Technical Research & Forecast January 30, 2024 – R Weblog

Gold seems to be consolidating sooner than beginning a brand new downward development. This evaluation encompasses the dynamics of quite a lot of currencies, together with EUR, GBP, JPY, CHF, AUD, commodities like Brent and Gold (XAU/USD), and the S&P 500 index.

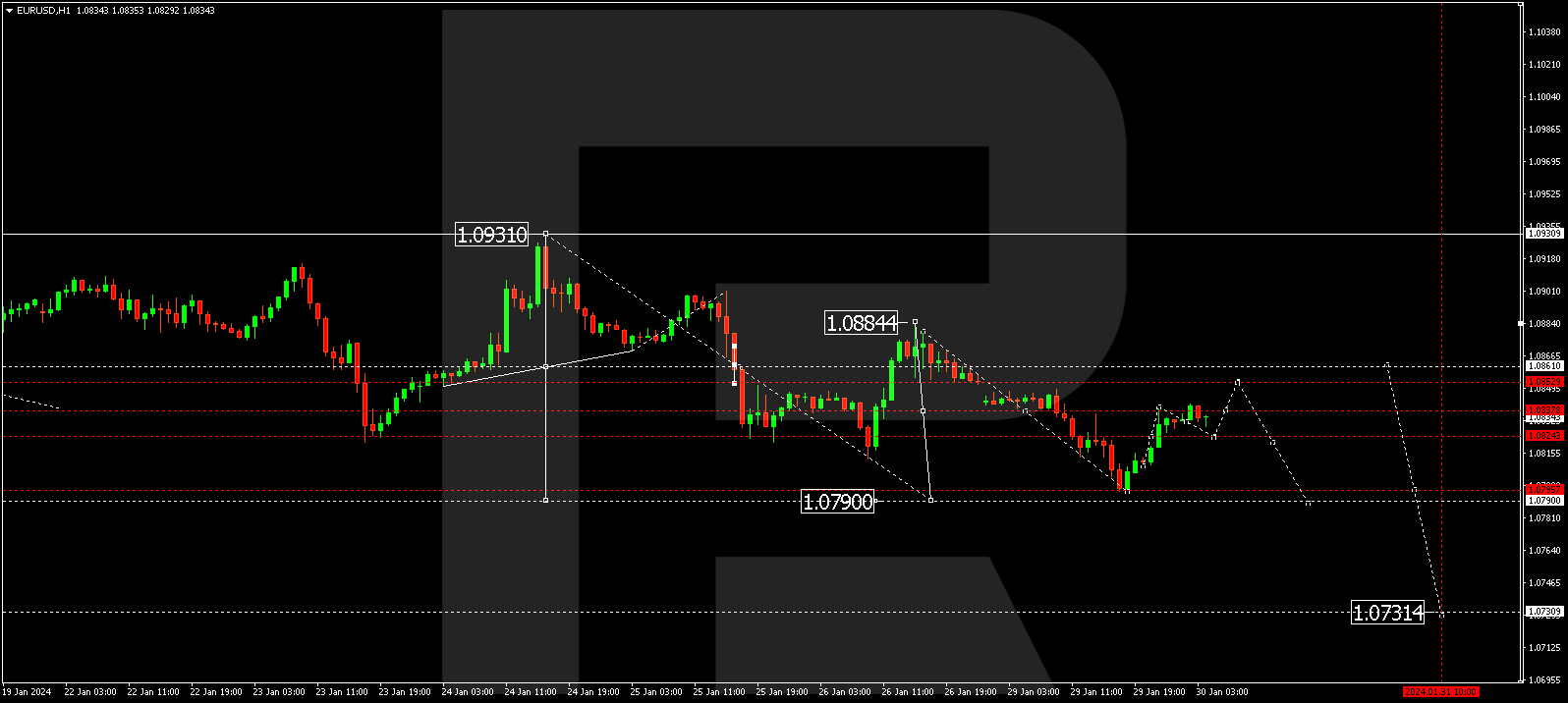

EUR/USD (Euro vs US Buck)

The EUR/USD pair has finished a downward wave to one.0795. As of late, the marketplace is present process a correction wave against 1.0850. As soon as this degree is reached, an expected continuation of the downward wave to one.0790 is anticipated—a neighborhood goal.

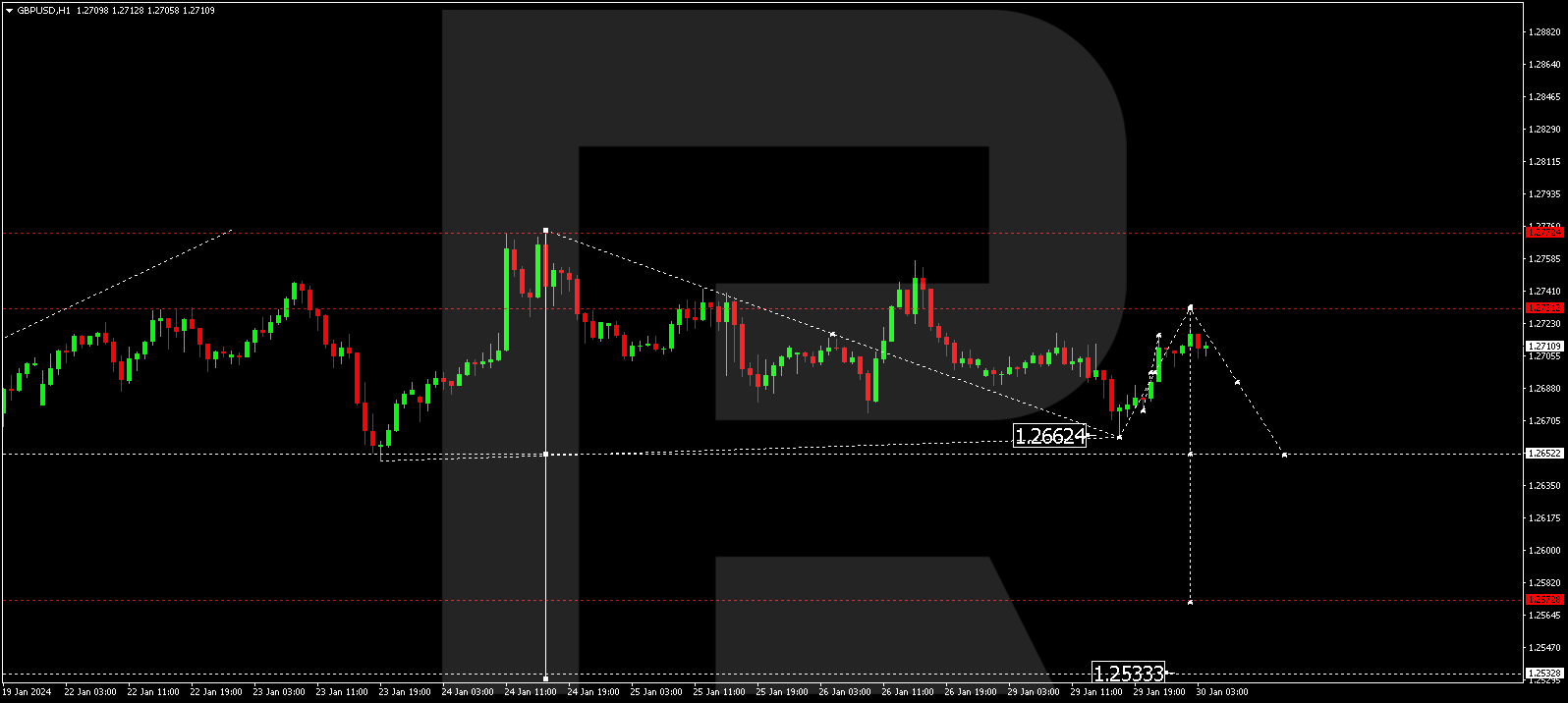

GBP/USD (Nice Britain Pound vs US Buck)

GBP/USD has concluded a downward wave to one.2662. A correction to one.2730 is recently forming. Following the correction, a brand new downward wave to one.2650 is expected, doubtlessly extending the craze to one.2575.

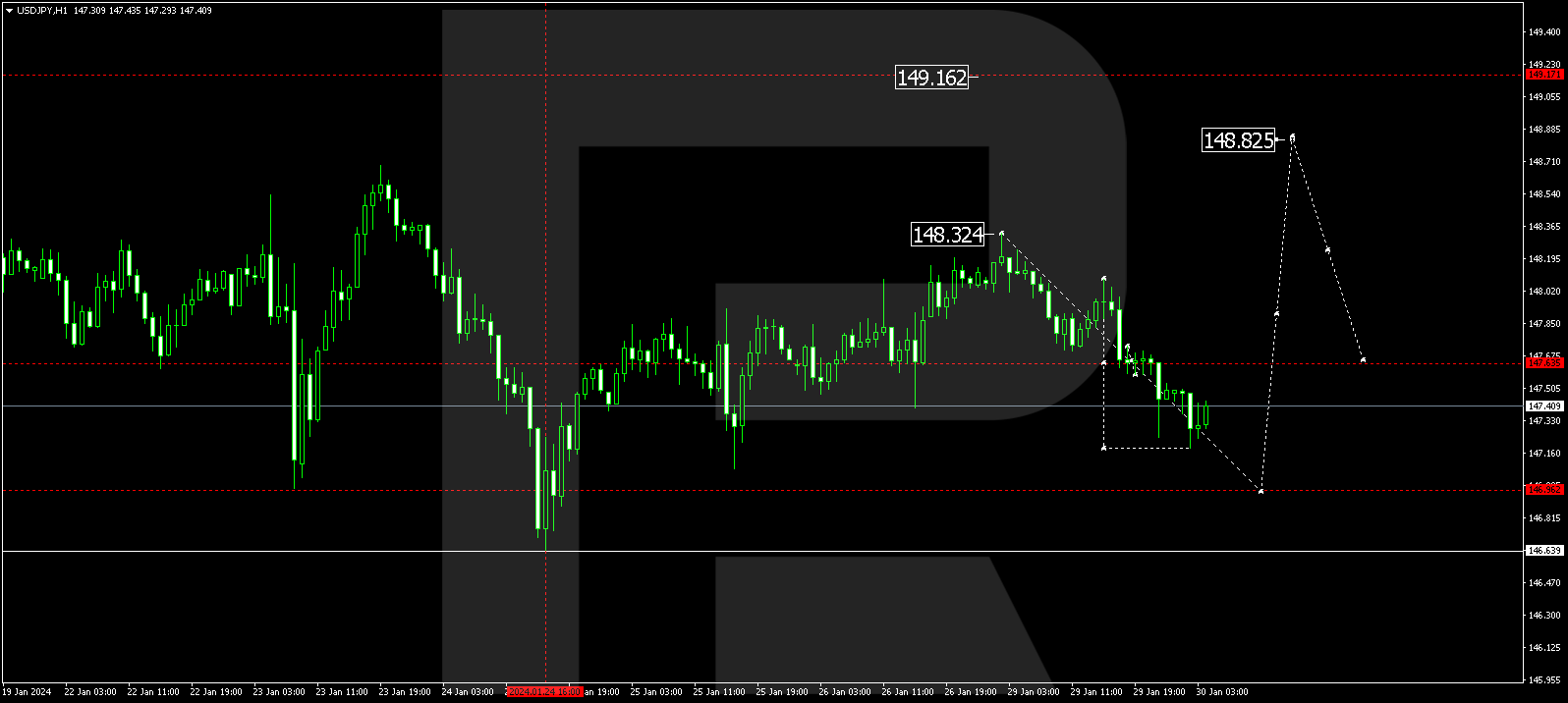

USD/JPY (US Buck vs Eastern Yen)

The USD/JPY pair has corrected to 147.65. A consolidation vary has shaped round this degree, and every other attainable downward construction to 146.96 isn’t excluded. Therefore, a upward push to 148.82 is anticipated—a neighborhood goal.

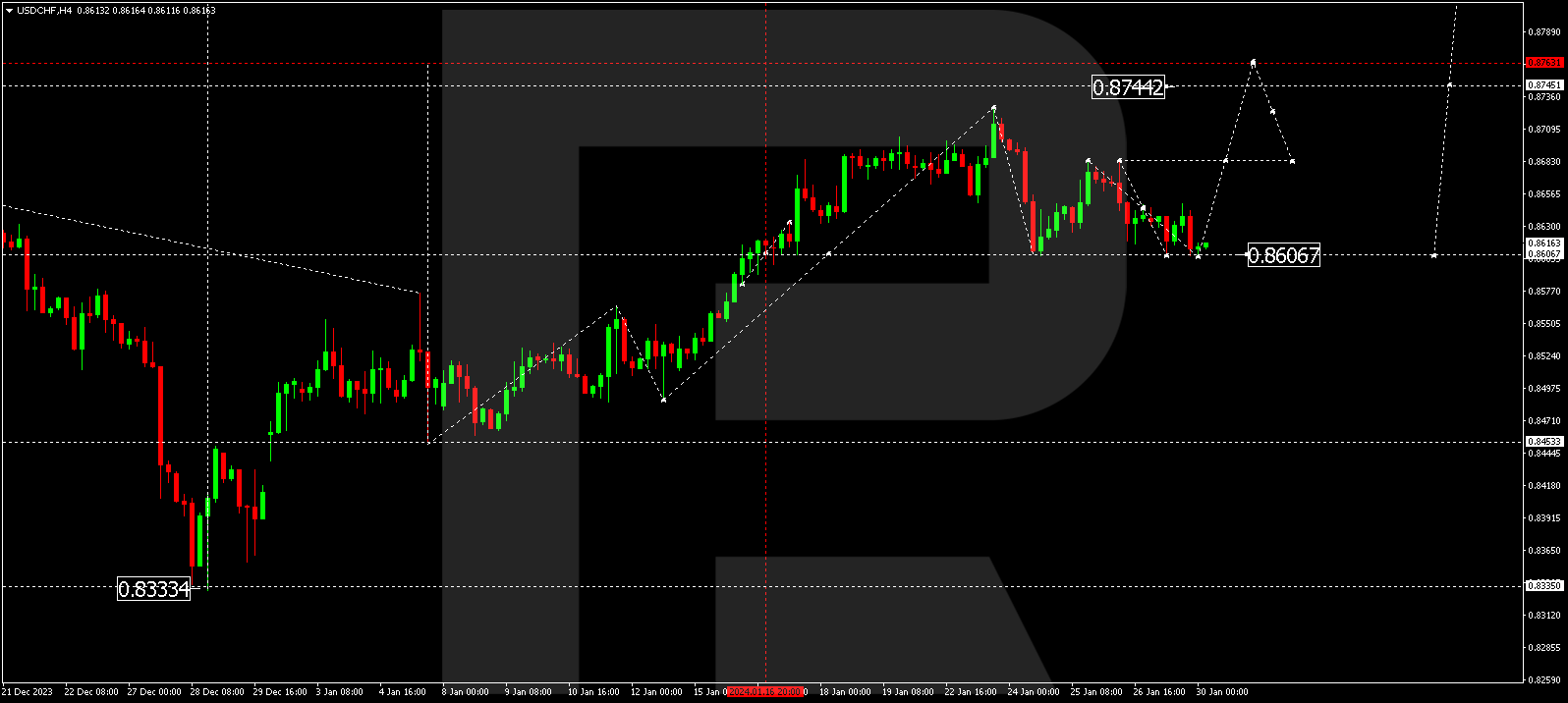

USD/CHF (US Buck vs Swiss Franc)

USD/CHF is within the means of creating a consolidation vary above 0.8607. A possible upward motion to 0.8690 would possibly happen nowadays. If this degree is breached, there may be attainable for a enlargement wave to 0.8760—a neighborhood goal.

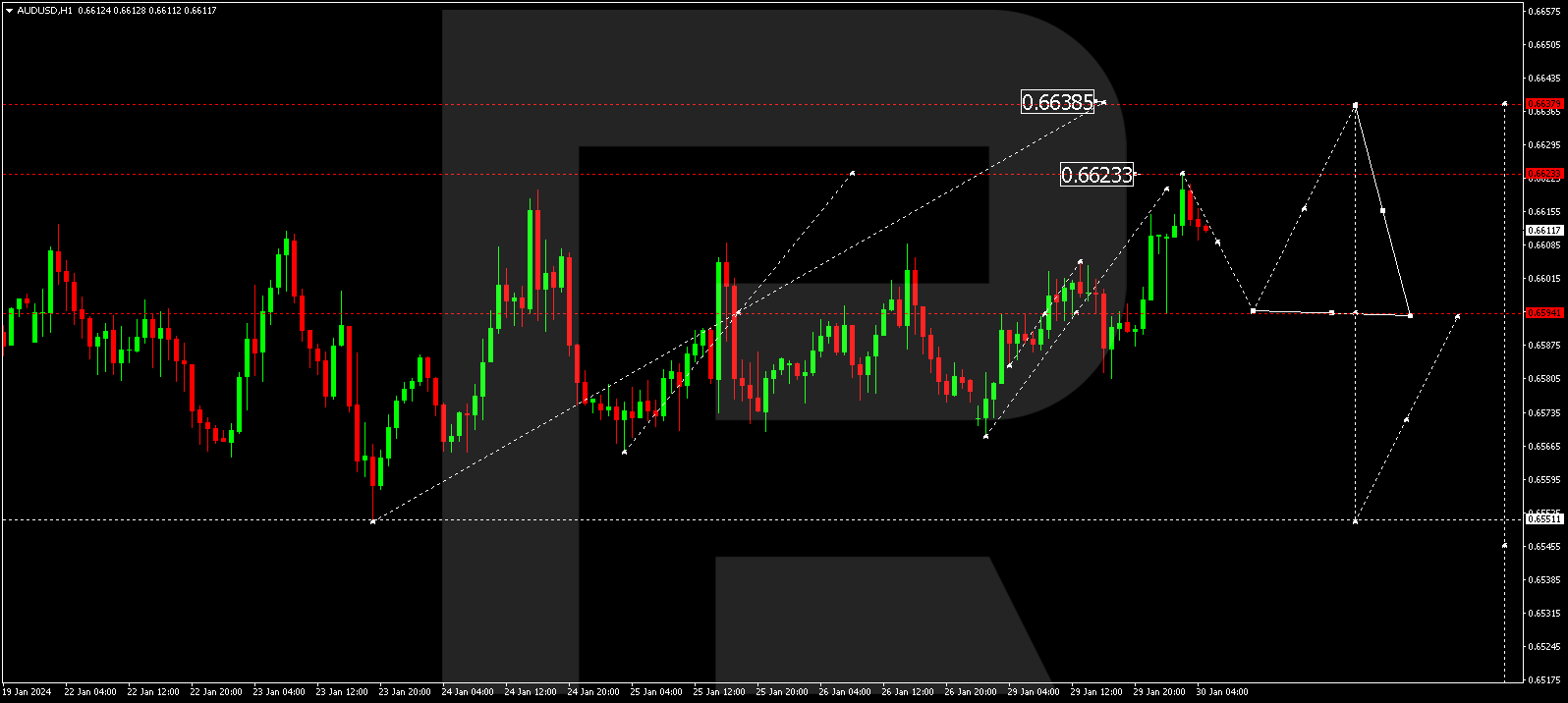

AUD/USD (Australian Buck vs US Buck)

The AUD/USD pair is recently forming a consolidation vary round 0.6594. The marketplace has prolonged the variability upwards to 0.6623. A possible downward motion to 0.6594 may practice nowadays. Subsequent, a brand new correction wave to 0.6636 isn’t excluded, with a conceivable decline to 0.6555—a neighborhood goal.

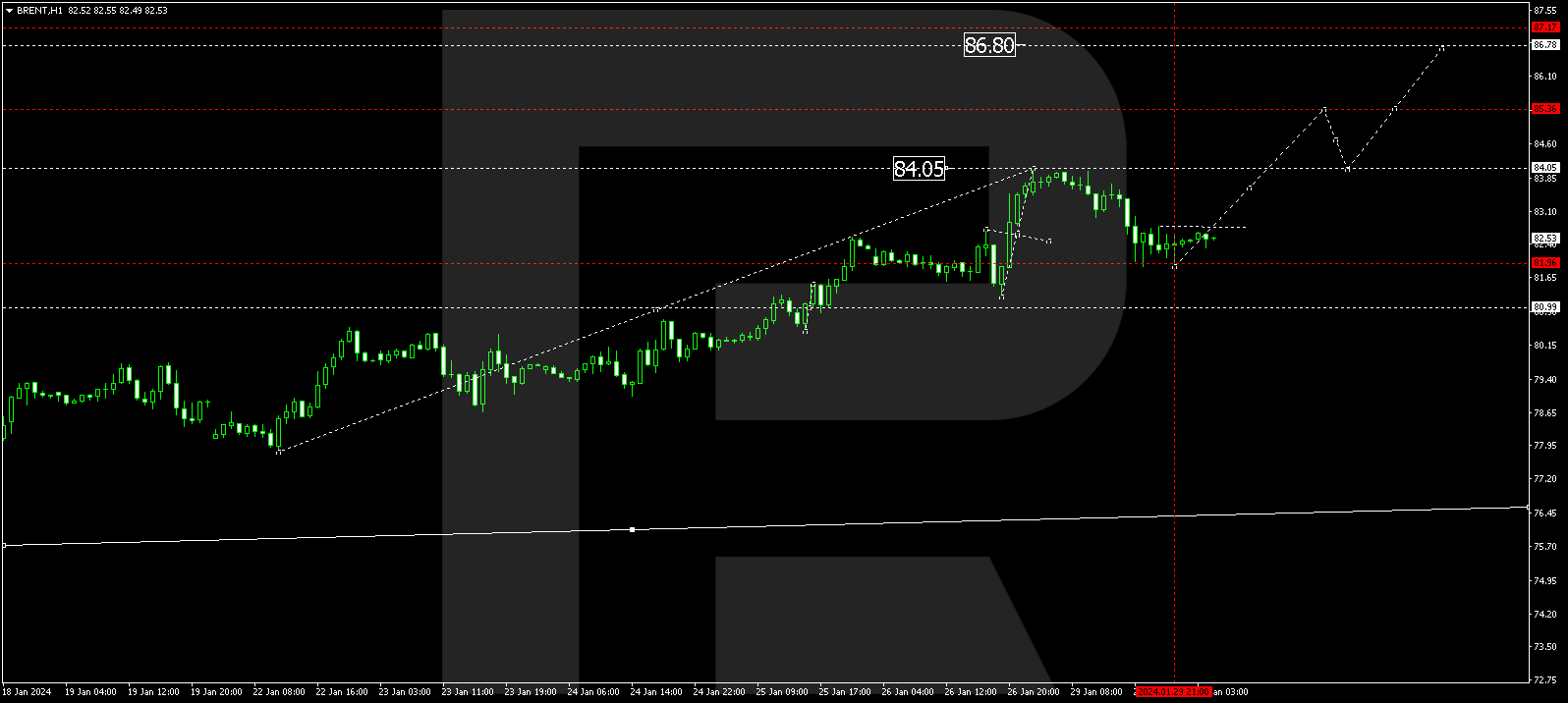

BRENT

Brent has finished a correction construction to 81.90. Lately, a consolidation vary is forming above this degree. A breakout from the variability upwards would possibly proceed the expansion wave to 84.22. Upon attaining this degree, a possible correction to 83.40 isn’t excluded. Therefore, the craze would possibly prolong to 85.55—a neighborhood goal.

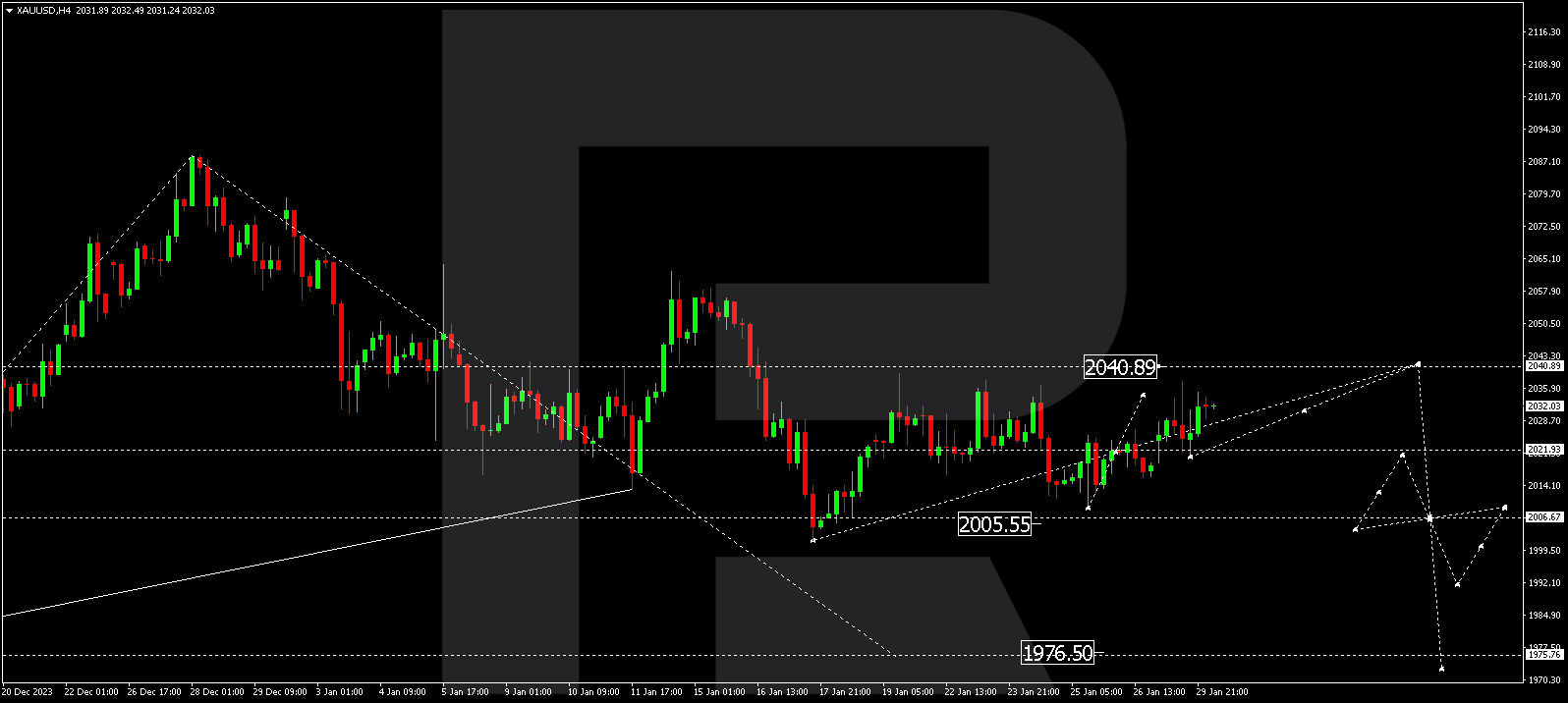

XAU/USD (Gold vs US Buck)

Gold continues creating a consolidation vary round 2022.22. A possible upward motion to 2040.90 would possibly happen nowadays, adopted via a possible downward motion to 2005.55. After breaking under this degree, a brand new downward construction to 1991.10 may practice, doubtlessly extending the craze to 1976.50.

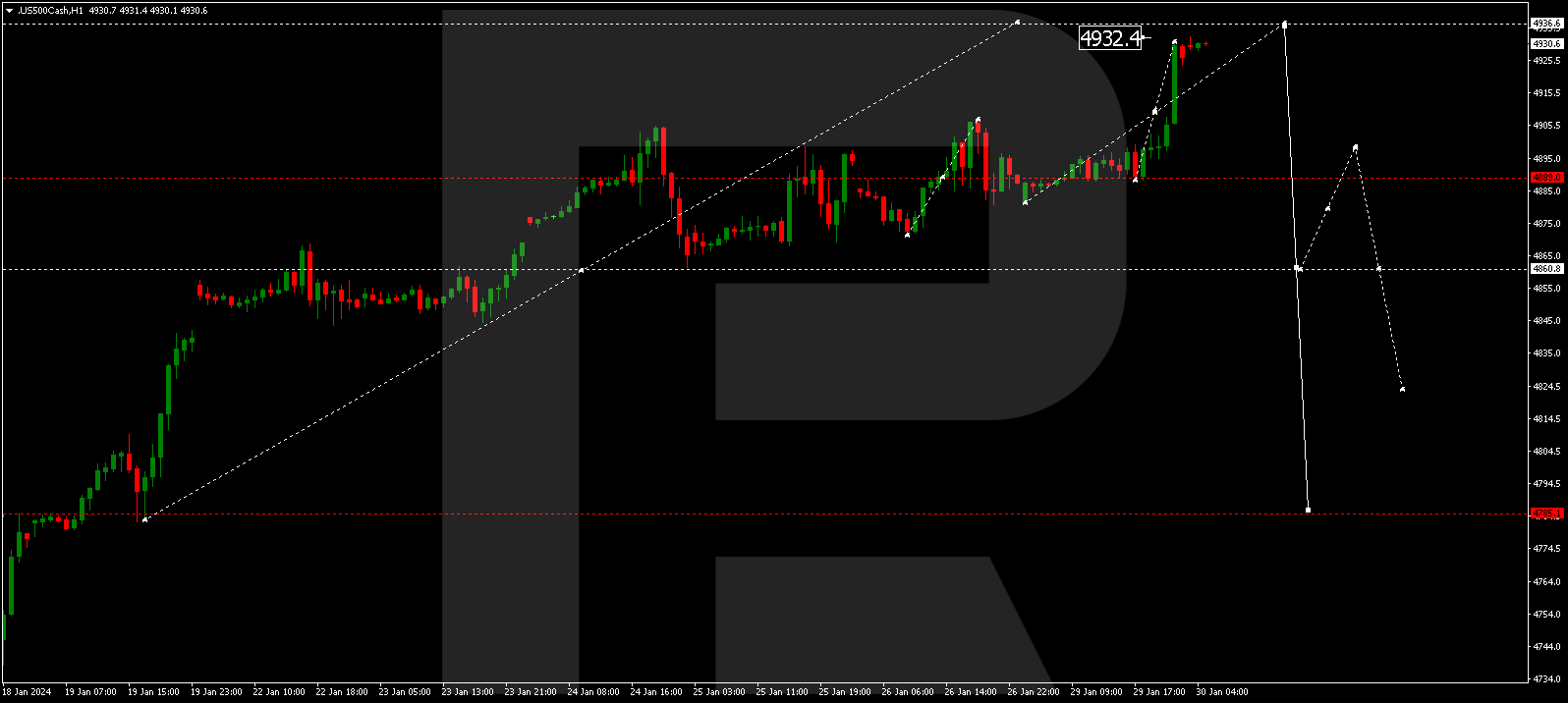

S&P 500

The inventory index is within the means of creating a consolidation vary round 4880.0. A breakout from the variability upwards would possibly prolong the expansion construction to 4936.6. Subsequent, a possible downward wave to 4860.0 would possibly start. If this degree is breached, there may be attainable for a wave to 4785.0—a primary goal.