Technical Research & Forecast for July 19, 2023 – R Weblog

EUR Prepares for a New Wave of Decline. The assessment additionally comprises the dynamics of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

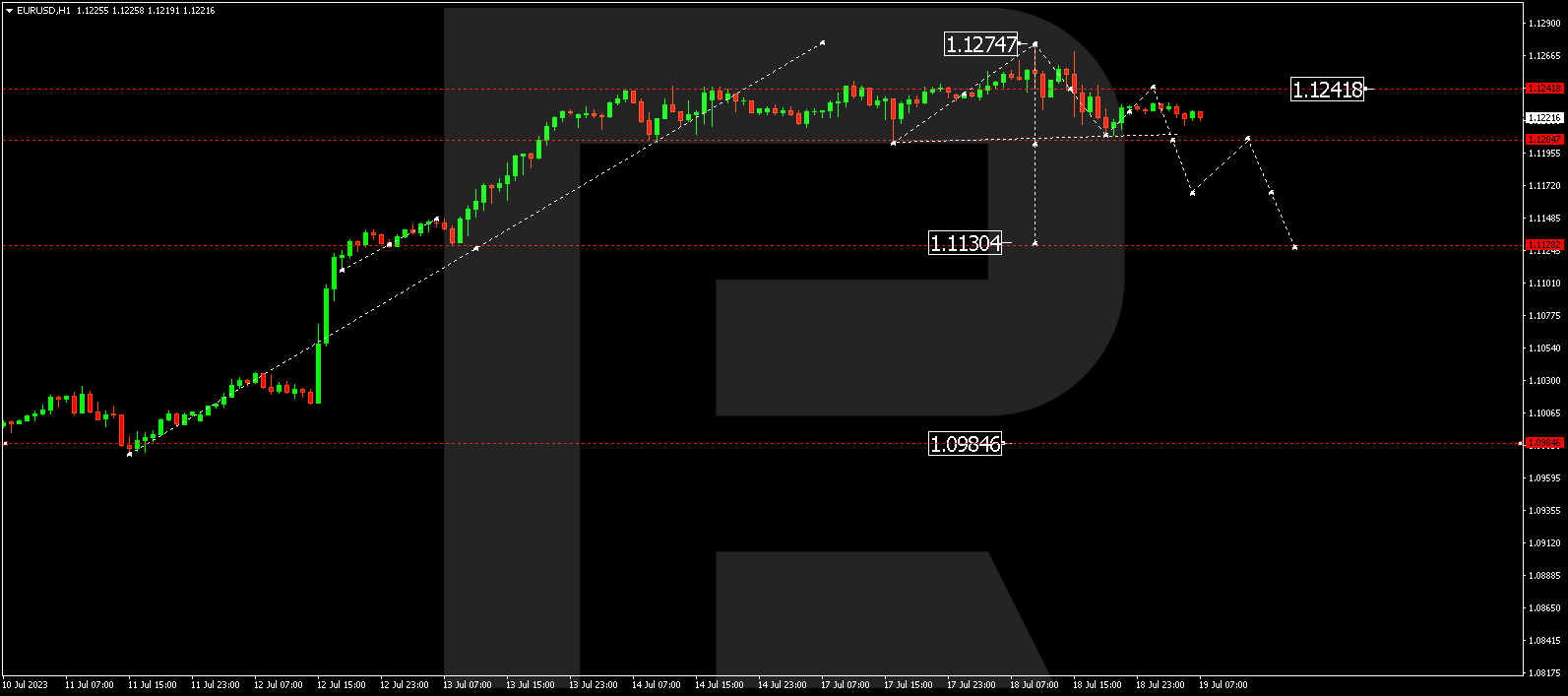

EUR/USD (Euro vs US Greenback)

The forex pair continues to expand a consolidation vary round 1.1242. Recently, the variety has expanded upwards to one.1275, and an impulse of decline to one.1208 has shaped. Lately, a rebound in opposition to 1.1242 is anticipated with a check from under. Subsequent, a decline to one.1200 would possibly apply. If this degree is breached downwards, the potential of a decline wave to one.1128 may open. That is the primary goal.

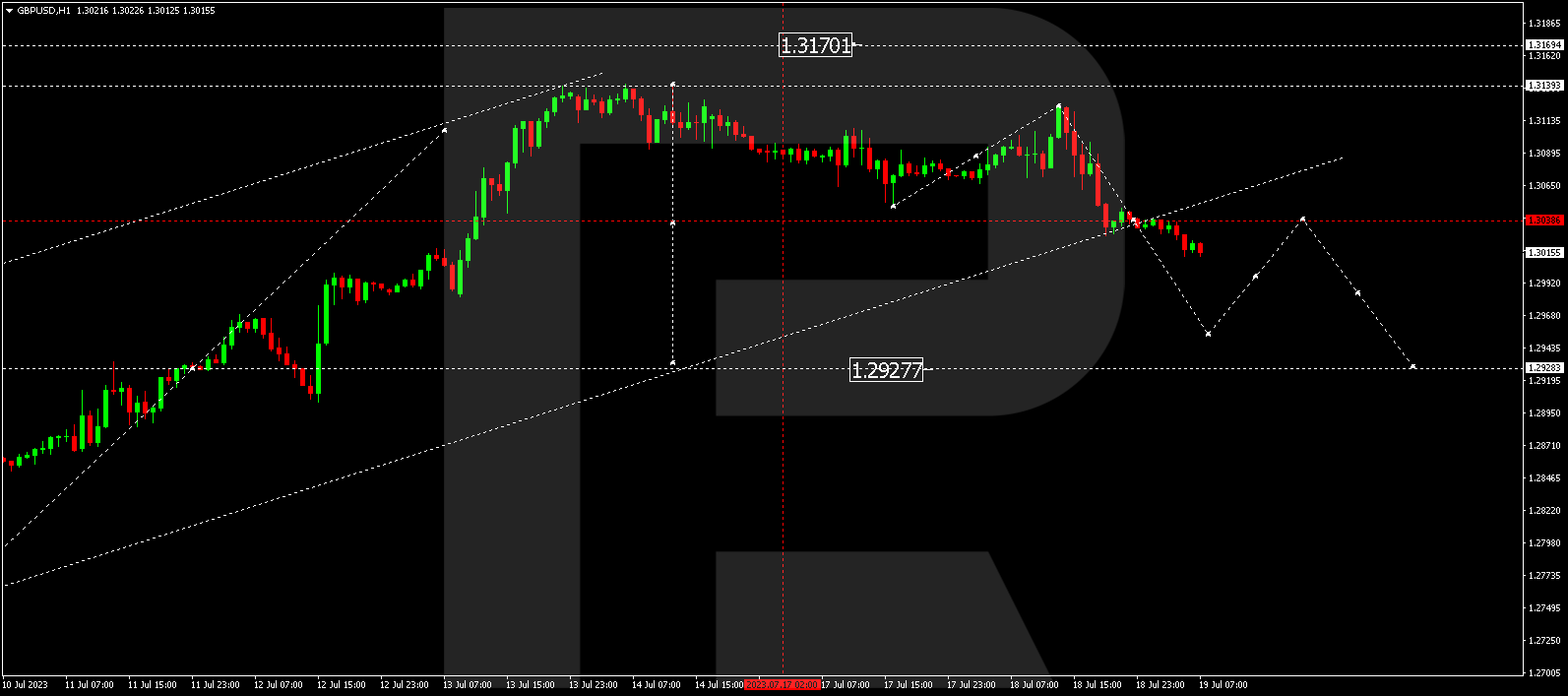

GBP/USD (Nice Britain Pound vs US Greenback)

The forex pair has finished a corrective construction to one.3124. Recently, the marketplace is forming a brand new declining wave in opposition to 1.2954. After attaining this degree, a correction to one.3038 would possibly happen with a check from under. Subsequent, a decline to one.2929 is anticipated. That is the primary goal.

Do not omit the risk to get one of the most highest buying and selling prerequisites available in the market with a Top account from RoboForex. Low commissions, spreads from 0 pips. Click on at the banner to open an account!

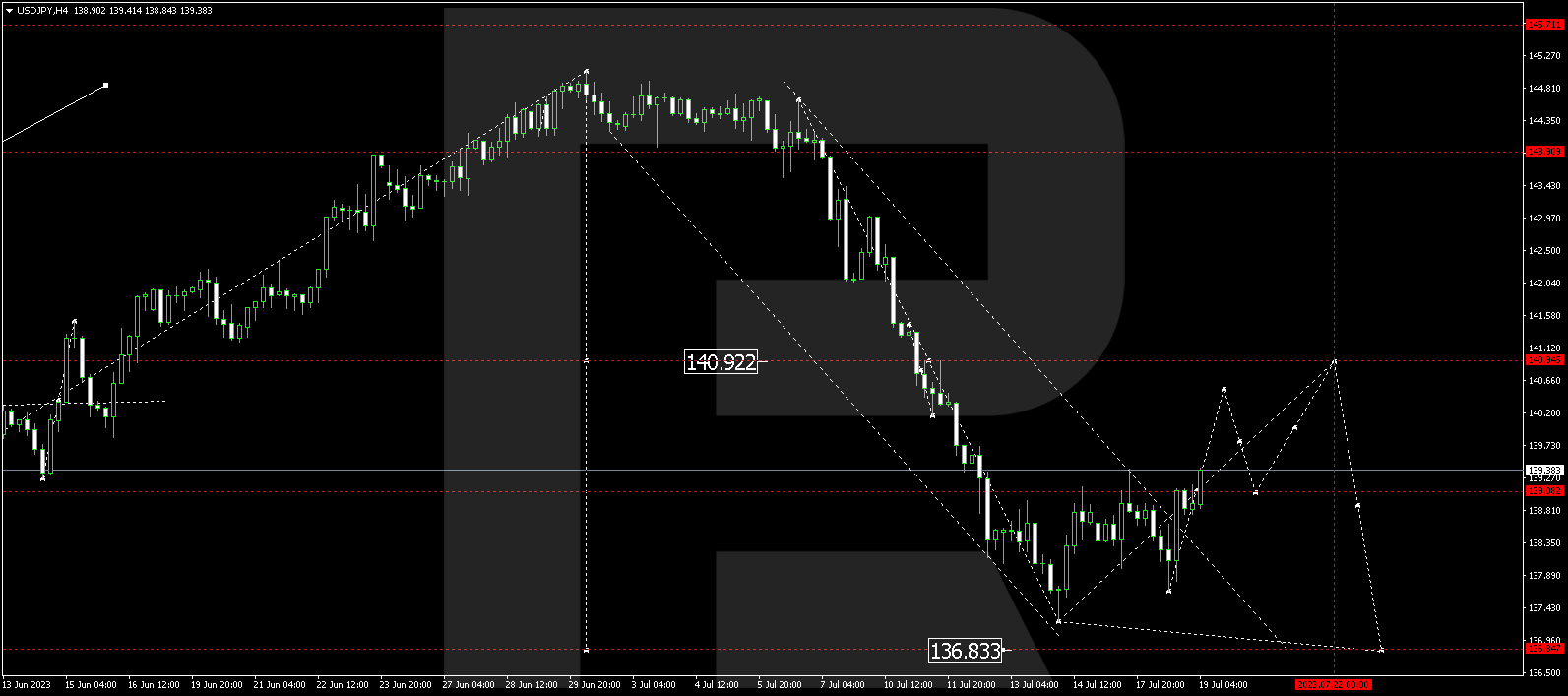

USD/JPY (US Greenback vs Jap Yen)

The forex pair has damaged 139.09 upwards, forming a slim consolidation vary with an upward breakout. An extra upward push to 140.52 is anticipated. This can be a native goal. After the fee reaches this degree, a decline to 139.09 isn’t excluded, adopted through a upward push to 140.95. That is the primary goal.

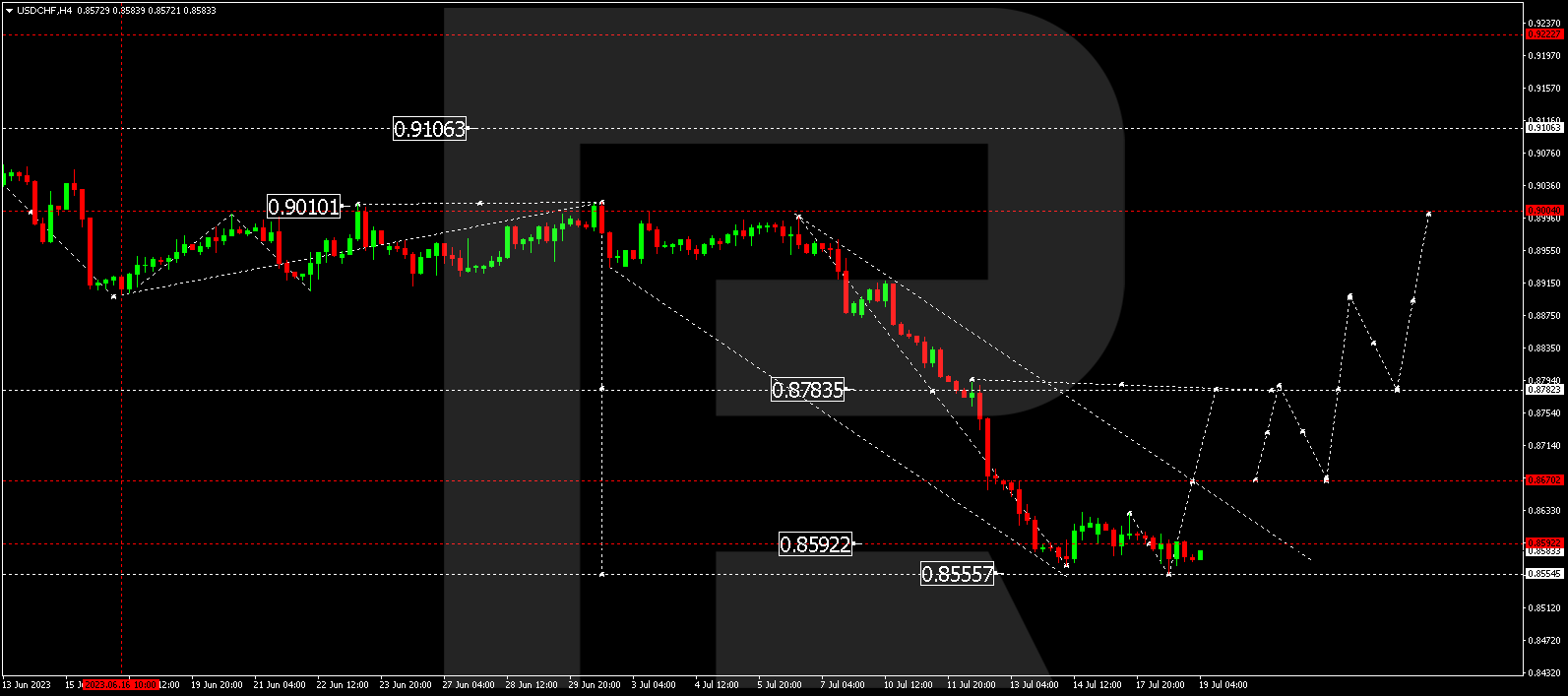

USD/CHF (US Greenback vs Swiss Franc)

The forex pair continues to shape a consolidation vary round 0.8590. Lately, the quotes may upward push to 0.8670. If there may be an upward breakout of this degree, the potential of a enlargement wave to 0.8782 would possibly open. That is the primary goal.

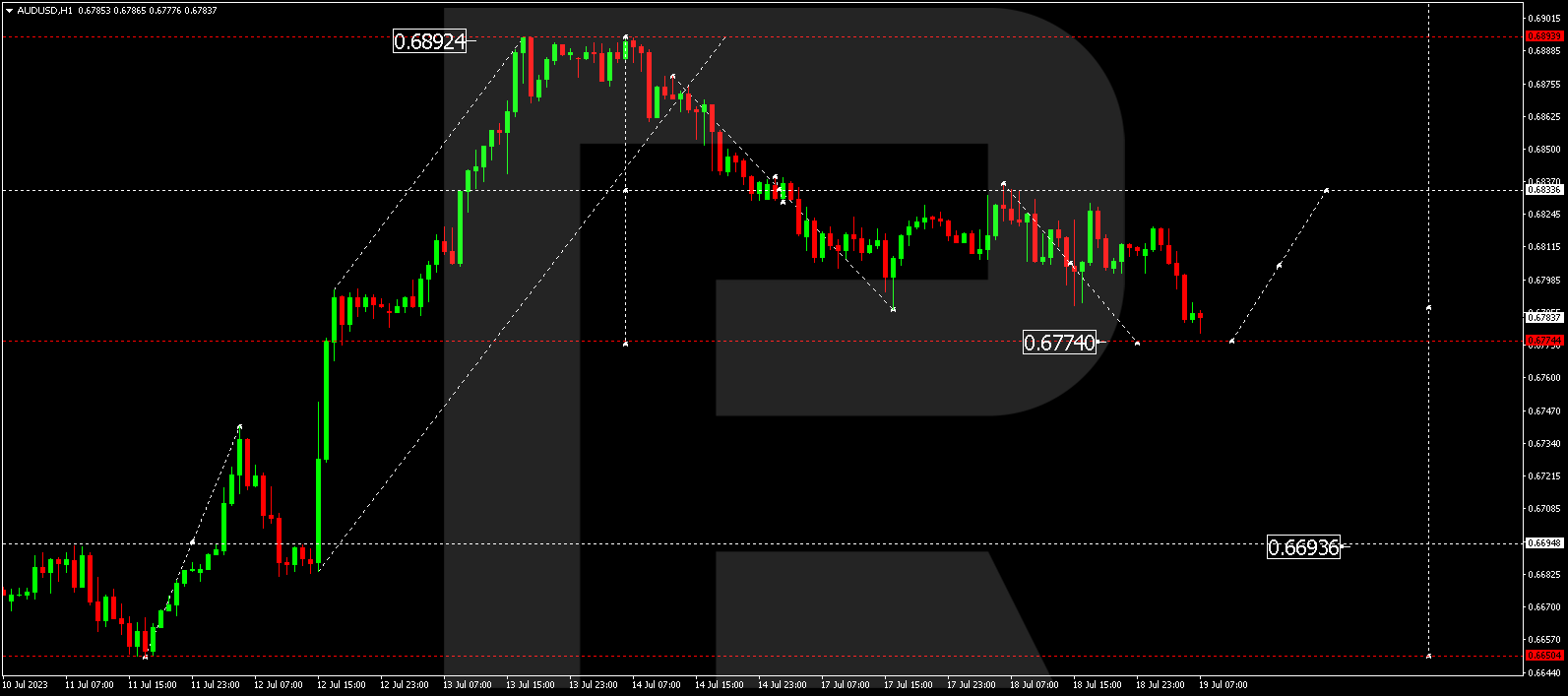

AUD/USD (Australian Greenback vs US Greenback)

The forex pair has reached the correction goal at 0.6833. Lately, the marketplace is forming a decline construction in opposition to 0.6774. That is the primary goal. After the fee reaches this degree, the quotes may right kind to 0.6883. Subsequent, a decline to 0.6696 would possibly apply.

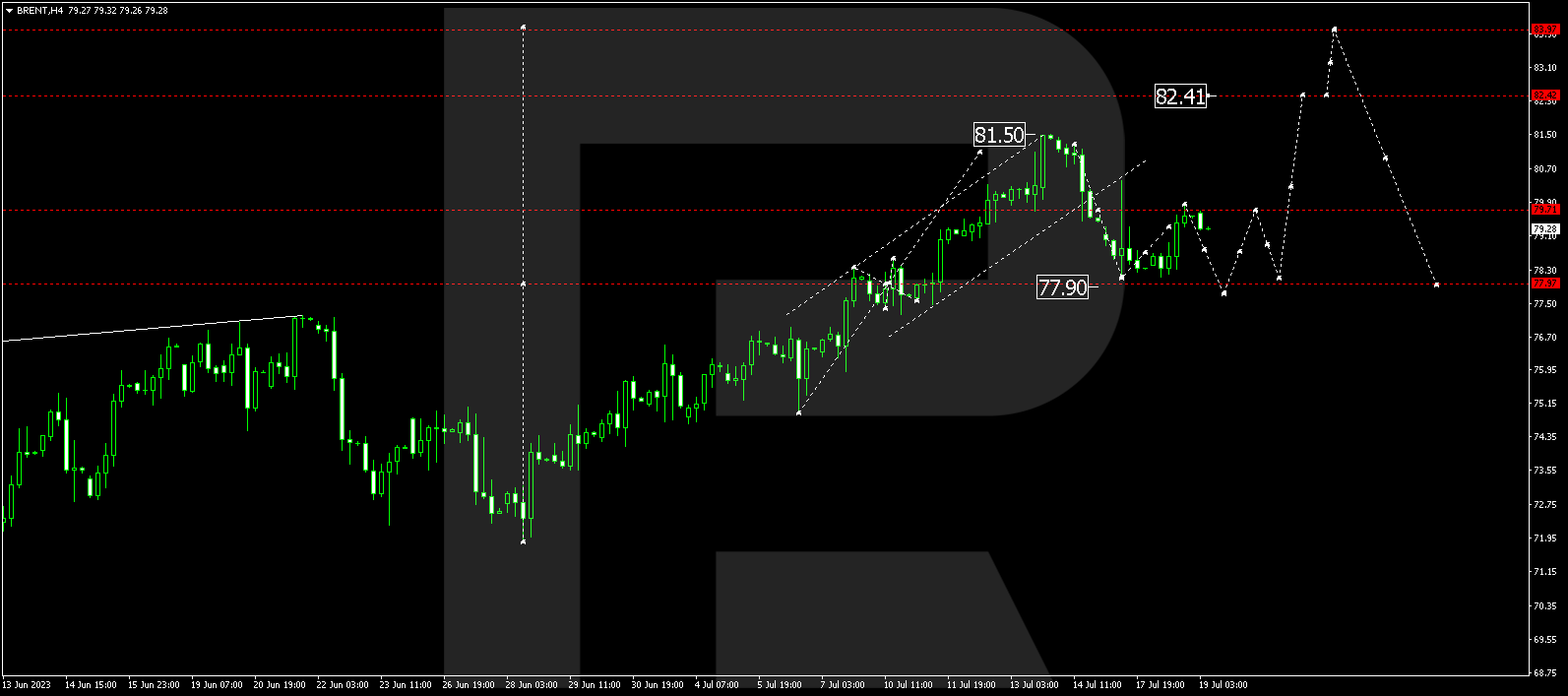

BRENT

Brent continues to shape a consolidation vary round 79.71. A corrective decline to 77.90 isn’t excluded (with a check from above). After the correction is over, a brand new wave of enlargement to 82.42 would possibly expand, from the place the development may proceed to 84.00. This can be a native goal.

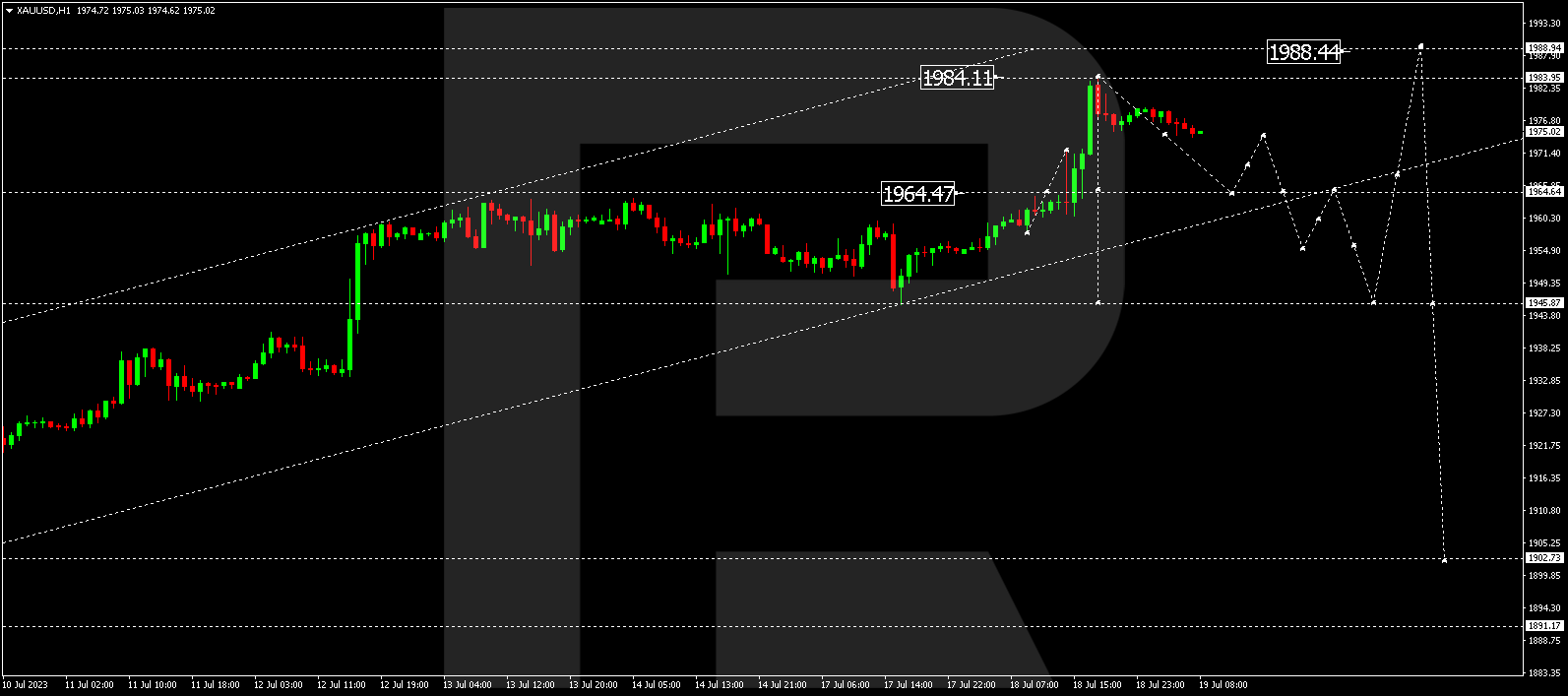

XAU/USD (Gold vs US Greenback)

Gold has damaged the 1964.64 degree upwards, extending the consolidation vary to 1983.95. Lately, a decline to 1964.64 is anticipated. In case this degree additionally breaks downwards, the potential of a decline wave to 1945.85 may open. If the fee rebounds from 1964.64 upwards, the construction of enlargement would possibly amplify to 1988.44, adopted through a decline to 1945.85.

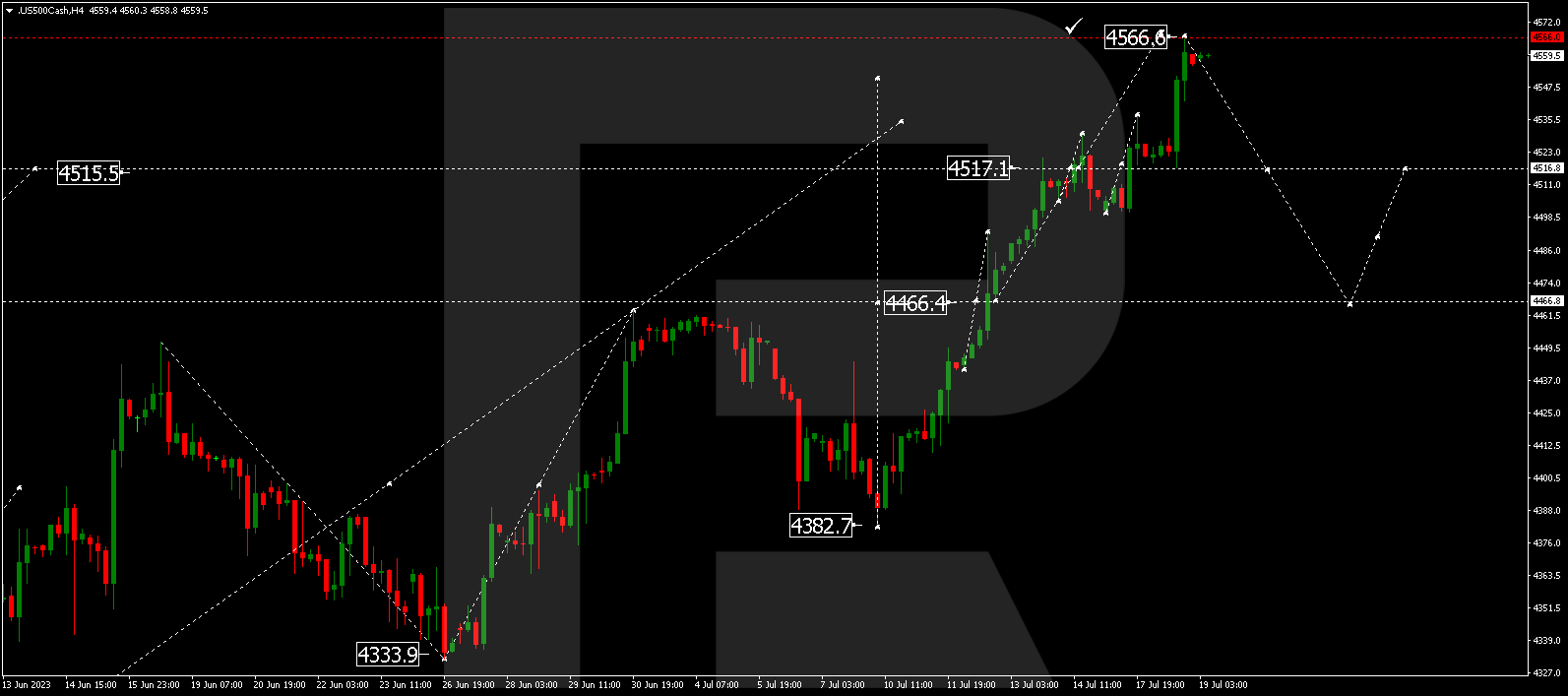

S&P 500

The inventory index has shaped a consolidation vary round 4517.0. After breaking out upwards, the marketplace prolonged the variety to 4566.6. Lately, a decline to 4517.0 is anticipated. If this degree is breached downwards, the wave of decline would possibly proceed to 4466.6. That is the primary goal.