USD/CAD Outlook: Loonie Strengthens Following Oil Value Surge

- The Canadian greenback reinforced after an enormous surge in oil costs on Wednesday.

- The EIA reported a higher-than-expected attract crude inventories closing week.

- Investors be expecting US information on wholesale inflation, retail gross sales, and preliminary jobless claims.

The USD/CAD outlook is dim on Thursday because the Canadian greenback features momentum, driving prime on a considerable oil worth surge from the former consultation. In the meantime, america greenback treads cautiously as buyers brace for an important financial information

–Are you curious about studying extra about earning money with foreign exchange? Test our detailed guide-

USD/CAD traded close to lows hit on Wednesday as oil costs rallied. Particularly, the rally in oil costs got here after the EIA reported a higher-than-expected attract crude inventories closing week. On the identical time, gas shares had a bigger-than-expected decline, appearing expanding call for.

On the identical time, the Canadian greenback stays robust amid a powerful economic system and relatively hawkish policymakers. Closing week, the Financial institution of Canada held charges and mentioned it used to be too early to believe charge cuts. In the meantime, different main central banks, together with the Fed, are inching nearer to charge cuts.

Moreover, employment information from Canada printed a powerful hard work marketplace that can give the BoC enough space to carry greater rates of interest. Traders are actually anticipating information on production gross sales. This would possibly give extra clues at the state of the economic system.

In the meantime, the greenback used to be range-bound as investors stayed at the sidelines forward of key financial information. Bets for a June Fed charge reduce have fallen from 71% to 65%. Particularly, fresh information has had little affect at the outlook for Fed coverage. The United States has launched combined information appearing a weaker hard work marketplace and nonetheless prime inflation.

These days, investors are waiting for information on wholesale inflation, retail gross sales, and preliminary jobless claims. Those studies would possibly exchange the outlook for Fed coverage forward of subsequent week’s Fed assembly.

USD/CAD key occasions as of late

- US retail gross sales

- US wholesale inflation

- US jobless claims

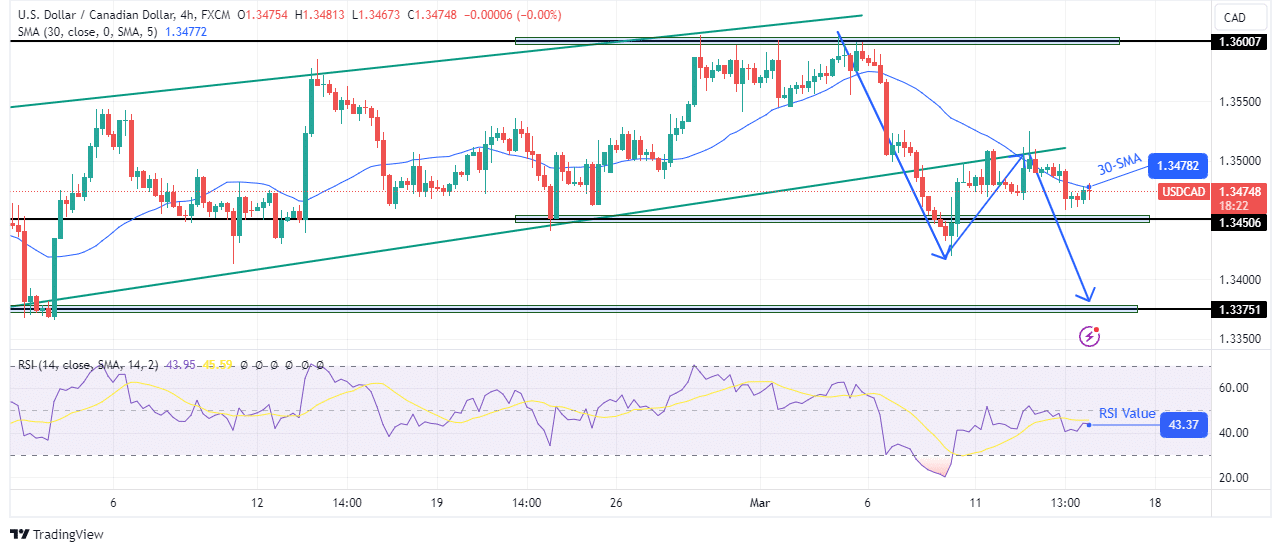

USD/CAD technical outlook: Value reverses after retesting channel improve.

At the charts, USD/CAD is bouncing decrease after retesting the lately damaged channel improve. On the identical time, the fee retested and revered the 30-SMA resistance. In the meantime, the RSI has stayed underneath the pivotal 50 stage, appearing forged bearish momentum.

–Are you curious about studying extra about MT5 agents? Test our detailed guide-

On the other hand, bears haven’t begun to substantiate the new channel breakout. They will have to push underneath the 1.3450 key improve stage to make a decrease low to try this. If this occurs, the fee will most probably retest the 1.3375 improve stage and get started a downtrend.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll come up with the money for to take the prime chance of shedding your cash