What’s OPEC, and How It Influences Crude Oil Costs – R Weblog

On this article, we can in finding out extra about OPEC and its actions. We will be able to have a look at the historical past of OPEC, and the way it was once established. We will be able to additionally attempt to analyse how the organisation influences international crude oil costs and insist.

What’s OPEC?

The time period OPEC (Group of the Petroleum Exporting International locations) refers to a bunch of 13 of the sector’s greatest oil-exporting nations. The organisation was once based in 1960 to coordinate the petroleum insurance policies of its member nations and the technical and financial cooperation amongst them. OPEC is headquartered in Vienna, the place the chief frame, the OPEC Secretariat, manages the daily operations of the organisation.

OPEC was once shaped in line with the Seven Sisters alliance, which integrated main global crude oil firms similar to British Petroleum, Exxon, Mobil, Royal Dutch Shell, Gulf Oil, Texaco, and Chevron. They adversely affected the advance of oil-producing nations whose herbal assets have been actively used.

In keeping with OPEC’s constitution, the organisation’s undertaking is to coordinate and unify the oil insurance policies of its member nations and stabilise the crude oil marketplace to make sure an effective and uninterrupted provide of black gold. The fundamental ideas guiding its paintings are oil for shoppers, strong source of revenue for manufacturers, and a good go back on capital for many who spend money on the crude oil trade.

The historical past of OPEC

OPEC was once created on the Baghdad Convention in September 1960 by means of officers from nations similar to Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Qatar, Indonesia, Libya, the United Arab Emirates, and Algeria joined within the Sixties adopted by means of Nigeria, Ecuador, Gabon, and Angola becoming a member of the organisation within the Seventies.

In December 2016, OPEC shaped an alliance with ten different oil-exporting nations: Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan, and Sudan. This new alliance is known as OPEC+.

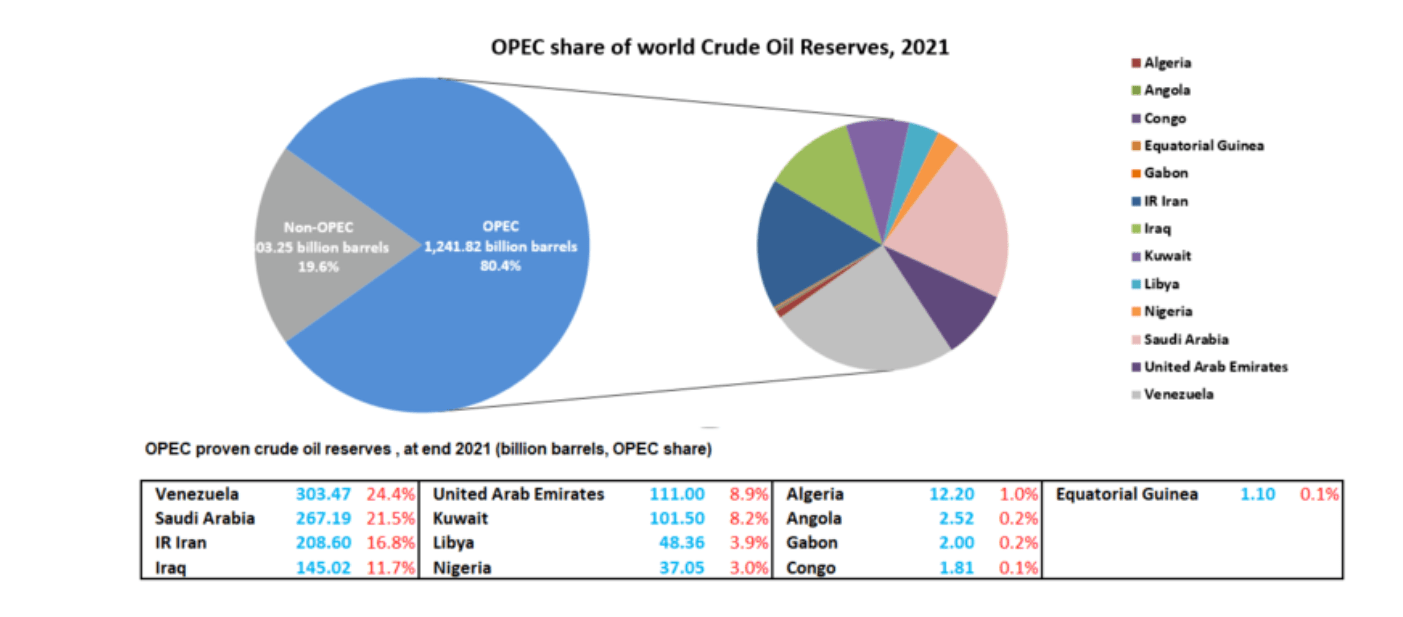

The club of the Organisation of Petroleum Exporting International locations has modified a number of instances over its historical past. As of January 2023, it has 13 nations as individuals, particularly Saudi Arabia, the United Arab Emirates, Venezuela, Nigeria, Libya, Kuwait, Iraq, Iran, Gabon, Algeria, Angola, Congo, and Equatorial Guinea.

One after the other, one of the crucial greatest oil-producing nations aren’t OPEC individuals, as an example, america, Canada, and China.

How OPEC impacts the cost of crude oil

Cartel individuals produce about 40% of the sector’s oil, and their exports account for approximately 60% of worldwide business in black gold. OPEC estimates that its member nations accounted for greater than 80% of the sector’s confirmed oil reserves in 2021.

Participants meet steadily to agree on how a lot crude oil to jointly promote on international markets. Each and every member nation is assigned its personal manufacturing quota to which it should adhere.

In case of sharp worth fluctuations, OPEC can keep watch over quotas and, via them, the sector’s crude oil provide. If the cost of the useful resource falls, OPEC reduces manufacturing – this reduces provide, thereby expanding costs. If the price of crude oil rises excessively, the cartel can building up manufacturing to assist carry costs down moderately.

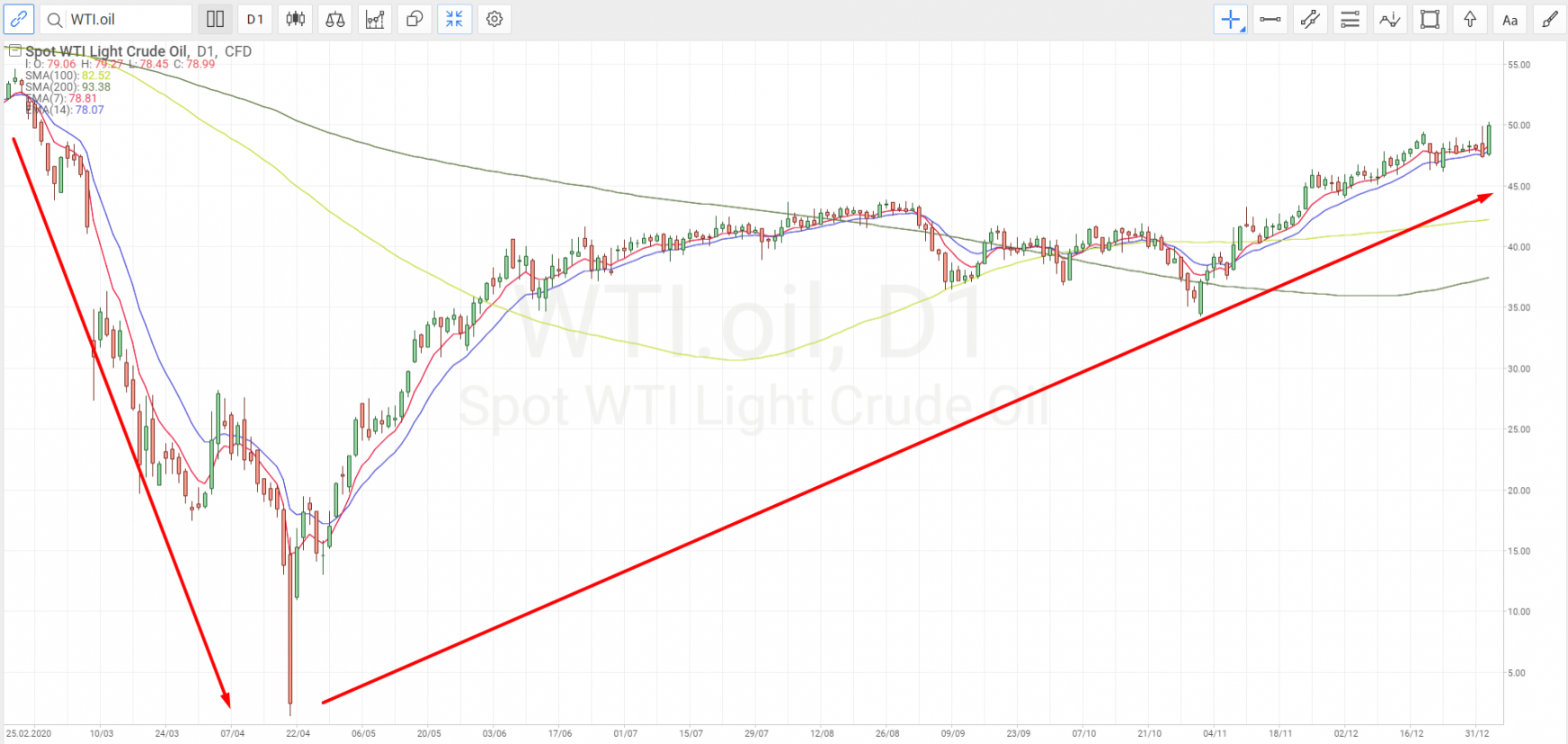

For instance, all the way through the commercial disaster of 2020 brought about by means of the COVID-19 pandemic, oil become very affordable: at one level, futures went from $50 according to barrel to even beneath 0. To stabilise costs, the OPEC+ contributors determined to considerably cut back the quantity of crude oil produced by means of slicing quotas. The availability stage fell, which made costs upward push steadily and rebound to the extent of $50 according to barrel by means of the tip of the 12 months. Sooner or later, the cost of crude oil reached $100/bbl.

Complaint of OPEC

OPEC grievance dates again to the Seventies when the organisation was once perceived as a monopoly. In 1973, member nations from the Heart East banned crude oil gross sales to the supporters of Israel within the Arab-Israeli battle, particularly america, Portugal, the Netherlands, and South Africa. Consequently, the cost of a barrel of crude oil quadrupled by means of 1974 and impacted end-users negatively with gasoline shortages, and the price of petrol skyrocketed. The embargo severely affected america and different economies.

In reaction, Western nations of their try to cut back their dependence on OPEC stepped up efforts to provide oil offshore within the Gulf of Mexico and the North Sea. Due to this fact, international oversupply and decrease call for ended in an important drop in the cost of black gold.

Nonetheless, some nations periodically accuse the cartel of collusion, in which they consider it manipulates the cost of crude oil by means of interfering with marketplace pricing.

The United States has drafted a invoice, NOPEC (No Oil Generating and Exporting Cartels), which might permit US courts to punish affiliation individuals and their companions for manipulating manufacturing volumes. However the challenge continues to be in draft shape.

The way forward for OPEC

The arena economic system wishes balance and predictability in relation to crude oil costs, manufacturing, and export volumes. Due to this fact, OPEC is prone to retain its place as a worth regulator within the quick time period. The cartel’s place appears reasonably strong within the context of the present power disaster, and the predicted enlargement in call for for black gold within the coming years.

It’s value noting, then again, that during the longer term, there are components that would cut back the affect of the organisation’s selections at the international economic system. Those may just come with an building up within the provide of inexpensive shale oil by means of non-alliance nations and an building up in the usage of renewable power assets.

Conclusion

The arena marketplace for crude oil and oil merchandise performs crucial function within the construction of person nations and the worldwide economic system. Established in 1960, the Organisation of the Black Gold Exporting International locations has through the years firmly established itself as the principle regulator of crude oil costs on this planet markets.

This alliance is prone to retain its main place within the coming years, however in the long term, it’s going to face demanding situations; in particular with the rising shale oil manufacturing international and the will of many nations to change to inexperienced power.