 to 176.43 TWh (terawatt according to hour).

Power intake in 2010

- Oil – 31.3%, 47.89 TWh

- Coal – 27.4%, 41.99 TWh

- Fuel – 20.65%, 31.58 TWh

- Firewood – 7.62%, 11.66 TWh

- Water energy – 6.2%, 9.518 TWh

- Nuclear power – 4.82%, 7.37 TWh

- Renewable power – 1.9%, 2.92 TWh

Power intake in 2021

- Oil – 29%, 51.17 TWh

- Coal – 25.2%, 44.47 TWh

- Fuel – 22.88%, 40.37 TWh

- Firewood – 6.29%, 11.11 TWh

- Water energy – 6.33%, 11.18 TWh

- Renewable power – 6.28%, 11.01 TWh

- Nuclear power – 3.98%, 7.03 TWh

Developments in international coal call for

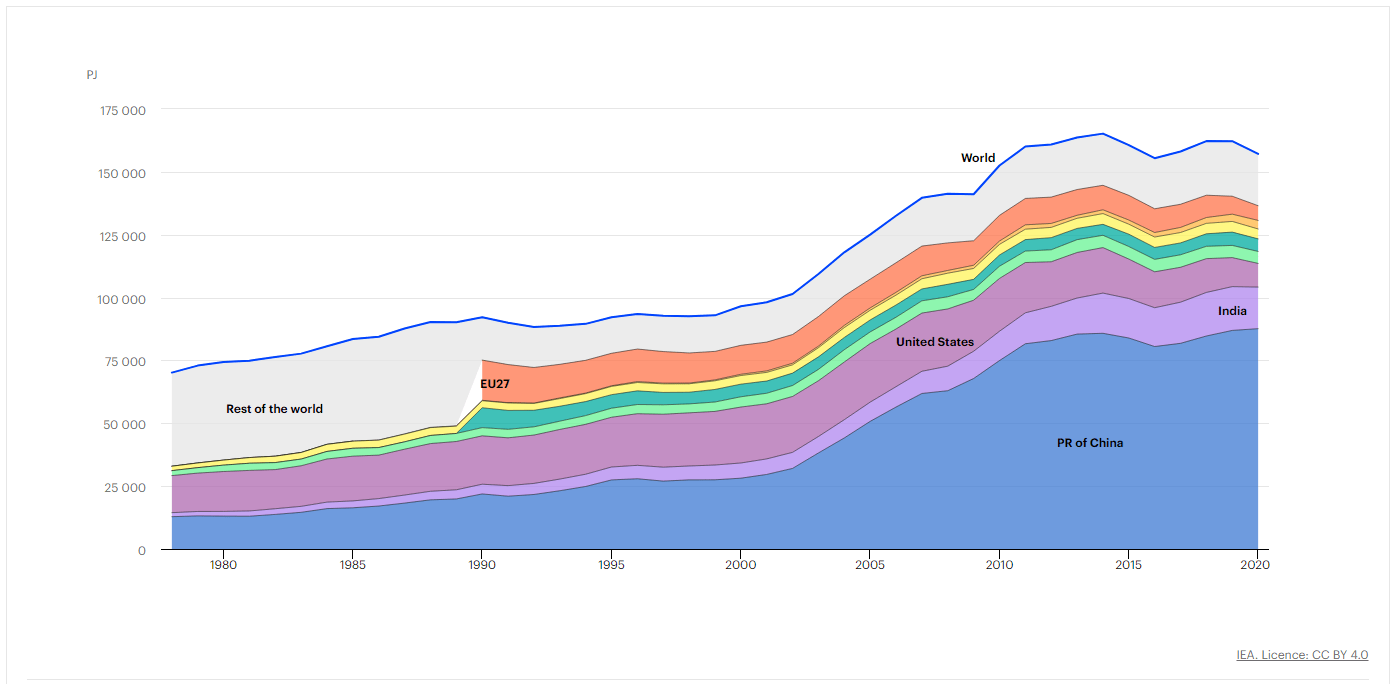

Of the power assets indexed above, coal is among the oldest and least environmentally pleasant. As well as, extra environment friendly choices have emerged with time. Given this, it may be assumed that call for for coal will have to have diminished. However consistent with the Global Power Company (IEA), international coal intake is expanding. It was once 70,160 PJ (Petajoule) in 1978 and rose to 157,164 PJ by means of 2020.

Notice that coal intake in China has higher markedly since 2002. On the similar time, coal manufacturing within the nation has risen impulsively, up from 1.04 billion to three.69 billion tonnes during the last 30 years. As well as, the improvement of recent coal mines continues within the nation.

Why is the call for for coal rising?

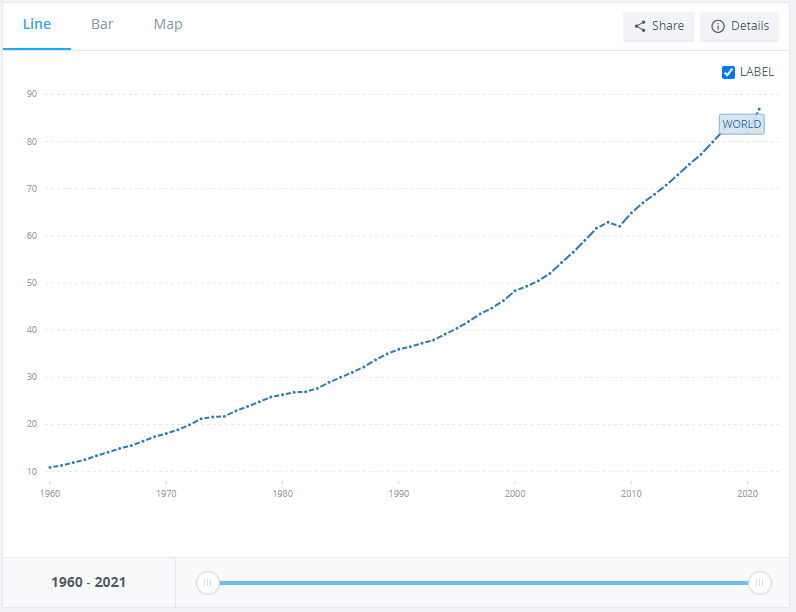

Hydrocarbons and nuclear power, which can be extra environmentally pleasant, didn’t get rid of the usage of coal however added to the listing of power assets. This was once more than likely because of the expansion of worldwide GDP and the inhabitants of the planet. Those components boosted the worldwide call for for power.

Consistent with Global Financial institution nationwide accounts information and OECD Nationwide Accounts information recordsdata, from 1960 to 2021 inclusive, international GDP has grown from 10.9 trillion to 86.8 trillion USD.

If international GDP continues to develop, renewable power assets aren’t more likely to substitute nowadays’s major assets however will complement them.

Investments within the oil business

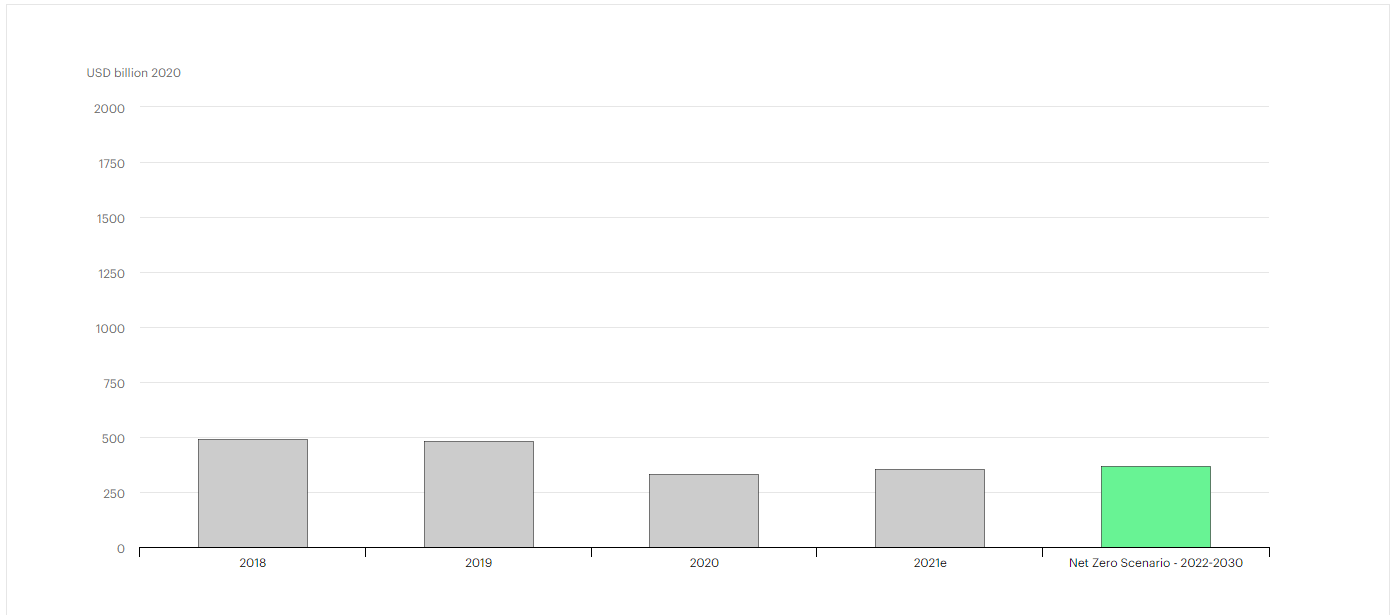

If international GDP continues to upward push, there will likely be a want to stay oil manufacturing at present ranges sooner or later. This may occasionally lend a hand keep away from a scarcity of oil as power intake rises.

To take care of manufacturing capability, it can be crucial to spend money on the improvement of recent fields to keep away from depletion of present reserves and stay alongside of call for. However amid the development for renewable power assets, investment for brand new oil traits has declined over the last few years.

Consistent with OPEC Secretary Basic Haitham Al Ghais, the oil and fuel sector calls for investments of 500 billion USD a 12 months, whilst the incoming quantity is far much less. In line with the IEA information, the quantity invested within the oil and fuel sector is on the degree of 366 billion USD according to 12 months, which is 24% lower than the 2018 quantity.

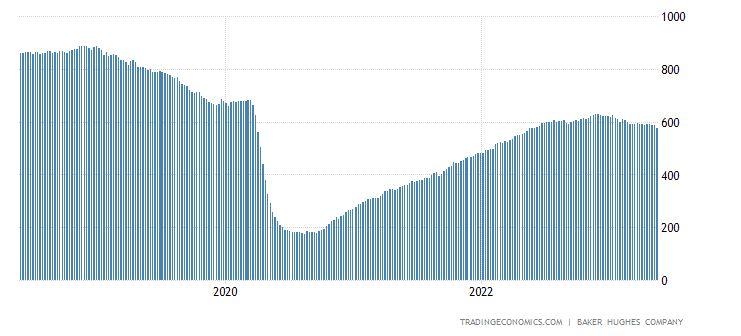

The location with drilling rigs additionally confirms the truth that funding within the oil and fuel sector is declining. As an example, the selection of rigs in the USA has dropped 37% since 2018.

What can scale back the call for for hydrocarbons?

Renewable power has a major downside: it’s volatile and is dependent upon the surroundings. Whilst leading edge applied sciences are being evolved to minimise the have an effect on of those components, they make energy manufacturing costlier. Nuclear fusion power may turn out to be an alternate sooner or later. Its major benefits are:

- Prime power potency. The power launched all through nuclear fusion is the densest type of power to be had. Moreover, the nuclear fusion response has a far upper power attainable than burning coal, oil, or fuel, and in addition greater than the atomic nuclear fission

- Environmental friendliness. Power manufacturing does no longer contain greenhouse fuel emissions into the ambience

On the other hand, the usage of nuclear fusion as a industrial power supply continues to be a problem for humanity: it’s dear, calls for the improvement of leading edge applied sciences, and isn’t but scalable. Scientists and engineers have no idea precisely how a lot time it’s going to take to put in force this venture.

Abstract

Berkshire Hathaway first purchased Occidental Petroleum Company inventory in 2019 and added Chevron Company stocks to the portfolio in 2020. A decline in oil manufacturing investments was once already noticeable in 2019, with the craze proceeding over the next years. Since then, Occidental Petroleum Company stocks rose 24% and Chevron Company inventory received 97%.

On the other hand, the fund isn’t locking in earnings however continues to shop for the stocks of those corporations. It may be assumed that Warren Buffett is making a bet on additional enlargement within the price of those shares, which is more likely to occur if oil costs stay solid or upward push. This situation is imaginable because of the ongoing enlargement of world GDP and decrease funding within the oil business.

Spend money on American shares with RoboForex on favorable phrases! Actual stocks will also be traded at the R StocksTrader platform from $ 0.0045 according to proportion, with a minimal buying and selling price of $ 0.5. You’ll additionally take a look at your buying and selling abilities within the R StocksTrader platform on a demo account, simply sign up on RoboForex and open a buying and selling account.