Nasdaq 100 Forecast 2024 – NAS100 Technical Research

On 13 December, we analysed the preferred inventory index Nasdaq 100 (NAS100) to find which corporations from its basket can also be known as enlargement leaders in 2023. We performed a technical research of the Nasdaq 100 chart and explored analysts’ forecasts for 2024.

Assessment of the Nasdaq 100 index

Nasdaq is without doubt one of the main alternate platforms in the USA. It was once based in 1971 and specialises within the shares of high-tech corporations. Nasdaq 100 is a capitalisation-weighted inventory index created in 1985. It tracks roughly 100 non-financial corporations whose stocks are traded at the Nasdaq.

Because of the index basket containing the shares of probably the most well known era corporations, it’s perceived as a barometer of this sector and enjoys recognition amongst buyers.

Most sensible 7 stocks with the most important capitalisation in Nasdaq 100

In line with the knowledge from Investopedia as of 30 September 2023, the Most sensible 7 listing of shares by way of weight within the index options:

Distribution of Nasdaq 100 corporations by way of sectors

- Generation – 57.1%

- Client Discretionary – 18.73%

- Healthcare – 7.12%

- Telecommunications – 5.48%

- Industrials – 4.87%

- Client Staples – 4.23%

- Utilities – 1.24%

- Fundamental Fabrics & Power – 0.96%

Reviewing the Nasdaq 100’s Adventure in 2023

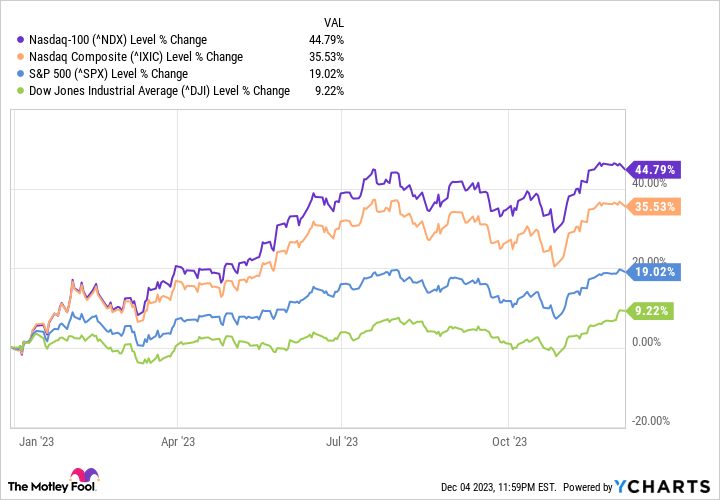

As you recognize, the Nasdaq 100 concluded 2022 with a 33% decline. When writing this newsletter, the index demonstrated a assured enlargement of over 45% because the starting of 2023. In line with Motley Idiot, the index surpassed the 3 main indices that observe US shares in early December – the S&P 500, Dow Jones Business Reasonable, and Nasdaq Composite.

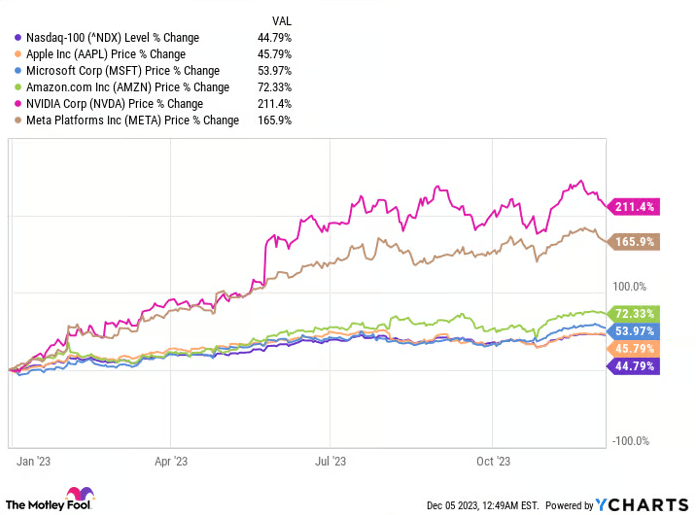

It may be meant that the robust enlargement of the Nasdaq 100 in 2023 represents buyers’ optimism and the growth of the era sector as a complete, for the reason that the index accommodates the stocks of the USA era giants. A considerable build up within the shares of the most important era representatives drove the Nasdaq 100 quotes enlargement in 2023. For the reason that starting of the 12 months, probably the most noticeable build up was once demonstrated by way of the next shares:

- NVIDIA Company +211.4%

- Meta Platforms Inc. +165.9%

- Amazon.com Inc. +72.33%

- Microsoft Company +53.97%

- Apple Inc.+45.79%

International financial dynamics shaping the Nasdaq 100

- The Fed’s financial coverage. Adjustments within the rate of interest can affect era corporations’ expenditures and their method to borrowing, therefore impacting index quotes

- International financial enlargement. Sustained enlargement within the international financial system generally leads to larger call for for era sector services and products, undoubtedly affecting the earnings of businesses indexed within the index and the costs in their shares

- Foreign money alternate charges. Many Nasdaq 100 corporations derive a good portion in their source of revenue from outdoor the USA. Fluctuations in foreign money alternate charges, the most important in changing income from foreign currency echange to the USA greenback, can affect quarterly and annual economic stories

- Monetary stories of businesses. Sure quarterly and once a year effects for firms within the Nasdaq 100 can cause an build up of their inventory costs, developing beneficial stipulations for the expansion of the index

- Essential home occasions. For example, tax reforms or regulatory adjustments can considerably affect the inventory marketplace and, as a result, the index

- International geopolitical occasions. As an example, army conflicts may end up in the rupture of industry agreements and disruption of provide chains, inflicting larger uncertainty and volatility in economic markets

- Marketplace sentiment and investor behaviour. Speculative process, as an example, can strongly affect the dynamics of index quotes

Technical research of Nasdaq 100 tendencies

After a descending correction in 2022, Nasdaq 100 quotes skilled an ascending rally in 2023. Starting the 12 months close to 11,000 issues, they approached the excessive set in 2021 at 16,764 issues by way of December. There was once a powerful ascending impulse when this newsletter was once written, and the Alligator and SMA (200) signs showed the uptrend.

On 13 December 2023, the quotes have been close to 16,354 issues, no longer a long way from the excessive of 2021 and the resistance line. This degree is perhaps attempted quickly. If the quotes fail to damage it immediately, a descending correction would possibly get started aiming on the nearest toughen degree at 15,932 issues or the toughen line of the ascending channel. Alternatively, if the index does ruin the resistance, just right stipulations will seem for emerging upper and atmosphere a brand new all-time excessive.

Technical Research of Nasdaq 100*

Long run outlook: Nasdaq 100 predictions for 2024

- In line with the LeoProphet portal, the Nasdaq 100 index would possibly drop to fifteen,012 issues by way of the top of the 12 months

- In line with the Pockets Investor portal, the index would possibly succeed in 16,387 issues by way of December 2024

- The Financial system Forecast Company (EFA) professionals be expecting the decline in inflation international may just let central banks lower the rates of interest, because of which the Nasdaq 100 would possibly succeed in an all-time excessive of 27,101 issues by way of the top of 2024

Attainable enlargement components for Nasdaq 100

- Use of synthetic intelligence. Selections in keeping with AI applied sciences may just give a boost to the efficiency of era corporations and lend a hand them save prices, which will have a good affect on their inventory costs and index quotes

- Creation of blockchain. Corporations incorporating blockchain era of their industry processes may just take pleasure in further fundraising alternatives and larger operational potency

- Traders’ pastime in inventions. Using novelties by way of era corporations draws buyers, which in most cases has a good affect at the normal dynamics of index quotes

Chance control in Nasdaq 100 investments

Whilst inventory indices generally show upward tendencies over the long run, making an investment within the Nasdaq 100 carries inherent dangers. As an example, a world financial disaster can precipitate a protracted decline within the shares of era corporations and the Nasdaq 100 index.

Allow us to recall the dotcom crash of 2000-2002 following the exuberant upward push of the USA inventory marketplace and the bubble formation in 1995-2000; Nasdaq 100 quotes plummeted by way of 76% from the excessive of 2000. It took the index 15 years to get better and resume enlargement.

Conclusion

The Nasdaq 100 is famend as one of the crucial international’s hottest inventory indices, consisting of shares from the most important non-financial corporations traded at the Nasdaq.

In 2022, a downward correction befell, however because the starting of 2023, the index has been on a powerful uptrend. Maximum inventory marketplace professionals specific optimism, anticipating the index to proceed its enlargement in 2024 and succeed in new all-time highs.

Alternatively, it is very important to recognize that those forecasts would possibly no longer materialise, given the possible chance of a slowdown in the USA financial system because of worsening financial stipulations, most likely influenced by way of the Fed’s excessive rates of interest.

FAQ

Nasdaq 100 is a inventory index comprising roughly 100 of the most important non-financial corporations registered at the Nasdaq alternate.

The primary drivers of the index are applied sciences and shopper services and products. Alternatively, the efficiency of those sectors can alternate yearly relying on financial and industry-specific components.

The listing of businesses from the Nasdaq 100 basket and real-time marketplace knowledge equipped by way of Nasdaq Final Sale can also be discovered right here.

After the descending correction in 2022, the index has demonstrated a strong upward rally because the starting of 2023. As of 13 December 2023, the index rose greater than 45% from the beginning of the 12 months.

Maximum inventory marketplace professionals are positive, anticipating endured enlargement in 2024 and the established order of latest all-time highs.

To put money into Nasdaq 100, you’ll use ETFs, similar to Invesco QQQ Believe or spot index finances that may be purchased by means of agents or mutual finances. Sooner than making any investments, thorough analysis is very important, and consulting with a economic marketing consultant is really helpful.

Not unusual methods come with diversification, long-term investments, and the use of inventory indices or ETFs. Traders will have to align their technique with applicable dangers and apply their funding targets.

Dangers come with marketplace volatility, technological sector decline, and financial components. Traders will have to believe their chance tolerance and seek the advice of a economic marketing consultant prior to making an investment.

* – The charts featured on this article originate from the TradingView platform, famend for its in depth set of equipment designed for economic marketplace research. Functioning as a user-friendly and complex on-line marketplace knowledge charting provider, TradingView lets in customers to accomplish technical research, discover economic knowledge, and connect to fellow buyers and buyers. Moreover, it gives precious steering on successfully working out the best way to learn foreign exchange financial calendar, along with offering insights into more than a few different economic belongings.