Technical Research & Forecast November 09, 2023 – R Weblog

The cost of gold continues to drop. As well as, we will be able to additionally check out the present traits for the EUR, GBP, JPY, CHF, AUD, Brent, and the S&P 500 index.

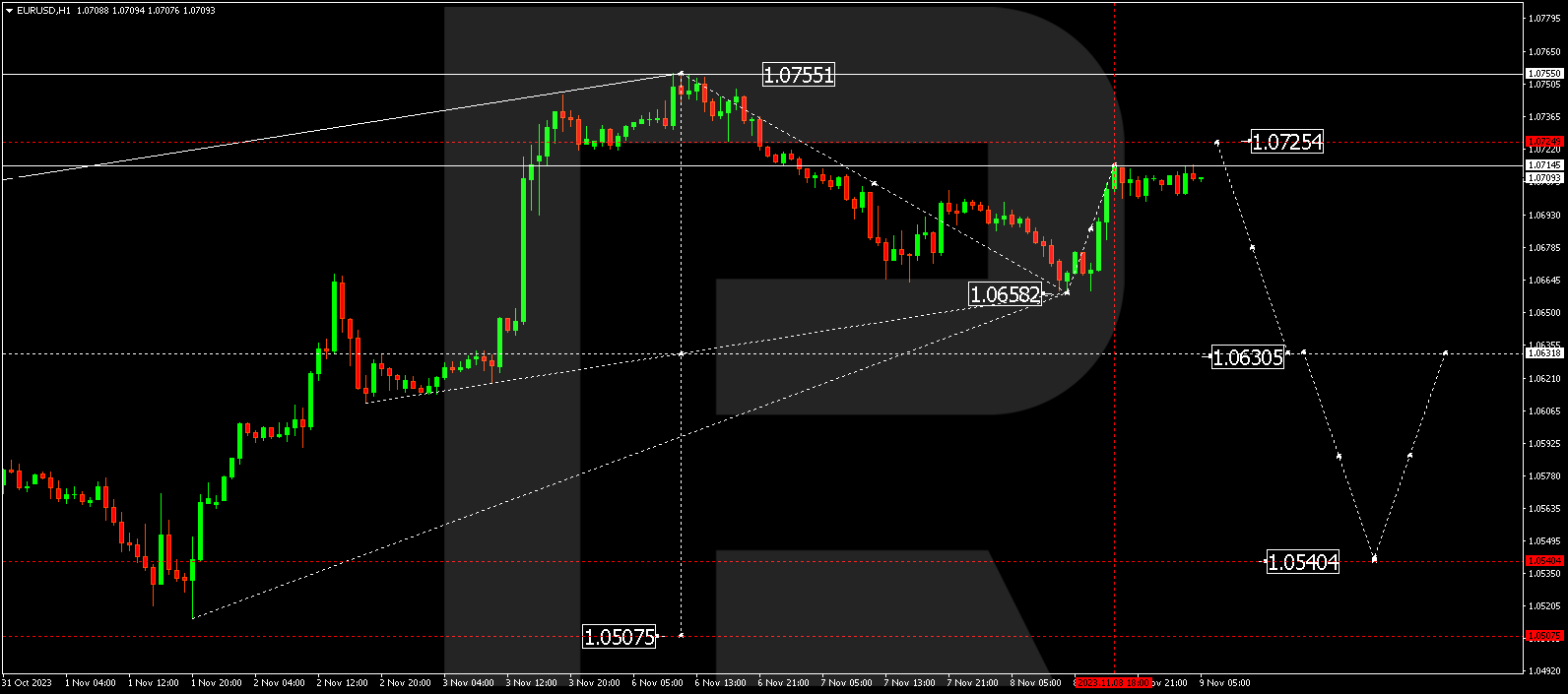

EUR/USD (Euro vs US Buck)

The EUR/USD pair has finished a downward motion, achieving a low of one.0658 earlier than correcting to one.0714 these days. There’s a risk of an additional correction to one.0725. Alternatively, if the pair breaks beneath the extent of one.0630, we will be expecting a possible decline to one.0540, which is our present goal.

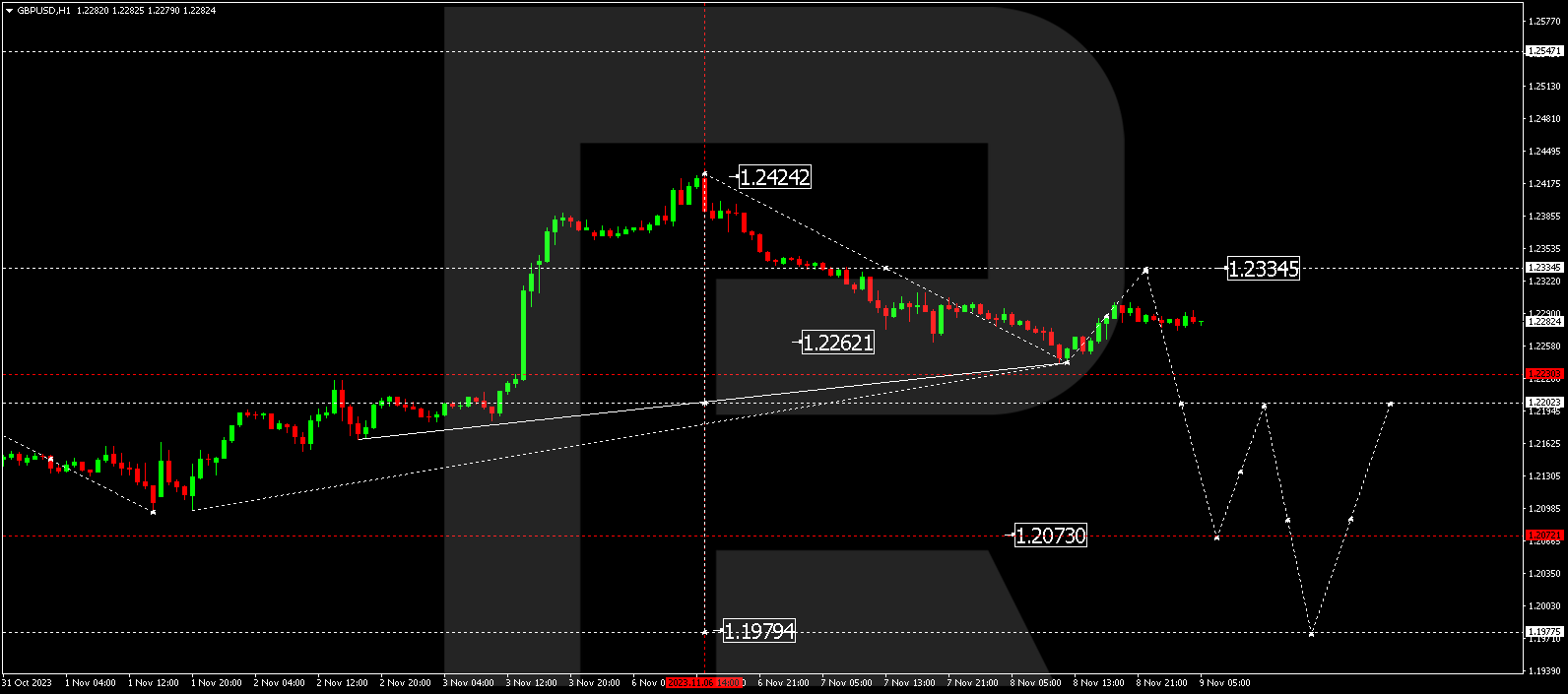

GBP/USD (Nice Britain Pound vs US Buck)

The GBP/USD pair has additionally skilled a downward motion, achieving a low of one.2245 earlier than correcting to one.2300 these days. We will be expecting a brand new upward motion to one.2333 earlier than every other wave of decline to one.2222. If the pair breaks beneath this stage, we will look ahead to a possible decline to one.2073, our present goal.

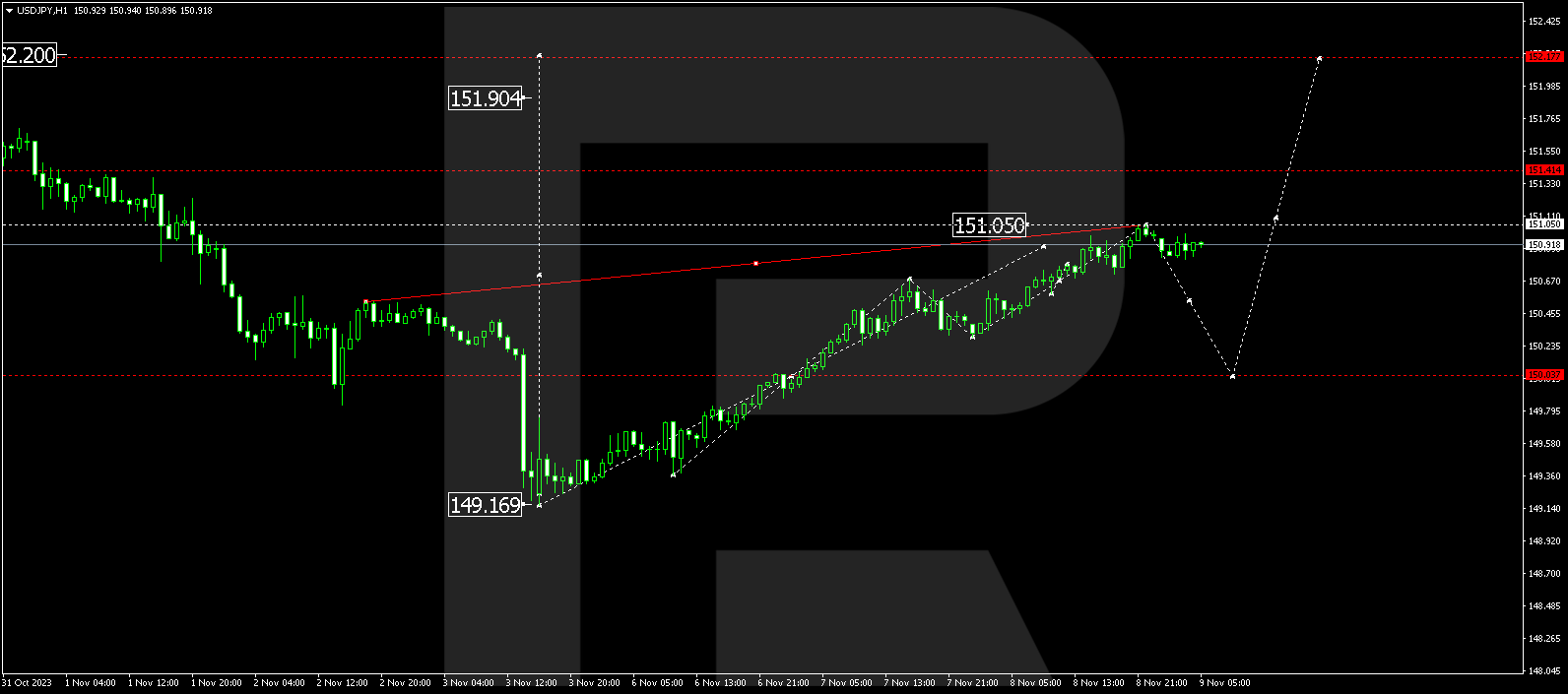

USD/JPY (US Buck vs Eastern Yen)

The USD/JPY pair has finished an upward motion to 151.04 and is recently correcting to 150.05. We will be expecting every other upward motion to 151.44, which might probably result in a upward thrust to 152.15 as soon as the extent of 151.44 is damaged.

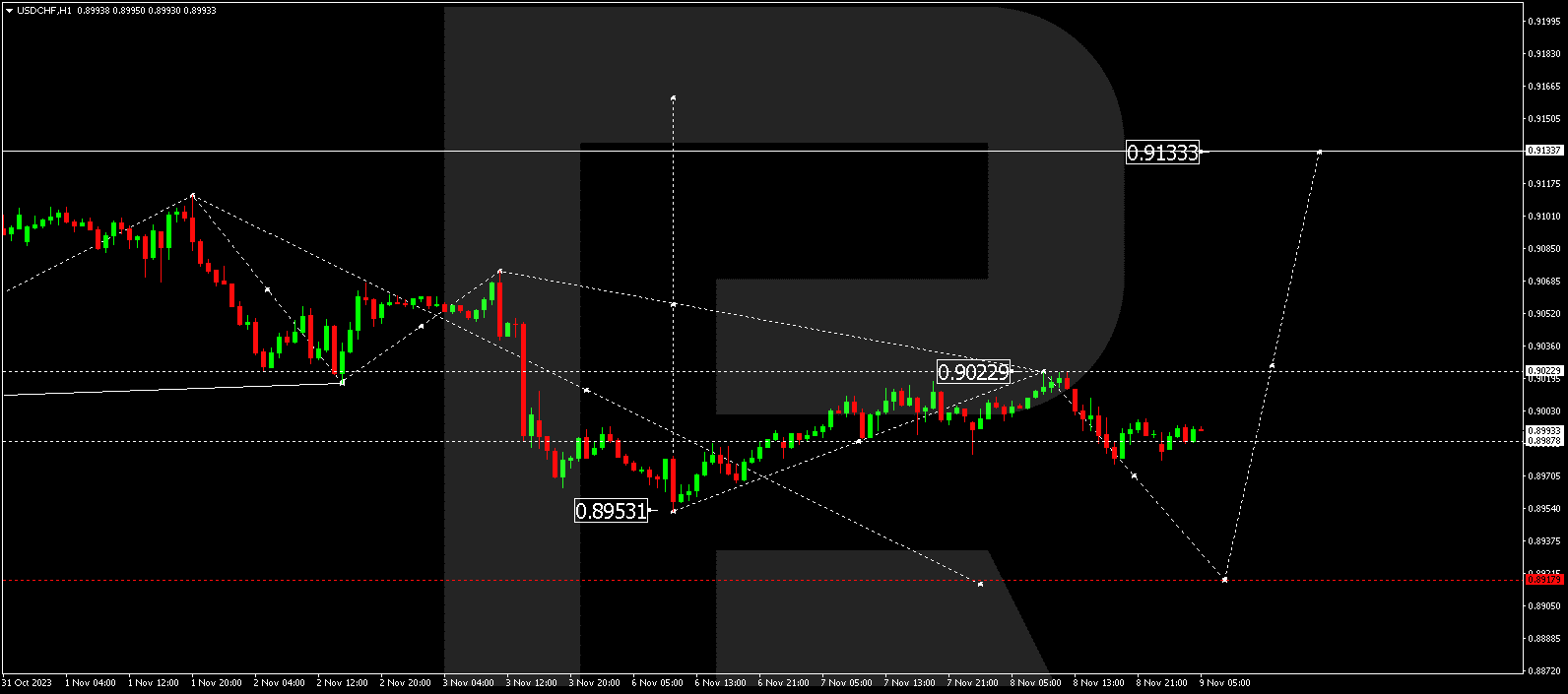

USD/CHF (US Buck vs Swiss Franc)

The USD/CHF pair has reached a prime of 0.9030 earlier than correcting to 0.8970 these days. A consolidation vary is forming between those ranges and a destroy beneath this vary may just result in a decline to 0.8918. Then again, a destroy above this vary may just probably result in a upward thrust to 0.9133.

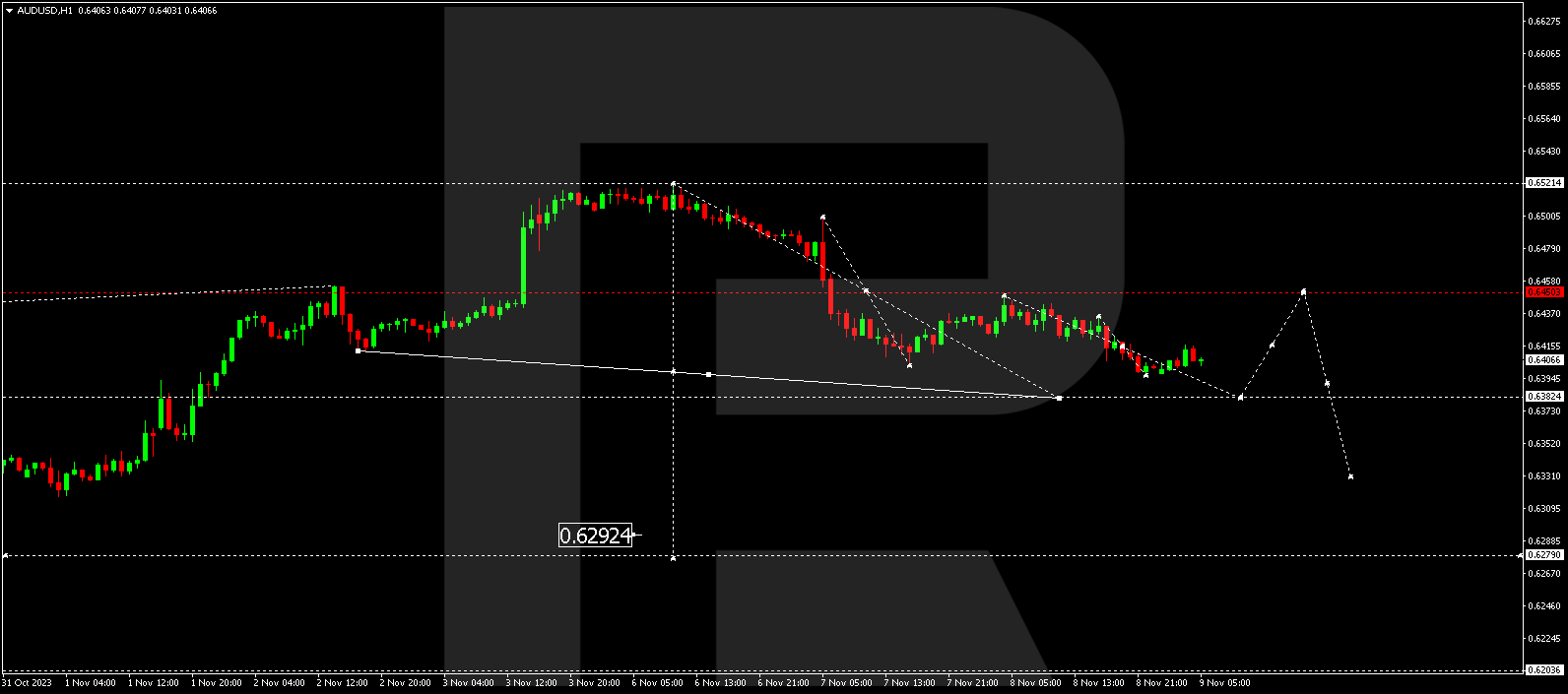

AUD/USD (Australian Buck vs US Buck)

The AUD/USD pair is recently in a downward motion to 0.6383. We will be expecting a correction to 0.6450 earlier than every other decline to 0.6333, which is our present goal.

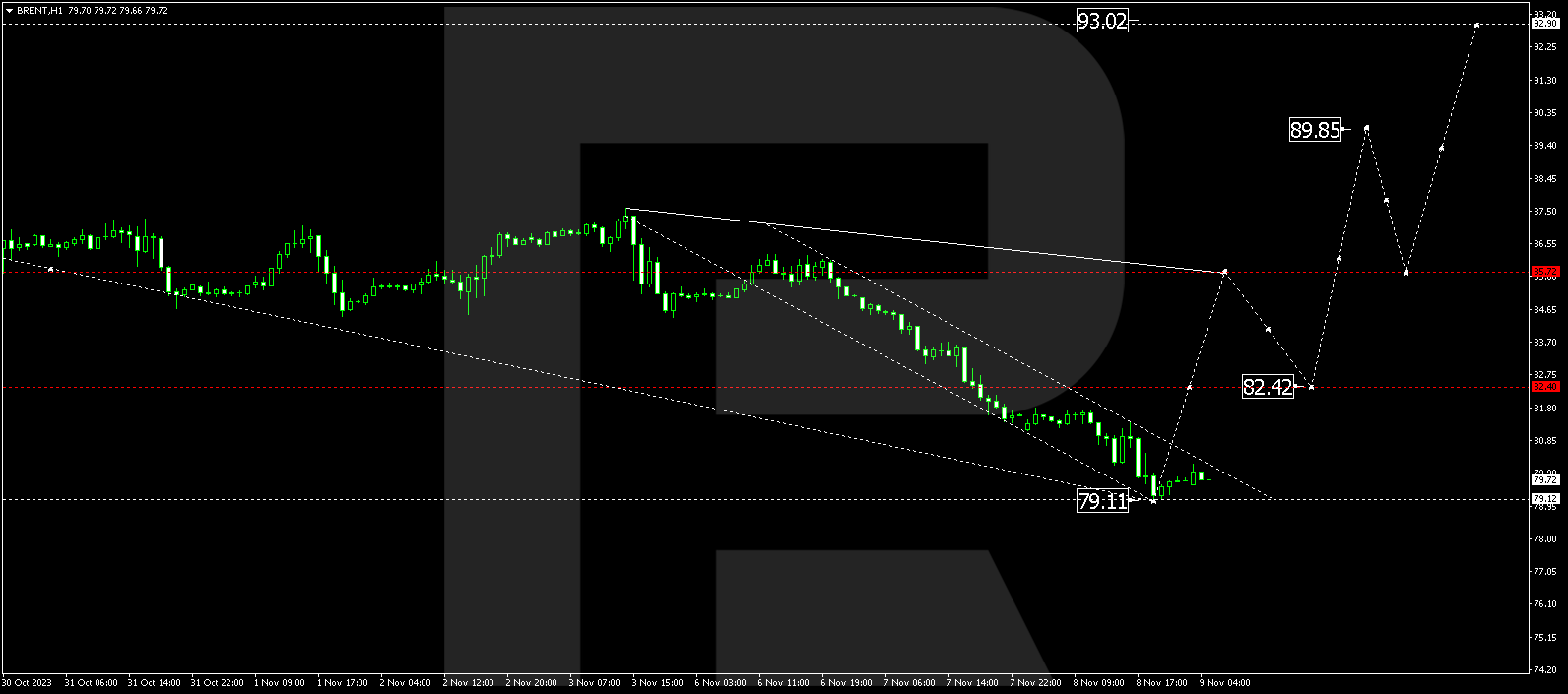

BRENT

The cost of Brent has finished a downward motion to 79.11. Alternatively, the potential of additional decline has expired and a consolidation vary may just shape above this stage these days. If the cost breaks above this vary, we will look ahead to a upward thrust to 85.75, our first goal.

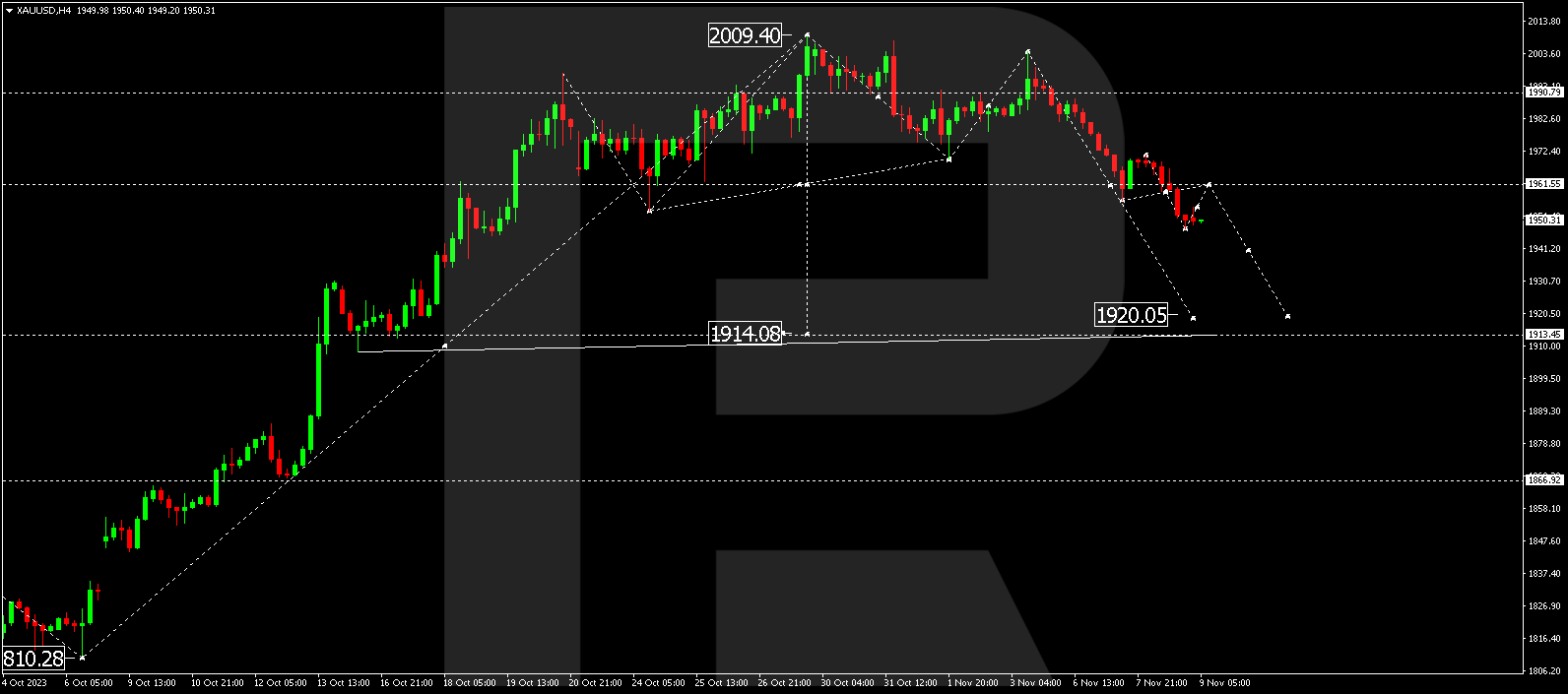

XAU/USD (Gold vs US Buck)

Gold is recently in a consolidation vary round 1961.55. If the cost breaks beneath this vary, we will be expecting a possible decline to 1920.00, adopted through a correction to 1960.00 earlier than every other decline to 1913.50, our first goal.

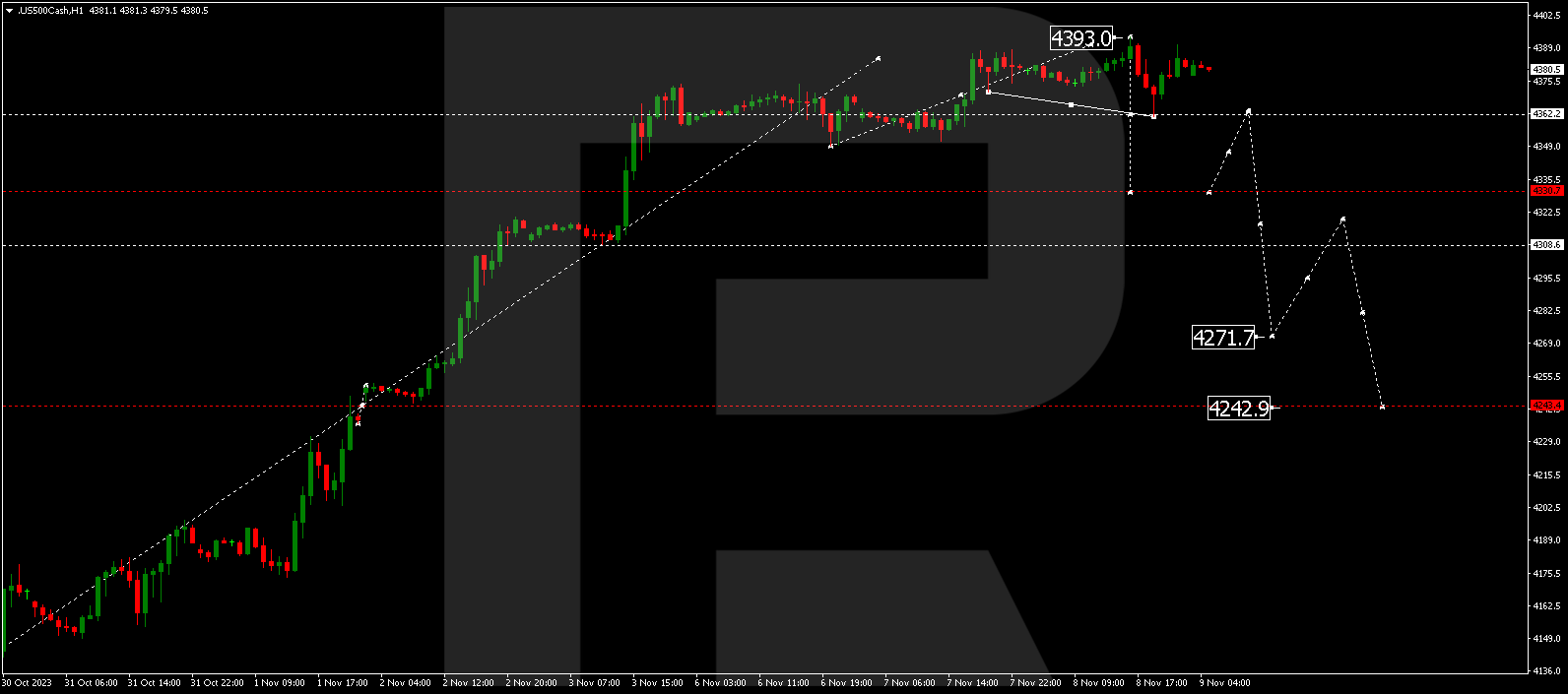

S&P 500

The S&P 500 index has finished a downward motion to 4362.2 earlier than correcting to 4390.0 these days. We will be expecting every other decline to 4330.3 earlier than the fad continues to 4242.0, our first goal.