Technical Research & Forecast November 01, 2023 – R Weblog

Gold‘s downward pattern persists. This research additionally encompasses the actions of EUR, GBP, JPY, CHF, AUD, Brent (oil), and the S&P 500 index.

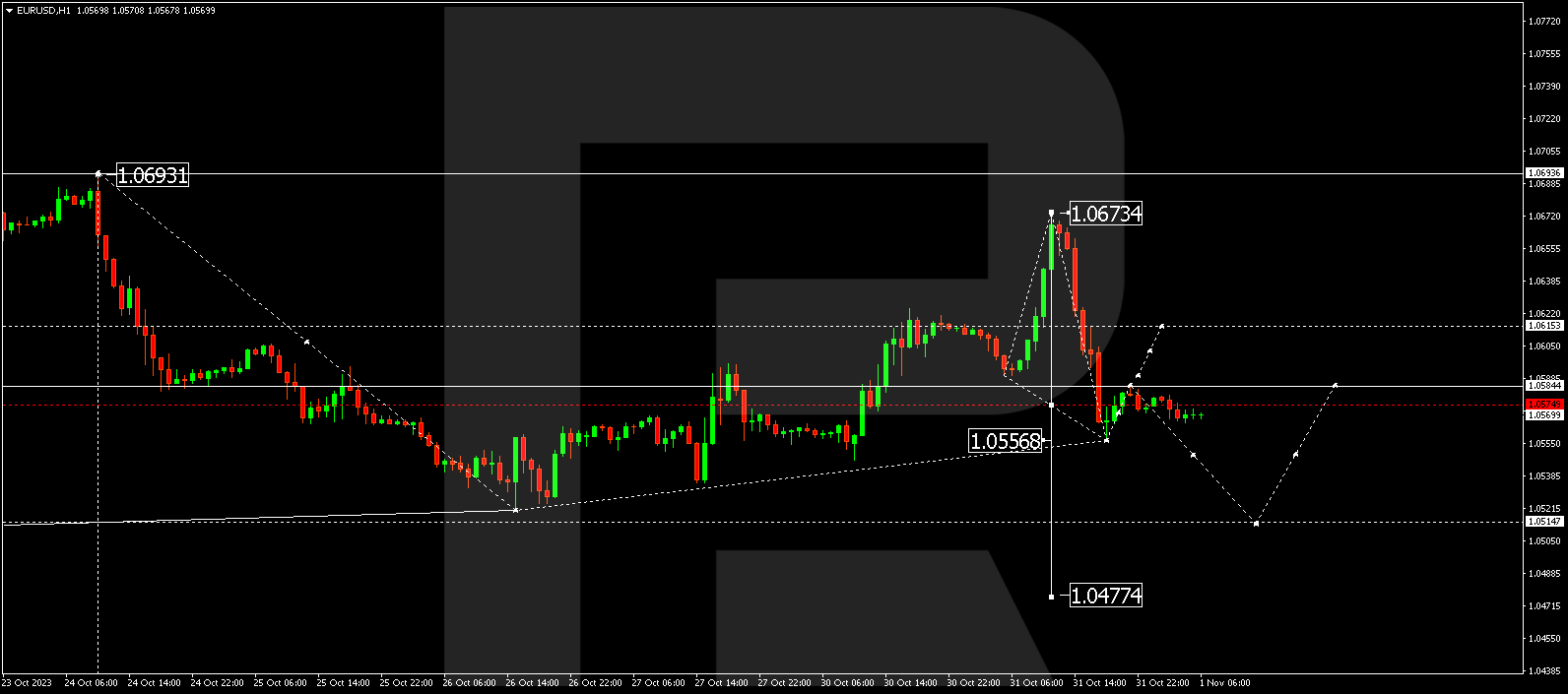

EUR/USD (Euro vs US Greenback)

EUR/USD initiated a speedy decline after a correction to at least one.0673. It has already reached the primary goal of one.0557. Lately, a consolidation vary is forming above this degree. A breakout to the upside may push the fee to at least one.0600 (with a take a look at from beneath). If it breaks out to the drawback, it might open the opportunity of a decline to at least one.0515, with the opportunity of the rage proceeding to at least one.0477. This is regarded as an area goal.

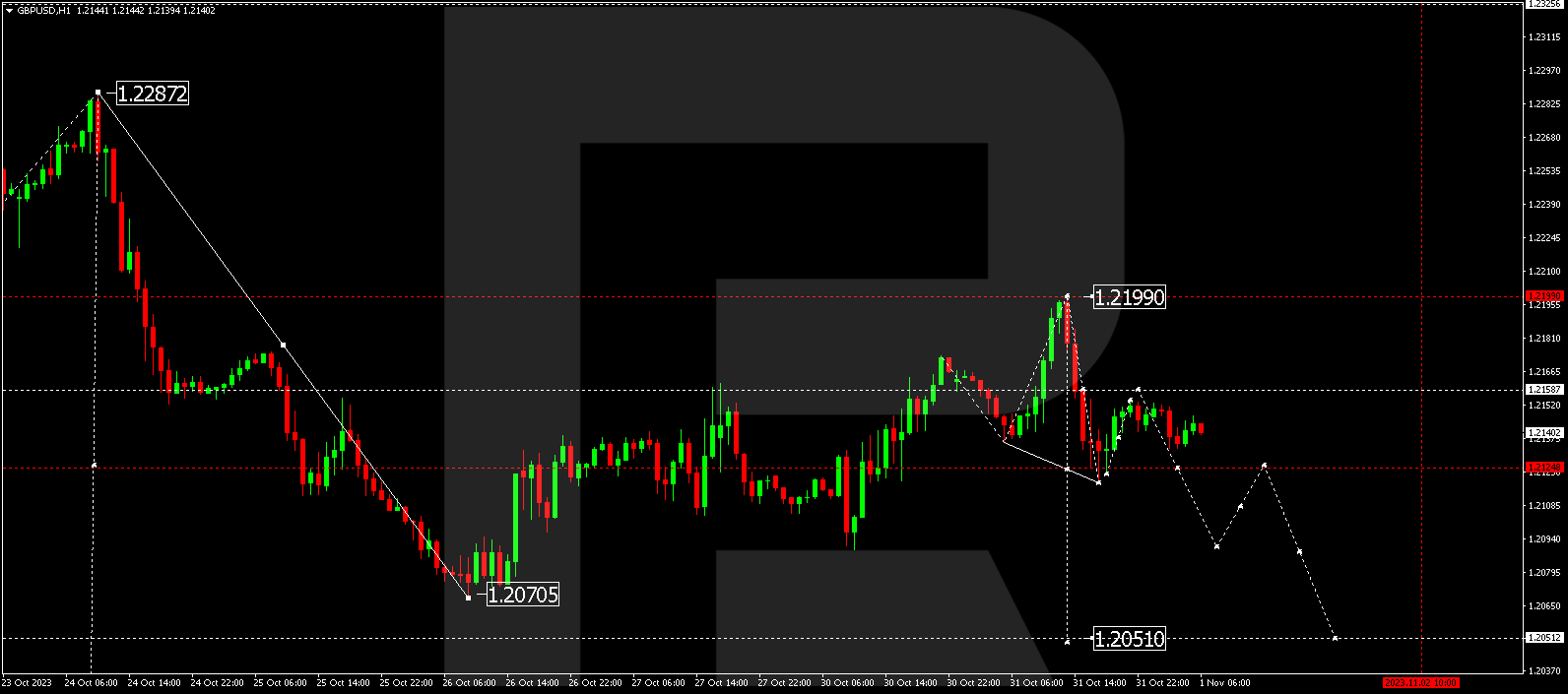

GBP/USD (Nice Britain Pound vs US Greenback)

GBP/USD, after correcting to at least one.2199, is on a speedy decline. The associated fee has reached the primary goal of one.2120. It is conceivable {that a} temporary upward correction to at least one.2158 may happen these days, adopted by way of a decline to at least one.2090, and the rage may probably prolong to at least one.2050. This is considered an area goal.

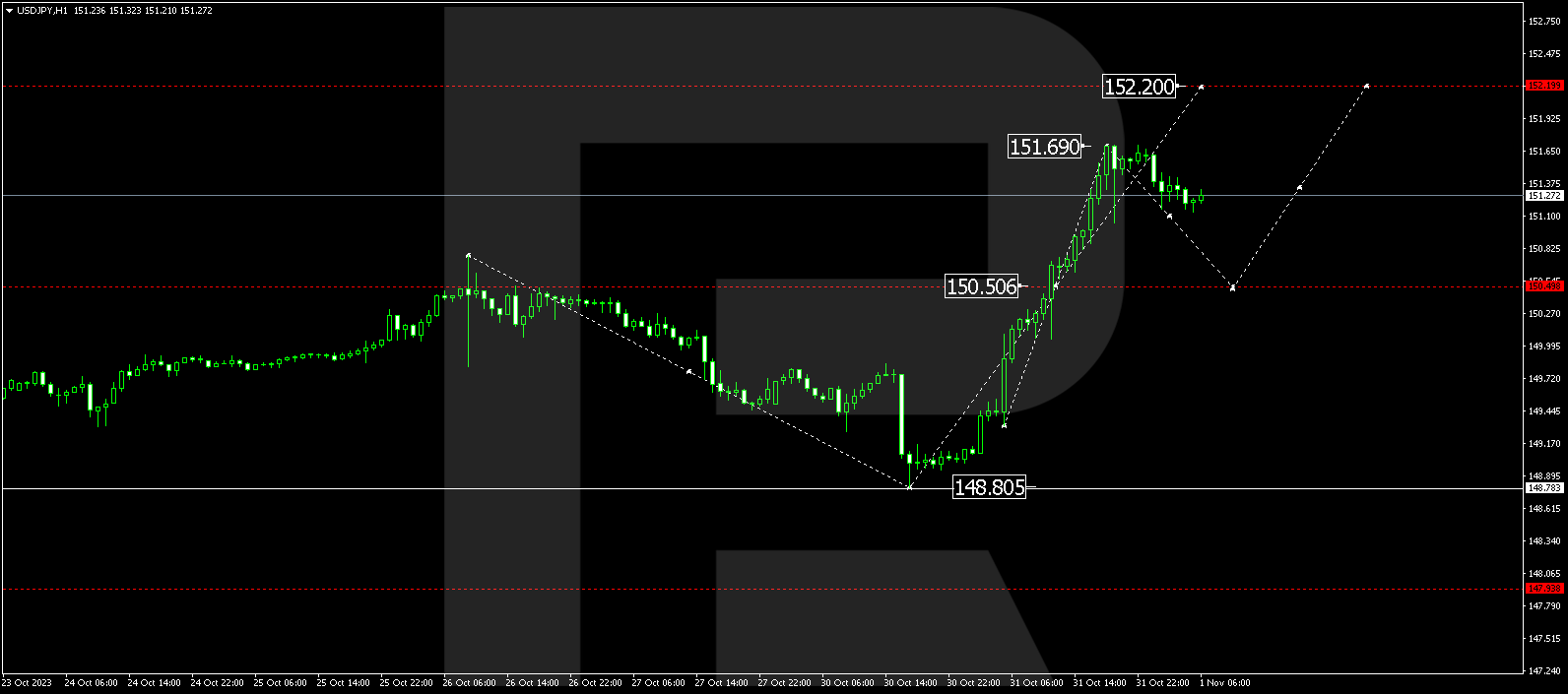

USD/JPY (US Greenback vs Jap Yen)

USD/JPY, having finished a expansion wave to 151.69, is these days consolidating beneath this degree. If it breaks downwards, the fee may right kind to 150.50. Then again, an upward breakout may sign the continuation of the rage to 152.20.

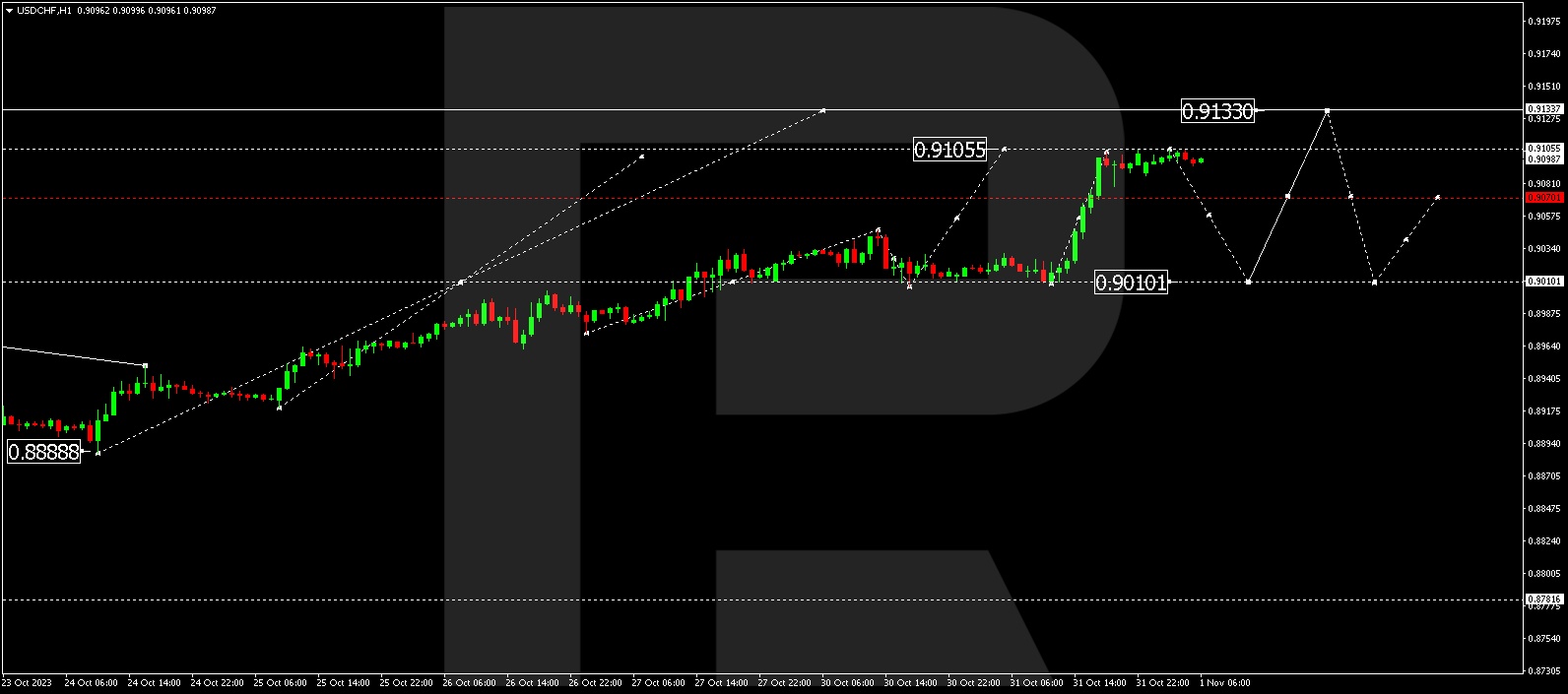

USD/CHF (US Greenback vs Swiss Franc)

USD/CHF, after attaining a top of 0.9105 in a expansion wave, may revel in a downward motion to 0.9070 these days. Following that, there is a doable upward push to 0.9133, which is regarded as the primary goal.

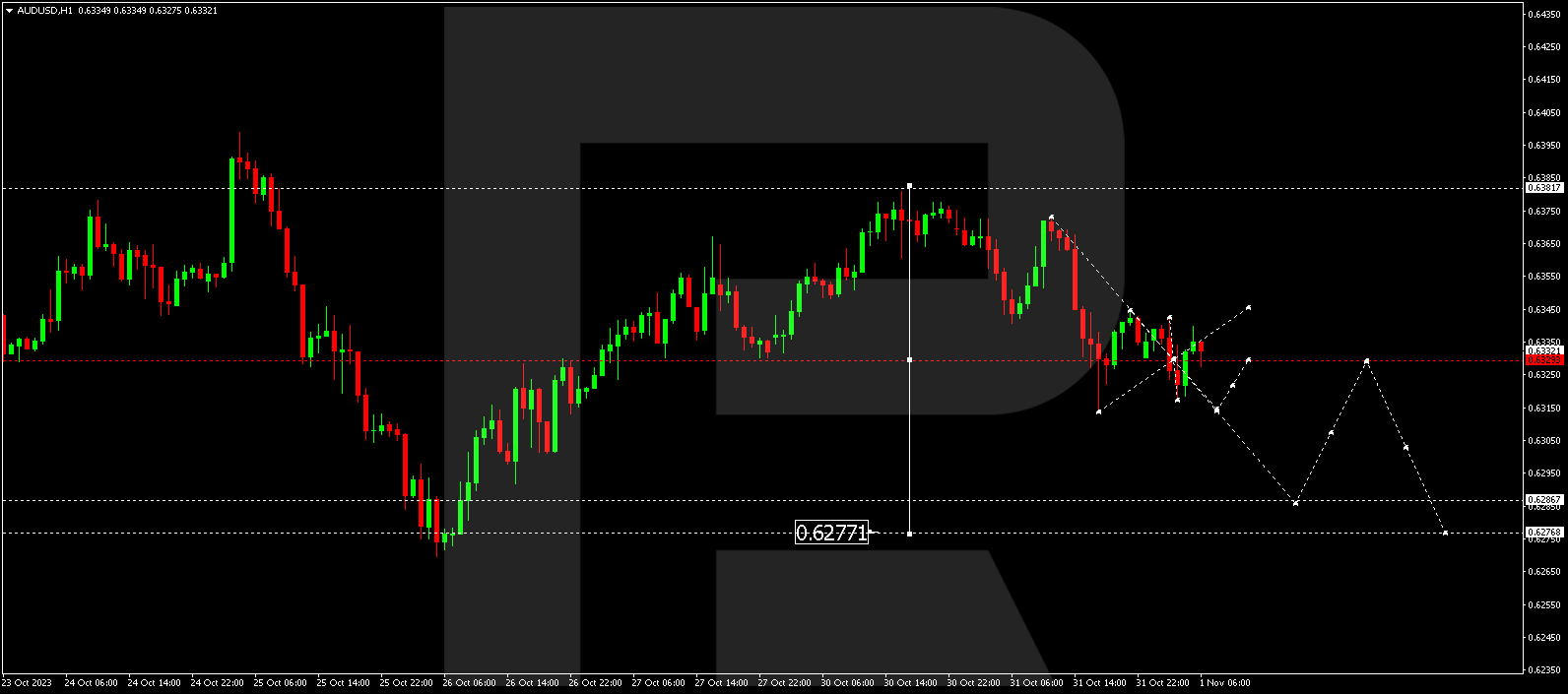

AUD/USD (Australian Greenback vs US Greenback)

AUD/USD is creating a consolidation vary round 0.6330. If a downward breakout happens, the decline may proceed to 0.6286, with the opportunity of the rage increasing to 0.6270. That is observed as the primary goal.

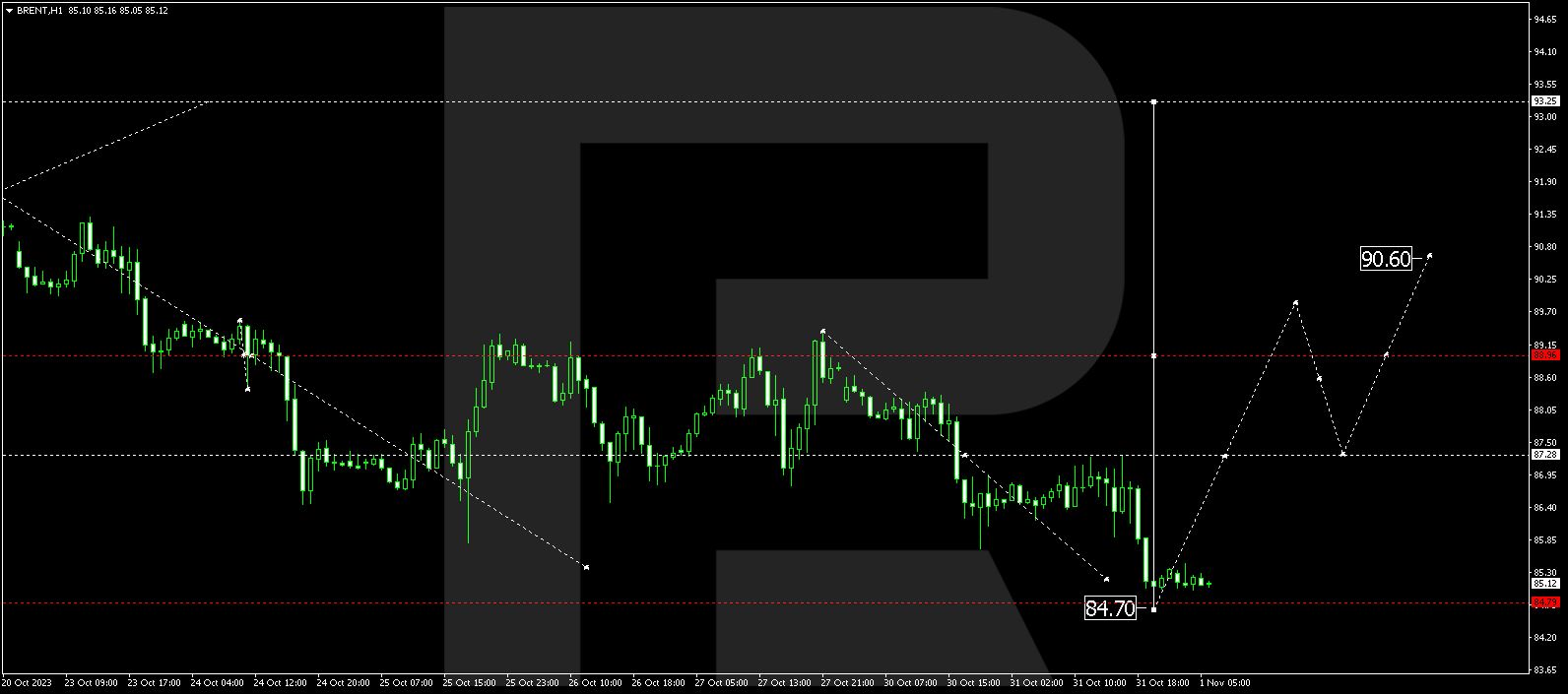

BRENT

Brent has completed a correction at 84.70. It’s anticipated {that a} consolidation vary will shape above this degree these days. An upward breakout would possibly result in a brand new expansion wave to 87.30. Breaking thru this degree may pave the best way for an upward motion to 95.00, which is regarded as an area goal.

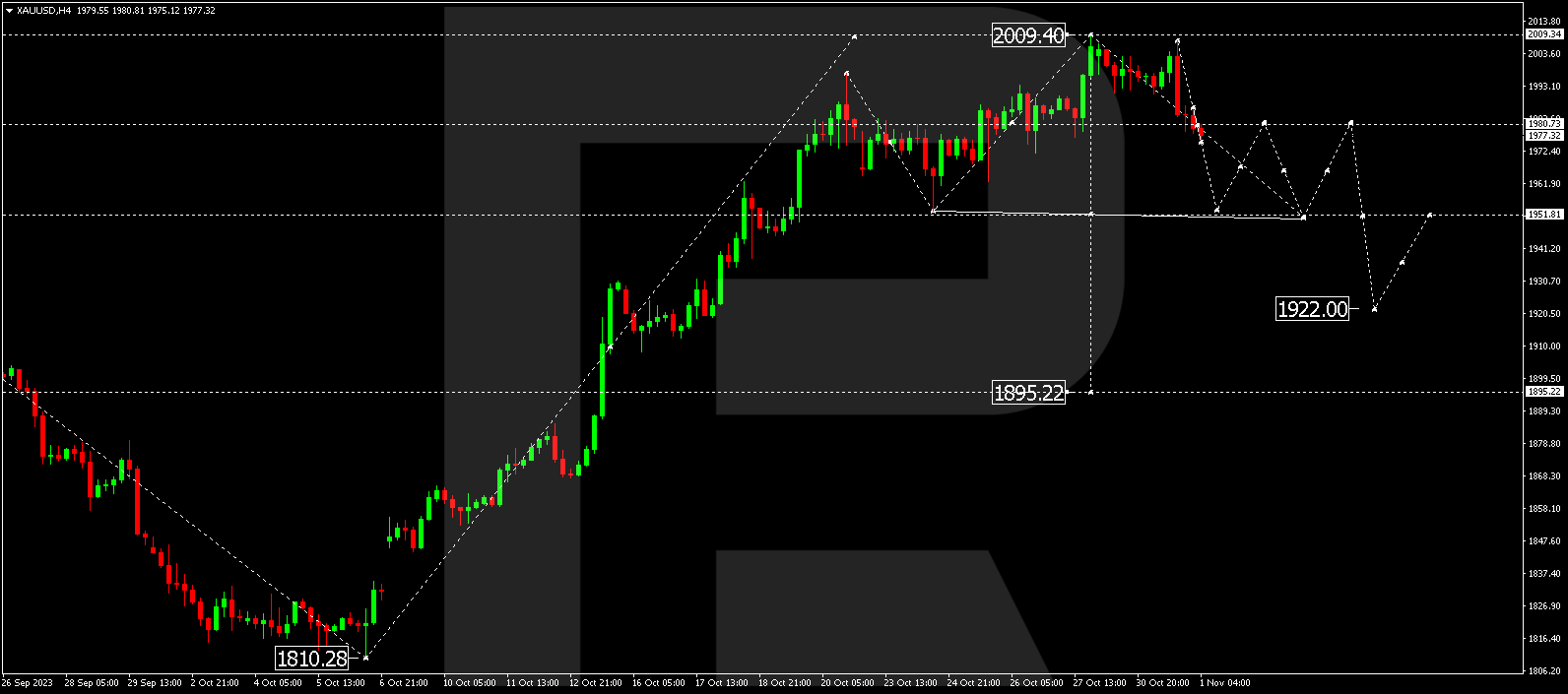

XAU/USD (Gold vs US Greenback)

Gold is in the middle of a declining wave to 1952.00. After achieving this degree, it could upward push to 1980.00 (with a take a look at from beneath) after which decline to 1951.80. That is the primary goal.

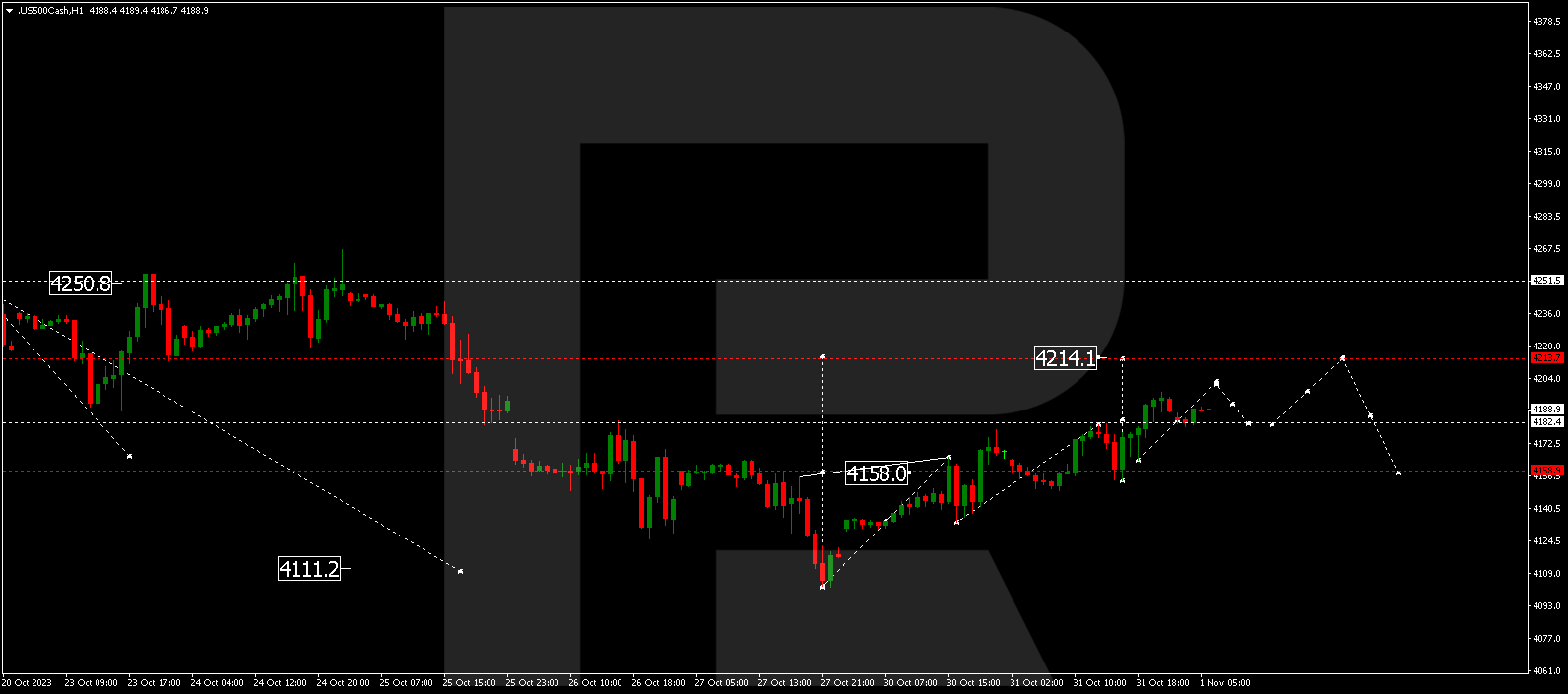

S&P 500

The inventory index is constant to increase a correction to 4213.7. As soon as it reaches this degree, the fee may proceed its motion to 4111.0, with the rage probably extending to 4000.0.