USD/CAD Worth Research: Hovering Oil Pours Water at the Rally

- Oil costs higher, pushed through geopolitical tensions and disruptions in US oil output.

- The United States greenback prolonged its fresh positive factors because of certain US exertions marketplace information.

- Economists watch for a zero.1% dip in Canada’s gross sales.

A bearish tone emerged within the USD/CAD worth research on Friday, propelled through surging oil costs amid geopolitical tensions and US output disruptions. The Canadian greenback recovered from a five-week low only a day previous, driving the wave of oil’s resurgence.

–Are you to be told extra about foreign exchange choices buying and selling? Test our detailed guide-

Adam Button, leader forex analyst at ForexLive, remarked, “The Canadian greenback wanted a spice up from the oil marketplace, and after all, oil noticed an uptick.”

Oil rose after the World Power Company forecasted a strong world oil call for. Additionally, there have been disruptions in US crude output brought about through chilly wintry weather climate. Moreover, oil were given make stronger from a considerable weekly attract crude inventories.

On Thursday, the IEA higher its forecast for world oil call for expansion in 2024. Then again, its upper projection nonetheless falls beneath OPEC’s expectancies.

Traders are watching for the November Canadian retail gross sales information free up for Friday. This represents the overall main financial document earlier than the Financial institution of Canada’s rate of interest choice subsequent week. Economists watch for a zero.1% dip in gross sales. Adam Button famous, “Friday’s retail gross sales document will most probably spotlight the distinction between Canadian and US customers, influencing the forex greater than anything else.”

In the meantime, america greenback remained robust following certain US exertions marketplace information, which diminished expectancies of a Fed price reduce.

USD/CAD key occasions lately

- Initial US shopper sentiment document

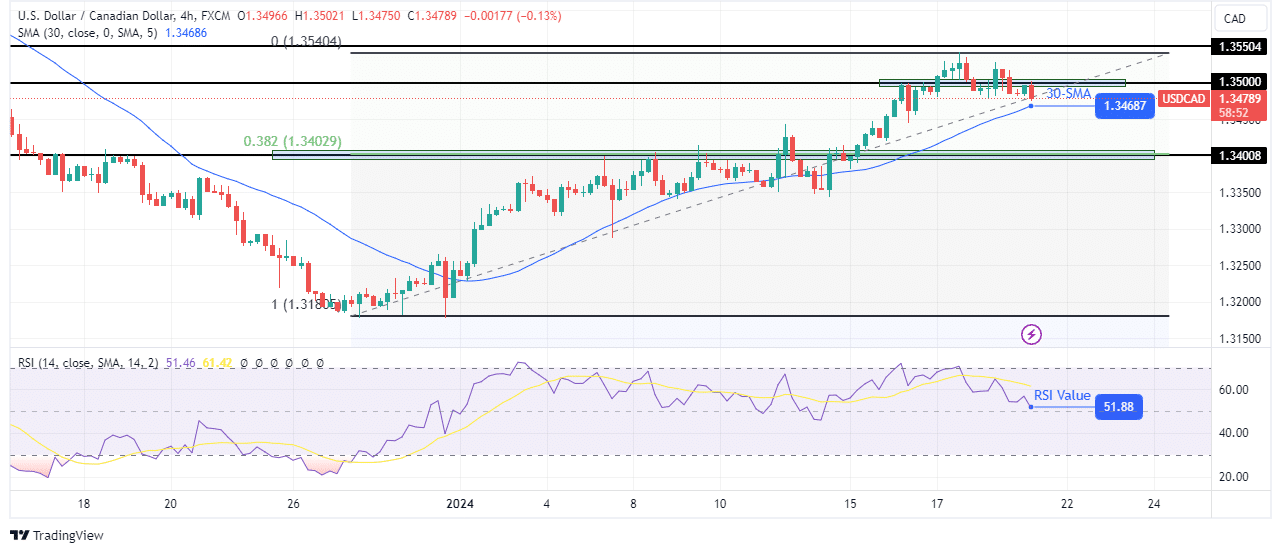

USD/CAD technical worth research: Worth prone to revisit 0.382 fib

At the technical aspect, the USD/CAD worth is pulling again to problem the 30-SMA make stronger. The cost met robust resistance on the 1.3500 key stage. To start with, it resulted in forming a bearish engulfing candle, appearing bears had been in a position to take over.

Nonetheless, the bulls had some power to push the cost above 1.3500, despite the fact that it was once briefly rejected above this stage. Bears made but any other engulfing candle, resulting in the decline against the 30-SMA.

–Are you to be told about foreign exchange robots? Test our detailed guide-

On the similar time, the RSI is readily shedding to 50, a pivotal stage. There’s a top likelihood bears will stay up the decline to wreck beneath the 30-SMA. Later on, the cost will most probably retest the make stronger zone comprising the 0.382 fib stage and the 1.3400 make stronger.

Having a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must imagine whether or not you’ll come up with the money for to take the top chance of dropping your cash.