RBA Set to Hike through 25bps

- The discharge of a number of upbeat financial experiences reinforced the greenback.

- Despite the fact that inflation in Australia fell, it stays neatly above the RBA’s goal.

- The Reserve Financial institution of Australia will most probably carry its rate of interest through 25 foundation issues.

The AUD/USD weekly forecast is somewhat bullish as traders be expecting a price hike at Tuesday’s RBA assembly.

Ups and downs of AUD/USD

In spite of a more potent greenback, AUD/USD closed the week neatly above its lows amid expectancies for an RBA price hike subsequent week. Significantly, the discharge of a number of upbeat financial experiences reinforced the greenback.

–Are you curious about studying extra about AI buying and selling agents? Take a look at our detailed guide-

The United States economic system demonstrated resilience as sure information at the housing marketplace, shopper self assurance, and sturdy items orders emerged. Moreover, there used to be encouraging information on GDP and preliminary jobless claims in the United States. Those experiences additional solidified the expectancies for added price hikes through the Fed.

Despite the fact that inflation in Australia fell, it stays neatly above the RBA’s goal, necessitating extra price hikes. Moreover, Australia’s exertions marketplace stays sizzling, wanting extra coverage tightening.

Subsequent week’s key occasions for AUD/USD

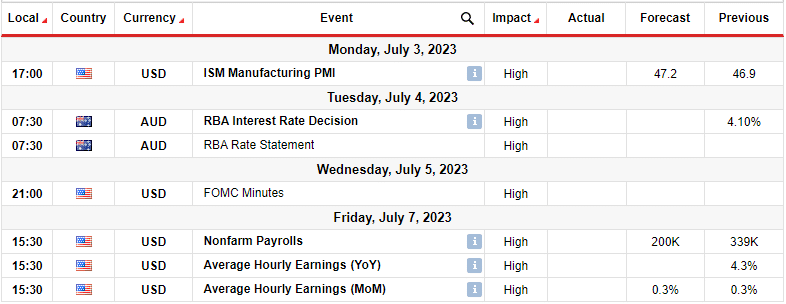

Subsequent week will likely be giant for AUD/USD as traders are looking forward to the RBA coverage assembly on Tuesday. There can be essential experiences from the United States, together with the FOMC assembly mins and the roles document.

On Tuesday, the RBA will most probably building up its rate of interest through 25 foundation issues to 4.35% to keep an eye on consistently prime inflation.

Alternatively, the NFP document will affect the outlook for rates of interest in the United States. The document will display whether or not present prime charges are operating to decrease call for within the exertions marketplace.

AUD/USD weekly technical forecast: Bulls take over at 0.6600 reinforce.

AUD/USD fell remaining week earlier than pausing on the 0.6600 reinforce point. Aussie has been shifting sideways for a very long time. It’s been slicing in the course of the 22-SMA, appearing neither bears nor bulls are prepared to push the associated fee a long way from the SMA.

–Are you curious about studying extra about foreign exchange bonuses? Take a look at our detailed guide-

On the similar time, the RSI has been crossing the pivotal 50-level, appearing widespread shifts in sentiment. As such, the associated fee bounced upper repeatedly when it retested the 0.6600 reinforce. In a similar fashion, the 0.6800 has acted as sturdy resistance.

Recently, the associated fee seems set to opposite at 0.6600 reinforce. If bulls take over, the associated fee will most probably spoil above the 22-SMA and climb to retest 0.6800.

Having a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll have the funds for to take the prime possibility of dropping your cash