The Curse of Revenge Buying and selling and How you can Keep away from it within the Long term

Are You a Revenge Dealer?

Whilst it will sound like the latest superhero saga to look within the Surprise Universe, Revenge Buying and selling is the rest however a hero’s paintings.

To the contrary, revenge investors are to be feared and have shyed away from. They’re investors who fail to confess when their trades are going against a loss or who refuse to just accept that they’re dropping and lacking their day by day targets.

Those anti-heroes have a destructive sense of failure and normally need to overcompensate. Glance your self within the replicate and ask your self – “Am I a revenge dealer?”

So as to compensate, the revenge dealer will nearly all the time chart a route this is propelled by way of feelings. In an trade the place buying and selling plans and preparation are the keys to sustained luck, emotional impulses are all the time a erroneous method.

When revenge dealer settles into the dropping mentality, each and every time they lose, they are attempting to mend it right away, leaning closely on emotionally pushed responses and reactions and not more on analytical or methodical idea processes. On this heightened emotional state, the revenge dealer loses their sense of professionalism and motels to looking to atone for their losses thru using poorly thought-out power.

What revenge buying and selling looks as if

Revenge buying and selling begins or is caused by way of an preliminary quite massive loss. After that loss, the dealer begins to conquer the massive loss with greater trades or a couple of deficient trades, which simplest makes issues worse. What can have been an remoted loss finally ends up turning into a catastrophic drawdown or margin name.

Know the Caution Indicators

Crucial factor for investors to grasp referring to this syndrome (revenge buying and selling) is that it’s quite common. As discussed above, it’s an emotional state that virtually any dealer would possibly fall into with out the right kind caution and avoidance methods in position. As soon as conscious about those pitfalls, the following factor a dealer has to do is know the way to steer clear of them.

If, for some explanation why, a dealer knew about revenge buying and selling however couldn’t steer clear of falling into its clutch, they wish to minimize their emotions and acknowledge their dangerous footing of their portfolio right away.

Let’s say, for instance, you’re struggling a chain of losses, you’re going clear of making your day by day purpose, and also you’re in point of fact wired. Take a step again and ask your self, “am I entering an emotional state the place it’s of the maximum significance that I make up all of my losses as briefly as imaginable?” if the solution is sure, you could be inflamed with the revenge dealer syndrome. Our skilled recommendation is to forestall the whole thing and make it fast.

For those who’re in it, you’re most certainly the kind of dealer who would fail to confess that you just’re able to taking losses. It’s possible you’ll fail to needless to say the marketplace doesn’t care about what you’re doing. Looking to be triumphant out there would possibly have turn out to be a more potent impulse than following the marketplace prudently and making affordable choices in accordance with what you learn about.

Most significantly, your idea of dropping trades is similar to failure. Know that taking losses in line with your plan isn’t a failure. Convince your self that that is the precise method and you’ll’t power your self. If you neglected it, right here is a brilliant information for the right way to embody one of these psychological state.

Watch our Right kind Mindset for Investors

Form of Buying and selling that Happens Whilst Below the Affect of Revenge Buying and selling

No longer all revenge investors are created similarly, regardless that, as there are various kinds of buying and selling that may occur whilst within the revenge state.

- Dealer overtrades and forces trades and research – This breed of revenge buying and selling could be very impulsive, and with out right kind research, the dealer would trade path, input the similar place at other costs, and endure extra losses.

- The “no loss slicing” revenge dealer – On this archetype, as a substitute of slicing losses and looking to regroup in line with a legitimate funding plan, the revenge dealer would possibly hedge the industry. Because it’s in this checklist, you’ll most certainly inform it’s a nasty thought, however we’ll say it anyway – it is a unhealthy thought. When investors do that, they delay the true choice making of when to unravel their industry. This leads many investors to get at a loss for words and in the end caught with out the power to get better. At one level you’ll must do away with one of the vital hedge aspects and the loss on the time of the preliminary hedge will stay regardless of the place the marketplace in the end ends. Keep away from hedging, it’s nearly by no means a viable answer for convalescing a loss.

- Probably the most reckless of all revenge investors is in all probability those that as a substitute of exiting a loss, hang the loss and buys a place at a most popular value. They are going to reasonable a greater access value however it is a deceptive technique as a result of for the reason that marketplace is going in zig-zags, it’s going to in reality get you on a break-even. Via doing so and succeeding to get out of this example, you’re being deceived and perilous destructive results on your profession. Time and again it’s going to be to your choose and also you smash even, on the other hand it simplest takes one time that it doesn’t and also you’re so heavy at the different aspect, you’ll fall extremely fast and hit your finish of the street margin name and smash the account. It’s an amazing quantity of labor for a ridiculously fast account crash.

How you can Organize If You’re Inflamed with The Revenge Dealer Syndrome

If you realize that you just’re a revenge dealer, as we’ve discussed, first are aware of it’s undeniably unhealthy on your portfolio. From there, you’ll attempt to maintain your psychological state.

- Trainer your self into now not permitting your self to ever get right into a place wherein you could mutate from a legitimate thoughts right into a wild revenge dealer. It’s a deadly emotional state that simplest grows the extra you attempt to all of a sudden react towards it. Buying and selling in an emotional state will all the time open you as much as abuses from the marketplace and just a centered and well-reasoned dealer can steer clear of getting knocked out by way of the marketplace.

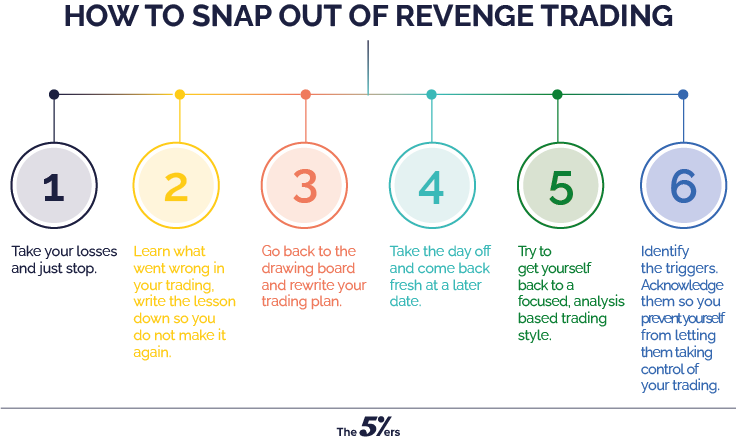

- Attempt to get your self again to a centered, research primarily based buying and selling taste. If you’ll’t, take your losses and simply forestall. Losses aren’t a failure, bear in mind! Return to the drafting board and rewrite your buying and selling plan.

- Stay the focal point on making reasoned choices. If you’ll’t, take the day without work and are available again contemporary at a later date. Being a revenger dealer will devastate your buying and selling and will by no means hang over a long run buying and selling means. Lend a hand unfold consciousness and let’s beat this syndrome/curse as soon as and for all!

- Take a smash and be informed from the error. A industry would possibly fail, however that doesn’t make you a failure. Take a step again and be informed what went unsuitable to your buying and selling, write the lesson down so you don’t make it once more.

- Establish the triggers. Revenge buying and selling could be caused by way of various factors in each and every dealer. Recognize them so that you save you your self from allowing them to taking regulate of your buying and selling.

How you can steer clear of revenge buying and selling someday

As we discussed, it’s crucial to grasp what would cause your revenge buying and selling conduct. After getting that during position, you wish to have to report the the reason why you’ve got misplaced a undeniable industry. Have in mind dropping trades are unavoidable and is a part of the buying and selling trade, so you should definitely are taking proper trades and bear in mind a few of the ones will finally end up dropping cash.

A small loss could be very not going to cause a revenge buying and selling angle, so you should definitely industry small place sizes, so you don’t get emotionally connected to a undeniable industry.

Finally, if you are feeling like expanding your lot dimension to conquer a loss, simply don’t! Forestall your self and stroll clear of the pc.

Revenge Buying and selling Abstract

Revenge buying and selling is without doubt one of the maximum not unusual and devastating behaviors investors can enjoy. It’s going to much more likely provide itself after a large loss or a dropping streak, main investors to extend place dimension and the collection of trades taken. All investors will perhaps enjoy it once or more, so you should definitely determine it as soon as it will get to you. In that method, it is possible for you to to stop it from destructive your account, and steer clear of it to your buying and selling efficiency.

👉 If you wish to obtain a call for participation to our are living webinars, buying and selling concepts, buying and selling technique, and top quality foreign exchange articles, signal up for our Publication.

👉 Click on right here to test our investment methods.

👉 Don’t pass over our the Forex market Buying and selling Concepts.

Practice us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView