USD/JPY Worth Research: Buyers on Edge Forward of US Inflation

- America inflation state of affairs is now leaning against decrease ranges.

- The greenback index is poised for a weekly lack of roughly 0.73%.

- Knowledge published a 2.5% year-on-year building up in Japan’s core client costs for November.

Friday’s USD/JPY worth research used to be bearish, with the greenback susceptible and buyers at the edge as they eagerly expected US inflation information. Consistent with Chris Weston, the top of study at Pepperstone, america inflation state of affairs is now unbalanced and leaning against decrease ranges.

Additionally, the greenback index is poised for a weekly lack of roughly 0.73%, extending the former week’s 1.3% decline.

In the meantime, the yen held stable, unaffected through Friday’s information revealing a 2.5% year-on-year building up in Japan’s core client costs for November. It marked the slowest enlargement over a 12 months. Additionally, this eases drive at the Financial institution of Japan to reduce its considerable stimulus. Significantly, the core client worth index decelerated from the two.9% acquire in October.

Moreover, the Jap foreign money seems poised to finish the week flat. Previous within the week, the BoJ maintained its ultra-loose coverage settings and equipped few indications of when it will shift clear of unfavorable rates of interest.

In other places, the mins of the Financial institution of Japan’s October assembly published ongoing divisions amongst board individuals in regards to the timeline for Japan to fulfill prerequisites for an go out. In the meantime, a Reuters ballot carried out in November confirmed that over 80% of economists anticipated that the BoJ would conclude its unfavorable fee coverage subsequent 12 months.

USD/JPY key occasions these days

- US Core PCE Worth Index m/m

- Revised UoM US Client Sentiment

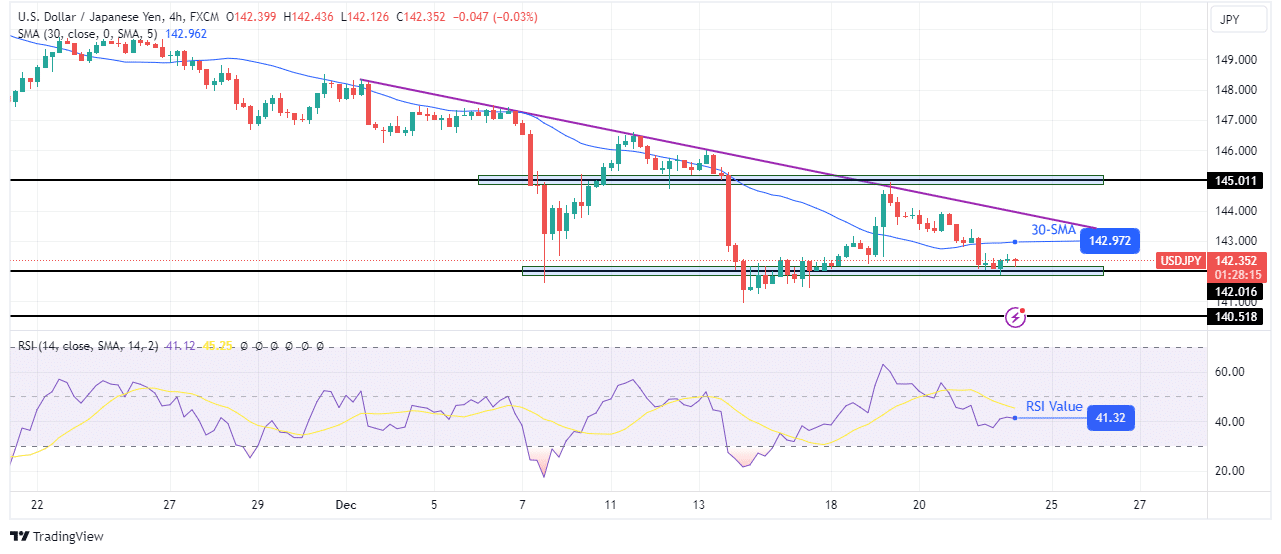

USD/JPY technical worth research: Worth returns to a very powerful 142.01 strengthen stage

At the charts, USD/JPY is again on the 142.01 strengthen stage. This comes after a failed try to opposite the rage. To begin with, patrons threatened to take regulate when dealers challenged the 142.01 stage a 2d time and failed to wreck under. Alternatively, the fee stopped on the resistance trendline and the 145.01 key stage.

–Are you to be informed extra about foreign exchange equipment? Take a look at our detailed guide-

Subsequently, dealers reversed the bullish transfer and driven the fee again under the 30-SMA. Dealers are difficult the 142.01 strengthen stage for a 3rd time. If they’re robust sufficient, the fee will wreck under and fall to the 140.51 stage and decrease. Alternatively, if the strengthen is company, bulls would possibly resurface.

Having a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll have enough money to take the prime chance of dropping your cash.