RBA Hikes 25-bps with Wary Tone

- The RBA boosted rates of interest by way of 25 foundation issues, finishing its four-month pause.

- Traders perceived the RBA’s ahead steering as dovish.

- The Australian greenback plummeted by way of as much as 0.9% after the RBA announcement.

The AUD/USD value research grew to become bearish following the RBA’s charge adjustment and shifted the outlook that induced hypothesis of an drawing close finish to charge hikes. Particularly, the RBA raised rates of interest by way of 25 foundation issues on Tuesday, finishing 4 months of strong coverage. Then again, the RBA changed its language regarding the long term outlook.

-Are you searching for foreign exchange robots? Test our detailed guide-

Carol Kong, a strategist on the Commonwealth Financial institution of Australia, famous that the RBA’s ahead steering used to be perceived as dovish. In consequence, the Australian greenback briefly reversed its positive factors following an preliminary rally.

Charges have risen by way of 425 foundation issues since Might of the former 12 months, marking essentially the most competitive cycle within the RBA’s historical past. Because of this, loan bills have risen considerably. Additionally, financial expansion has slowed to a two-year low of two.1%, and the RBA predicts it’ll manner 1% in 2024 as the whole results of upper charges take dangle.

The opportunity of a charge hike had emerged as shopper value inflation exceeded expectancies within the 3rd quarter. Moreover, the central financial institution’s forecasts for CPI had been adjusted to a few.5% by way of the tip of 2024, up from 3.3%. Moreover, policymakers handiest be expecting inflation to achieve the highest finish of the objective vary by way of the tip of 2025.

Following the RBA’s announcement, the Australian greenback plummeted by way of as much as 0.9% to $0.64305 all over the consultation.

AUD/USD key occasions nowadays

Buyers will stay soaking up the RBA charge determination and coverage outlook as there are not any different important occasions set for the day.

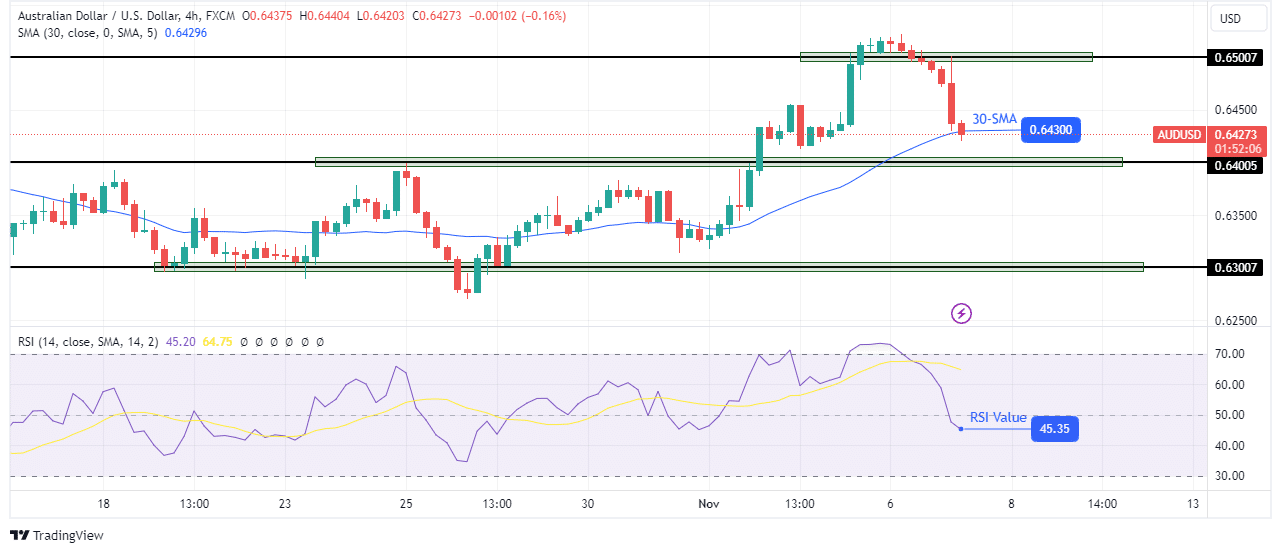

AUD/USD technical value research: Bears pause on the 30-SMA enhance.

The AUD/USD value has collapsed to the 30-SMA after in short buying and selling above the 0.6500 key degree. In a similar way, the RSI has entered bearish territory after buying and selling within the overbought area. It signifies that the cave in used to be unexpected and steep. Then again, bears are but to wreck under the 30-SMA enhance. This might be an important step in taking on keep an eye on from the bulls.

-Are you searching for the most productive CFD dealer? Test our detailed guide-

Additionally, a destroy under the SMA would permit bears to retest and most probably destroy under the 0.6400 enhance degree. Then again, it is usually conceivable that the SMA will halt the decline. If so, bulls would go back to retest the 0.6500 resistance.

Taking a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll be able to manage to pay for to take the top possibility of shedding your cash.