Technical Research & Forecast February 21, 2024 – R Weblog

The S&P 500 index would possibly proceed its descent. This evaluate additionally delves into the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and Gold.

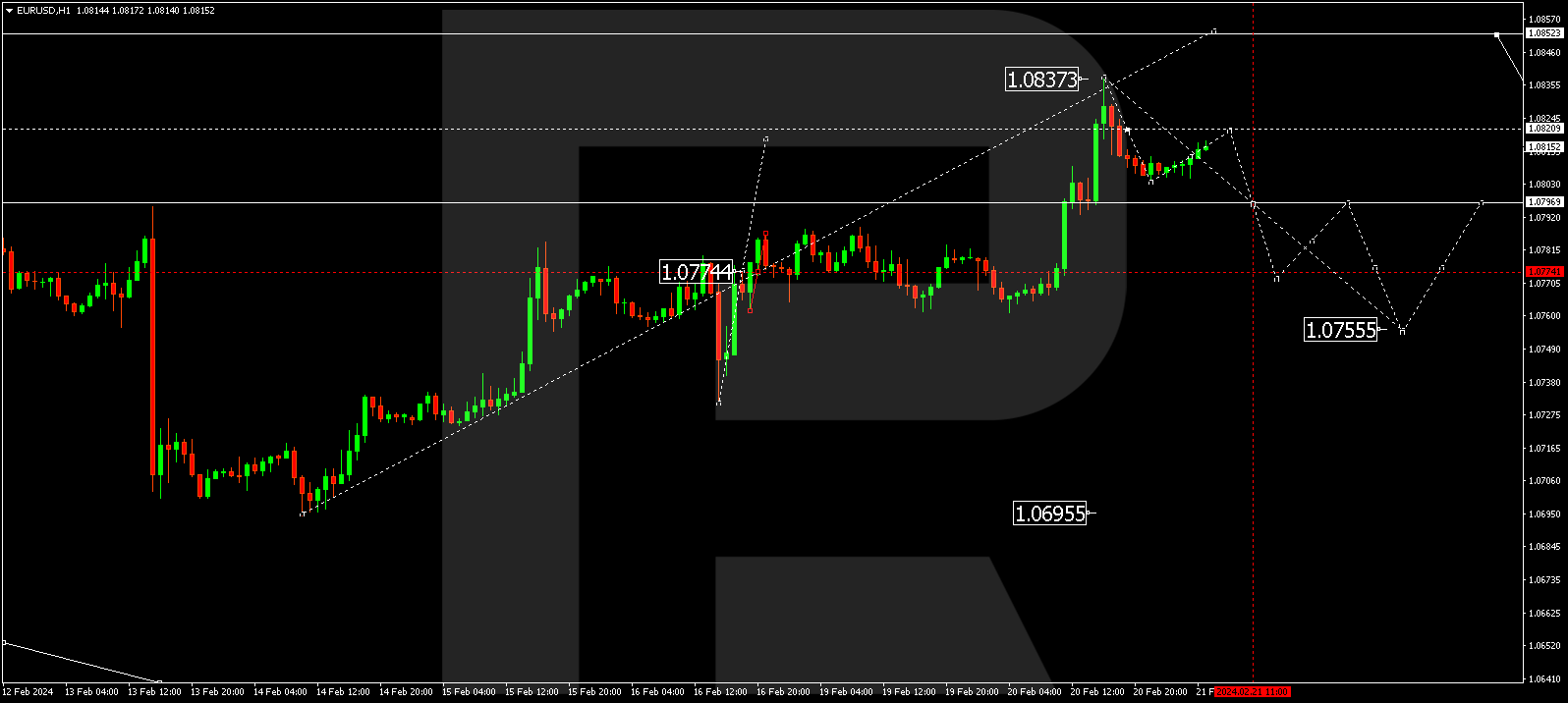

EUR/USD (Euro vs US Greenback)

The EUR/USD pair has crafted a construction with an upward surge to at least one.0838 and a next downward slide to at least one.0803 these days. At this time, a expansion section to at least one.0820 is unfolding. Necessarily, new consolidation ranges would possibly emerge round those values. A breakout to the upside may see the variability increasing to at least one.0850. Conversely, a downward breakout may pave the best way for a brand new downward wave to at least one.0755. This marks the preliminary goal.

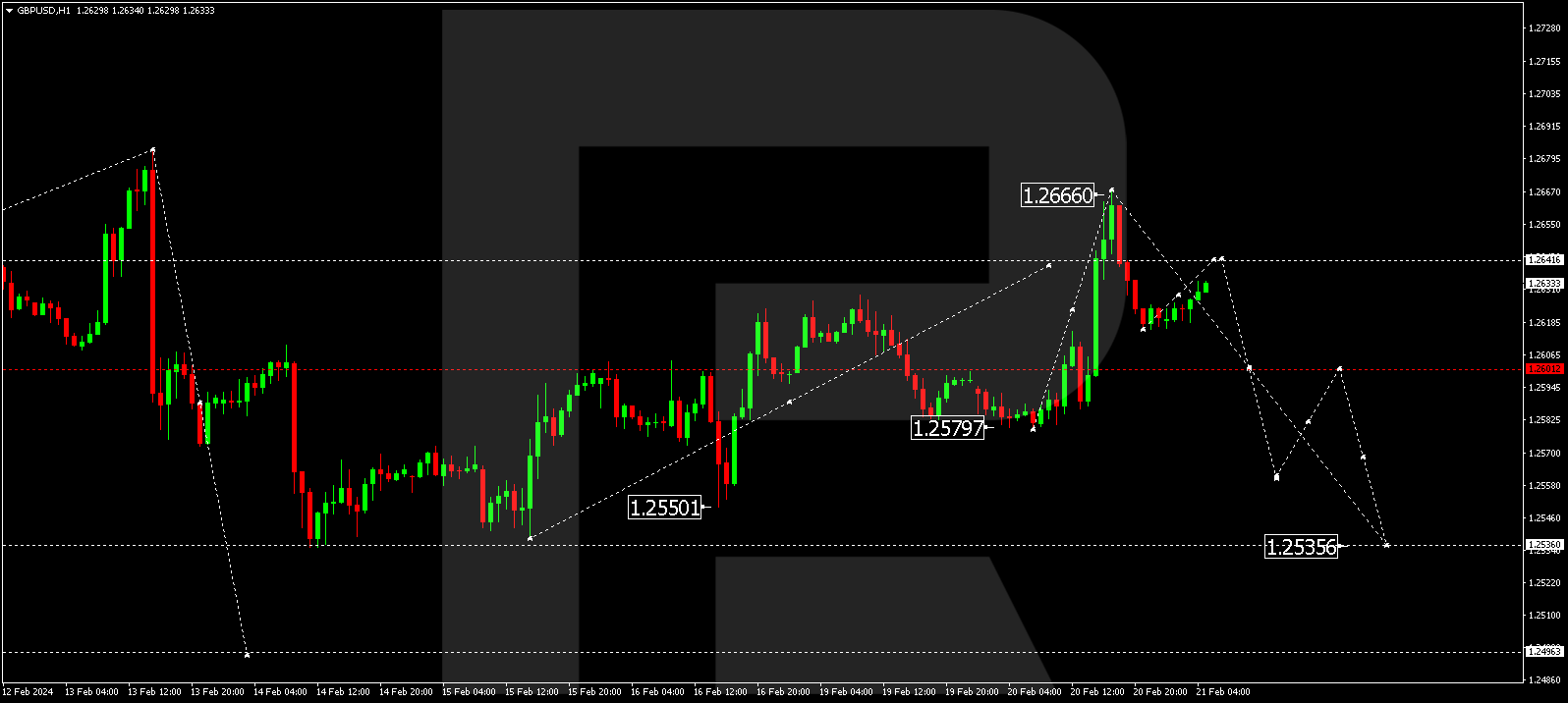

GBP/USD (Nice Britain Pound vs US Greenback)

The GBP/USD pair has concluded an upward wave at 1.2660. Recently, a downward momentum to at least one.2626 has taken form. A corrective section to at least one.2642 may materialize these days. As soon as the correction concludes, a contemporary downward wave to at least one.2560 would possibly begin, extending the fashion to at least one.2535. This constitutes the preliminary goal.

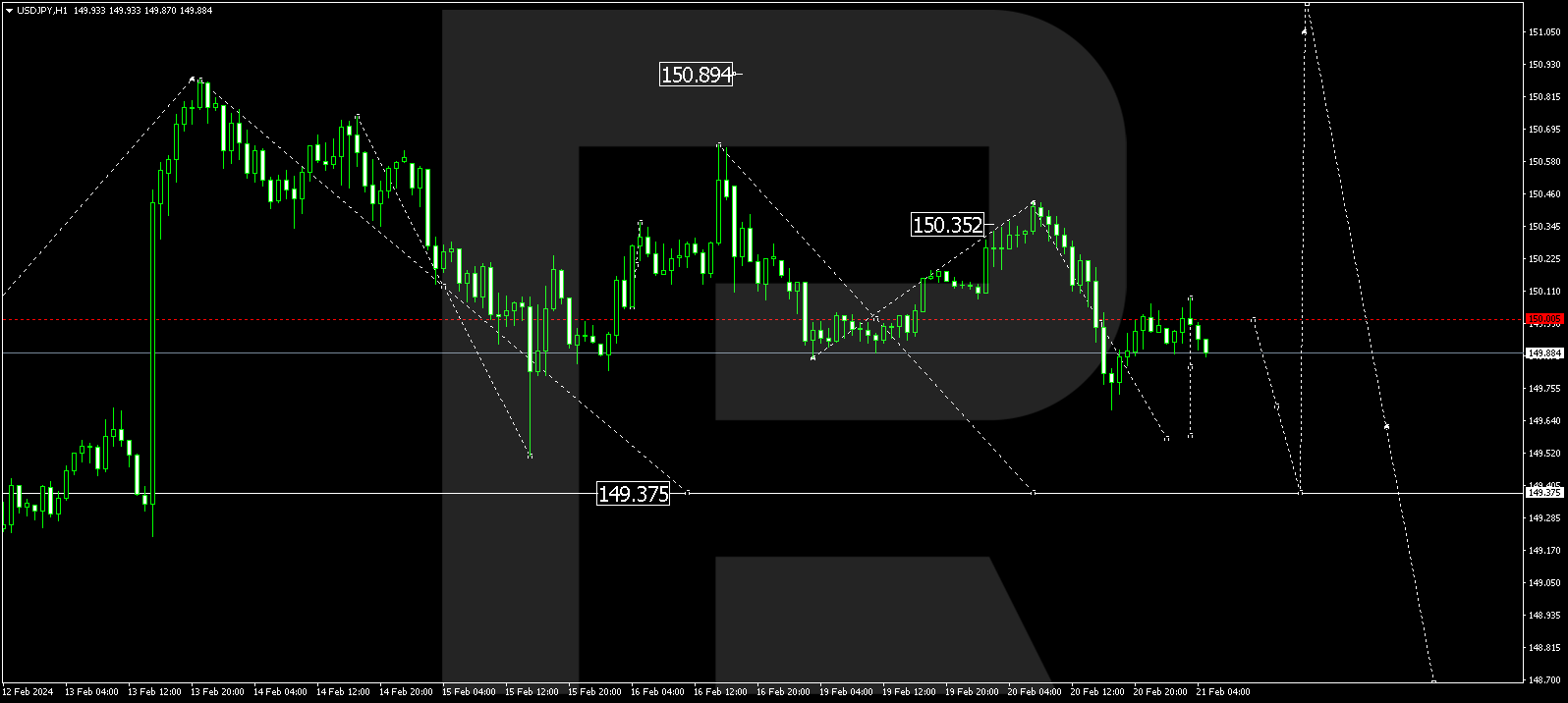

USD/JPY (US Greenback vs Jap Yen)

The USD/JPY pair is within the technique of unfolding a downward wave to 149.58. Following this, costs would possibly right kind to 150.05 (an ordeal from beneath). Therefore, a decline to 149.37 is expected. As soon as this degree is attained, a brand new upward wave to 151.50 may begin.

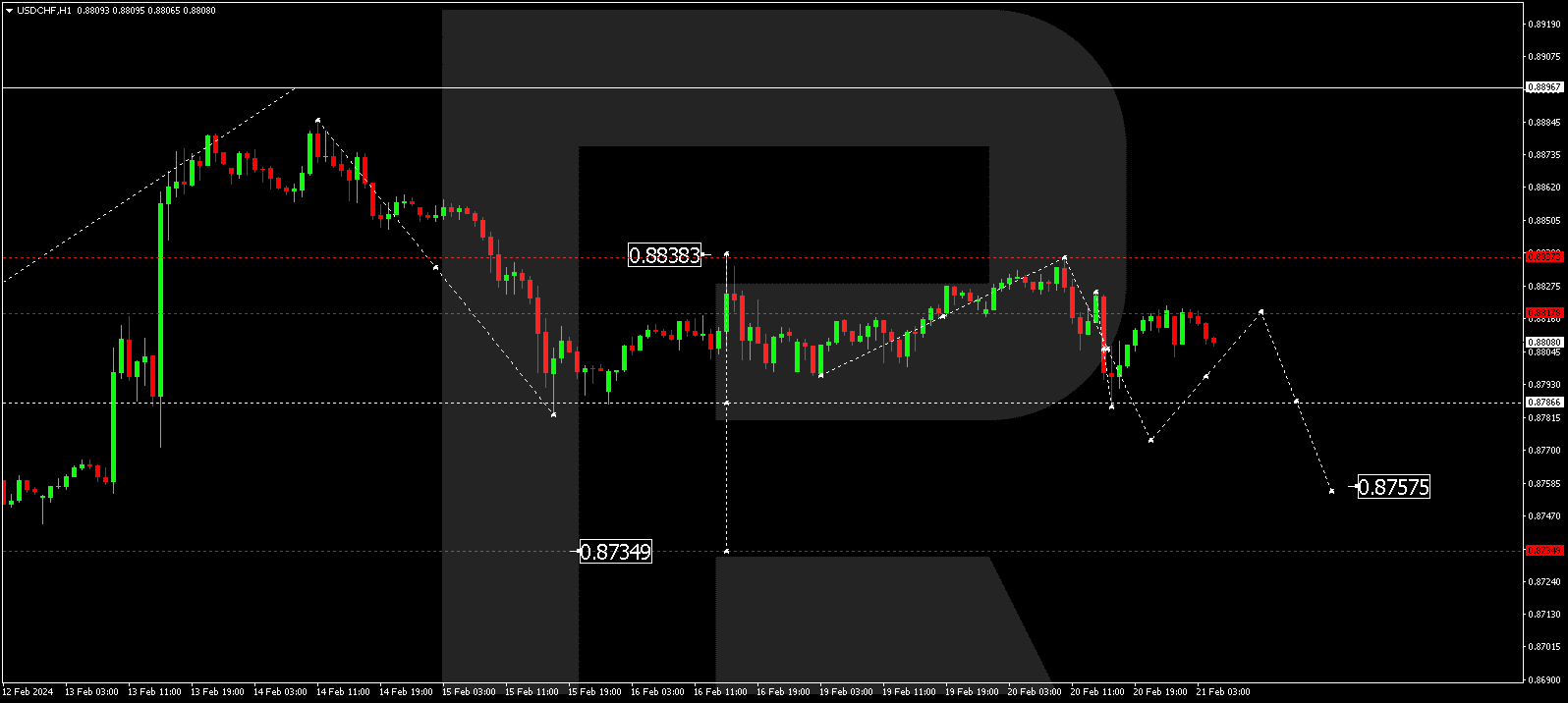

USD/CHF (US Greenback vs Swiss Franc)

The USD/CHF pair has finished a decline to 0.8785. Lately, the marketplace has retraced to the consolidation vary round 0.8818. A breakout to the upside may pave the best way for an ascent to 0.8880. Conversely, a downward breakout may prolong the correction to 0.8757.

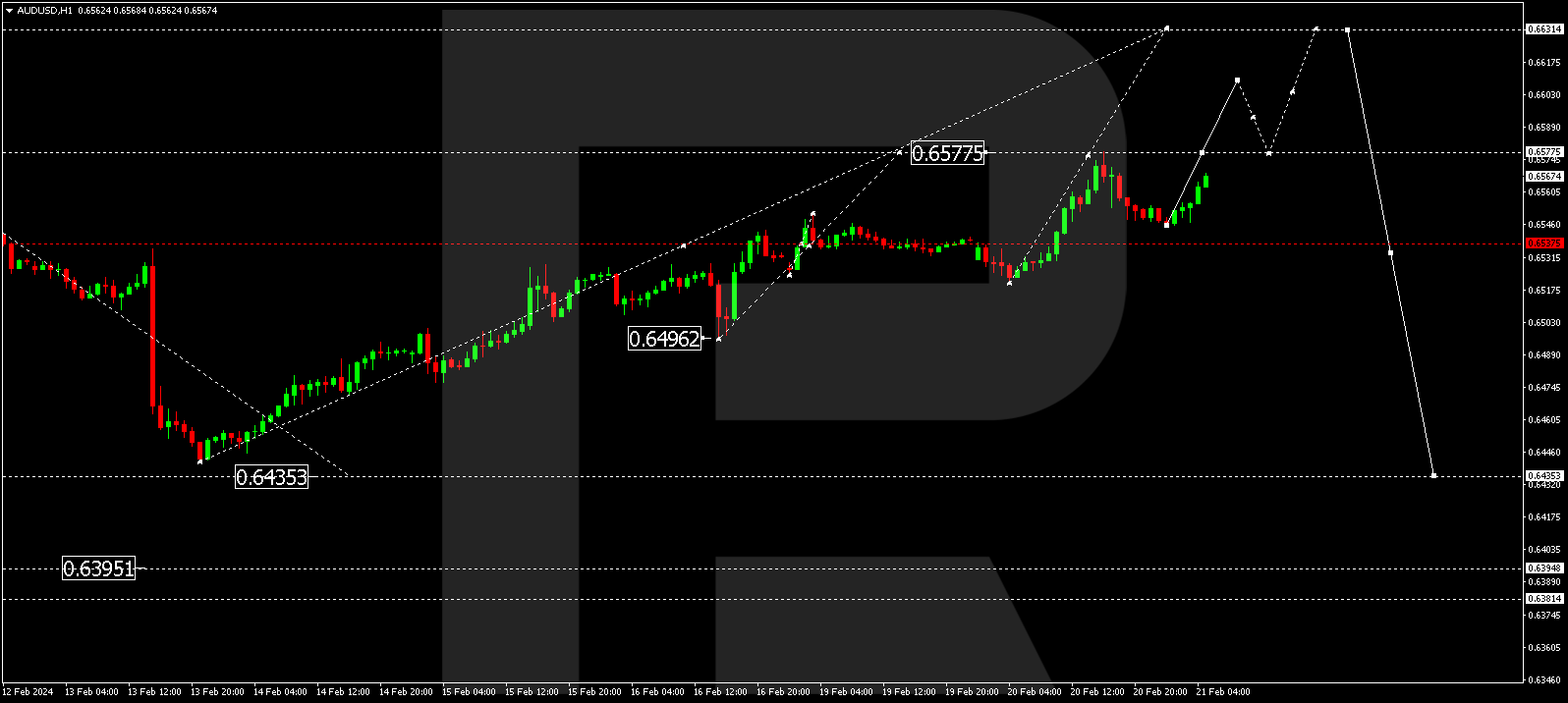

AUD/USD (Australian Greenback vs US Greenback)

The AUD/USD pair has wrapped up an upward wave at 0.6577. Recently, a consolidation vary is shaping up beneath this degree. A downward breakout may proceed the descent to 0.6455. Conversely, an upward breakout would possibly prolong the correction to 0.6630. Therefore, a trend-based decline to 0.6455 would possibly ensue. This represents the preliminary goal.

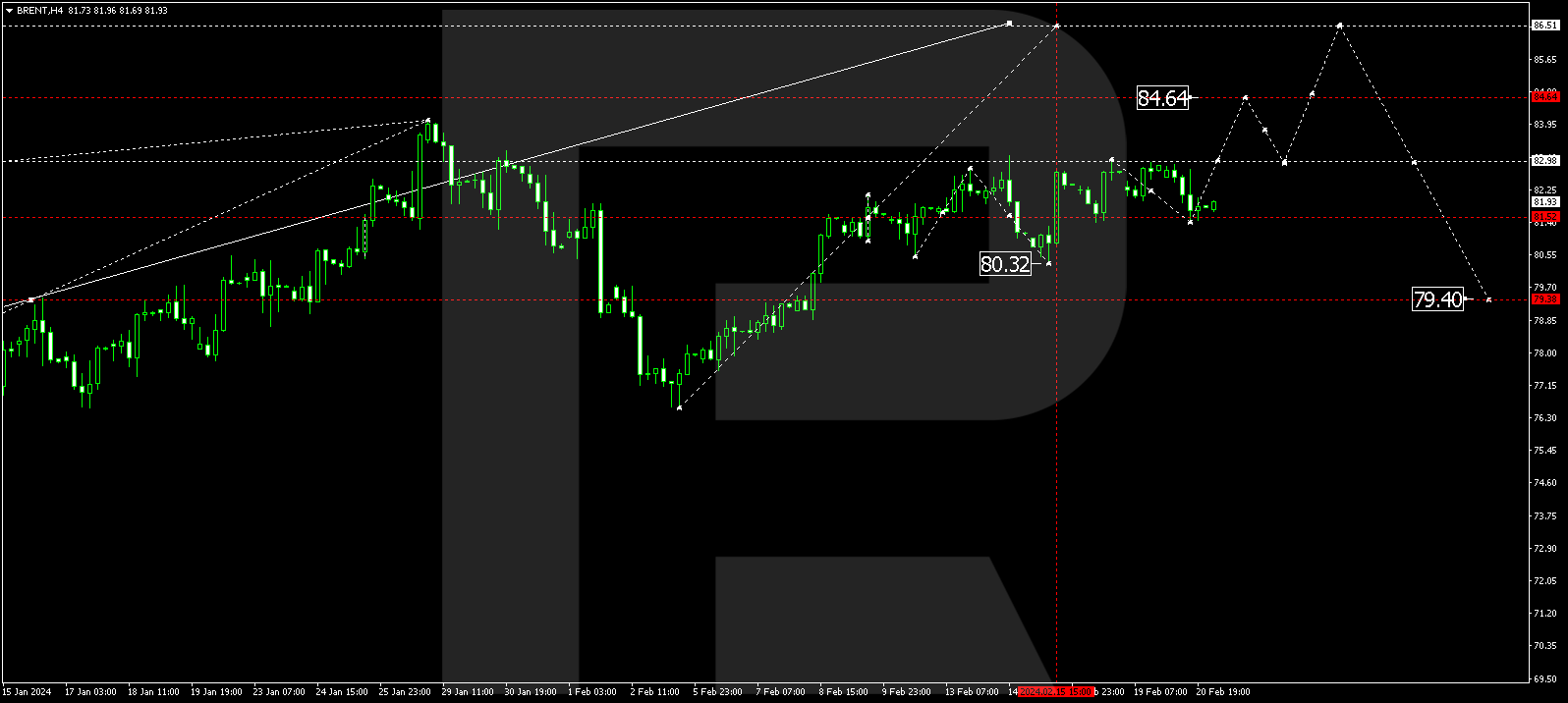

BRENT

Brent is recently in a consolidation vary round 81.52 with no transparent style. An upward breakout may see the continuation of the expansion wave to 84.64, resulting in a possible style continuation to 86.50. That is the preliminary goal.

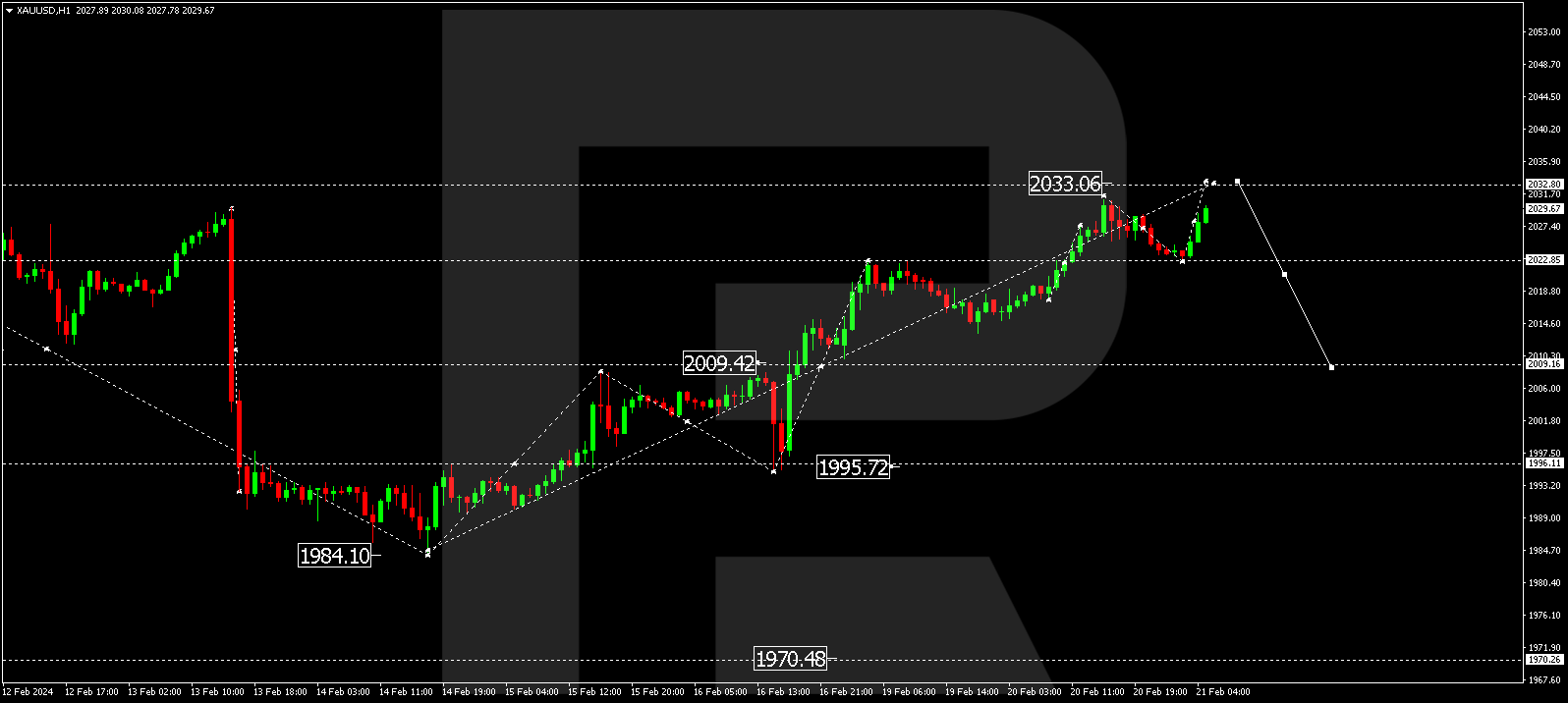

XAU/USD (Gold vs US Greenback)

Gold is extending an upward wave to 2033.00. After achieving this degree, a brand new downward wave to 2009.00 is expected to begin. That is the preliminary goal.

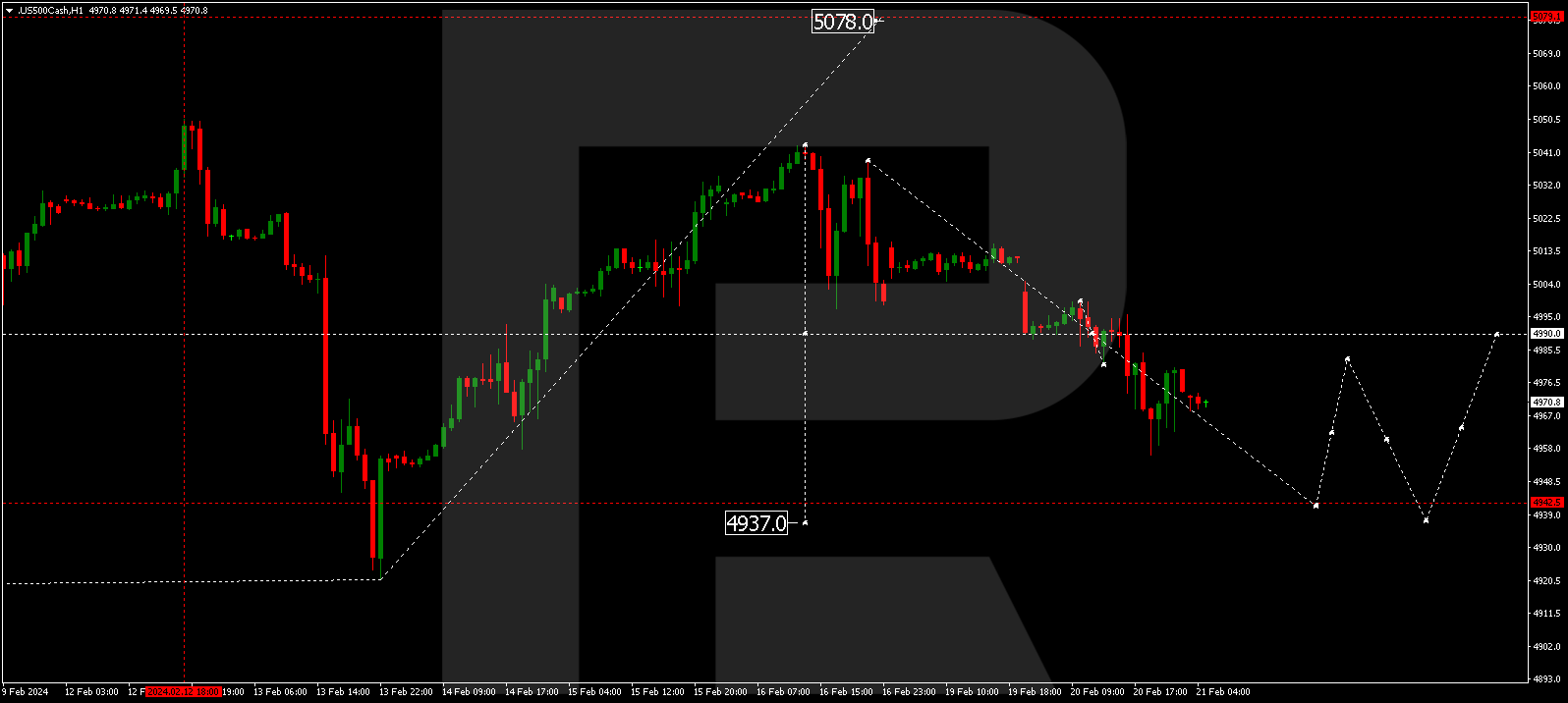

S&P 500

The inventory index has finished a downward wave construction to 4956.1. A correction to 4990.0 is believable these days (a check from beneath). Therefore, a decline to 4942.5 would possibly manifest. This can be a native goal.