U Energy IPO: Battery Alternative Stations for Electrical Automobiles in China – R Weblog

Nowadays we’re introducing U Energy Restricted, which is growing speedy battery-changing era for electrical automobiles, and is development the corresponding stations in China. This Chinese language corporate will move public at the NASDAQ alternate on 23 March below the ticker image UCAR.

We can move into element concerning the U Energy Restricted IPO, the issuer’s industry type, the outlook of its addressable marketplace; and describe its monetary scenario, identify its major competition, and listing its strengths and weaknesses, and the main points of its coming near near IPO.

U Energy briefly

U Energy Restricted was once based in 2013 as a automobile distributor, however then started to expand UOTTA era, which permits speedy battery substitute in electrical automobiles and industrial cars. As well as, UOTTA makes it conceivable to trace the site of the closest battery substitute stations and optimise using routes.

The electrical battery substitute carrier is in call for within the Chinese language marketplace as it handiest takes 3-5 mins to switch a battery, which is considerably lower than the time it might take to completely fee it.

Within the PRC, the issuer operates below the U Energy emblem. Headquartered in Shanghai, the corporate is headed by way of Jia Li who’s the founder, CEO and Chairman of the Board of Administrators. He was once prior to now vice chairman of SAIC-GMAC Automobile Finance Corporate Restricted and Siemens Ltd. China.

The industry of changing batteries in electrical automobiles accounts for greater than 70% of U Energy Restricted’s revenues. The corporate’s control due to this fact plans to allocate greater than 40% of the finances raised on the IPO for construction of this industry. It must be famous that China is among the international leaders within the selection of environmentally pleasant cars at the nation’s roads. This might turn out to be a driving force for the improvement of this trade.

U Energy Restricted, in its makes an attempt to optimise and adapt its battery substitute era for industrial electrical cars, is development partnerships with native automotive producers and start-ups.

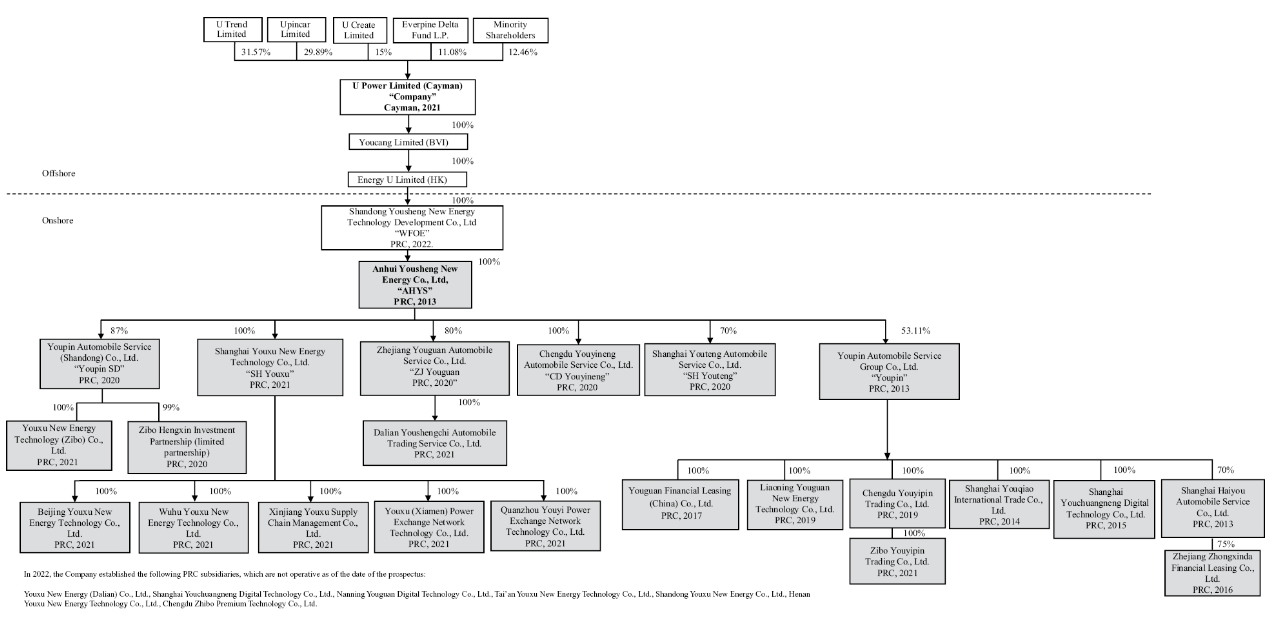

As of 30 June 2022, the volume of funding raised by way of U Energy Restricted reached 54.2 million USD. The principle traders are U Create Restricted, Everpine Delta Fund LP, and U Development Restricted.

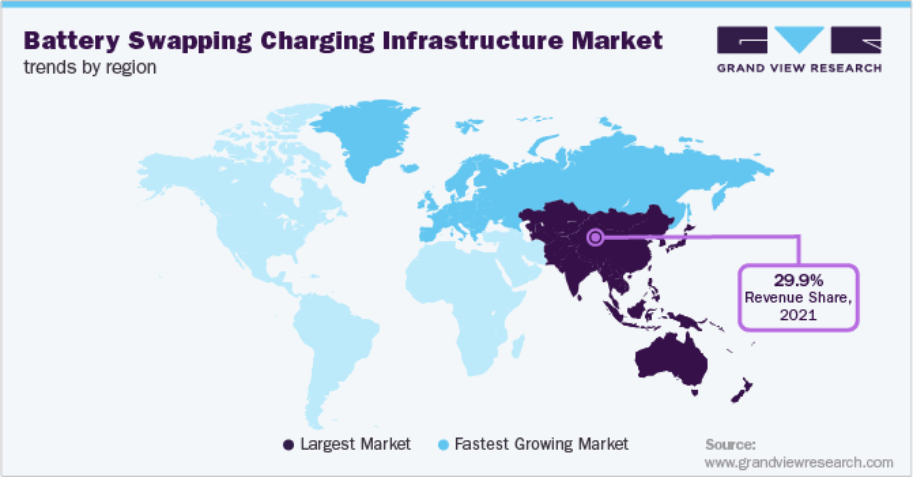

Possibilities for the U Energy addressable marketplace

In step with Grand View Analysis, the worldwide marketplace estimate for electrical automobile battery charging infrastructure was once 166.5 million USD in 2021. It’s anticipated to succeed in 872 million USD in 2030. The projected compound annual expansion charge (CAGR) from 2022 to 2030 inclusive is 20.2%.

Major competition:

- Kwang Yang Motor Co. Ltd.

- Lithion Energy Non-public Restricted

- Panasonic Holdings Company

- BYD Co. Ltd.

- Solar Mobility Non-public Restricted

- Tesla Inc.

- NIO Inc.

- Gogoro Inc.

U Energy’s monetary efficiency

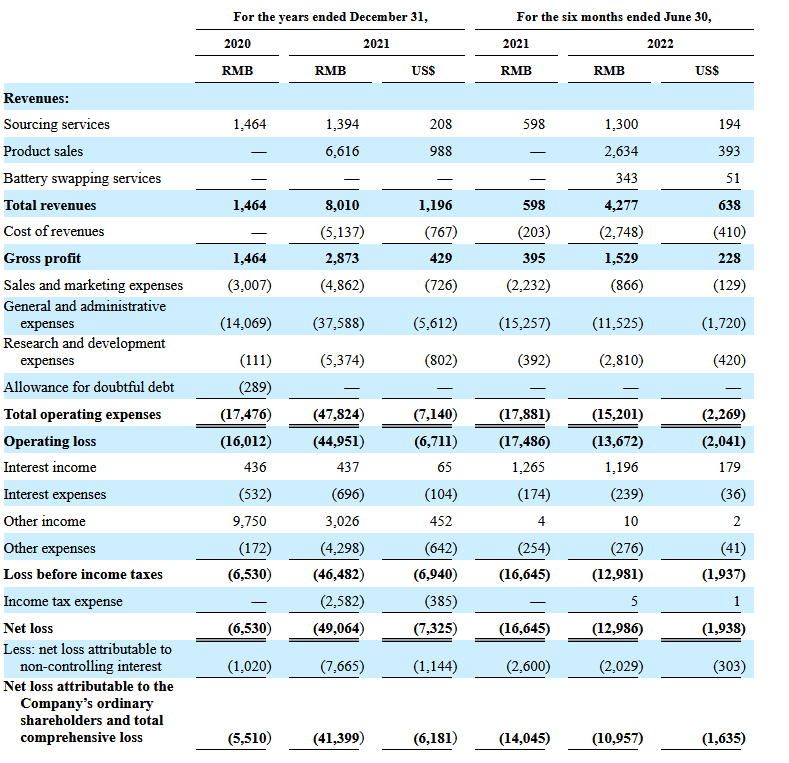

U Energy Restricted’s 2021 earnings amounted to one.2 million USD, an build up of 447.13% from the former yr. From January to June 2022 inclusive, earnings skyrocketed 615.22% to 0.64 million USD in comparison to the statistics for a similar length in 2021. From July 2021 to June 2022 inclusive, revenues reached 1.75 million USD. The calculation is in keeping with the alternate charge for 30 June 2022, at which 1 USD equals 6.69 CNY.

The issuer’s web loss for the yr 2021 was once 7.33 million USD, which is 611.82% greater than the statistics for the yr 2020. From January to June 2022 inclusive, the indicator declined by way of 22.01% to 1.94 million USD in comparison to the similar length in 2021.

As at 30 June 2022, U Energy Restricted’s web money go with the flow was once damaging and had reached 12.5 million USD. All over the similar length, the corporate had 1.8 million USD in its accounts, with overall liabilities achieving 9.8 million USD.

Strengths and weaknesses of U Energy

Strengths:

- A promising addressable marketplace

- Leading edge era advanced in-house

- Certified control

- Earnings expansion

- Web loss aid

Weaknesses:

- Fierce pageant

- Dependence at the criminal framework of the PRC

- Loss of web benefit

What we all know concerning the U Energy IPO

AMTD Wealth Control Answers Workforce Restricted and WestPark Capital, Inc. are the underwriters for the U Energy Restricted IPO. The issuer plans to promote 2.5 million not unusual stocks on the introduced reasonable worth of 7 USD according to unit. Gross proceeds from the sale of shares will quantity to USD 17.5 million, except the sale of choices by way of the underwriter. The company’s marketplace capitalisation may just achieve USD 367.5 million.

There’s a chance that the issuer’s P/S (capitalisation/revenues) more than one will achieve 210. One of these price might be regarded as over the top for a consultant of the sphere. Alternatively, expansion within the lock-up length is conceivable in case of beneficial marketplace prerequisites.

Spend money on American shares with RoboForex on favorable phrases! Actual stocks can also be traded at the R StocksTrader platform from $ 0.0045 according to proportion, with a minimal buying and selling price of $ 0.5. You’ll be able to additionally check out your buying and selling abilities within the R StocksTrader platform on a demo account, simply sign up on RoboForex and open a buying and selling account.