Technical Research & Forecast August 4, 2023 – R Weblog

Gold is recently present process consolidation previous to an expected correction. This evaluation additionally delves into the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and the S&P 500 index.

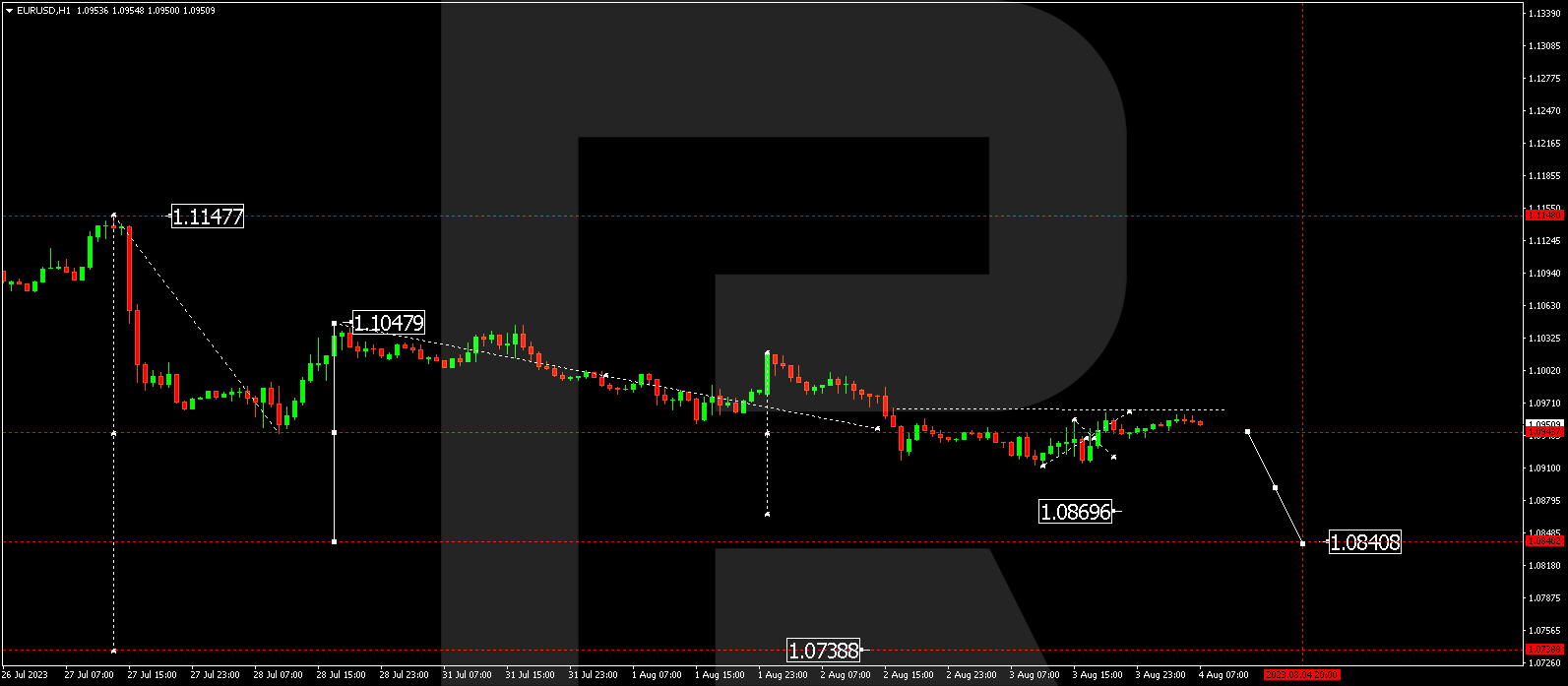

EUR/USD (Euro vs US Buck)

EUR/USD has concluded a downward wave, attaining the 1.0917 stage. At the moment, the marketplace is organising a consolidation vary above this stage. A possible expansion segment may observe, extending the variability against the 1.0964 stage. Within the match of an upward breakout from this vary, a correction against 1.0997 is conceivable. Conversely, a downward breakout may pave the way in which for the vogue to proceed against 1.0869.

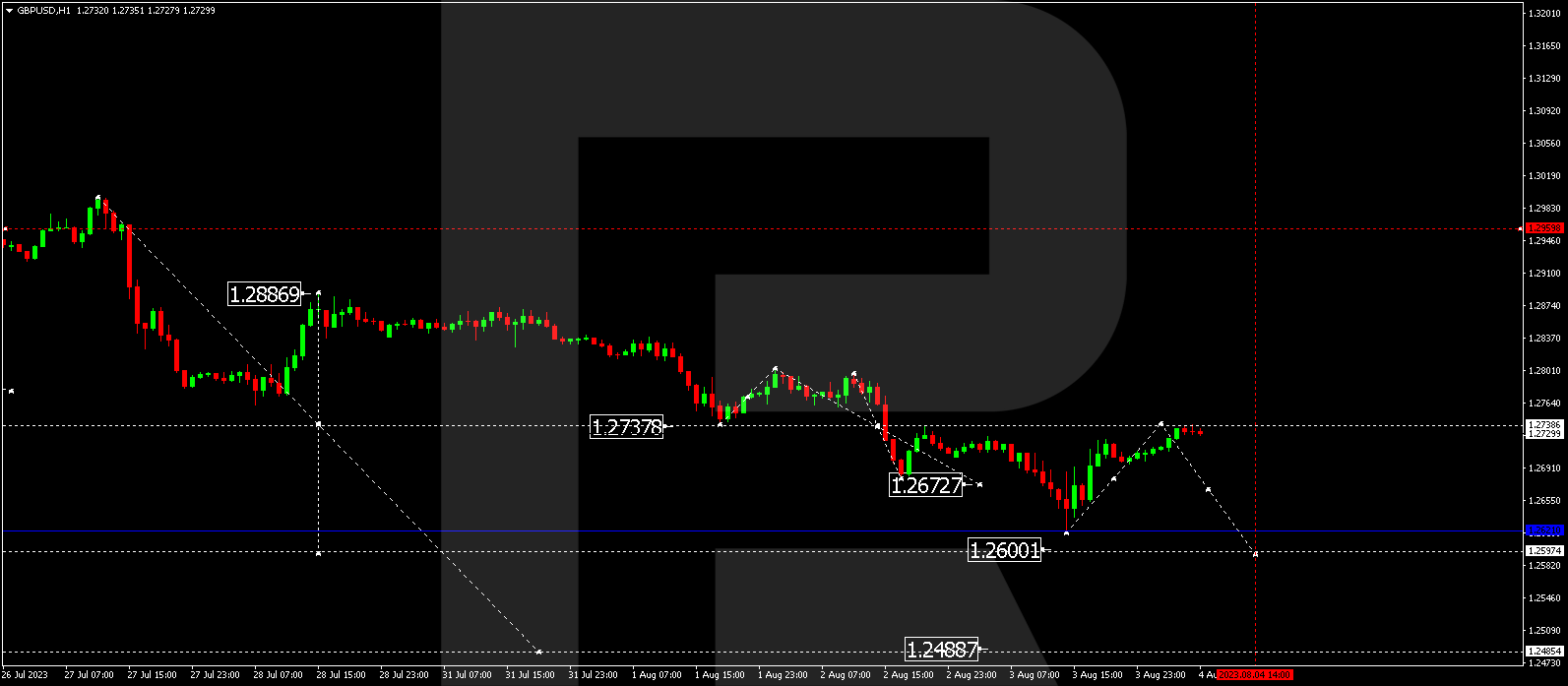

GBP/USD (Nice Britain Pound vs US Buck)

GBP/USD has effectively finished a descending construction, attaining the 1.2620 stage. Nowadays, the marketplace has skilled a correction to at least one.2737 (a check from underneath). An extra decline construction against 1.2600 is projected as a neighborhood goal. After attaining this stage, every other correction to the 1.2737 stage may expand, adopted via a decline against the 1.2488 stage.

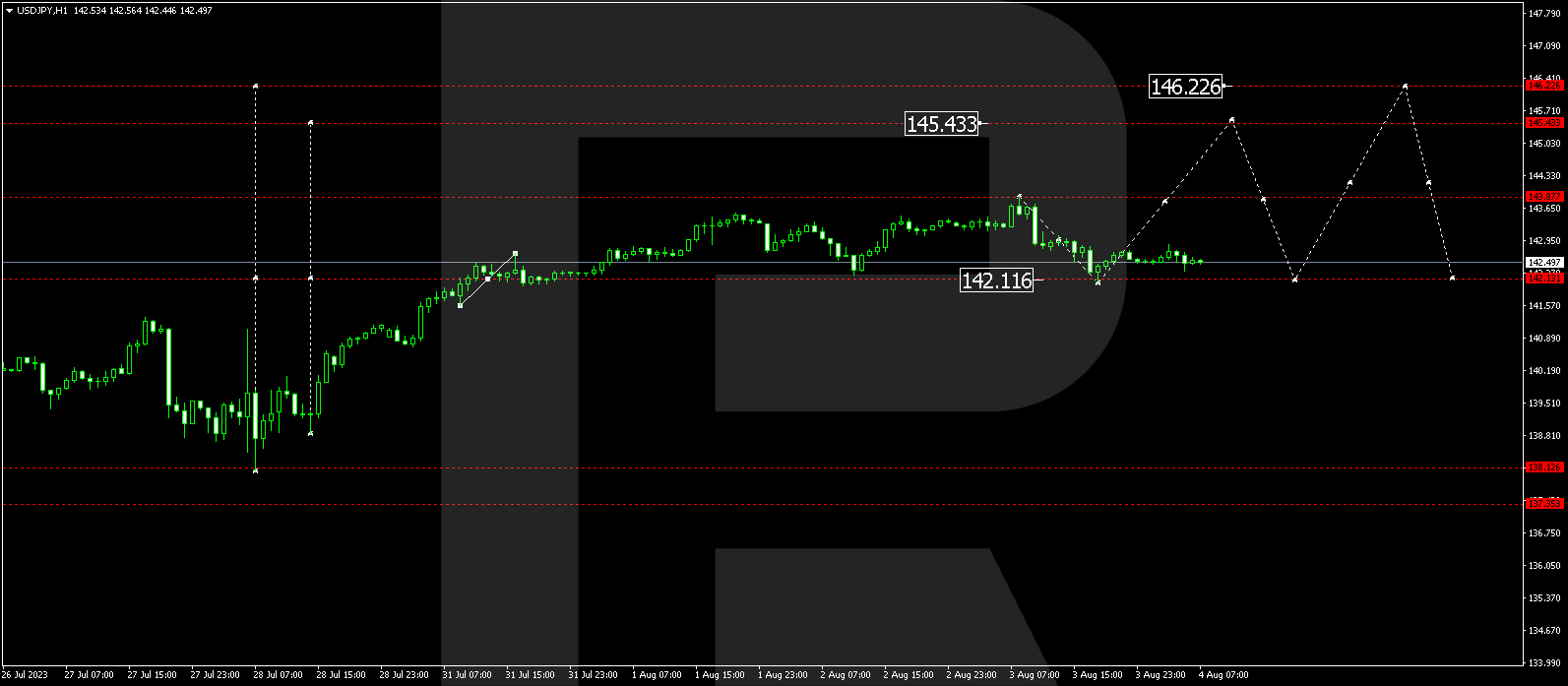

USD/JPY (US Buck vs Eastern Yen)

USD/JPY has wrapped up a corrective hyperlink, attaining the 142.11 stage. Right now, the marketplace is forming a consolidation vary above this stage. Within the state of affairs of a downward breakout, the correction may proceed against the 140.20 stage. On the other hand, with an upward breakout, a expansion hyperlink against 145.45 may ensue, with the opportunity of vogue continuation to 146.22.

Sign up for the RoboForex spouse programme and earn as much as 84% of the corporate’s source of revenue for attracting purchasers. Do not pass over this chance!

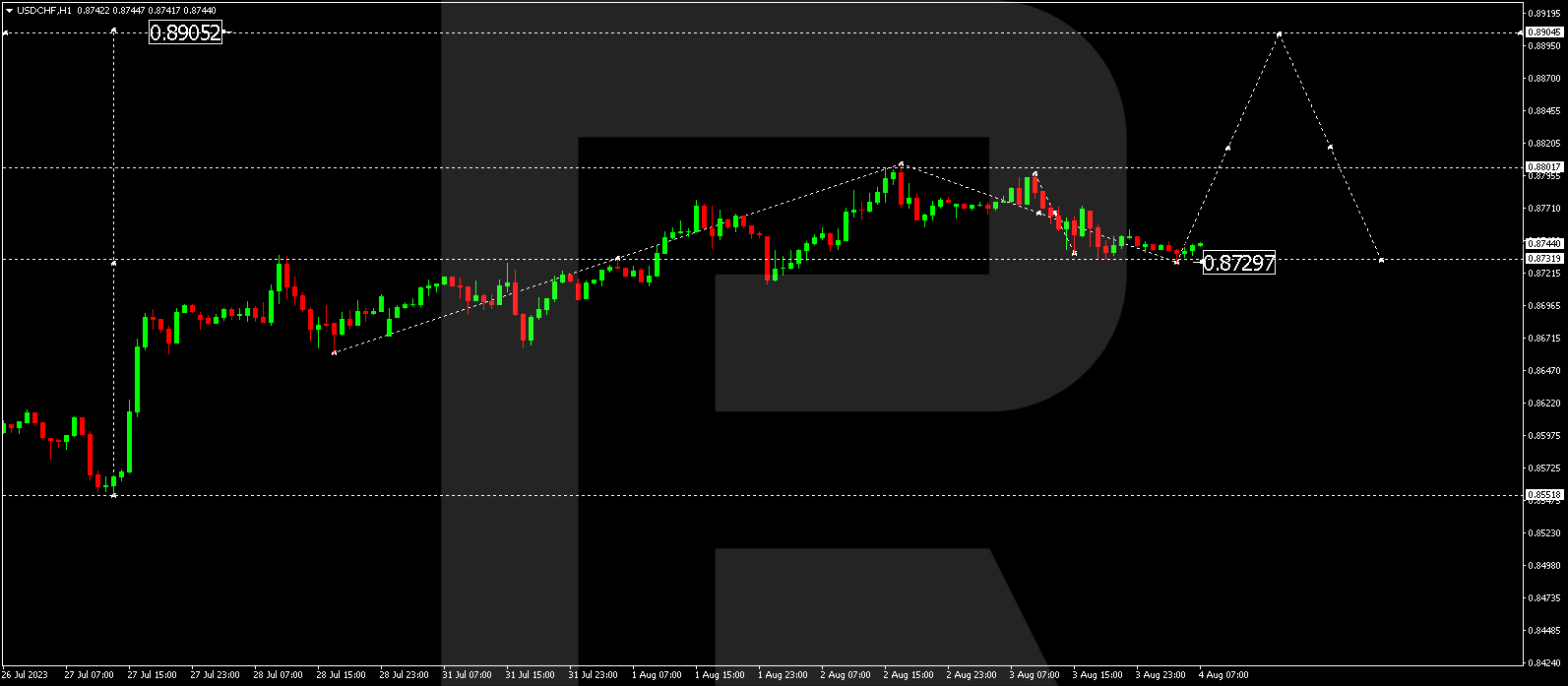

USD/CHF (US Buck vs Swiss Franc)

USD/CHF has concluded a corrective wave, attaining the 0.8730 stage (a check from above). An extra expansion construction against the 0.8800 stage is expected. An upward breakout from this stage may result in a trend-driven motion against 0.8900, representing the preliminary goal.

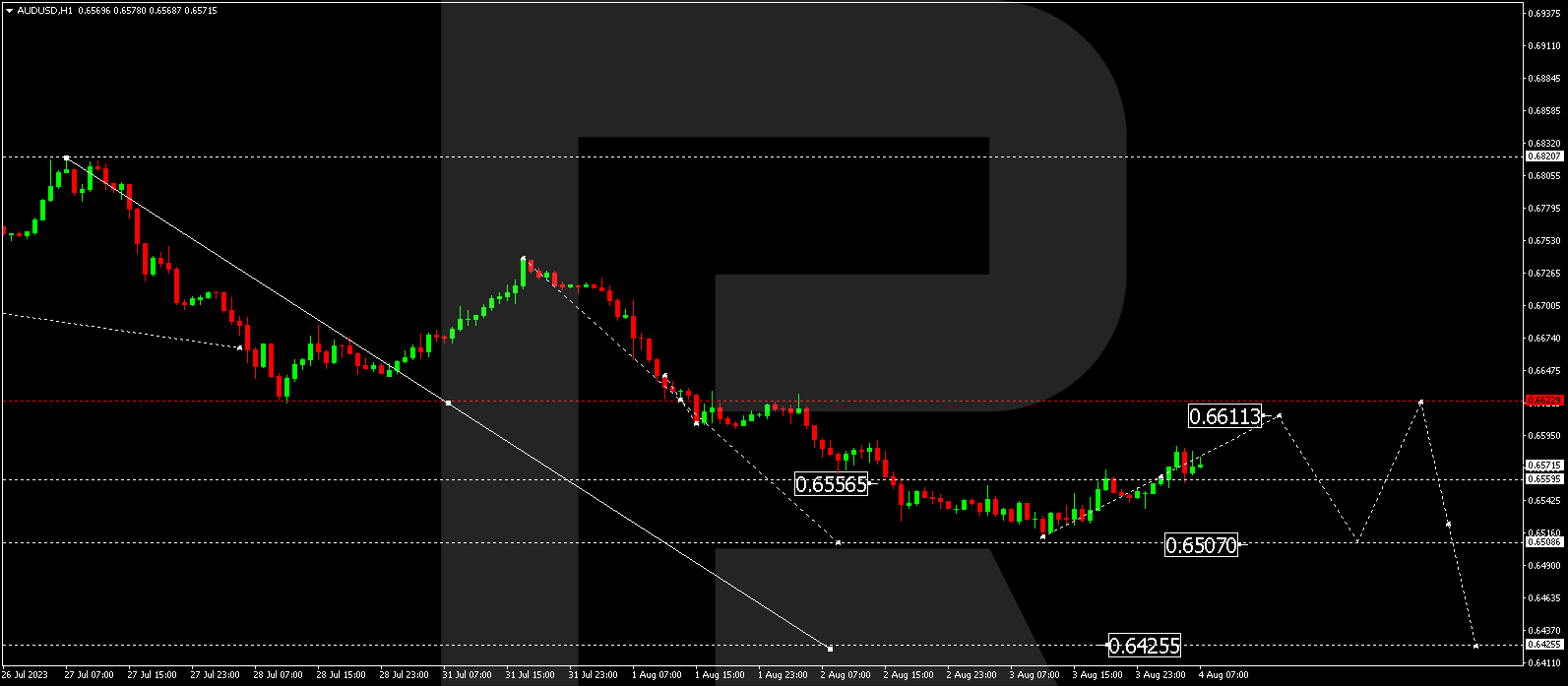

AUD/USD (Australian Buck vs US Buck)

AUD/USD has finalized a downward wave, attaining the 0.6514 stage. Nowadays, the marketplace has concluded a correction hyperlink to the 0.6577 stage. Every other segment of correction against 0.6613 may observe. Following the crowning glory of the correction, a contemporary downward wave against 0.6500 may start up. In case of a breakout underneath this stage, the rage may lengthen against the 0.6425 stage.

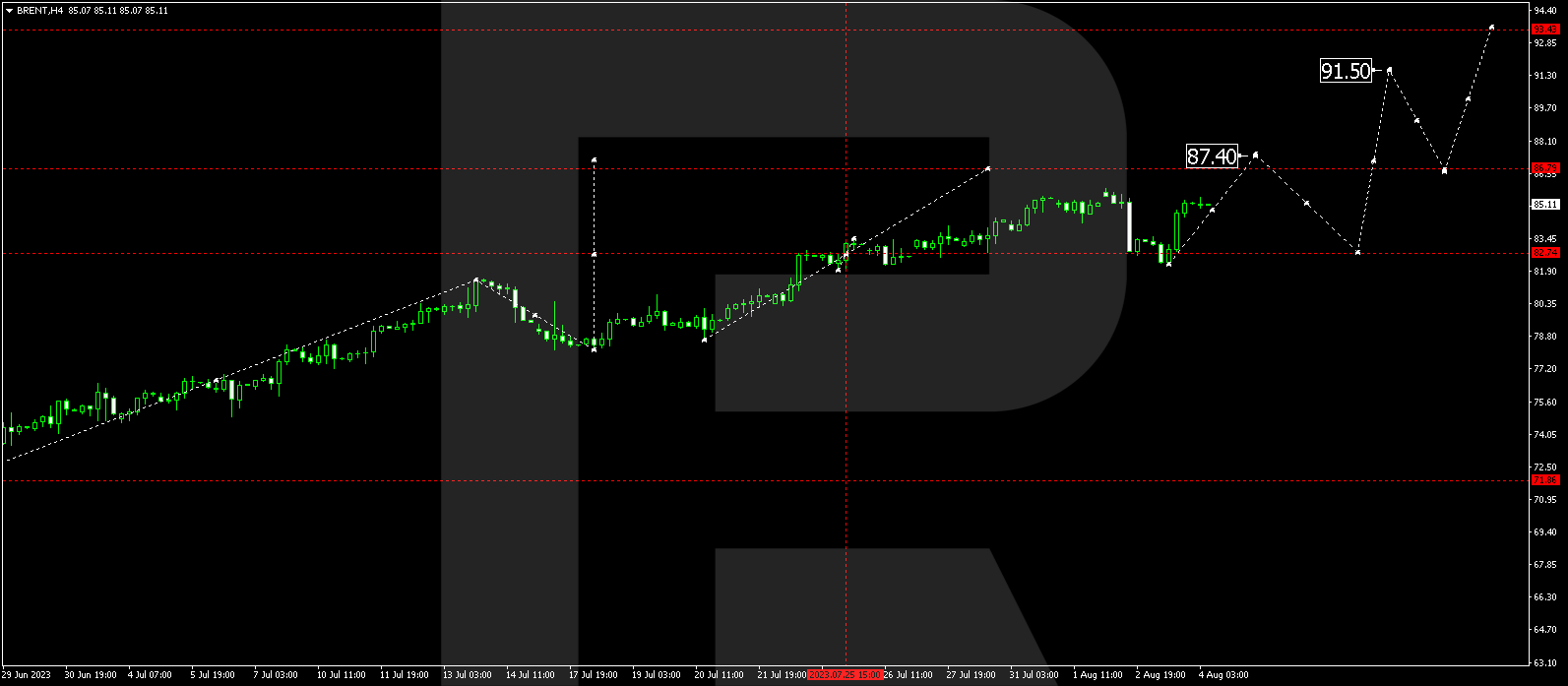

BRENT

Brent has passed through a correction to the 82.25 stage. Nowadays, the marketplace has finished a expansion construction against 85.40. These days, a consolidation vary is taking form round this stage. An upward breakout may result in a wave against 87.40, with the opportunity of vogue continuation against the 91.50 stage.

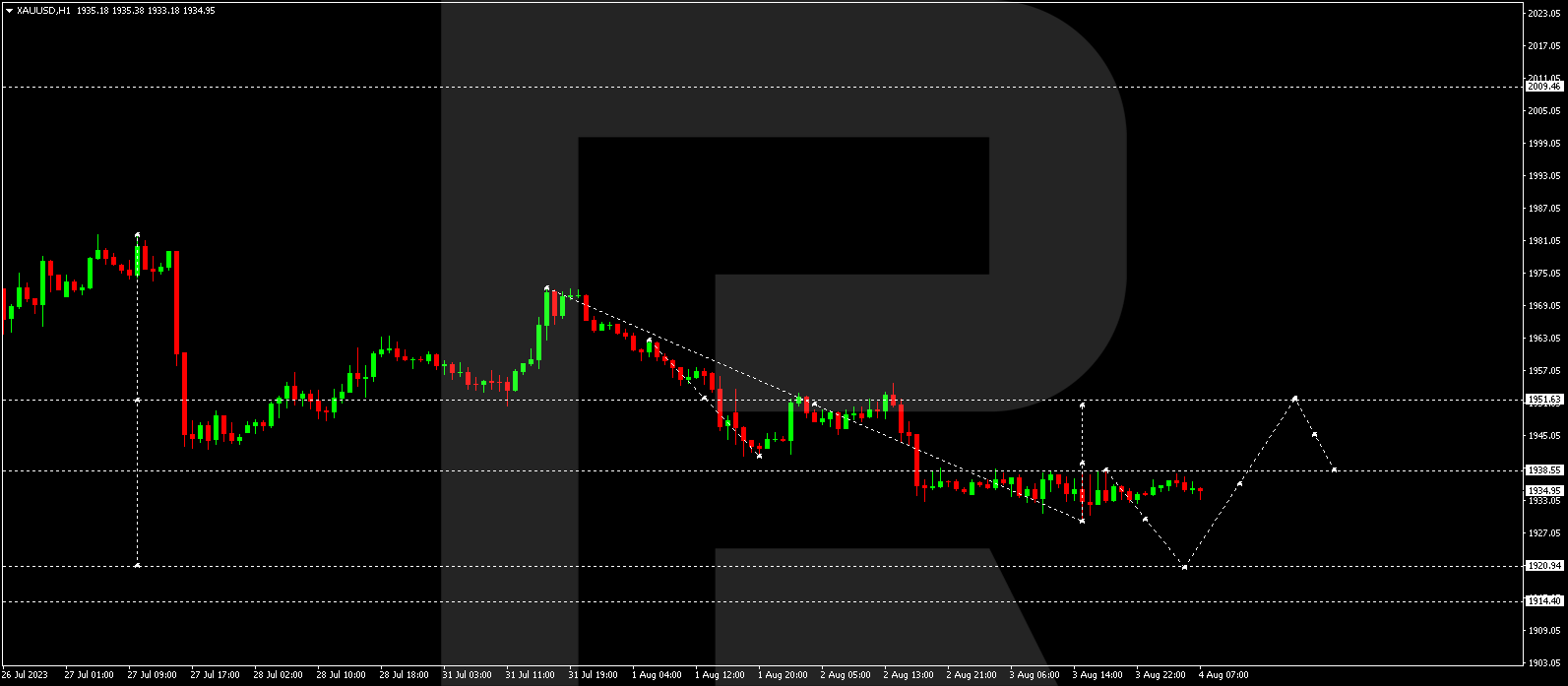

XAU/USD (Gold vs US Buck)

Gold has concluded a downward wave, attaining the 1929.14 stage. Nowadays, the marketplace continues to ascertain a consolidation vary above this stage. In case of an upward breakout, a correction hyperlink against the 1951.60 stage may observe. Conversely, a downward breakout may pave the way in which for vogue continuation against 1920.90, with a possible extension of the wave to 1914.40.

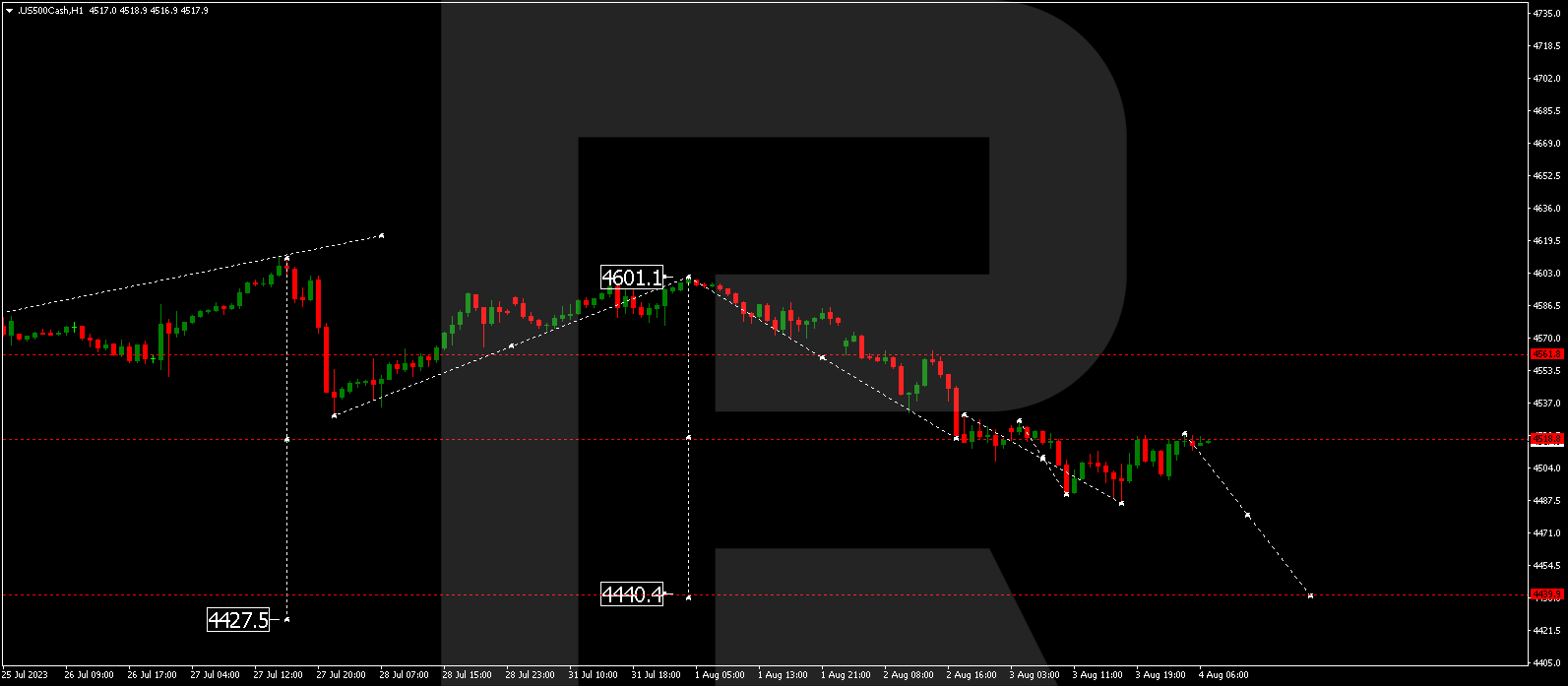

S&P 500

The inventory index has wrapped up a downward wave, attaining the 4486.5 stage. Nowadays, the marketplace is present process a correction against 4522.2. Upon crowning glory of the correction, every other descending construction against 4440.4 may evolve, representing a neighborhood goal.