Susceptible US Knowledge Cooled Price Bets; Australia inflation Under Anticipated

Wall Side road took convenience from a number of problem surprises in US macro information in a single day, with the information taming some price hike bets and noticed US Treasury yields decline. The USA two-year yields have been down 11 basis-point (bp), reversing all of remaining week’s beneficial properties, whilst the 10-year yields have been down 8 bp to ship a two-week low. The US greenback reverses additional (-0.3%), permitting main US indices to safe its 3rd instantly day of beneficial properties.

Each the USA activity openings and shopper self belief information in a single day have been not up to anticipated, which level in opposition to a weaker shopper spending outlook and a few cooling in labour call for. US shopper self belief fell via essentially the most in two years, whilst activity openings touched its lowest stage since March 2021. The weaker information would possibly assist to tame the upside in pricing pressures forward and equipped room for the Fed to believe holding charges on grasp, as in comparison to further tightening.

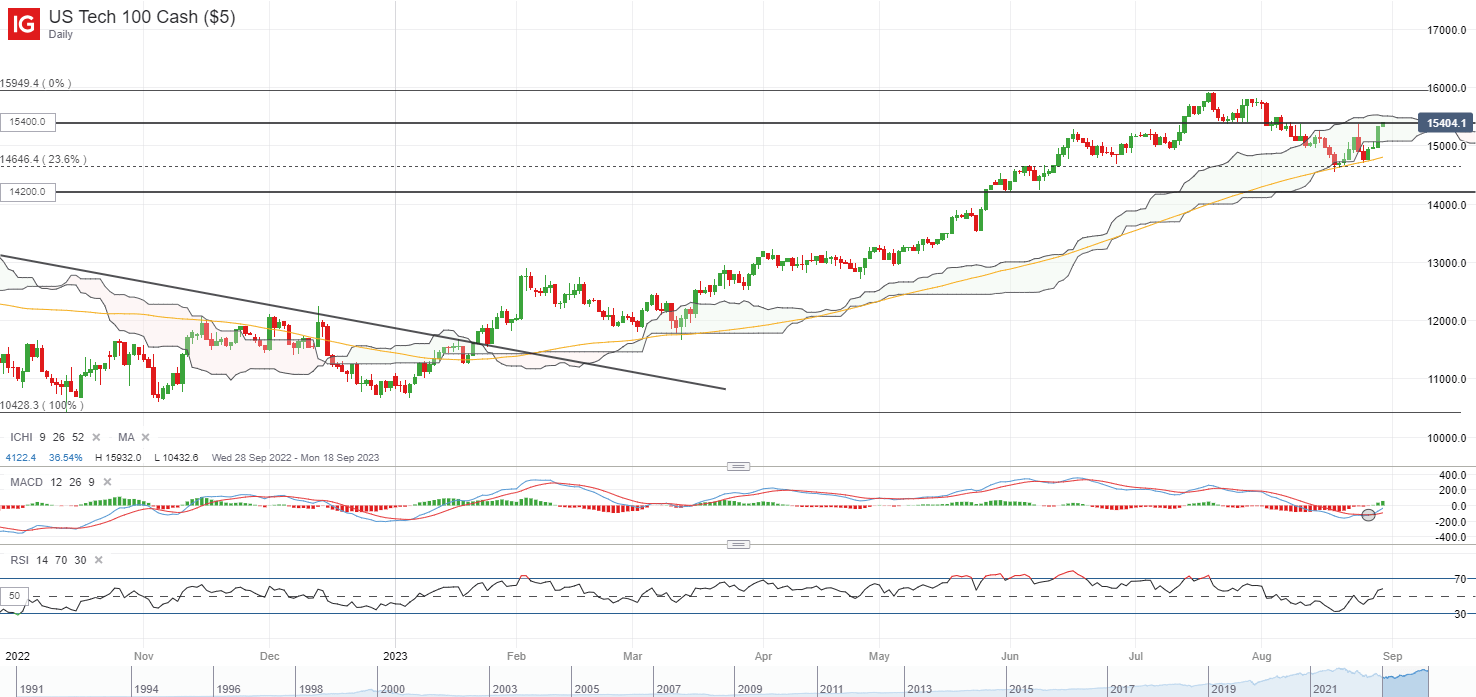

The in a single day possibility rally has allowed the Nasdaq 100 index to conquer its remaining Thursday’s sell-off, reflecting some keep an eye on from consumers. This follows after discovering make stronger off the 14,630 stage, the place its 100-day shifting reasonable (MA) stands along the decrease fringe of its Ichimoku cloud at the day-to-day chart. A bullish crossover is shaped on its shifting reasonable convergence/divergence (MACD), with any transfer above the 15,400 stage probably paving easy methods to retest its year-to-date prime on the 15,900 stage subsequent.

Supply: IG charts

Asia Open

Asian shares glance set for a good open, with Nikkei +0.47%, ASX +0.85% and KOSPI +0.66% on the time of writing. The Nasdaq Golden Dragon China Index is up 3.7% in a single day, with Chinese language equities driving at the progressed possibility atmosphere for a turnaround from Monday’s whiplash. Previous stamp accountability cuts on inventory trades equipped some lingering optimism, despite the fact that its upcoming buying managers index (PMI) releases the following day will supply some other reckoning for its still-weak financial prerequisites.

This morning noticed a vital problem wonder in Australia’s per month Client Worth Index (CPI) learn, coming in at 4.9% as opposed to the 5.2% anticipated, which validates present price expectancies for the Reserve Financial institution of Australia (RBA) to stay charges on grasp into subsequent 12 months. This marked the primary time since February 2022, the place the per month CPI indicator falls under the 5% stage. However for the reason that it’s nonetheless a distance clear of the RBA’s 2-3% goal, the central financial institution would possibly proceed to take care of its hawkish-pause stance for some coverage flexibility, despite the fact that we’re most probably seeing the top of its tightening procedure.

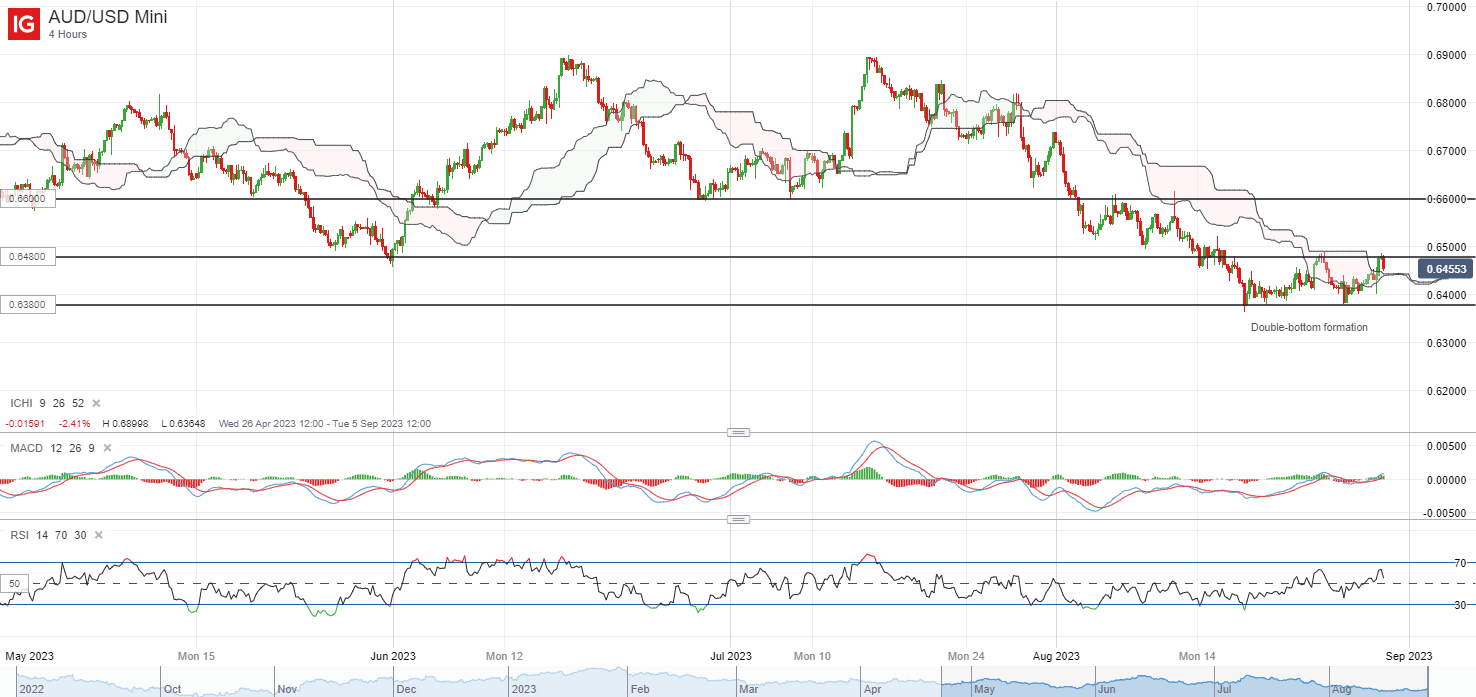

Advanced possibility sentiments and a few near-term reduction at the China’s entrance have allowed room for some restoration within the AUD/USD this week, however upside has been challenged into lately’s consultation with the lower-than-expected Australia’s inflation quantity. The pair has been showing a near-term double-bottom trend on its four-hour chart, however resistance are recently discovered at its neckline on the 0.648 stage, which additionally marked the height of remaining Thursday’s sell-off. A transfer above this stage shall be a lot had to make stronger additional restoration to retest the 0.660 stage subsequent, whilst alternatively, additional problem would possibly go away its 0.638 stage on watch.

Supply: IG charts

At the watchlist: Paring price hike bets introduced some cooling in US greenback rally

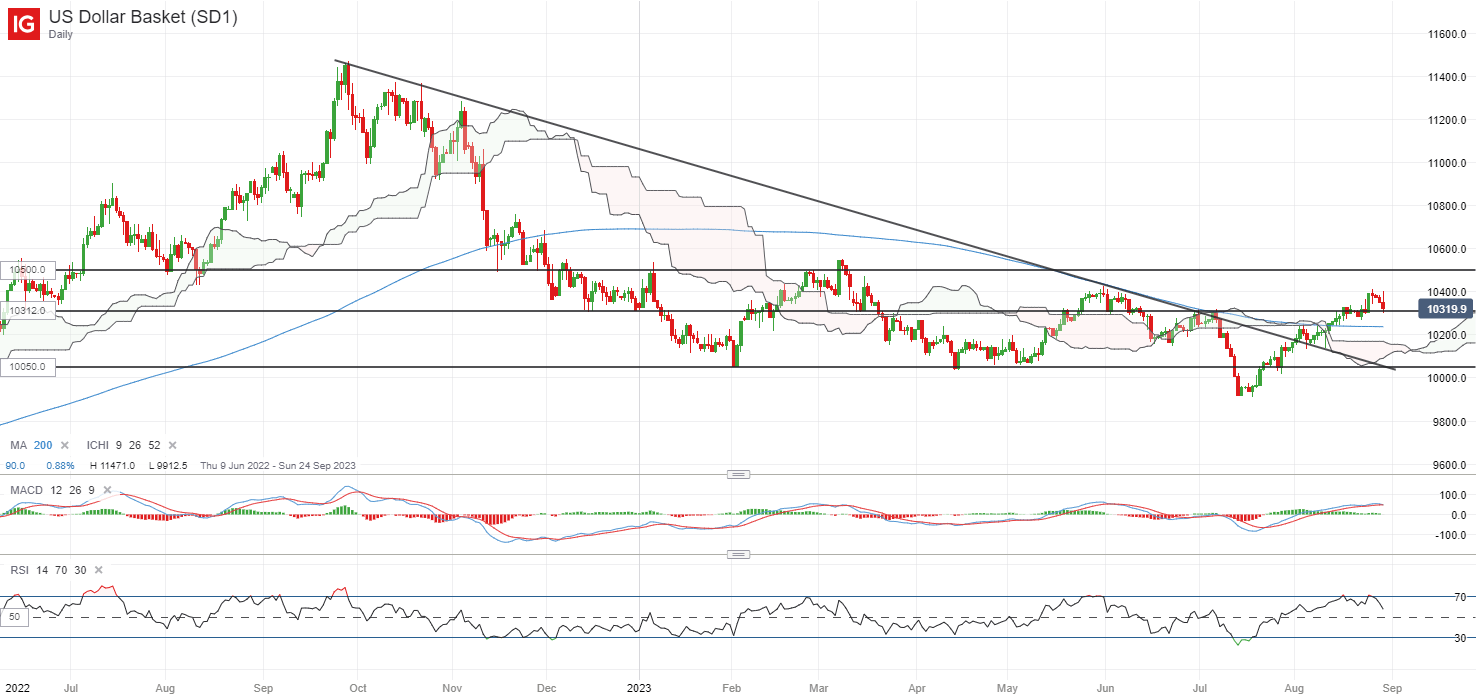

Price expectancies for the November Fed assembly have leaned again in opposition to a rate-pause state of affairs, following the day past’s weaker-than-expected US macro information. The percentages for charges to be stored on grasp in November recently stands at 51%, as opposed to the 38% chance priced originally of the week. With paring price hike bets, the USA greenback rally cooled for the 3rd instantly day, discovering its as far back as the 103.12 stage.

Its 200-day MA shall be one to look at subsequent, with the USA greenback having reclaimed the MA line prior to now for the primary time since November 2022. Any failure for the 200-day MA to carry would possibly validate dealers in larger keep an eye on and probably pave the best way again in opposition to the 100.50 stage subsequent.

Supply: IG charts

Tuesday: DJIA +0.85%; S&P 500 +1.45%; Nasdaq +1.74%, DAX +0.88%, FTSE +1.72%