USD/CAD Weekly Forecast: BoC-Fed Divergence Favors Bears

- The Canadian financial system skilled its 3rd consecutive month of slow efficiency.

- Canada’s annual inflation fee stayed at 3.1% in November.

- US costs skilled their first decline in over 3 1/2 years in November.

The outlook takes a bearish flip within the USD/CAD weekly forecast because the Financial institution of Canada urges warning, deeming it untimely to watch for fee cuts. In the meantime, in the USA, buyers be expecting fee cuts in 2024 towards the backdrop of softer inflation.

–Are you to be told extra about foreign exchange choices buying and selling? Test our detailed guide-

Ups and downs of USD/CAD

The pair had a bearish week because the Canadian greenback reinforced with oil costs amid provide issues. Additionally, the forex weakened because of a decline within the greenback after the core PCE index file.

In November, US costs skilled their first decline in over 31/2 years. This downturn greater expectancies of an rate of interest reduce through the Federal Reserve in March.

In the meantime, the Canadian financial system skilled its 3rd consecutive month of slow efficiency in October. Additionally, economists expect a modest enlargement outlook for November. The central financial institution asserts that it’s untimely to watch for fee cuts. Then again, monetary markets be expecting a decline in rates of interest beginning in April.

In different places, Canada’s annual inflation fee stayed at 3.1% in November, surpassing the central financial institution’s 2% goal.

Subsequent week’s key occasions for USD/CAD

There are not any key occasions subsequent week as markets will likely be closed for Christmas. Due to this fact, buyers will get ready for subsequent 12 months.

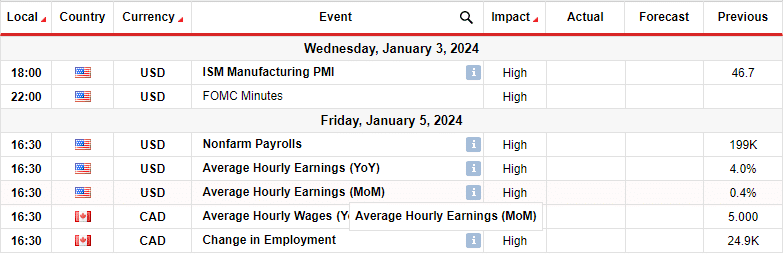

The brand new 12 months will get started with main stories from the USA, together with the FOMC assembly mins and the per thirty days employment file. In a similar fashion, Canada will liberate knowledge on employment exchange.

Investors will likely be willing at the FOMC assembly mins as they could comprise clues at the Fed’s coverage outlook.

In the meantime, the employment stories from the USA and Canada will affect selections on the subsequent Fed and BoC coverage conferences.

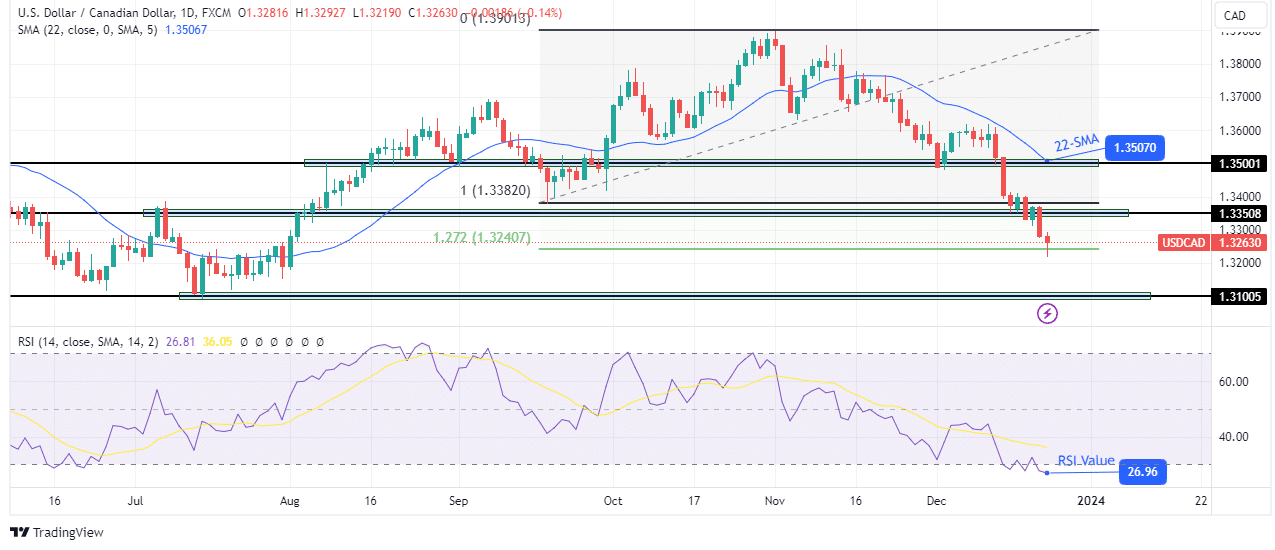

USD/CAD weekly technical forecast: Decline pauses on the 1.27 fib extension degree

The USD/CAD worth has damaged underneath main give a boost to ranges, strengthening the bearish bias. After respecting the 22-SMA as resistance, the cost fell during the 1.3500 and 1.3350 give a boost to ranges. On the similar time, it fell neatly underneath the SMA, appearing a steep and strong bearish transfer. In the meantime, the RSI dipped into oversold territory, supporting forged bearish momentum.

–Are you to be told extra about foreign exchange equipment? Test our detailed guide-

Then again, the cost has additionally prolonged to a robust fib give a boost to degree at 1.27. Due to this fact, bulls would possibly get the danger to push the cost off this give a boost to degree to retest the 1.3350 key degree or the 22-SMA. Then again, the cost will then most likely proceed decrease with the following goal on the 1.3100 give a boost to.

Having a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll find the money for to take the top possibility of dropping your cash.